Listen to this article

The IMF global growth forecast stands out as a critical indicator of economic stability and prospects for nations worldwide. In its latest economic outlook, the International Monetary Fund (IMF) has flagged trade tensions and potential setbacks in the artificial intelligence sector as significant risks to this growth trajectory. While the fund acknowledges some resilience in the current global economy, it emphasizes that uncertainties surrounding central bank independence and inflation predictions could pose challenges ahead. As global inflation rates fluctuate and companies navigate the complex landscape of investment in technology, including AI, the implications on the trade landscape are vital. Keeping an eye on the IMF global growth forecast will help stakeholders better understand the interconnectedness of global markets and the potential impact of emerging risks.

The latest projections from the International Monetary Fund paint a complex picture of worldwide economic prospects. This update suggests that geopolitical conflicts and advancements in technology may significantly influence the global investment landscape. With increasing concerns surrounding the sustainability of trade relations and the potential decline of the AI boom, the report highlights challenges that could jeopardize economic recovery. Observers must pay close attention to the evolving dynamics of inflation rates as central banks strive to maintain their independence. In navigating these turbulent waters, the global economy’s adaptation to such shifts will determine its resilience moving forward.

IMF Global Growth Forecast: A Resilient Outlook

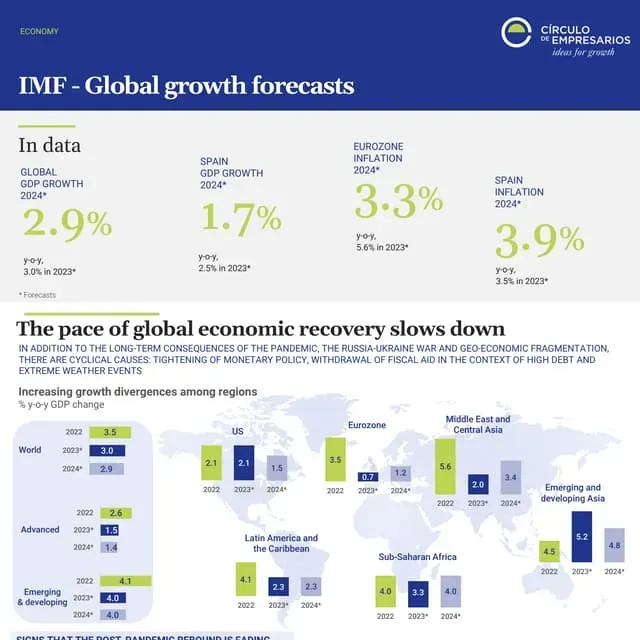

The International Monetary Fund (IMF) has recently released its latest global growth forecast, projecting an increase from 3.1% to 3.3% for the current year. This adjustment reflects a more optimistic view of the world economy, as it has shown resilience despite significant challenges, including ongoing trade tensions and potential setbacks in the artificial intelligence sector. According to the IMF, while growth rates may not appear outsized, the underlying stability of the global economy suggests that it can withstand external shocks, thus maintaining a steady momentum entering 2025.

The IMF’s chief economist, Pierre Olivier Gourinchas, noted that the global economy has been effectively managing the disruptions posed by recent trade conflicts. This newfound resilience could be partly attributed to robust investments in technology and innovation, particularly in AI. Nevertheless, the IMF cautions that the optimistic growth forecast is contingent on avoiding escalated trade wars and a stable inflation environment. If these risks materialize, the projected growth rates could quickly reverse, underscoring the fragile nature of the current economic climate.

Impact of Trade Tensions on Global Economy

Trade tensions have emerged as a significant risk factor for the global economy, with implications that go beyond immediate fiscal concerns. The IMF has highlighted how tariffs and other trade barriers can lead to uncertainty, potentially slowing down economic activity. As countries impose tariffs on each other’s goods—such as Donald Trump’s consideration of tariffs against European nations—businesses may hesitate to invest or expand, fearing reduced demand and higher costs. This hesitation can lead to broader implications for global supply chains and commodity prices, which are critical components of the international trade system.

Moreover, the layering of geopolitical tensions can exacerbate these issues, prompting nations to adopt protectionist stances that distract from collaborative international trade practices. The IMF warns that prolonged trade conflicts could stifle innovation, increase prices for consumers, and erode the purchasing power that fuels global growth. Consequently, the linked nature of today’s global economy means that disruptions in one area can have a ripple effect, further complicating the global growth trajectory.

