Listen to this article

In the world of finance, the term “How to Launder Money” raises eyebrows and ignites conversations about the depths of financial crime. The complexities of money laundering not only challenge law enforcement but also create a convoluted net of financial regulations that many struggle to navigate. George Cottrell, a co-author of the eye-catching book by the same name, brings a unique perspective to this crucial issue, having firsthand experience with the legal and financial systems. Published by Biteback Publishing, this guide aims to illuminate the inner workings of money laundering and provide insight to those tasked with combating it. Through a blend of humor and hard-hitting truths, Cottrell and his co-author Lawrence Burke Files aim to foster a vital dialogue surrounding the implications of current anti-money laundering practices and their effects on legitimate businesses.

Exploring the topic of illicit financial transactions, the concept of laundering money often conjures images of shadowy figures and underground schemes designed to obscure the true origin of funds. This extensive guide serves not only law enforcement agencies but also policymakers and prosecutors, aiming to redefine the conventional understanding of money laundering. By investigating both the practical realities faced by criminals and the often ineffective responses of financial regulations, the authors seek to shed light on a pressing global issue. With Cottrell’s extensive background in finance and Burke Files’ expertise in due diligence, the book endeavors to engage readers in a more profound discussion about the implications of money management and the systemic failures of existing anti-money laundering laws. The insights presented serve as a necessary reminder of the continuous evolution within financial systems and the importance of vigilance and reform.

Understanding Money Laundering: The Basics

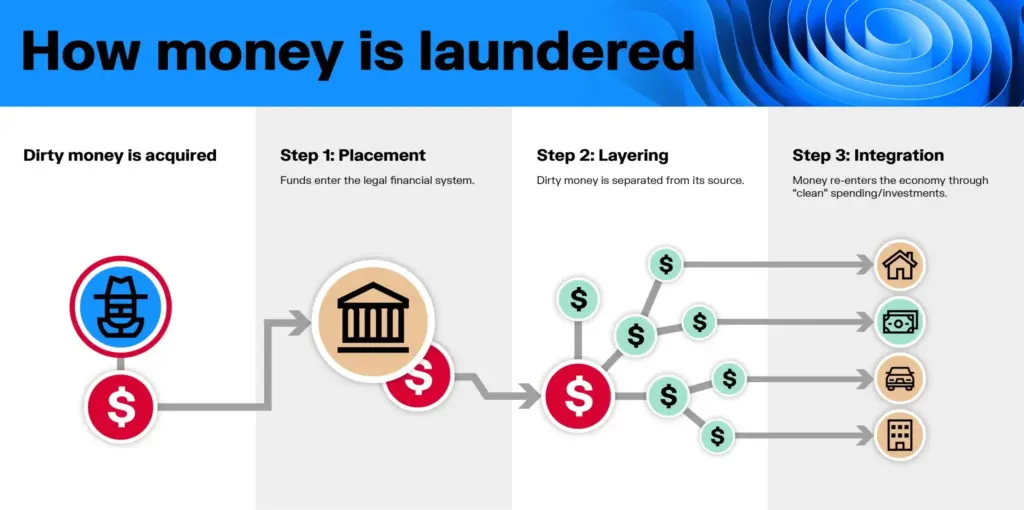

Money laundering is often defined as the process of making illegally obtained funds appear legitimate. This practice involves a series of financial transactions designed to conceal the origin of the money, ultimately allowing criminals to benefit without drawing the scrutiny of law enforcement. The intricacies of money laundering have been recognized globally, with countries implementing stringent financial regulations to combat these illicit activities. Books like ‘How to Launder Money’ aim to enlighten both law enforcement and the general populace about the mechanics of this financial crime, presenting both the methods criminals use and the weaknesses that can be exploited in the system.

As highlighted in the book by George Cottrell and Lawrence Burke Files, there’s a notable gap in understanding among legitimate businesses regarding the tactics used by money launderers. With Cottrell’s firsthand insights and Burke Files’ extensive experience in finance and due diligence, the authors provide a unique vantage point. They aim to bridge the knowledge gap by elucidating the patterns of money laundering schemes and how they can be recognized and thwarted by financial institutions and law enforcement. This knowledge is critical as it empowers regulatory bodies to create more effective measures against financial crimes.

