Listen to this article

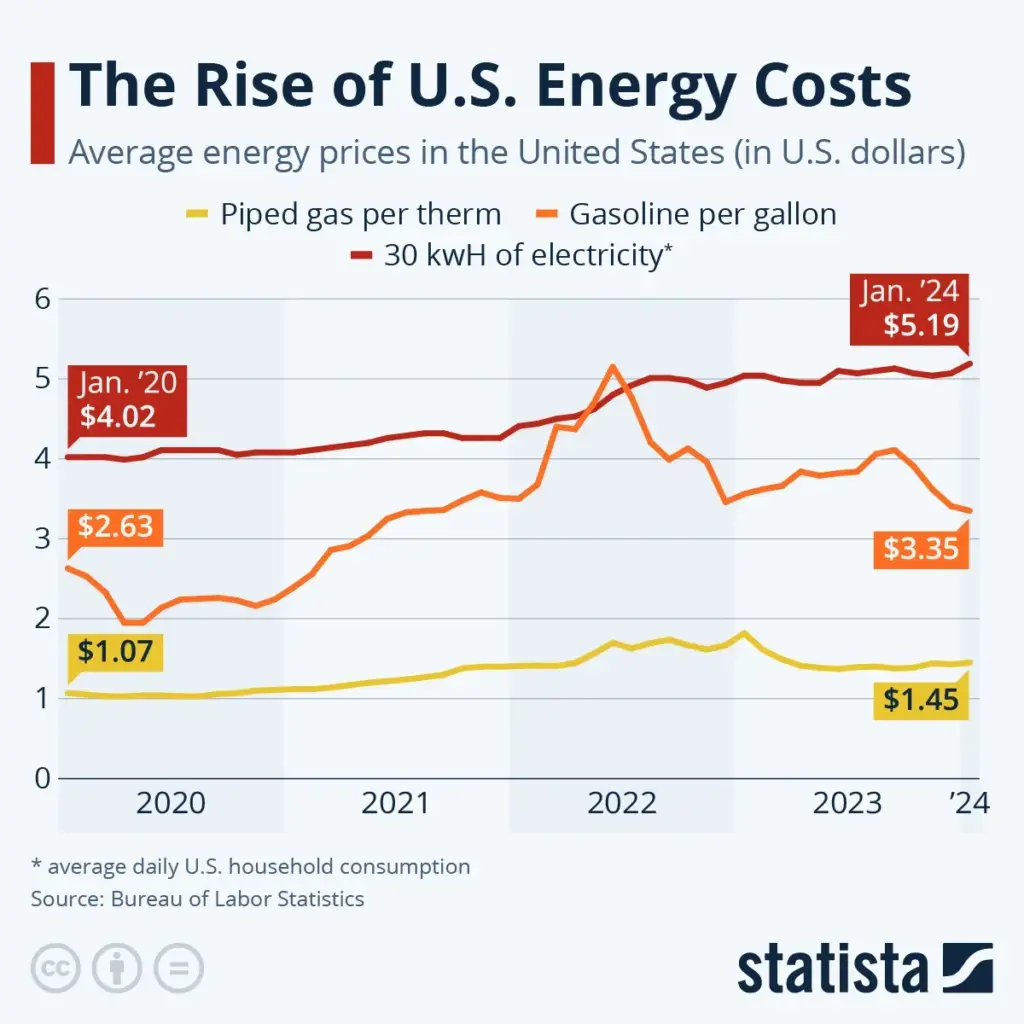

Rising energy prices have become a pressing concern for households across America, as families grapple with increasing costs of heating and electricity. Many families, like Kristy Hallowell’s, have faced extreme challenges, experiencing dramatic spikes in their utility bills that push them into financial turmoil. The electricity bill assistance programs that once offered a lifeline are now being inundated with requests from struggling families overwhelmed by utility debt. This surge in household energy struggles comes amidst a significant natural gas price increase, adding to the financial burdens many face during harsh winters. As discussions around clean energy investments swirl, the immediate need for effective solutions feels more critical than ever.

The surge in household energy expenditures has sparked intense discussions around affordability and sustainability. With costs of powering homes escalating, many American families are finding themselves in precarious financial positions, struggling to manage their rising electricity bills and increasing heating expenses. As consumers face these mounting utility challenges, there has been a notable focus on electric assistance programs and relief mechanisms available for those burdened by utility debts. Additionally, fluctuations in natural gas prices have further compounded the issue, urging lawmakers and energy advocates to explore cleaner, more economically viable energy solutions. The imperative for robust energy policies that address both immediate family needs and sustainable investments in renewable energy has never been more significant.

The Impact of Rising Energy Prices on American Households

Rising energy prices have had a profound impact on American households, forcing many families to reassess their budgets and spending habits. With electricity and natural gas prices climbing significantly over the past year, countless households are struggling to keep up, leading to what many refer to as ‘utility debt.’ As reported, Kristy Hallowell’s energy bill tripled unexpectedly, highlighting the reality that families across the nation are facing similar challenges, often resulting in disconnections of vital services like gas and electricity.

