Listen to this article

Merton council tax increase is set to affect residents significantly, as the Labour-led council has proposed a 4 percent rise for the 2026/27 financial year. This hike will impact Band D properties, with bills projected to rise from £1,598.05 to approximately £1,661.97, thereby increasing the financial burden by about £64 annually. The council cites the recent government funding review and Merton’s funding gap as critical reasons for this decision, which also includes cuts to services such as adult social care. Although the rise is less than the potential 5 percent that could be implemented without a referendum, it promises to generate an estimated £134.2 million for local services. As the council grapples with balancing its budget, residents are encouraged to understand the implications of the Merton council tax rise 2026 and how it may affect the quality of local services amid ongoing adjustments in the Merton council budget 2026.

The increase in local taxation imposed by Merton council reflects broader fiscal challenges facing the borough as it attempts to balance its budget. With expectations of lower funding from government sources and an increasing funding gap, local leaders have aligned the rise in council levies with essential service funding needs. This approach not only addresses immediate financial shortfalls but also highlights the ongoing struggle to maintain adequate support in areas like adult social care amidst cuts. The so-called Merton council tax rise signals a closely watched decision that will stir discussions regarding the impact on local families, particularly in light of rising costs of living. As the council endeavors to streamline efficiencies within its budget while facing stringent operational realities, residents must stay informed about how these financial decisions may shape the region’s services and communal well-being.

Understanding the Merton Council Tax Increase for 2026

Merton residents are facing a significant council tax increase for the 2026/27 financial year, as the Labour-led council proposes a 4 percent rise. This decision, which raises bills for Band D properties from £1,598.05 to an estimated £1,661.97, reflects the council’s need to maintain essential services amid a challenging financial landscape. The council leadership argues that even with this increase, Merton’s rates will still be lower than those in nearby boroughs, aiming to alleviate the burden on residents while adhering to government-prescribed limits.

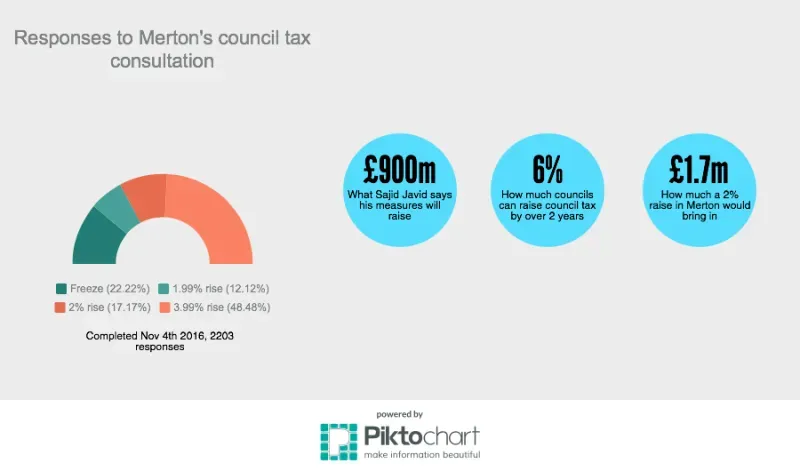

The increase encompasses a 2 percent rise in core services along with an additional 2 percent specifically allocated for adult social care funding. This dual approach indicates that the council is prioritizing critical service areas such as adult social care, which has faced its own funding challenges. The government’s ‘Core Spending Power’ model expectedly anticipates a higher council tax rise, yet Merton is choosing a more moderate approach to balance community needs and fiscal responsibility.

Exploring the Implications of the Merton Funding Gap

As Merton Council navigates its financial challenges, the issue of the funding gap has become increasingly critical. Currently projected to reach £5.78 million by 2029/30, this funding gap represents the disparity between the council’s spending requirements and the available financial support from government grants. The council’s leadership is under pressure to address this shortfall while ensuring essential services remain accessible to the community.

In light of these financial constraints, the council’s decision to implement efficiency savings and budget cuts is important. For instance, over £7.2 million in budget cuts for the upcoming year includes significant reductions in adult social care and children’s services. These measures, while necessary, raise concerns over the impact they may have on vulnerable populations within Merton and the long-term sustainability of local services.

Merton’s Adult Social Care Cuts and Their Consequences

The proposed budget for Merton includes over £2 million in cuts to adult social care, sparking serious discussions about how these reductions will affect the community. Significant portions of this budget come from reviewing aftercare packages for individuals leaving hospital care. With the potential to limit support services available for mental health recovery, many fear that these cuts could exacerbate existing pressures on families and community health systems.

