Listen to this article

In recent years, London bank closures have surged, signaling a significant shift in the banking landscape across the city. As high street banks continue to retreat, a staggering number of branches like those of Lloyds and Halifax are preparing to close their doors permanently by 2026. Already this year, three notable bank branches have vanished, contributing to a growing list of UK bank closures that now exceeds 2,000 since February 2022. With the rise in digital banking and a noticeable drop in cash transactions, the traditional banking model faces unprecedented challenges. For anyone concerned about the future of their local bank, an interactive map detailing the London’s impending closures is now available, illuminating which bank branches are fading from the urban fabric into the digital age.

The recent trend of shuttered bank outlets across London paints a picture of a fading era in brick-and-mortar banking. With many establishments like those belonging to Lloyds and Halifax joining the fray, communities are grappling with the implications of these closures on their access to banking services. As financial institutions adapt to the increasingly digital preferences of their customers, the high street has witnessed a considerable withdrawal of traditional bank presence. This shift raises questions about the future of local banking and the support systems in place for residents who still depend on in-person banking. Enhanced tools such as interactive maps can provide an essential resource for Londoners looking to navigate this evolving financial landscape.

Overview of Upcoming London Bank Closures

The financial landscape in London is undergoing a significant transformation, with numerous bank branches set to close in the near future. By 2026, it is estimated that approximately 100 banks will cease operations, among them some of the largest high street names such as Lloyds and Halifax. Already in 2023, three branches in London have shut their doors, indicating a concerning trend for residents who depend on these services in their local communities.

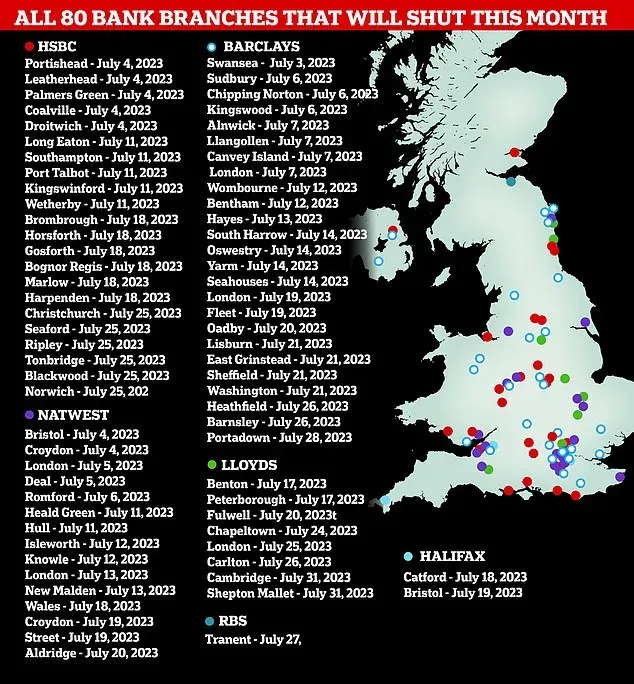

As traditional banking habits shift and digital transactions become increasingly prevalent, the number of physical bank locations is dwindling. The recent closures reflect a broader trend affecting not just London, but the entire UK, where upward of 2,065 branches have either closed or announced their intention to do so since early 2022. This decline has raised questions about accessibility for those who still rely on face-to-face banking services.

Impact of Lloyds and Halifax Bank Closures in London

The recent closures of banks, particularly Lloyds branches in Mitcham and Croydon, as well as the Halifax branch in Wandsworth, have highlighted the challenges faced by residents. Each closure impacts not only the immediate community but also the convenience and accessibility of banking services in densely populated areas. With Lloyds leading the charge in closures with 40 banks closing across the UK, customers are left searching for alternative banking solutions.

Furthermore, the Halifax branch closures add to the growing concerns as customers lose valuable access points. Many individuals, particularly those who are older or less familiar with digital banking, may find it harder to navigate this new landscape, potentially facing difficulties in managing their finances without local support. The cumulative effect of these closures could lead to a profound impact on community connectivity and economic stability.

