Listen to this article

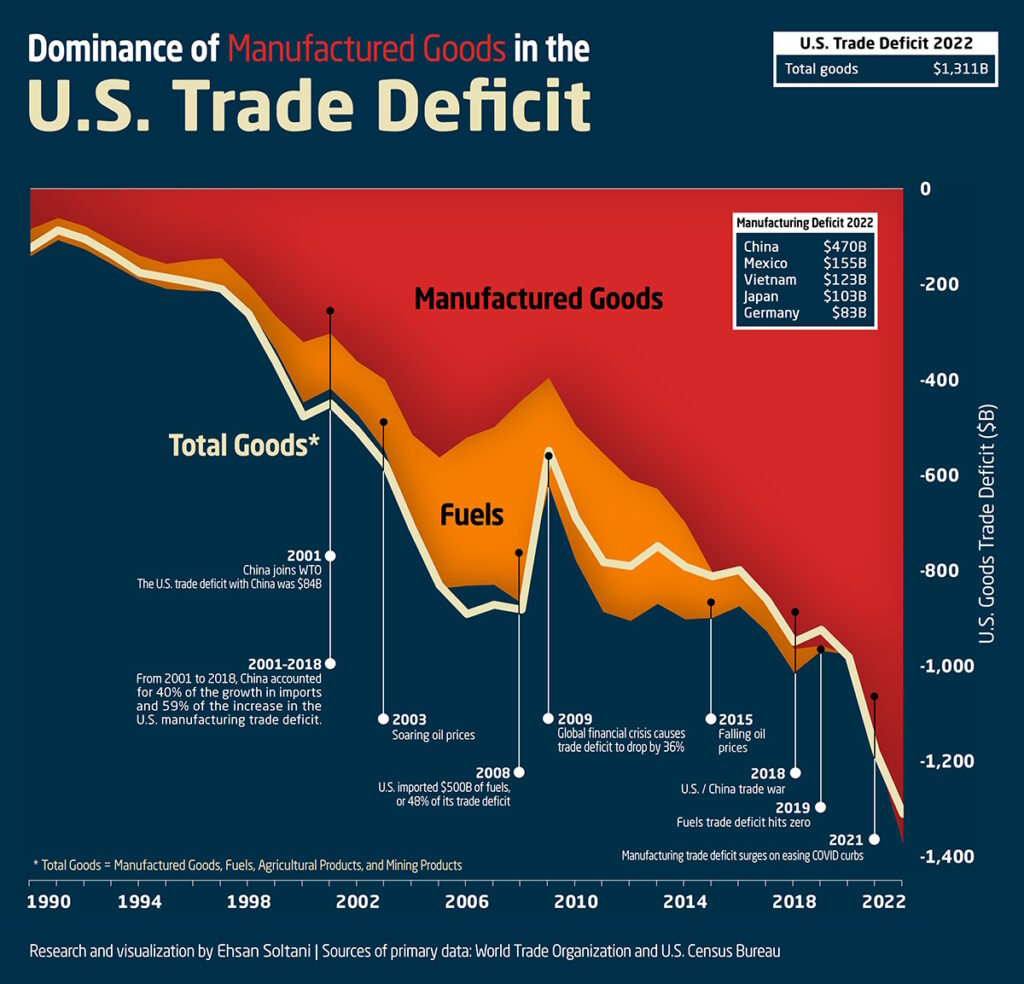

The US trade deficit has reached a staggering record high, underscoring the challenges facing American trade policies. In a climate where imports consistently outpace exports, the trade deficit is a focal point of concern, particularly as the impact of tariffs from President Trump’s administration is scrutinized. Despite significant tariffs aimed at curbing reliance on foreign goods, data reveals an expansion of the gap to a historic $1.2 trillion, reflecting ongoing complexities in US-China trade relations. The analysis of the trade deficit prompts critical discussions on how these policies affect domestic production and overall economic stability. Understanding the nuances of this trade imbalance is essential, as the ripple effects of these tariffs continue to shape the landscape of international commerce and American competitiveness.

The imbalance in trade flows, often referred to as a trade gap, has become a pressing issue for the United States, particularly amid turbulent economic conditions. As imports soar past exports, the ramifications of tariff implementations are being hotly debated. The intricacies of the trade deficit, which includes both goods and services, reveal much about the nation’s economic health and its relationships with partners like China and Mexico. With discussions surrounding protectionist measures and their effects looming large, it is crucial to analyze the evolving dynamics of international trades, such as the consequences of tariffs on supply chains and overall market stability. By fostering a deeper understanding of these trade discrepancies, one can better appreciate the long-term implications for the US economy.

