Listen to this article

Taxing electric cars could have significant implications for the future of the electric vehicle market, especially at a time when the sales momentum for these eco-friendly alternatives appears to be slowing down. Lisa Brankin, Ford UK’s managing director, has voiced concerns that increased taxes on electric vehicles might deter customers from making the switch, ultimately undermining UK electric car sales. As the Chancellor considers new EV market trends that include pay-per-mile charges, the urgency of maintaining fair tax regimes is becoming ever clearer. With Ford electric vehicles striving to embrace the government’s net-zero ambitions, balanced taxation could serve as a crucial factor. Therefore, the dialogue around electric vehicle taxes is not just about economics; it’s about fostering a sustainable automotive landscape in the UK.

The conversation surrounding the levies on eco-friendly vehicles, such as electric cars, is heating up as industry leaders express caution regarding their potential negative impact. Recent discussions have highlighted the challenges facing the EV sector, particularly in light of planned taxes that may hinder consumer acceptance. Ford’s Lisa Brankin stresses the necessity of fostering a positive environment for electric mobility, suggesting that imposing extra charges could detract from the attractive features of green vehicles. As we navigate the evolving landscape of electric transportation and sustainable practices, it’s essential to consider how current policies might influence consumer behavior and industry growth. Ultimately, the approach to taxing electric cars could set the tone for future electric vehicle taxes and impact the push for greener alternatives in the automotive industry.

Impacts of Taxing Electric Cars on Consumer Adoption

As highlighted by Ford UK’s managing director, Lisa Brankin, the introduction of taxes on electric cars could serve as a significant barrier to consumer adoption in an already uncertain market. With EV market trends suggesting a recent dip in demand, any disincentive could further diminish the interest of prospective buyers. Consumers have become more hesitant as they weigh the costs associated with making the switch to electric vehicles, particularly if new taxes restrict affordability or add complexity to the purchase process.

The concern over taxing electric vehicles extends beyond just consumer hesitance; it also reflects broader implications for the auto industry. Major players like Ford are aiming to transition towards electric vehicles in alignment with the UK’s net-zero emissions target. If such taxes are introduced, they could inadvertently undermine these efforts, making it difficult for Ford to meet expectations for new car sales being predominantly electric by 2030.

Frequently Asked Questions

What impact will taxing electric cars have on EV market trends?

Taxing electric cars could significantly hinder EV market trends, as highlighted by Lisa Brankin, managing director of Ford UK. She warns that introducing taxes on electric vehicles may deter potential buyers at a time when demand is already weakening. This could slow down the transition to electric vehicles and impact sales, making it essential for policymakers to consider these effects.

How might the UK government’s plans to tax electric vehicles affect UK electric car sales?

The UK government’s consideration to introduce new taxes on electric vehicles could adversely affect UK electric car sales. As noted by Ford’s Lisa Brankin, imposing taxes, such as a pay-per-mile charge, may deter drivers from switching to electric options, potentially leading to a decrease in market demand and complicating the achievement of net-zero targets.

What are the concerns related to electric vehicle taxes raised by Lisa Brankin of Ford?

Lisa Brankin has raised several concerns regarding electric vehicle taxes, stating that they could act as a deterrent against purchasing electric cars, especially as the market is experiencing fragile demand. She emphasizes that taxing electric vehicles may push consumers away from adopting greener technologies, complicating efforts to meet environmental targets.

What are the potential effects of a pay-per-mile charge for electric vehicles?

Introducing a pay-per-mile charge for electric vehicles, as considered by the UK Chancellor, might have a chilling effect on future EV adoption. Lisa Brankin from Ford warns that such policies could discourage consumers from making the switch to electric cars, especially when the demand is already declining. Accurate mileage tracking could also complicate the process for drivers.

Are there incentives available for buying electric vehicles in the UK?

Yes, the UK government has reintroduced a grant of up to £3,750 to encourage the purchase of electric vehicles. This support is crucial according to Ford UK’s Lisa Brankin, as it can help achieve the target of 80% EV sales by 2030. Without such incentives, automakers may struggle to motivate consumers to choose electric vehicles over traditional petrol and diesel options.

How do company car tax rates compare for electric vehicles versus petrol and diesel vehicles?

Electric vehicles benefit from significantly lower company car tax rates compared to petrol and diesel vehicles. This favorable tax treatment is critical for businesses converting their fleets to greener alternatives, as highlighted by Lisa Brankin of Ford. Maintaining these benefits is essential for bolstering the electric vehicle market and promoting sustainable practices among corporations.

What does Lisa Brankin say about the future of Ford’s operations related to electric vehicles in the UK?