The Shift to Digital Banking and Its Consequences

The ongoing trend toward mobile and online banking is reshaping how consumers interact with their financial institutions. Banks like Lloyds and Santander have cited this shift as a primary reason behind their closure decisions, indicating customers prefer to conduct their banking through technology rather than visiting physical locations. As technology advances, so too does consumer behavior, leading to a fundamental change in the banking industry.

This rapid digitalization offers convenience for many, yet it creates challenges for sectors of the population that rely on traditional banking services. Despite the push for digital solutions, there remains a substantial number of individuals who still rely on cash transactions. This demographic is left vulnerable when their local branches close, prompting a critical discussion on how to balance innovation with accessibility, especially for the elderly and low-income communities.

Mapping Future Bank Closures in London

For Londoners eager to stay informed about impending bank closures, an interactive map has been developed to track which branches are set to shut their doors. This tool not only highlights the affected areas but also helps consumers plan accordingly by identifying alternate banking facilities nearby. Users can visualize where closures are occurring, providing a clear picture of which neighborhoods will be most impacted.

As banks continue to announce closures, such an interactive map will become essential for residents to navigate the evolving financial landscape. It also serves as a resource for understanding trends in bank availability and potential future changes as the high street adapts to the ongoing digital shift.

Challenges Faced by Vulnerable Customers in a Cashless Society

With the rise of cashless transactions, many vulnerable customers—including the elderly, low-income households, and those without reliable internet access—are at risk of being left behind. Bank closures mean that these groups may have to travel further to access essential financial services or may need to adapt to using technology they are not comfortable with. The physical presence of bank branches has historically provided a sense of security and familiarity that is vital for many community members.

Organizations like LINK are responding to these challenges by assessing the impact of bank closures on the community and ensuring that alternative cash services are accessible to those who need them. This commitment to maintaining cash access, especially as more branches close, highlights the need for a balanced approach that accommodates all consumers as the shift towards a cashless society accelerates.

Community Reactions to Bank Closures in London

Reactions to the news of local bank closures are mixed among London residents. Many express frustration over losing nearby services, particularly in boroughs where bank branches have become integral to community life. Residents voice concerns over the growing distance they may need to travel for banking, which can pose challenges for those with mobility issues or limited transportation options.

Conversely, some community members advocate for embracing digital banking solutions, citing convenience and efficiency. This divide highlights the broader societal implications of transitioning away from traditional banking as individuals navigate their preferences and the limitations imposed by closures. Addressing these diverse viewpoints is crucial for stakeholders as they work to implement solutions that meet the needs of varying demographics.

Potential Solutions to Mitigate Impact of Bank Closures

In light of extensive bank closures, various solutions are being devised to cushion the impact on communities. One approach includes establishing banking hubs that combine services from multiple banks in a single, accessible location. This strategy not only provides convenience for customers but ensures that despite branch closures, residents still have access to the banking services they require.

Additionally, introducing more free ATMs and ensuring reliable online services for those who adapt to check their balances digitally can also alleviate some pressure resulting from closures. Collaboration between banks, local authorities, and community organizations can foster a support network, ensuring no customer is left stranded as the banking landscape continues to evolve.

Future of Banking in a Post-COVID World

The global pandemic has accelerated the trend of banking moving online, showcasing a significant shift in consumer behavior. Following these changes, traditional banks are reassessing their strategies, leading to the announced closures of many branches across London. Experts predict that the banking sector will continue to evolve post-COVID, potentially ushering in a new era of banking that emphasizes digital tools and services over physical presences.

However, this transformation raises pressing questions about the future of banking. How can financial institutions continue to provide crucial services to a diverse population while adapting to technological advancements? Ensuring that vulnerability is addressed will remain a challenge as banks pave the way forward in a predominantly cashless society.