Artificial Intelligence Risks and Economic Stability

The recent boom in artificial intelligence has introduced both exciting opportunities and considerable risks to the global economy. The IMF has cautioned that while investment in AI technologies can act as a significant growth driver, overly optimistic projections of AI’s benefits could lead to abrupt market corrections if expectations are not met. Such corrections can severely impact wealth accumulation, particularly as companies increasingly leverage debt to finance their AI ventures. A sudden downturn could result in reduced consumer spending and altered corporate investment strategies, thereby jeopardizing economic stability.

Furthermore, the potential fallout from inflated expectations in AI development amplifies existing vulnerabilities within financial markets. As businesses recalibrate their investment plans in the face of changing market realities, both corporate and consumer confidence may wane, further eroding economic growth. The IMF emphasizes the need for balanced predictions surrounding AI—recognizing its strengths while preparing for potential pitfalls—to ensure that the global economy can navigate these transformative trends calmly and effectively.

The Importance of Central Bank Independence

Central bank independence is a cornerstone of macroeconomic stability, according to the IMF’s latest report. The organization stresses that maintaining autonomy from political pressures is vital for central banks to fulfill their mandates effectively, particularly concerning inflation control and economic growth. Recent challenges to this independence, highlighted by controversies in countries with significant borrowing needs, underscore the risks involved when governments attempt to influence monetary policy in favor of short-term economic gains. Such dynamics can lead to inflation and destabilizing long-term financial costs.

The IMF warns that challenges to central bank independence can disrupt the delicate balance required to sustain a robust economy, with the risk of fiscal dominance rising in environments influenced by populist pressures. Consequently, ensuring the operational independence of central banks is critical in navigating future economic challenges, allowing them to make unbiased decisions aimed at fostering economic prosperity and stability. The Sovereign independence of monetary authorities remains essential for maintaining credibility and confidence among investors, ultimately contributing to a more resilient global economy.

Global Inflation Predictions and Economic Growth

In its recent updates, the IMF has projected a decline in global inflation, forecasting a drop from 4.1% in 2025 to a more manageable 3.4% by 2028. These predictions reflect ongoing improvements in global economic conditions and anticipated adjustments in industry-specific pricing, such as energy and transport. The organization indicates that as inflationary pressures ease, central banks will have more flexibility to manage interest rates without immediate threats of rising prices, thus supporting sustainable economic growth.

However, the IMF reminds us that persistent inflation issues can quickly erode consumer confidence, leading to reduced spending and potential economic slowdowns. For nations like the UK, where inflation rates are tightly monitored, any substantial deviation from projected benchmarks could prompt monetary policy changes that affect growth trajectories. As global inflation trends evolve, the interplay between consumer expectations and central bank responses will be crucial in steering economies toward overall recovery and expansion.

The Role of Technology in Economic Expansion

Investment in technology acts as a central pillar in driving economic expansion, with artificial intelligence at the forefront of this evolution. The IMF has highlighted how advancements in technology have led to increased productivity, innovation, and ultimately economic growth, suggesting that tech investment is a fundamental aspect of modern economic strategies. As firms increasingly integrate AI and other emerging technologies into their operational fabric, the potential for economic advancement becomes significant. However, along with this opportunity comes the necessity for caution, as rapid technological changes can lead to displacement and transitional economic challenges.

The integration of technology should be viewed as a double-edged sword—while it propels growth, it also poses challenges that require intentional navigation. The risks associated with an over-reliance on technological advancements must be balanced by strong financial practices and an emphasis on workforce adaptability. By aligning technology with strategic economic frameworks, businesses can strive to maximize the benefits from innovations like AI while mitigating associated risks that could derail growth.

Geopolitical Tensions and Economic Outlook

Geopolitical tensions introduce significant uncertainty into the global economic outlook, as highlighted by the IMF in its latest commentary. Nations frequently find themselves at odds over trade policies, territorial disputes, and resource allocations, creating a tumultuous environment for international commerce. This volatility can hinder economic activity and deter potential investments, as businesses may shy away from entering markets fraught with political risks. The IMF emphasizes that, to maintain growth, countries must navigate these tensions with diplomacy and cooperation, fostering environments conducive to trade and shared economic benefits.

The interconnected nature of global markets means that geopolitical turmoil in one region can have far-reaching implications affecting supply chains, commodity prices, and overall economic stability. As countries like the United States consider actions like imposing tariffs, there is a genuine risk of further exacerbating these tensions. Engaging in proactive dialogues on trade agreements and conflict resolution could mitigate some of these risks, facilitating a more stable economic landscape conducive to growth and development.

Consumer Confidence and Economic Health

Consumer confidence serves as a critical barometer for economic health, influencing spending behaviors and investment decisions. The IMF report underscores the interplay between inflation, interest rates, and consumer sentiment in shaping overall economic dynamics. As inflation pressures begin to decrease, consumer confidence can potentially rebound, leading to increased spending and subsequently, economic growth. However, if consumers perceive economic instability—stemming from either trade tensions or geopolitical risks—they may temper their spending, which could directly impact growth trajectories.

