Listen to this article

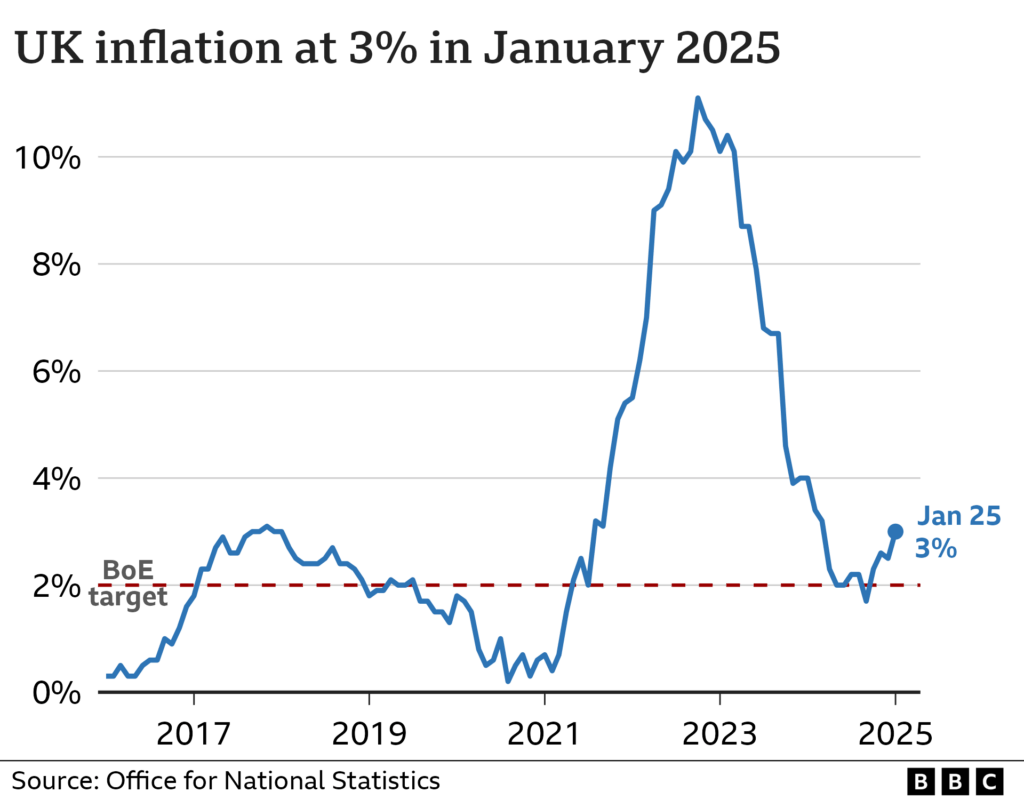

The UK inflation rate has captivated economic analysts and civilians alike as it recently fell to 3.6% for the year ending in October, marking the most significant decrease in the past four months. According to the latest ONS inflation statistics, the slower rise in costs—particularly in energy prices for gas and electricity—has provided a glimmer of hope amid ongoing economic challenges. This data points to a potential easing of the cost of living in the UK, as household energy bills and hotel accommodations play a crucial role in shaping consumer experiences. However, the rise in food prices following a drop in the previous month highlights the complexities surrounding inflation dynamics. As the October inflation report reveals these trends, the anticipation builds regarding how the latest data might influence interest rates UK moving forward.

As the economic landscape shifts, the recent decrease in the inflation rate in the UK signifies a pivotal moment for both consumers and policy makers. This decline brings into focus various factors influencing prices, such as energy costs and accommodation fees, which greatly impact household budgets. The interplay of inflation metrics encompasses not just the cost of living adjustments but also broader economic implications, including potential adjustments to interest rates. With rising raw material costs for businesses contributing to price changes, understanding these economic indicators becomes increasingly important. The fluctuations in consumer prices and their subsequent effects on spending behaviors underscore the delicate balance of maintaining economic stability.

Understanding the Recent UK Inflation Rate

The recent decrease in the UK inflation rate to 3.6% as reported in October serves as a significant indicator of the nation’s economic health. This drop represents the lowest inflation rate observed in the past four months, suggesting reduced pressure on consumers as costs begin to stabilize. The Office for National Statistics (ONS) attributes this decline primarily to the moderation of energy prices, particularly in the gas and electricity sectors. Understanding these dynamics is crucial for both consumers and businesses alike, as it indicates the overall cost of living may be aligning closer to wage growth and economic recovery.