Understanding the US Trade Deficit in 2024

The US trade deficit reached unprecedented levels in 2024, surpassing $1.2 trillion. This phenomenon occurred despite President Trump’s extensive tariff measures aimed at curbing imports and bolstering domestic production. The increase in the trade deficit can largely be attributed to the sustained imbalance between imports and exports, where the US found itself importing $3.4 trillion worth of goods while exports remained steady but did not keep pace. This situation raises important questions about the efficacy of current US trade policies and their long-term implications for the economy.

Many analysts argue that the US trade policies under the Trump administration, specifically the tariffs on various goods, were intended to strengthen American manufacturing and reduce foreign dependency. However, the reality shows a complex picture where, despite significant tariff impositions, the imports continued to rise. The trade deficit analysis indicates that without effective policy adjustments and strategic international negotiations, merely increasing tariffs may not generate the desired results in reducing the deficit.

Impact of Tariffs on US Trade Relationships

The implementation of tariffs, particularly those aimed at China, has had significant repercussions on US trade relationships. The tariffs were intended to minimize the country’s reliance on foreign goods and bolster domestic production; however, they have inadvertently affected global trade dynamics. While imports from China decreased, the overall trade flows with other countries like Mexico and Vietnam have surged, leading to record trade deficits with these nations. This shows a shift in trade patterns that underscores the complexities of international trade.

Moreover, the effects of Trump’s tariffs are not uniformly negative; some sectors saw growth in exports, while others struggled. The trade policy changes have revealed vulnerabilities in American supply chains, prompting many businesses to explore alternative sourcing strategies in response to tariff pressures. The impact of tariffs therefore extends beyond immediate financial metrics, influencing longer-term business decisions and international collaborations.

The Role of US-China Trade Relations

US-China trade relations have been a focal point in the discussion of the ongoing trade deficit. The bilateral trade figures show that US imports from China have dropped significantly, leading to a 30% decrease in the bilateral trade deficit, which fell to $202.1 billion, marking the smallest deficit in nearly two decades. This reflects the intent of US trade policies to reduce dependency on a single market and diversify import sources.

However, the decline in trade with China raises questions about the future of US-China relations. As tariffs remain a key tool in negotiations, the uncertainty surrounding trade policies could lead to further shifts in economic alliances. Commentary from experts emphasizes that while the immediate outcomes may appear favorable, the long-term effects on trade relations and market confidence remain to be seen.

Tariff Adjustments and Future Trade Strategies

The recent adjustments in tariffs reflect a broader strategy that the Trump administration hopes will ultimately stabilize the US trade deficit. The administration has shown a willingness to reassess its approach as the economic landscape evolves. For instance, adjustments in tariffs and the potential reapplication of these taxes via different mechanisms signal an adaptive strategy aimed at maximizing leverage in international negotiations.

As analysts predict further fluctuations in supply chains and trade dynamics, businesses are encouraged to stay agile. With supply chain strategies expected to undergo continued transformation in light of tariff repercussions, companies may need to identify new markets and diversify their import bases to mitigate risks associated with fluctuating trade policies. This proactive approach could better position firms to adapt to potential tariff changes and maintain competitive advantages in an increasingly globalized economy.

The Effects of Trade Policies on Domestic Manufacturing

The interplay between trade policies and domestic manufacturing is another critical area of discussion. The Trump administration’s stated goal was to invigorate American manufacturing through stringent tariffs on imported goods. However, despite these initiatives, many manufacturers report disruptions caused by fluctuating cost structures and uncertainty in sourcing materials. These challenges illustrate the unintended consequences of aggressive trade measures.

Moreover, while there have been pockets of growth in local production, a substantial number of industries continue to face significant challenges due to the increased costs associated with imported materials. This has prompted discussions around the need for a balanced approach in trade policy—one that can encourage manufacturing growth without alienating trade partners or complicating supply chains.

Global Economic Implications of the US Trade Deficit

The rising US trade deficit has far-reaching implications for the global economy. As America continues to import more than it exports, foreign markets are increasingly impacted, particularly those that rely heavily on US consumer demand. Countries that have seen a rise in exports to the US may face economic volatility if shifts in trade policy result in reduced demand or increased tariffs.

Additionally, the global interconnectedness of supply chains means that changes in US trade policies can reverberate across borders, affecting economies in Asia, Europe, and beyond. The ongoing state of the US trade deficit raises critical questions about future global trade relations, particularly as other economic powers respond to these shifts and recalibrate their trade strategies accordingly.

Evaluating the Future of US Trade Policies

As the landscape of US trade policies continues to evolve, it is essential for stakeholders to evaluate the potential long-term outcomes of the current strategies. The trade deficits witnessed in recent years suggest that while tariffs may have been aimed at achieving certain economic goals, they have not resulted in the intended reductions in the trade gap.