Effective communication from policymakers and central banks regarding inflation expectations and economic forecasts plays a pivotal role in shaping consumer confidence. By maintaining transparency and displaying a commitment to correcting imbalances, authorities can foster a climate of optimism among consumers. On the flip side, if consumer sentiment falls under the weight of external shocks, such as rising trade disputes or economic uncertainty, it can quickly derail growth momentum—solidifying the need for sustained vigilance in economic management to counteract these threats.

Investment Strategies for Economic Resilience

Investment strategies focused on resilience can play a vital role in navigating the complex landscape of the global economy. The IMF has highlighted how prudent investments in technology, infrastructure, and sustainable practices can span initial returns and long-term stability for various economies. By identifying sectors poised for growth, such as renewable energy and artificial intelligence development, investors can capitalize on emerging trends while simultaneously bolstering the economic framework against unforeseen challenges.

Moreover, diversification remains a key strategy for mitigating risks associated with global economic fluctuations. As geopolitical and trade tensions continue to pose threats to economic growth, spreading investments across a broader array of assets can help cushion potential downturns. This comprehensive approach enables economies to adapt to changing market conditions, fostering resilience and sustained growth over time as they respond dynamically to the evolving global landscape.

Frequently Asked Questions

What is the IMF global growth forecast for this year?

The IMF global growth forecast projects a growth rate of 3.3% for this year, an increase from the previous prediction of 3.1%. This indicates a resilient global economy despite challenges such as trade tensions.

How do trade tensions impact the IMF global growth forecast?

According to the IMF global growth forecast, trade tensions pose a significant risk to economic growth. While the global economy remains resilient, escalating trade tensions can create uncertainty that may slow down growth rates.

What are the risks associated with artificial intelligence according to the IMF global growth forecast?

The IMF global growth forecast identifies the risks of a reversal in the artificial intelligence boom as a potential threat. If AI growth expectations are overly optimistic, it could trigger market corrections, impacting global economic stability.

What role does central bank independence play in the IMF global growth forecast?

The IMF emphasizes that central bank independence is paramount for macroeconomic stability and growth. The IMF global growth forecast suggests that maintaining this independence helps anchor inflation expectations and avoids fiscal dominance.

What are the IMF’s global inflation predictions for the coming years?

The IMF’s global inflation predictions anticipate a decline from 4.1% in 2025 to 3.8% in 2026, and further to 3.4% in 2027. This trend reflects a stabilizing macroeconomic environment associated with the global growth forecast.

How might geopolitical tensions affect the IMF global growth forecast?

The IMF warns that geopolitical tensions could disrupt global growth by creating uncertainty that influences financial markets and impacts trade. Such factors can weigh heavily on the IMF global growth forecast.

What is the significance of the IMF’s world economic outlook in relation to global growth forecasts?

The IMF’s world economic outlook provides a comprehensive analysis of global economic conditions, influencing global growth forecasts and offering insights into risks and opportunities impacting the economic landscape.

In what way are recent trade policies affecting the IMF global growth forecast?

Recent trade policies, including tariffs, have been indicated as a risk factor in the IMF global growth forecast. The response to such policies can lead to slowdowns in global activity and economic growth.

How does the IMF assess the impact of technology investments on global growth forecasts?

The IMF notes that surging investments related to technology, including artificial intelligence, provide tailwinds that support the global growth forecast, although risks remain if expectations about these investments are not met.

What should policymakers focus on according to the IMF’s global growth forecast?

Policymakers should prioritize preserving central bank independence to maintain economic stability and mitigate risks outlined in the IMF global growth forecast, as this is crucial for achieving sustained growth and managing inflation.

| Key Points | Details |

|---|---|

| IMF’s Global Growth Forecast | Global growth projected at 3.3% in 2027, up from 3.1%. |

| Risks to Growth | Trade tensions and AI boom reversal identified as primary risks. |

| Central Bank Independence | IMF emphasizes the importance for effective economic stability. |

| National Forecasts | UK expected to grow by 1.3% in 2025, maintaining G7 ranking. |

| Inflation Projections | Global inflation expected to decline from 4.1% to 3.4% by 2028. |

| Geopolitical Risks | Domestic and geopolitical tensions may disrupt economic activity. |

Summary

The IMF global growth forecast indicates a resilient economy, projecting a growth rate of 3.3% for 2027 due to technological advancements and investment. However, potential risks, particularly from trade tensions and an unpredictable AI investment landscape, could hinder this trajectory. Additionally, the importance of maintaining central bank independence is highlighted as crucial for macroeconomic stability.