Moreover, the decline in inflation often leads to a cautious optimism about potential interest rate adjustments by the Bank of England. With inflation rates indicating a potential peak decline, market analysts are speculating whether this trend will persist. If inflation continues to ease, it could prompt the central bank to consider lowering interest rates, which would significantly impact borrowing costs for consumers and businesses. This scenario may lead to a further boost in economic activity as reduced interest rates generally promote spending and investment.

Impact of Energy Prices on Inflation Trends

One of the most influential factors in the recent inflation trends in the UK has been the fluctuation of energy prices. The ONS reported that energy costs, specifically gas and electricity, increased at a slower pace in the year leading up to October, compared to the previous year. This moderation is notably linked to adjustments in the Ofgem energy price cap, which effectively managed how much energy suppliers could charge consumers. This stabilisation in energy costs is critical, as they have a direct correlation with overall inflation statistics and household budgets.

The impact of these energy prices cannot be understated; they often dictate the trajectory of the cost of living in the UK. When energy costs rise sharply, it triggers a domino effect, increasing transportation and production costs across various sectors. However, the recent easing of energy prices may provide respite for households, potentially allowing discretionary spending to increase, thereby stimulating demand and supporting economic growth.

Explaining the Cost of Living Crisis in the UK

The cost of living crisis in the UK has been markedly influenced by inflationary pressures, leading to a substantial rise in essential expenditure. As reported by the ONS, the cost of food and non-alcoholic beverages rose considerably, contributing heavily to the overall inflation figure. In October, food prices saw a notable annual increase of 4.9% which highlights ongoing challenges for households trying to manage budgets amidst rising living costs. This persistent inflation in food prices adds strain on consumers already grappling with tight finances.

Addressing the cost of living crisis requires comprehensive policy responses aimed at alleviating some of this burden on households. Solutions might include targeted support for low-income families, food assistance programs, or broader economic policies that promote wage growth in line with inflation rates. The goal would be to ensure that consumers can cope with the rising prices, while also fostering a balanced economic environment conducive to growth and stability.

The Role of Interest Rates in Economic Recovery

Interest rates play a pivotal role in shaping the UK’s economic landscape, particularly in times of fluctuating inflation. The Bank of England uses interest rates as a primary tool to either stimulate or cool the economy based on inflation metrics. With the recent dip in the UK inflation rate to 3.6%, there is growing speculation that a reduction in interest rates may be on the horizon. Such a move could make borrowing cheaper, encouraging spending and investment, which are crucial for economic recovery.

Simultaneously, lower interest rates could provide relief to homeowners and businesses currently facing high repayments. The relationship between interest rates and inflation is a delicate balance that the Bank of England must navigate carefully to avoid triggering excessive inflationary pressures through increased borrowing. Consequently, monitoring upcoming decisions regarding interest rates is vital for understanding the broader economic outlook in the UK.

October Inflation Report Insights

The October inflation report released by the ONS illustrates the ongoing fluctuations in the UK’s economic environment. Notably, the report highlighted a significant reduction in the inflation rate to 3.6%, largely driven by factors such as the slower pace of energy price increases. It serves as a critical benchmark for assessing consumer confidence and economic stability going forward. For businesses and policymakers, understanding the nuances of this report is essential for adapting strategies that align with current inflation trends.

Furthermore, these insights equip consumers with necessary context for their financial decisions. By understanding the detailed factors contributing to inflation—such as changes in energy prices and the hospitality sector—individuals can better navigate their budgets and spending habits amidst economic uncertainties. As we track the implications of these inflation statistics, it becomes clear that timely and informed decisions will be key to weathering ongoing economic challenges.

Trends in Non-Alcoholic Beverage Pricing

The pricing trends of non-alcoholic beverages have shown notable fluctuations that align with broader inflation trends in the UK. With the inflation rate significantly influenced by various sectors, the beverages sector has seen a mix of price increases and stabilisation. As consumers adapt to shifting economic conditions, the demand for these products has shifted, prompting suppliers to adjust pricing strategies accordingly. The impact of these price trends can significantly affect the overall inflation rate as these beverages are staples in many households.

As the ONS reports indicate, the inflation rate for non-alcoholic beverages contributes to the overall uptick in inflation, making understanding these trends crucial for consumers. These continuous adjustments emphasize the need for consumers to stay informed about pricing dynamics which can either alleviate or exacerbate financial pressures. Moreover, as businesses adapt to these pricing trends, there is broader economic significance, reflecting shifts in consumer preferences and spending patterns.

