Listen to this article

Walmart’s market value recently soared to an unprecedented $1 trillion, marking a historic milestone for this retail giant. As the first conventional retailer to achieve such a valuation, Walmart’s ascension into this exclusive club, primarily comprised of technology companies, reflects its strategic shift towards e-commerce and digital innovation. The company’s impressive growth in the US retail market has been supported by significant investments in Walmart stock and advancements in Walmart AI initiatives. This remarkable valuation underscores not only the effectiveness of Walmart’s online operations but also its ability to adapt to emerging retail market trends. As consumers increasingly seek cost-effective shopping options, Walmart remains at the forefront, navigating the evolving landscape with resilience and agility.

As a trailblazer in the retail industry, Walmart has rewritten the narrative about traditional brick-and-mortar stores with its astounding $1 trillion market valuation. This achievement exemplifies how Walmart is positioning itself as a formidable player in the digital landscape, especially through its aggressive expansion in online sales and cutting-edge technology. With a focus on enhancing customer experiences via artificial intelligence and staying aligned with current consumer preferences, Walmart is well-equipped to thrive amidst ongoing shifts in the retail sector. The retailer’s strategic choices have sparked interest among investors, showcasing the potential for sustained growth in today’s competitive marketplace. With the trend towards e-commerce and digital connectivity, Walmart is solidifying its status as an influential leader in the global retail environment.

Walmart’s Historic $1 Trillion Market Value

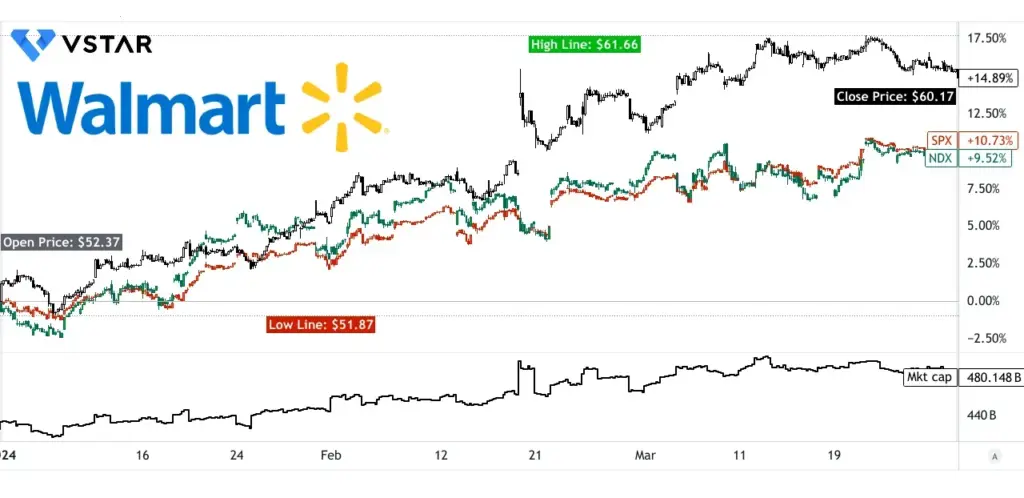

Walmart has made headlines by becoming the first traditional retailer to achieve a staggering market value of $1 trillion. This accomplishment not only sets Walmart apart in the retail sector but also places it in an exclusive club typically dominated by tech giants such as Nvidia and Alphabet. The company’s stock performance has seen significant growth, reflecting investors’ confidence in Walmart’s ability to adapt and thrive in an evolving market landscape, particularly in the realms of e-commerce and technology.

This milestone underscores Walmart’s strategic positioning within the US retail market, especially as it navigates challenges such as inflation and shifting consumer preferences. The company’s diverse offerings and competitive pricing have attracted a wide array of customers, solidifying its status in a market where low prices have become increasingly appealing to both budget-conscious shoppers and those from higher-income brackets seeking deals.

Walmart’s E-Commerce Growth Strategy

Walmart’s robust e-commerce initiatives have been a driving force behind its remarkable market valuation. With online sales experiencing a remarkable growth of 28% in the months leading up to October, the retailer has efficiently capitalized on the increasing demand for digital shopping solutions. This growth in Walmart e-commerce has allowed the company to compete effectively against online giants such as Amazon, which still holds a market value that exceeds $2.6 trillion.