Lisa Brankin outlines that Ford is facing challenges in meeting the UK’s 80% electric vehicle sales target without further government support. She emphasizes the importance of incentives like grants for fostering EV sales, as well as the potential impact on Ford’s facilities and workforce, particularly the Dagenham diesel engine plant, as the company transitions towards electric vehicle production.

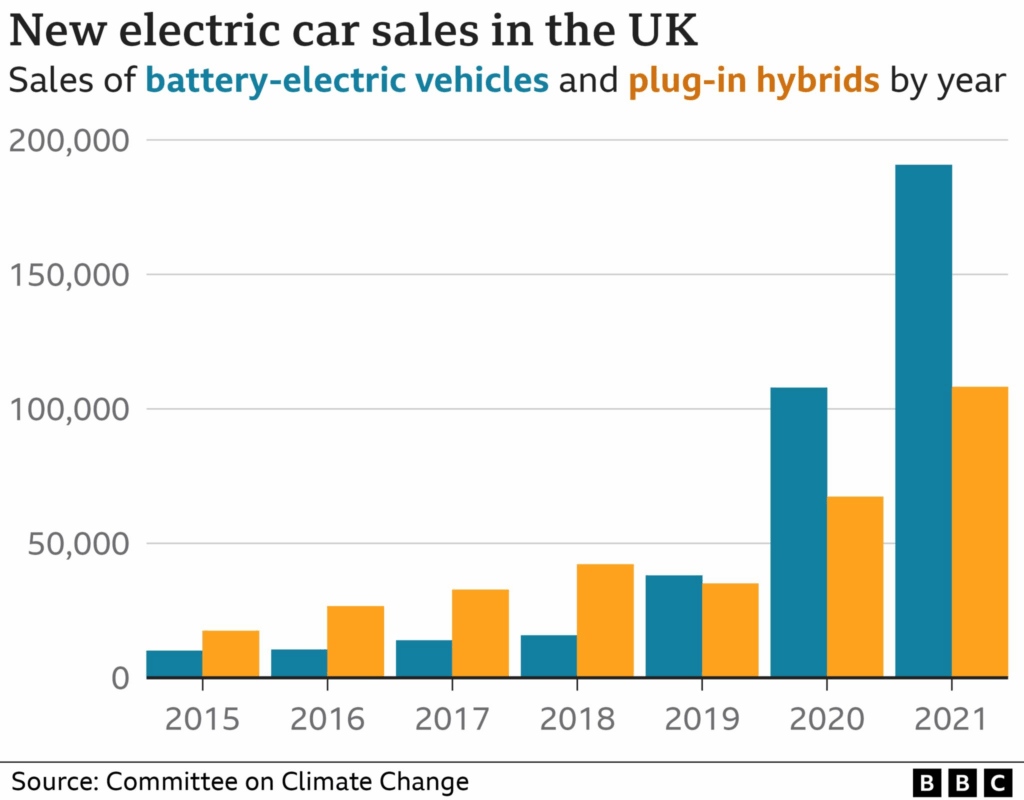

How do sales data reflect the current state of the electric vehicle market in the UK?

Recent sales data indicate that electric vehicles accounted for approximately 22.4% of total new car sales as of October 31, 2025, marking an increase from 18.1% the previous year. Despite this growth, Lisa Brankin notes that the current sales momentum is not enough to meet ambitious targets, underscoring the need for ongoing support and favorable tax policies to sustain demand in the electric vehicle market.

| Key Point | Details |

|---|---|

| Warning Against Taxing Electric Cars | Ford’s managing director, Lisa Brankin, warned that new taxes on electric vehicles may further decrease demand. |

| Potential Pay-Per-Mile Charge | Chancellor Rachel Reeves is considering a pay-per-mile charge for EVs starting in 2028, which may discourage buyers. |

| Impact on EV Sales | Despite an uptick in demand, sales of electric vehicles are still falling short of the UK’s 80% target by 2030. |

| Government Grants | A grant of up to £3,750 has been reintroduced to encourage electric vehicle purchases. |

| Concerns for Ford’s Workforce | The transition to EVs may impact jobs at Ford’s diesel engine plant in Dagenham, which will produce diesel engines until 2030. |

| Market Distortions | Heavy discounting and lower resale values of EVs indicate a distorted market, according to Brankin. |

Summary

Taxing electric cars is a critical issue, as highlighted by Ford’s UK managing director, Lisa Brankin. She warns that introducing new taxes on electric vehicles could deter consumers from transitioning to EVs just when momentum is already faltering. With plans for potential mileage taxes on EVs, it is essential to carefully consider how these policies might impact both sales and the long-term goals of the UK’s net-zero strategy. Encouraging EV adoption with incentives like grants could be more effective in achieving the targets needed to meet government goals and promote a sustainable automotive industry.