Moreover, the implementation of AI technology is intended to mitigate demands on services and ease hospital admissions, yet the success of such strategies remains uncertain. Critics argue that reliance on technology may inadvertently overlook the personal touch and tailored care that individuals often need as they transition back to daily life after illness. The repercussions of these cuts, therefore, could lead not only to increased strain on families but also to long-term deficits in community health outcomes.

Contextualizing the Merton Council Tax Rise Within the Broader Budget 2026

The Merton Council tax rise for 2026 is directly tied to the overall budget presented by the council, which aims to navigate the complexities of local government funding amid changing regulations. The Labour administration has highlighted the government’s impending ‘Fair Funding Review’, which redefines the funding allocation to local authorities based on various criteria. This adds an additional layer of complexity to the budgeting process as Merton tries to balance funding needs with the pressures of maintaining low tax rates for residents.

While the proposed increase of 4 percent is marketed as a responsible choice in context, it is tempered by a backdrop of anticipated budget cuts affecting core services. As Merton attempts to manage its resources effectively, residents are left to consider not only the immediate implications of the council tax rise but also the long-term sustainability of local services that will be impacted by the ongoing funding review and necessary budget realignments.

Community Reactions to Merton’s Proposed Budget Cuts

The proposed budget for 2026/27 has sparked a mixed range of reactions from Merton residents and local officials. Many community members have voiced concerns over the potential impact of council tax increases combined with significant budget cuts across vital services like social care and children’s programs. Local political opposition, particularly from the Liberal Democrats, has labeled the cuts as ‘panicked’ and lacking transparency, emphasizing their belief that the budgetary choices made by the Labour council should be scrutinized more closely.

Critics argue that these budget cuts come at a time when many families are already grappling with the rising cost of living. They fear that the council’s decision to raise taxes while slashing essential services could result in a compounded effect on the health and well-being of the most vulnerable in the borough. The local community, therefore, is calling for greater accountability from the council, hoping that future budget decisions will prioritize the needs of residents and maintain necessary public services.

Comparing Merton’s Tax Rates with Neighboring Boroughs

One of the arguments put forth by Merton Council in favor of the proposed tax rise is that even following the increase, Merton’s council tax rates will remain lower than those of neighboring boroughs. This strategy is part of the Labour administration’s attempt to cushion the blow of tax increases by emphasizing relative affordability. Council Leader Ross Garrod has pointed out that the rates are structured to alleviate the burden on hard-working families while ensuring that essential services can be funded adequately.

However, while lower taxes than surrounding areas might provide some solace, the challenge lies in reconciling affordability with the inevitable cuts to services. Residents are tasked with balancing the understanding of the need for funding against the real-life implications of budget shortfalls and service reductions. The comparisons with neighboring boroughs, therefore, may offer a reprieve, yet they do not fully address the specifics of how the local services that residents rely on are being compromised.

The Future of Merton Council Services Post Budget Decisions

Looking beyond the immediate council tax increase and the cuts proposed in the 2026 budget, it is essential to consider the sustainability and future of Merton’s public services. Forecasts indicate that the borough will experience ongoing pressures related to housing growth and increased demand for social services, which necessitate mindful fiscal planning. The council’s choices now will shape the trajectory of service delivery in the years to come, particularly as pressures from a growing population intersect with budget constraints.

Residents are justifiably concerned about the durability of the services they depend on, especially with the specter of funding gaps looming on the horizon. The long-term success of public programs will hinge on the council’s ability to innovate within fiscal limitations while ensuring that the fabric of community support—especially for the most vulnerable—is not irreparably damaged. The decisions made during the budget planning process will have lasting repercussions well beyond the immediate financial year.

Insights on Merton’s Core Spending Power Model

Merton Council’s relationship with the Core Spending Power model is central to understanding its budgeting strategy for the next few years. The model assumes that local councils will raise taxes by up to 5 percent annually. However, Merton’s decision to implement a lesser 4 percent increase is indicative of a strategic choice to prioritize affordability for residents over maximizing tax revenue. This stance stems from an awareness that higher tax rates would ultimately burden local families, particularly given the current economic pressures many are facing.

This approach, while admirable in its intent, reflects a complex negotiation between local needs and governmental expectations. As Merton continues to monitor its fiscal situation, balancing local service needs against higher assumptions from the government will be an ongoing challenge. The way this tension is navigated will not only dictate the immediate efficacy of the council’s budget decisions but also shape the long-term viability of Merton’s public services in an evolving financial environment.