The financial strain of utility bills is compounded by other rising costs such as rent and healthcare, which many families prioritize over their energy expenses. As a result, many are falling behind on payments, leading to increased anxiety and fear of shut-offs, particularly during the harsh winter months. Reports indicate that nearly one in 20 households risk having their utility debts turned over to collections, underscoring the severity of this crisis that’s affecting diverse families across the country.

Utility Debt Relief Initiatives for Struggling Families

Amidst the crisis of rising energy costs, utility debt relief initiatives have emerged as a vital source of support for struggling families. Organizations like local non-profits have stepped in to negotiate agreements between families and utility providers, enabling many to keep their lights on despite massive debts. Kristy Hallowell’s story is just one example of how community support can make a significant difference in the lives of those facing dire energy challenges.

As soaring utility bills continue to crush household budgets, many states have also proposed increased funding for electricity bill assistance programs. Such initiatives are essential not just for temporary relief but also for long-term stability in energy management for low-income families. Distributing aid to families can help reduce the burden of utility debt, helping them navigate through financial instability while waiting for broader systemic changes in energy pricing and production.

Rising Natural Gas Prices: Causes and Consequences

Natural gas prices have surged over the past year, contributing directly to the rising costs of electricity across the nation. Factors such as increased international demand for natural gas, coupled with significant domestic production shifts, have led to higher prices at home. As reports indicate, almost half of the electricity generated in the U.S. relies on natural gas, tying the rising costs directly to consumers’ energy bills and pushing many families further into utility debt.

In addition to rising prices, the deregulation and export of natural gas has placed additional stress on domestic markets, leading to uneven price hikes that disproportionately affect low-income families. As they grapple with growing energy costs, essential assistance programs become even more critical in ensuring that households have access to affordable energy resources. Without intervention, the gap in energy affordability could widen, exacerbating existing economic disparities.

Electricity Bill Assistance Programs: Lifelines for Families

Electricity bill assistance programs have become crucial lifelines for families struggling with rising energy costs. These programs, often backed by government initiatives and local organizations, aim to provide financial support to households falling behind on their utility bills. Many families, like those represented by the Public Utility Law Project’s clients, find these resources indispensable amidst the increasing pressures of financial instability, making them a necessary component of the social safety net.

Despite the availability of assistance, awareness of these programs often remains low, further complicating the challenges for households needing support. As energy prices continue to rise, it’s imperative for local governments and utility companies to enhance communication about available aid options to ensure that more families can access the help they so desperately need, safeguarding them from disconnections and increasing utility debt.

The Role of Clean Energy Investments in Reducing Costs

The push for clean energy investments is gaining momentum as a potential long-term solution to the soaring energy prices that have engulfed American households. Experts argue that by investing in renewable energy sources, we can decrease reliance on fossil fuels, which have seen significant price increases. Furthermore, clean energy projects have the potential to create jobs and stabilize energy costs over time, providing a much-needed reprieve from the financial strain that many families currently face.

Unfortunately, recent policy shifts have stalled clean energy projects at a time when the need for sustainable solutions is more pressing than ever. The cancellation of key initiatives has hindered progress, making it imperative for lawmakers to reconsider their strategies. By prioritizing clean energy investments, we can foster a more resilient energy infrastructure that protects families from the unpredictability of rising utility costs, easing their burden of utility debt in the long run.

Economic Factors Driving Utility Debt Among Families

Economic instability is a significant driving force behind the increasing utility debt among American families. As wages stagnate and the cost of living rises, many households are struggling to make ends meet, leading them to prioritize other essential expenses over utility bills. This struggle is reflected in the swelling numbers of overdue utility accounts, with many families now owing upwards of several thousand dollars in utility debt, a stark contrast to pre-pandemic levels.

The interplay of economic factors such as inflation, unemployment, and rising energy costs creates an environment where families are increasingly vulnerable. When economic fundamentals falter, the consequences ripple outward, impacting energy affordability. To address this, comprehensive economic policies that consider the interdependence between wages, cost of living, and utility access are necessary to ensure that families can maintain their basic needs without succumbing to crippling debt.

Addressing Households’ Energy Struggles through Policy Change

Policy change is crucial in addressing the growing energy struggles facing American households. As utility bills rise disproportionately, effective legislation can help shield low-income families from the brunt of rising costs. Initiatives focused on strengthening energy assistance programs and introducing regulations to maintain affordable energy prices can provide immediate relief while paving the way for a more sustainable energy future.

Moreover, policymakers should advocate for transparent pricing and accountability from energy providers, ensuring that rate hikes are justified and communicated effectively. Strengthening consumer protections against excessive utility costs will significantly enhance family resilience against economic hardships brought on by rising energy prices and the related utility debt crisis.

Community Support Systems: A Beacon for Families in Crisis

Community support systems play a pivotal role in helping families navigate the fallout from rising energy costs. Local non-profits, churches, and grassroots organizations have stepped up to provide assistance, including financial aid and counseling. These groups often serve as crucial intermediaries, negotiating with utility companies to facilitate payment plans that prevent service shut-offs and catastrophic utility debt.

