Listen to this article

The US economy growth has seen a remarkable acceleration over the past quarter, marking its most significant expansion in two years. With an annual growth rate soaring to 4.3%, the world’s largest economy is buoyed by a surge in consumer spending and a rebound in exports, defying earlier predictions of stagnation. This unexpected strength highlights not just a recovery, but an economy resilient enough to navigate challenges posed by shifting trade policies and ongoing inflationary pressures. Analysts are now reevaluating their outlooks, suggesting that sustained consumer confidence is pivotal for future economic growth. As households increase their spending, the implications for the US economy are profound, indicating a robust path forward in the face of adversities.

In recent months, the growth of the American economic landscape has outpaced expectations, showcasing vigorous development. With significant increases in consumer expenditures and exporting activities, the foundation of this economic upturn reveals a complex interplay between various factors like inflation and trade regulations. Observers are taking note of the strength of this economic performance, especially as spending habits among consumers suggest an optimistic outlook. As we approach critical milestones in fiscal policies and central banking strategies, the data points towards an upward trajectory for the nation’s financial health. This combination of elements underscores the underlying resilience of the American market system and its ability to evolve amid challenges.

US Economy Growth: A Resilient Performance

The latest data reflects a remarkable upswing in the US economy, showcasing an impressive growth rate of 4.3% annually for the third quarter, making it the fastest growth observed in two years. This surge is notably driven by robust consumer spending and a significant rebound in exports, both crucial indicators of economic stability and progression. The resilience of the economy has been highlighted by experts, who assert that despite existing challenges, such as inflation and fluctuating trade policies, the US economy stands on solid ground, reflecting a capability to bounce back from adversities.

Moreover, analysts suggest that the consistent economic growth can be attributed to effective consumer spending habits, which saw an increase of 3.5% in the recent quarter. This uptick in consumer expenditure signifies not only an increase in confidence but also a growing adaptability of households in the face of economic uncertainty. The strength of consumer spending has a ripple effect on various sectors, further propelling the overall economic activity and ensuring a sustainable growth trajectory moving forward.

Impact of Trade Policies on Economic Growth

Trade policies have played a pivotal role in shaping the current landscape of the US economy. Recent tariffs implemented by the Trump administration have considerably impacted imports, leading to a notable decrease. While these measures have caused temporary disruptions, the rebound in exports by 7.4% indicates that domestic producers are starting to adapt to the evolving trade environment, showcasing the resilience of American industries amid policy shifts. Such adaptability proves essential for economic growth as it helps stimulate demand and enhance global competitiveness.

Nonetheless, sustained economic growth will require a delicate balance of trade policies that not only protect local industries but also encourage healthy competition and accessibility to international markets. As the economy approaches 2026, upcoming tax cuts and potential adjustments in interest rates may further incentivize trade and investment, fostering an environment conducive to robust economic growth while navigating the complexities of global trade dynamics.

Consumer Spending: A Key Driver of Economic Revival

Consumer spending remains a cornerstone of the US economy, contributing significantly to its growth. The latest figures indicating a 3.5% increase in consumer expenditure demonstrate the willingness of households to spend despite the pressures of inflation. This spending surge is crucial as it reflects the confidence of consumers in their economic situation, allowing businesses to thrive and pushing the economy forward. The emphasis on healthcare spending particularly highlights a shift in priorities among consumers, adapting to the changing economic landscape.

However, it’s essential to recognize that while high consumer spending propels the economy, it is also impacted by prevailing economic conditions such as inflation and job market fluctuations. Recent surveys suggest that households are beginning to feel the strain of rising prices, particularly among lower and middle-income families. This shift may lead to more cautious spending behaviors in the near future, underscoring the importance of maintaining a stable economy that can support consumer needs and reinforce spending power.

Challenges Ahead: Inflation and Economic Sustainability

Despite the robust growth recorded in recent quarters, the persistent issue of inflation looms large over the US economy. As reported, the personal consumption expenditures price index increased by 2.8%, raising concerns among experts about the sustainability of the current growth rate. Inflation poses a dual challenge: not only does it threaten to erode household purchasing power, but it can also lead to a decrease in consumer confidence, which is vital for economic stability.