In response to the retail market trends, Walmart has increasingly focused on enhancing its digital platforms and infrastructure. Investments in technology, innovation, and customer-centric services have played an integral role in refining its online presence. By enriching customer experiences through efficient delivery services and personalized shopping options, Walmart is not only retaining current customers but also attracting new ones from various demographic backgrounds.

Impact of AI Initiatives on Walmart’s Valuation

Walmart’s foray into artificial intelligence (AI) has significantly bolstered its market value, drawing positive attention from Wall Street investors. Under the leadership of Chief Executive John Furner, the company’s AI initiatives promote advancements in customer engagement, making it easier for shoppers to access information and services. For instance, the partnership with OpenAI shows Walmart’s commitment to integrating AI into its operations, allowing consumers to engage with the brand in innovative ways.

The acknowledgment of AI’s potential to reshape customer interactions elevates Walmart’s standing in the increasingly digitized retail market. Innovations such as AI-driven meal planning and intelligent inventory management not only improve customer satisfaction but also streamline operational efficiencies. As Walmart continues to embrace and implement AI technologies, its stock performance and overall valuation could experience even further growth.

Walmart’s Position in the US Retail Market

As the largest physical retailer in the US, Walmart holds a commanding position in the retail landscape. The company’s broad spectrum of product offerings and its reputation for low prices allow it to effectively serve diverse clientele. Consumers, especially during economic downturns, are drawn to Walmart’s value proposition, showcasing its resilience and adaptability within a fluctuating retail environment.

Walmart’s proactive approach towards market trends, including its ability to meet the demands of higher-income consumers during inflationary periods, has reinforced its strength in the retail sector. By continually assessing customer needs and adjusting accordingly, Walmart ensures its relevancy and durability, which contributes to its colossal market value.

Walmart’s Strategic Stock Move to Nasdaq

Walmart’s transition of its stock listing from the New York Stock Exchange to the Nasdaq is a deliberate move designed to align the company with technology-centric markets. This strategic decision reinforces Walmart’s ambition to be viewed not just as a retail giant but also as a forward-thinking digital enterprise. The Nasdaq listing is emblematic of Walmart’s shift towards innovation and technology-driven growth.

The implications of this decision extend beyond stock performance; it signifies a cultural shift within the company as Walmart continues to embrace technology and AI. By positioning itself on a tech-oriented platform, Walmart hopes to attract more investors keen on companies that prioritize digital advancements. This progressive approach could lead to enhanced market performance and sustained growth in a competitive space.

Competitive Landscape: Walmart vs. Amazon

Within the competitive landscape of the US retail market, Walmart and Amazon emerge as the two leading players, each vying for dominance in the e-commerce space. Walmart’s recent growth in online sales has strengthened its position against the e-commerce behemoth, which currently holds a market cap more than double that of Walmart. Despite this substantial difference, Walmart’s strategic enhancements in digital offerings and customer engagement reflect a determined effort to close the gap.

Walmart’s focus on providing a more personalized shopping experience, coupled with its strong grocery business, allows it to carve out a distinct identity that attracts a loyal customer base. Furthermore, with rising e-commerce integration and technological investments, Walmart is positioning itself effectively to compete with Amazon’s extensive reach and resources.

The Role of Consumer Behavior in Walmart’s Success

Understanding consumer behavior is critical to Walmart’s ongoing success. The retailer’s ability to cater to diverse income levels, especially during economic fluctuations, illustrates its keen awareness of market dynamics. Trends indicate that more affluent consumers are turning to lower-priced Walmart options as economic pressures mount. This shift not only amplifies Walmart’s reach but also reinforces its reputation as a value-driven brand.

As consumer preferences continue to evolve, Walmart’s adaptability proves vital. Its investment in customer service technologies, such as online shopping interfaces and efficient supply chain logistics, has enabled the company to better respond to changing shopping habits. This dedication to understanding and meeting customer needs directly influences sales performance, contributing to Walmart’s overall market value.

Walmart’s Earnings Update: A Reflective Measure

Walmart’s latest earnings update showcases remarkable sales performance across key sectors, particularly groceries and clothing. The company’s ability to thrive during periods of economic uncertainty emphasizes its strong business model and comprehensive understanding of consumer demand. Financial reports that exceed market expectations serve as a barometer of Walmart’s operational efficiency and strategic market positioning.