Understanding Consumer Behavior Amidst Inflation

Consumer behavior often shifts dramatically in response to changes in inflation rates. With inflation reported at a decreased rate of 3.6% in October, understanding how consumers adapt is vital. People are likely to alter their spending habits, prioritising essential goods over discretionary expenditures during periods of financial strain. The dynamics of consumer behavior play a crucial role in shaping demand and ultimately influence the economic recovery trajectory.

Furthermore, businesses must recalibrate their strategies to accommodate these changes in consumer behavior. By focusing on essential products and affordable options, suppliers can better navigate the complexities introduced by fluctuating inflation. Monitoring buying habits and consumer confidence levels will be crucial as the economy continues to evolve and respond to ongoing inflationary pressures.

Food Price Inflation and Its Implications

The increase in food prices is a significant driver of inflation within the UK, as highlighted by the recent ONS report detailing a 4.9% rise. This persistent inflation scenario underscores the challenges businesses and consumers face, as rising food costs affect household budgets directly. An understanding of the implications of food price inflation is necessary for both economists and policymakers who aim to tackle the broader cost of living crisis in the UK.

As food prices continue to rise, consumers may adapt by seeking alternatives or adjusting their meal planning strategies to mitigate costs. In essence, high food inflation can lead to decreased consumer spending in other areas, consequently impacting economic growth. With food prices added as a critical factor in overall inflation calculations, monitoring these changes will remain a priority for ONS and financial experts as they interpret the economic landscape.

Future Predictions for UK Inflation

Looking ahead, predictions for UK inflation will heavily rely on the interplay between current economic conditions and consumer behaviors. With inflation easing to 3.6%, there is cautious optimism about the potential for further declines in upcoming months. Economists are closely watching various indicators—including energy prices, consumer demand, and supply chain challenges—as these elements will shape the trajectory of inflation in the UK.

Additionally, the Bank of England’s response to these inflation rates will be pivotal in determining future economic policies and interest rates. Should inflation continue to fall, there may be greater expectations for reduced interest rates, which could foster a more robust economic environment. As such, keeping an eye on these developments will be essential for both consumers and businesses making financial decisions amid fluctuating economic conditions.

Frequently Asked Questions

What was the UK inflation rate in the latest October inflation report?

The UK inflation rate decreased to 3.6% in the year leading up to October, marking the lowest rate in four months according to the latest October inflation report by the Office for National Statistics (ONS).

How does the decrease in inflation affect the cost of living in the UK?

The decrease in the UK inflation rate to 3.6% suggests that the cost of living may be increasing at a slower pace, providing some relief to households facing rising prices.

What factors contributed to the decrease in the UK inflation rate reported by the ONS?

The decrease in the UK inflation rate to 3.6% was primarily driven by slower increases in gas and electricity prices compared to last year, along with a decrease in hotel room prices, as reported by the ONS.

Will the decrease in the UK inflation rate lead to lower interest rates?

Analysts suggest that the decline in the UK inflation rate to 3.6% raises hopes for lower interest rates, as slower inflation may reduce pressure on the Bank of England to raise rates further.

What are the trends in food prices according to the ONS inflation statistics?

According to the ONS inflation statistics, while overall inflation decreased, food prices rose by 4.9% in October, compared to 4.5% in September, indicating ongoing upward pressure in this category.

What implications does the October inflation report have for UK consumers?

The October inflation report, showing a decrease to 3.6%, may provide UK consumers with some optimism as it indicates that prices are rising more slowly, potentially easing the financial burden associated with higher living costs.

How do UK interest rates correlate with the inflation metrics reported?

UK interest rates are closely monitored alongside inflation metrics; as the inflation rate decreases, as seen in October’s report, it may influence the Bank of England to consider lowering interest rates to stimulate economic activity.

| Key Points | Details |

|---|---|

| UK Inflation Rate | The UK inflation rate decreased to 3.6% in October, the lowest in four months. |

| Factors for Decrease | Slower price increases in gas and electricity mainly contributed to the decline, as well as reduced costs in the hotel sector. |

| Recent Trends | After rising to 3.8%, inflation fell back to 3.6%; the previous rate of 3.6% was in June. |

| Food Prices | Food prices increased to a year-on-year rate of 4.9% in October, up from 4.5% in September. |

| Future Outlook | The slower inflation rate raises hopes for lower interest rates, indicating potential economic stabilization. |

Summary

The UK inflation rate has recently shown a decrease, landing at 3.6% in October, primarily driven by slower price increases for gas and electricity compared to last year. This reduction reflects a broader trend of easing inflation pressures, though food prices remain a concern. The latest figures suggest a potential peak in inflation, which may lead to discussions of lower interest rates in the future as the economy seeks stability.