As economic indicators fluctuate, policymakers must navigate through the complexities of inflation, ensuring that measures are in place to combat rising prices without stifling growth. Addressing inflation effectively will be crucial for maintaining the momentum of the economy and ensuring that the benefits of growth are felt across all income levels. The challenge lies in balancing aggressive monetary policies with the need to support continued expansion and consumer confidence.

The Role of Government Spending in Economic Growth

Government spending plays a critical role in bolstering the US economy, particularly during periods marked by volatility. The recent increase in defense expenditures is a testament to the government’s strategic approach to stimulate growth and reinforce the economy. Such spending not only directly injects capital into the economy but also creates jobs and supports ancillary industries, catalyzing a positive economic cycle.

Moreover, government investments in key sectors like infrastructure and technology are essential for sustaining long-term economic growth. While current spending levels have shown recovery, it is imperative that policymakers remain committed to developing robust fiscal policies that facilitate continued investments across various sectors. This commitment will be crucial for ensuring that the economy remains resilient and adaptive to future challenges.

Forecasting the Future: Economic Trends through 2026

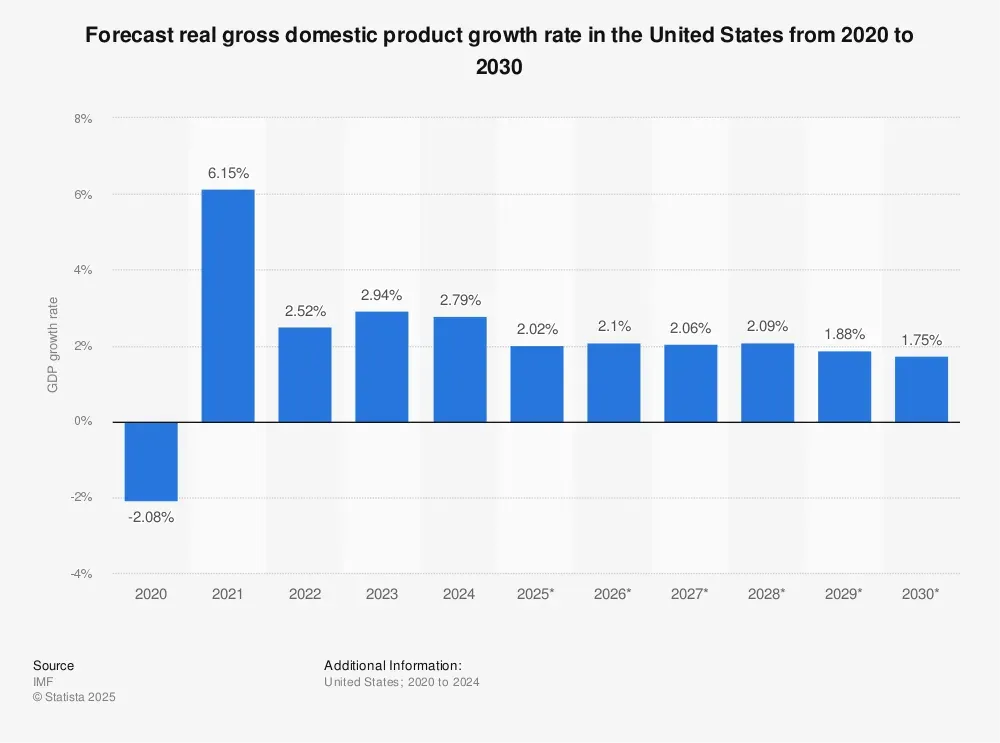

Looking ahead, economic analysts are optimistic about the potential trajectory of the US economy through 2026, anticipating beneficial impacts from recent tax cuts and adjustments in interest rates by the Federal Reserve. The expectation is that these changes will create a favorable environment for both consumers and businesses, resulting in sustained economic growth and improved consumer confidence. Strong underlying measures suggest a consistent expansion is possible, setting a positive tone for future economic activities.

However, it is crucial to remain vigilant regarding external factors that could influence these forecasts. Global economic challenges, shifts in trade relations, and domestic issues such as inflation could impede this growth trajectory. Maintaining proactive economic policies will be integral to navigating these potential hurdles and ensuring that the economy continues its path towards resilience and stability.