The Role of George Cottrell in the Fight Against Financial Crime

George Cottrell, co-author of ‘How to Launder Money’, has a compelling narrative that intertwines personal experience with the broader conversation on financial regulations. After his time in prison for wire fraud, Cottrell transformed his past into a tool for advocacy, seeking to support law enforcement efforts against money laundering. His collaboration with Lawrence Burke Files not only brings expertise but also personal stakes into the discourse, emphasizing that criminals understand the landscape of financial systems better than most. Cottrell’s journey provides a unique perspective that challenges perceptions about individuals involved in financial crimes.

The book’s introspection illuminates Cottrell’s commitment to addressing the very issues that saw him incarcerated. By engaging with the complexities of money laundering and its implications on society, he aims to aid policymakers and law enforcement in their pursuit of justice. His comments during the book launch, including clarifications about the intent to educate rather than promote criminal activities, underscore his dedication to reformative discourse in the aftermath of his past. This approach provides a fresh viewpoint in discussions around financial crime, shifting focus from merely punitive measures to educational and preventive strategies.

Law Enforcement Responses to Money Laundering

In the ever-evolving financial landscape, law enforcement agencies have faced significant challenges in combating money laundering. The complexity of modern financial transactions, coupled with the rise of digital currencies and online banking, has made it increasingly difficult to track illicit activities. The insights from ‘How to Launder Money’ underscore the need for law enforcement to innovate their approaches in detecting and dismantling money laundering schemes. Cottrell and Burke Files advocate for a more cohesive strategy that involves multiple stakeholders including financial institutions, regulatory bodies, and community organizations.

Recent examples highlighted in discussions surrounding the book point to the failures of existing frameworks. With references to historical cases and the intricacies of international finance, the authors argue for enhanced cooperation among global law enforcement agencies. Money laundering, as they suggest, is not confined by borders; thus, a unified front that shares intelligence and resources could significantly bolster efforts against financial crime. The dialogue invoked by their work invites a necessary critical examination of current policies and calls for innovative reforms that can adequately address the challenges posed by modern laundering techniques.

Impact of Financial Regulations on Money Laundering Efforts

Financial regulations play a crucial role in the fight against money laundering, but they also present significant challenges to legitimate businesses. As outlined in ‘How to Launder Money’, the authors argue that existing regulations have devolved into a convoluted framework that inadvertently burdens honest enterprises while failing to deter criminals effectively. Cottrell and Burke Files emphasize the irony where stringent laws, aimed at preventing financial crimes, may stifle legitimate growth and economic development due to their complexity and burdensome compliance requirements.

Highlighting their experiences in finance and regulatory environments, the authors advocate for a re-evaluation of these financial regulations. They suggest that a more streamlined approach can support law enforcement efforts without penalizing good-faith businesses. By focusing on creating transparent, practical, and cooperative regulatory frameworks, it becomes possible to enhance compliance while simultaneously empowering law enforcement to implement more effective strategies against money laundering.

The Importance of Education in Preventing Financial Fraud

Education is a pivotal element in reducing instances of money laundering and financial fraud. According to ‘How to Launder Money’, an informed public and vigilant financial institutions are critical to identifying suspicious activities before they escalate into major financial crimes. Cottrell and Burke Files highlight the necessity for training programs and resources for both law enforcement and private sector employees to recognize red flags associated with money laundering, thus fostering an environment of proactive vigilance.

Moreover, by sharing knowledge and best practices, organizations can build a more robust defense against financial crimes. The authors argue that the criminals are often steps ahead of the regulatory frameworks designed to catch them. Therefore, equipping legal entities with the latest intelligence and methodologies in combating money laundering can enhance their effectiveness significantly. Public awareness campaigns and education at the community level can also empower individuals to identify and report suspicious financial behavior, creating a more comprehensive safety net.

Financial Crimes: A Global Perspective

Money laundering is not merely a domestic issue but a global phenomenon that transcends national boundaries. ‘How to Launder Money’ discusses the transnational nature of money laundering activities, drawing attention to how international schemes exploit variances in regulations across countries. As financial systems become interlinked, it is crucial for nations to collaborate and share information to effectively tackle this challenge. The authors call for global cooperation as individual countries may not possess all the necessary tools to combat sophisticated money laundering networks.