Going forward, policymakers will need to consider a more nuanced approach that balances protectionist measures with the realities of global trade. This may involve rethinking tariff applications, exploring new trade agreements, and fostering partnerships that support both domestic manufacturing while remaining competitive internationally.

The Role of Economic Data in Trade Decisions

Economic data plays a critical role in shaping trade decisions and policies. The US trade deficit, for instance, is a key indicator that reflects the health of the economy and the effectiveness of current trade policies. Up-to-date analyses help policymakers assess whether current strategies are yielding favorable outcomes or whether adjustments are necessary.

Understanding the nuances within trade statistics, including the components of trade such as goods, services, and capital flows, provides insight into how tariffs and trade policies impact the economy on multiple levels. Regular reviews of economic data are essential to inform decisions that promote sustainable trade practices and support the overarching goal of reducing the trade deficit.

Projections for the Future of Trade in the US

Looking ahead, the future of trade in the US appears to be weighing heavily on the outcomes of ongoing tariff policies and international relations. Analysts suggest that while the current administration’s tactics may lead to short-term outcomes, the long-term impact on the trade deficit remains uncertain. There could be a continuation of trade imbalances if rapid shifts in policy do not accompany strategic planning.

Trade relations will likely evolve with new administrations and policies that prioritize both domestic interests and international collaboration. Projections indicate that focusing on innovation, technology, and effective negotiation will be crucial in creating a balanced trade environment that finally addresses the longstanding issue of the US trade deficit.

Frequently Asked Questions

What is the current state of the US trade deficit in relation to Trump tariffs?

The US trade deficit reached a record high of approximately $1.2 trillion, an increase of 2.1% compared to 2024. This widening gap occurred despite the implementation of Trump’s tariffs, which were designed to reduce the deficit by making US products more competitive.

How do US trade policies affect the trade deficit?

US trade policies, particularly those enacted under the Trump administration, have had a significant but complex impact on the trade deficit. Despite the intention to reduce reliance on imports through tariffs, the trade deficit has continued to grow due to high import levels that outstrip exports.

What is the impact of tariffs on the US trade deficit?

Tariffs imposed by the Trump administration aimed to decrease the trade deficit but have inadvertently contributed to its expansion. The duties, particularly on Chinese goods, have led businesses to adjust their supply chains and sometimes rely more heavily on imports.

How do US-China trade relations influence the trade deficit?

US-China trade relations play a crucial role in the overall trade deficit. Although recent years have seen a reduction in the US trade deficit with China by about 30%, this has not been sufficient to offset the growing deficits with other countries, leading to an overall record trade deficit.

What are the implications of the Trump tariffs effect on trade deficit levels?

The Trump tariffs effect, intended to protect American manufacturing and reduce the trade deficit, has seen mixed results. While some sectors may have benefited, the overall trade deficit remains at an all-time high, highlighting the challenges posed by protective trade measures.

Can we expect changes in the US trade deficit due to ongoing trade policy adjustments?

Yes, ongoing adjustments in US trade policies and tariffs may lead to further changes in the trade deficit. Analysts predict a modest increase in imports may continue despite the tariffs, particularly as businesses adapt to shifting supply chain dynamics.

Are there long-term effects of the current US trade deficit on the economy?

The long-term effects of the current US trade deficit could pose challenges for the economy, including potential impacts on domestic production, currency valuation, and international relations. A persistent trade deficit may affect the country’s manufacturing capabilities and economic security.

What are the broader implications of trade deficit analysis in light of recent tariffs?

Trade deficit analysis in the context of recent tariffs suggests that while some immediate effects are visible, such as shifts in trade with China, the broader implications may take time to materialize. Companies are still navigating tariff impacts, creating uncertainty in both domestic and global markets.

| Key Point | Details |

|---|---|

| US Trade Deficit | The trade deficit reached a record high of approximately $1.2 trillion. |

| Impact of Tariffs | Tariffs imposed by Trump did not reduce the deficit; imports still surged to $3.4 trillion. |

| China Trade Relations | Bilateral trade with China decreased, reducing the deficit with China by 30%. |

| Exports | US exports also hit a new peak, even as some sectors struggled. |

| Political Uncertainty | The adjustment of tariffs created uncertainty and confusion for businesses. |

| Future Projections | Analysts expect a modest increase in imports despite tariffs. |

Summary

The US trade deficit reached its highest point ever, significantly exceeding exports despite the imposition of tariffs intended to encourage domestic production. This enduring gap highlights persistent economic challenges and the complexities of trade relationships, particularly with major partners like China. As the administration’s trade strategies evolve, the implications for businesses and future trade dynamics remain uncertain.