Linking Data and Cash Access Solutions

With the extensive data gathered on bank closures since February 2022, LINK emphasizes its commitment to keeping the cash infrastructure intact. This organization plays a crucial role in assessing the impact of each closure and identifying where additional cash services may be necessary to meet demand. Their proactive stance aims to protect those who depend entirely on cash or prefer face-to-face banking.

By understanding the specifics of each closure and its broader neighborhood effect, LINK can ensure all community members retain access to necessary banking services. Partnerships with local businesses and government organizations will be critical as these networks work together to address the ongoing challenges presented by the shift toward digital payments and bank closures.

Frequently Asked Questions

What are the reasons behind the London bank closures occurring in 2026?

The London bank closures scheduled for 2026 are primarily due to a significant shift in customer behavior, with a growing preference for mobile and online banking services. As more people choose digital banking, traditional high street banks are facing declining foot traffic, leading them to close branches. This trend is part of a larger pattern across the UK, where over 100 bank branches are set to shut down, including major players like Lloyds and Halifax.

Can I find an interactive map showing London bank closures?

Yes, there is an interactive map available that details the London bank closures slated for 2026. This map allows you to see which specific bank branches are closing in your area, helping you stay informed about any changes that could affect your banking habits.

How many bank branches are expected to close in London by 2026?

By 2026, it is projected that up to 100 bank branches will close across London. This is part of a wider trend of UK bank closures, which has seen a significant number of branches shut down due to changes in consumer banking habits.

Which banks are closing branches in London this year?

This year, several major banks, including Lloyds, Halifax, NatWest, and Santander, have confirmed the closure of their branches in London. Specifically, three branches in London have already closed recently, with more scheduled to shut their doors throughout the year.

What impact will the London bank closures have on local communities?

The closures of bank branches in London can significantly impact local communities, especially for those who rely on in-person banking services. To address this gap, banking hubs are being established to provide essential services and support for customers, ensuring that vulnerable populations and small businesses continue to have access to banking facilities.

How many Lloyds branches are closing in London this year?

Lloyds is leading the bank closures this year with a total of 40 branches scheduled to close, including several in London. These closures are part of a larger trend towards digital banking, which has been increasingly adopted by customers.

What is the trend of bank closures in London over the past few years?

Over the past few years, London has experienced a staggering decline in the number of bank branches, with approximately 275 banks disappearing from the high streets since February 2022. This represents a significant shift in how banking services are delivered and used by the public.

Are there alternatives to traditional banking after the London bank closures?

Yes, alternatives such as banking hubs and cash access services are being introduced to fill the void left by bank closures. These hubs serve customers of multiple banks and provide essential services, helping those who still rely on cash and face-to-face banking.

What can I do to prepare for the London bank closures?

To prepare for the London bank closures, review your banking habits and explore online banking options. Additionally, utilize the interactive map to locate nearby branches that remain open and consider using banking hubs for essential services.

| Key Point | Details |

|---|---|

| Closure of Banks | In 2026, 100 banks are set to close, including major banks such as Lloyds and Halifax. |

| Recent Closures | Three London branches have already closed this year: Lloyds (Mitcham), Lloyds (New Addington), and Halifax (Wandsworth). |

| Total Closures in UK | Since February 2022, 2,065 branches have closed or planned closures across the UK. |

| Impact on London | 275 banks have closed in London since February 2022, with significant losses in Westminster and other boroughs. |

| Future Closures | Additional bank closures will occur throughout the year, including ongoing closures announced by Lloyds and others. |

| Support Measures | LINK and Cash Access UK are working to establish banking hubs and cash services to support communities. |

Summary

London bank closures are a pressing issue as the banking landscape shifts towards digital services. With many high street banks set to shut down, significant efforts are being made to address the needs of customers who still rely on physical banking and cash transactions. The establishment of banking hubs and services by organizations like LINK signifies a commitment to maintaining access to essential financial services for vulnerable populations even amidst these closures.