Household Spending Trends: Navigating Economic Challenges

Recent trends indicate that while higher-income households are continuing to spend, lower and middle-income families are facing significant challenges due to rising costs and a cooling job market. Analysts warn that these economic pressures could lead to a slowdown in consumer spending, which is essential for sustaining growth. As inflation affects basic goods and services, households are forced to navigate tightening budgets, potentially resulting in reduced overall economic activity.

To mitigate such challenges, targeted economic policies aimed at supporting lower-income households need to be prioritized. This could involve initiatives to control inflation, improve wage growth, or provide support for families facing economic hardship. Enhancing consumer confidence and spending across all income brackets is vital for the long-term health of the economy, ensuring that recovery is inclusive and sustainable.

Inflation’s Impact on Economic Behavior

Inflation is not only a measure of price changes but also significantly impacts consumer behavior and economic decision-making. While higher-income households may have the luxury to absorb rising costs, lower and middle-income households feel the pinch more acutely, often leading to reduced discretionary spending. This behavioral shift, induced by inflation, poses risks to the general economic health as consumer confidence wanes, potentially resulting in decreased overall demand.

As households limit their spending in response to inflation, businesses may experience a decline in revenue, which could prompt them to cut back on investments and hiring. This creates a feedback loop that could stifle economic growth. Therefore, understanding and addressing the nuances of how inflation affects consumer behavior is critical for crafting effective economic policies aimed at fostering a stable and growing economy.

Consumer Confidence: A Vital Economic Indicator

Consumer confidence is a pivotal indicator of economic health, directly influencing spending patterns and investment. Recent declines in consumer confidence, compounded by rising prices and economic uncertainties, highlight the fragility of current growth conditions. Analysts suggest that sustained economic growth hinges on restoring consumer trust, which can encourage increased spending and investment across various sectors.

Addressing the factors contributing to declining consumer confidence, such as economic pressures, volatile job markets, and inflation, will be essential for fostering a stable economic environment. Policymakers must focus on creating strategies that enhance consumer confidence, encouraging spending, and supporting productive investment, which is vital for a thriving economy.

Frequently Asked Questions

What factors contributed to the recent US economy growth?

The recent US economy growth can be attributed to a significant increase in consumer spending, which rose at an annual rate of 3.5%, and a rebound in exports, surging by 7.4%. Additionally, the recovery in government spending, particularly in defense, played a crucial role in boosting the economic growth rate to 4.3% for the last quarter.

How does consumer spending influence US economic growth?

Consumer spending is a vital driver of US economic growth, accounting for a large portion of the GDP. Recent reports indicate that consumer expenditures have increased, indicating confidence in the economy despite pressures from inflation and a cooling job market, thus supporting the overall economic expansion.

What role do trade policies play in shaping US economy growth?

Trade policies significantly impact US economy growth by affecting imports and exports. Recent tariffs imposed on imports have contributed to a decline in incoming goods, while a rebound in exports has bolstered economic activity, showcasing the interdependence of trade and economic growth.

Is inflation a concern for ongoing US economy growth?

Yes, inflation remains a concern for ongoing US economy growth. The recent increase in the personal consumption expenditures price index, which rose by 2.8%, indicates rising prices that could affect consumer purchasing power, particularly for lower and middle-income households.

What is the outlook for the US economy growth in the coming years?

The outlook for US economy growth appears positive, with projections indicating that recent tax cuts and monetary policy changes by the US central bank could stimulate further expansion as we approach 2026. However, analysts remain cautious about the sustainability of this growth due to rising inflation and potential impacts on consumer spending.

| Key Points | Details |

|---|---|

| US Economy Growth Rate | The economy expanded at an annual rate of 4.3% for the third quarter, up from 3.8% in the previous quarter. |

| Consumer Spending | Increased by 3.5%, indicating strong household expenditure despite a cooling job market. |

| Exports Growth | Exports surged by 7.4%, marking a significant recovery after previous declines. |

| Government Spending | Recovery driven mainly by defense expenditures, countering the slowdown in business investments. |

| Challenges Faced | Rising prices and inflation are impacting lower and middle-income households, potentially hindering growth. |

Summary

US economy growth is marked by a notable acceleration during the third quarter, showcasing resilience amid various challenges. The recent growth figures highlight a vital rebound in consumer spending and exports, driving an overall annual growth rate of 4.3%. Despite lingering inflation and its effects on lower-income households, the economy’s solid performance suggests a promising outlook as it adapts to policy changes and market fluctuations.