Transparency and Accountability in Merton’s Budget Proposals

As the Merton Council prepares for its budget proposal review on February 25, calls for transparency and accountability are echoing throughout the borough. Community stakeholders and opposition parties are insisting that the details surrounding budget cuts and tax increases be made fully clear to residents. The need for open communication regarding how the proposed cuts will affect local services and the rationale behind the tax increases is crucial to maintaining public trust.

This push for transparency reflects wider concerns about how local governments operate and communicate with their communities, especially during times of financial strain. As Merton grapples with balancing the books against public sentiment, ensuring that residents are kept informed will be pivotal in fostering a collaborative approach to budgeting. Ultimately, the council’s responsiveness to public feedback and its commitment to accountability will significantly influence how well the proposed budget is received.

Frequently Asked Questions

What is the proposed Merton council tax increase for 2026/27?

Merton council is proposing a 4 percent increase in council tax for the 2026/27 financial year, rising from approximately £1,598.05 to £1,661.97 for a typical Band D property.

How will the Merton council tax rise in 2026 affect funding for adult social care?

The Merton council tax rise includes a 2 percent precept specifically earmarked for adult social care, aimed at addressing ongoing budget pressures in this critical service area.

What factors are contributing to the Merton council budget 2026 decisions?

The Merton council budget 2026 decisions are influenced by the government’s recent Fair Funding Review and the necessity to close an increasing funding gap, which is projected to reach £5.78 million by 2029/30.

What is the impact of the Merton council tax rise on local services?

The increase in Merton council tax is projected to generate around £134.2 million for local services, although it is lower than last year’s 4.99 percent rise.

How does the Merton funding gap affect residents in the borough?

The Merton funding gap indicates that the difference between the council’s spending needs and available funding is widening, potentially leading to cuts in services or increased taxes for residents in the future.

What cuts are included in the Merton council’s budget for adult social care?

The Merton council’s budget includes over £2 million in cuts to adult social care, including £435,000 from reviewing aftercare packages and additional savings through the use of predictive AI to manage demand.

Why has the Merton council decided to implement a smaller tax rise than the maximum allowed?

Merton council has chosen a 4 percent council tax rise instead of the maximum 5 percent allowed, in an effort to support families facing cost-of-living pressures, while still balancing its budget needs.

What criticisms has the Merton council faced regarding the cuts in services?

The Liberal Democrat opposition has criticized the cuts as ‘panicked’ and ‘shameful’, arguing that they disproportionately impact essential services for residents, particularly children and those needing health support.

When will the Merton council tax increase be finalized?

The final decision on Merton’s council budget, including the proposed tax increase, will be made at the Full Council meeting on February 25.

How do Merton’s council tax rates compare to neighboring boroughs?

Despite the proposed Merton council tax rise, the council asserts that residents will still pay less in council tax compared to those in neighboring boroughs.

| Aspect | Details |

|---|---|

| Council Tax Increase for Band D | Rise from £1,598.05 to £1,661.97; approximately £64 increase annually. |

| Proposed Increase Percentage | 4% increase proposed for 2026/27 financial year. |

| Breakdown of the Increase | 2% for core services, 2% for adult social care spending. |

| Reason for Increase | Informed by government’s Fair Funding Review; Merton is classified as a low-needs, high-resourced authority. |

| Government’s ‘Core Spending Power’ Model | Assumes Merton should raise council tax by 5% annually; suggests residents should pay £2,060 by 2026/27. |

| Long-term Impact | Funding gap forecast to be £5.78 million higher by 2029/30. |

| Council’s Position | Claims to freeze main elements of council tax while keeping rates comparatively low. |

| Budget Cuts Explained | Budget includes over £7.2 million in cuts, affecting various services including adult care and children’s services. |

| Opposition’s Reaction | Liberal Democrats call cuts “panicked” and push for transparency. |

| Final Decision | To be decided at Full Council meeting on February 25. |

Summary

The Merton council tax increase for the upcoming financial year is set to raise significant concerns among residents. With the proposed 4 percent rise for 2026/27 to address funding gaps, many in the community are anxious about the implications for their household budgets. This adjustment is framed by the council leadership as a necessity due to external financial pressures, while also promising to keep rates lower than in neighboring boroughs. As the February 25th council meeting approaches, Merton’s residents are encouraged to engage in the discussions and understand how these changes will affect their local services.