The insights drawn from earnings updates inform investors and stakeholders about the company’s trajectory in the competitive retail environment. By highlighting strong sales amidst economic challenges, Walmart solidifies its reputation as a resilient player in the US retail market, reiterating the value it offers to consumers even during tough economic times.

Governmental Influences on Walmart’s Business Model

The impact of governmental policies, such as tariffs imposed under the previous administration, has also shaped Walmart’s business strategies. While the immediate effects of these tariffs on pricing for certain goods posed challenges, Walmart’s size and operational scale have enabled it to manage these fluctuations more effectively than smaller competitors. This resilience reinforces the company’s competitive edge in the retail market.

Government policies thus serve as an influential backdrop against which Walmart shapes its pricing and supply chain strategies. By proactively managing the ramifications of these external factors, Walmart can maintain its low-price guarantee, ensuring that it continues to attract budget-conscious shoppers even as cost pressures fluctuate.

Frequently Asked Questions

What is Walmart’s current market value and how does it compare to its competitors?

Walmart has recently achieved a market valuation of $1 trillion, making it the first traditional retailer to reach this milestone. This positions Walmart alongside tech giants like Nvidia and Alphabet, although it still trails behind Amazon, which has a market value of approximately $2.6 trillion.

How has Walmart’s stock performance influenced its market value?

Walmart’s stock has surged in recent months, contributing significantly to its current market value of $1 trillion. This increase is largely driven by the company’s strong e-commerce growth and strategic investments in artificial intelligence (AI), which have enhanced its appeal to consumers.

What role does Walmart’s e-commerce strategy play in its market valuation?

Walmart’s thriving e-commerce operations have been a major factor in achieving its $1 trillion market value. The company’s online sales surged by 28% in a recent quarter, making it a formidable player against competitors like Amazon, and attracting budget-conscious shoppers looking for value.

How are retail market trends affecting Walmart’s market value?

Current retail market trends, including a shift towards budget-friendly shopping amid inflation, have boosted Walmart’s market value to $1 trillion. The retailer has capitalized on these trends by offering lower-priced items, attracting consumers across various income levels.

What impact are Walmart’s AI initiatives having on its stock and market value?

Walmart’s investments in AI have played a crucial role in its market value increase, helping it to streamline operations and enhance customer engagement. The Wall Street response to these initiatives has been positive, reflected in the rising stock price which has contributed to reaching the $1 trillion market value.

How does Walmart’s market value reflect its position in the US retail market?

Walmart’s market value of $1 trillion reflects its dominant position in the US retail market, particularly as it is the largest physical retailer. This valuation signifies Walmart’s successful adaptation to changing consumer behaviors and its growth in e-commerce, solidifying its competitiveness.

What strategic moves has Walmart made recently to boost its market value?

Recently, Walmart transferred its stock from the New York Stock Exchange to the Nasdaq, focusing on its identity as a digital enterprise. This strategic move, alongside its partnerships in AI and enhancements in e-commerce, has been pivotal in driving its market value to $1 trillion.

| Key Point | Details |

|---|---|

| Walmart’s Market Value | First traditional retailer to reach $1 trillion market value, joining tech giants. |

| Stock Exchange Shift | Moved from NYSE to Nasdaq to enhance digital company perception. |

| E-commerce Growth | Reported a 28% rise in e-commerce sales, outperforming competitors. |

| Consumer Trends | Higher-income shoppers choosing lower prices amid inflation. |

| AI Investments | Positive Wall Street response to Walmart’s embrace of AI. |

| Grocery and Clothing Sales | Strong sales performance reported in groceries and clothing. |

| Competitive Landscape | Competing against Amazon, although its market value is $2.6 trillion. |

Summary

Walmart’s market value has reached an impressive $1 trillion, making it the first traditional retailer to join this prestigious group. This milestone reflects Walmart’s successful navigation of e-commerce growth, effective pricing strategies, and strategic investments in technology like artificial intelligence. Not only has Walmart embraced a digital transformation by moving its stocks to Nasdaq, but it also continues to adapt to consumer trends, appealing to budget-conscious shoppers during economic fluctuations. As Walmart forges ahead in the retail space, its climb to this market valuation signifies a new era for traditional retail.