As such, community efforts not only provide immediate relief but also foster a sense of solidarity among families facing similar struggles. Encouraging community engagement and support networks is essential for building resilience in times of crisis and ensuring that families do not have to face their energy challenges alone. By working together, communities can empower families to advocate for their rights and seek necessary resources to overcome financial adversity.

The Future of Energy Pricing and Its Implications for Families

Looking to the future, energy pricing will remain a critical issue for American families, especially as factors such as climate change, demand fluctuations, and government policies continue to shape the landscape. The shift towards more sustainable energy practices presents both opportunities and challenges; while it can lead to long-term savings, the transition period may pose immediate financial burdens for households. Families must be advised on this transitional strategy to better prepare for the changes ahead.

Ultimately, it is essential for policymakers to prioritize equitable energy solutions that can mitigate the impact of rising prices on vulnerable populations. Initiatives aimed at ensuring that all households have access to affordable energy solutions will be paramount in fostering economic stability. By recognizing the interconnectedness of energy prices, economic policy, and household wellbeing, a more sustainable and equitable energy future can unfold.

Frequently Asked Questions

What are the main causes of rising energy prices affecting American households?

Rising energy prices in America are primarily driven by an increase in natural gas prices, which is a key fuel for electricity generation, and by the growing demand from data centers due to the boom in artificial intelligence. Additionally, the rollback of clean energy investments has exacerbated these costs, resulting in higher electricity bills for many households.

How can households struggling with rising energy prices find assistance?

Households navigating the challenges of rising energy prices can seek utility debt relief programs or electricity bill assistance initiatives offered by local non-profits and government agencies. These programs are designed to help reduce outstanding utility debts and manage monthly energy expenses more effectively.

What are the impacts of falling behind on energy bills amid rising energy prices?

Falling behind on energy bills due to rising energy prices can lead to severe consequences, including utility shut-offs and accumulating utility debt. Many families face the risk of disconnection, which can necessitate reliance on alternative sources of energy, like generators, to maintain basic necessities.

Are there any government initiatives to help with utility debt relief in light of rising energy prices?

Yes, there are government initiatives aimed at providing utility debt relief and electricity bill assistance, particularly for low-income families. However, some recent proposals to reduce funding for these programs could limit the support available to households struggling with rising energy prices.

How do rising energy prices affect low-income families and their ability to pay bills?

Rising energy prices significantly strain low-income families, leading to higher utility debt and an increased risk of disconnections. Many families have to choose between paying energy bills and other essential expenses, resulting in a traumatic cycle of financial instability.

What role do clean energy investments play in mitigating rising energy prices?

Investments in clean energy can potentially mitigate rising energy prices by diversifying energy sources and increasing energy efficiency. However, reductions in clean energy projects, as observed in recent years, have led to higher long-term electricity costs for consumers.

Why are electricity prices increasing faster than overall inflation rates?

Electricity prices are increasing faster than overall inflation rates largely due to the rising cost of natural gas, which is a major fuel source for electricity generation. Additionally, the increased demand for electricity from various sectors, such as data centers, adds further pressure on prices, creating a unique inflationary trend in energy costs.

What measures can states take to alleviate the burden of rising energy prices on consumers?

States can implement measures such as requiring large energy-consuming businesses, like data centers, to bear their own power costs, or facilitate clean energy initiatives that help stabilize prices. Providing utility debt relief programs at the state level can also aid families in managing rising energy bills.

What impact does the AI boom have on rising energy prices for households?

The AI boom drives up energy demand from data centers, which have substantial electricity requirements. This increased demand contributes to rising energy prices for households as the pressure on the power grid escalates, leading to higher bills for consumers.

What steps can consumers take to manage their energy bills amidst rising energy prices?

Consumers can manage their energy bills by exploring utility debt relief options, signing up for energy assistance programs, and adopting energy-efficient practices to lower overall consumption. It’s also advisable to regularly review energy plans and consider competitive rates to mitigate costs.

| Key Point | Details |

|---|---|

| Soaring Energy Prices | Residential energy bills have become a significant cost-of-living concern, with a 6.9% increase in electricity prices over the past year. |

| Impact on Families | Many families, like Kristy Hallowell’s, struggle with unpaid bills, leading to utility disconnections and reliance on generators. |

| Rising Utility Debt | Nearly 1 in 20 households are at risk of their utility debt being sent to collections, showcasing increased overdue bills. |

| Influences of Energy Costs | Higher natural gas prices, reduced clean energy investments, and increased demand from technology sectors contribute to rising costs. |

| Government’s Response | While the White House blames previous administrations for economic issues, experts suggest that embracing clean energy could alleviate price pressures. |

| Future Projections | Residential energy costs are expected to remain high in the coming months, with winter heating costs projected to increase 9.2%. |

Summary

Rising energy prices have become a pressing concern for American households, as many struggle to keep up with inflated utility bills and face the threat of service disconnections. As costs continue to surge due to various economic and policy factors, the impact on families is profound, leading to increased debt and financial instability. Moving forward, finding sustainable solutions will be crucial to mitigate the burden of rising energy prices and restore consumer confidence.