In light of globalization, financial institutions need to implement practices that are not limited by geographical constraints. The book emphasizes the importance of developing common standards and frameworks that can be adopted across jurisdictions. This includes harmonizing anti-money laundering laws and increasing transparency among financial entities worldwide. Such efforts would enhance the ability to track and prosecute global money laundering schemes, combining resources and expertise to create a more fortified front against financial crimes.

Criminal Justice and Money Laundering: Challenges and Solutions

The relationship between criminal justice and money laundering is fraught with challenges. The complexities involved often render traditional investigative methods ineffective. Cottrell and Burke Files, in ‘How to Launder Money’, delve into these challenges, stressing the limitations of conventional approaches in tracking the flow of illicit funds. They highlight the need for reform within the justice system that allows for more flexible and responsive measures against financial crimes.

One of the proposed solutions within the text includes leveraging advanced technology to enhance investigative capabilities. By adopting data analytics, artificial intelligence, and machine learning, law enforcement can analyze vast amounts of financial data, uncover patterns, and make connections that may not be readily observable. These technologies can empower investigators to stay one step ahead of money launderers, who continuously evolve their tactics. With a forward-thinking approach to integrating technology into criminal justice strategies, agencies can significantly improve success rates in both identifying and apprehending those involved in complex money laundering schemes.

The Role of Policymakers in Combatting Financial Crime

Policymakers have a direct impact on the effectiveness of measures implemented to combat money laundering. As seen in ‘How to Launder Money’, George Cottrell and Lawrence Burke Files emphasize the importance of well-informed, effective policymaking that reflects the realities of financial crime. They advocate for legislative frameworks that are adaptable and responsive to new threats emerging in the financial landscape, ensuring that the policies are not only reactive but also preventive.

By fostering open dialogues with law enforcement, financial institutions, and the community, policymakers can craft rules that facilitate, rather than hinder, cooperation among these parties. The book posits that collaborative efforts create a stronger regulatory environment that not only curbs money laundering but also supports economic integrity. Engaged and informed policymakers can drive initiatives that promote transparency, efficiency, and fairness in the financial sector, crucially aiding in the fight against financial crime.

Public Awareness and Its Role in Financial Crime Prevention

Understanding the public’s role in financial crime prevention is a theme strongly represented in ‘How to Launder Money’. The authors argue that public awareness is instrumental in equipping individuals with the knowledge needed to identify and report suspicious activities related to money laundering. Campaigns aimed at educating the public about the signs of financial crime can mobilize community members to act, creating a vigilant society where illicit financial practices can be identified and addressed promptly.

Moreover, increased public awareness can lead to greater accountability for financial institutions. When consumers are educated about their banking processes and aware of their rights, they are less likely to tolerate unjust practices. This ripple effect can encourage banks to maintain rigorous compliance with anti-money laundering regulations, knowing that their clientele is informed and engaged. Such empowerment lays the foundation for a collective effort against money laundering that encompasses society at large, ultimately leading to a more transparent financial system.

Frequently Asked Questions

What is the book ‘How to Launder Money’ by George Cottrell about?

‘How to Launder Money,’ co-authored by George Cottrell and Lawrence Burke Files, explores money laundering from both a criminal and law enforcement perspective. The authors aim to shed light on the techniques used by money launderers while also critiquing existing financial regulations. It serves as a guide for law enforcement, prosecutors, and policymakers to better understand the complexities of money laundering.

Can ‘How to Launder Money’ help criminals in their activities?

The authors of ‘How to Launder Money,’ including George Cottrell, assert that the book contains no instructions or assistance for criminals. Instead, it provides insights into how money laundering works and highlights the challenges faced by law enforcement in combating it. Cottrell emphasizes that the spotlight is on understanding and preventing these crimes.

What techniques are discussed in ‘How to Launder Money’ related to financial regulations?

In ‘How to Launder Money,’ the authors discuss various techniques used in money laundering and the implications of financial regulations designed to combat these practices. They critique current laws as convoluted failures that burden legitimate businesses while providing insights useful for law enforcement and policymakers tasked with addressing money laundering.

Who are the authors of ‘How to Launder Money’ and what are their backgrounds?

The book ‘How to Launder Money’ is co-authored by George Cottrell and Lawrence Burke Files. Cottrell is known for his experience in finance and his former legal troubles involving money laundering, while Burke Files has over four decades of experience in finance, particularly in due diligence and corporate investigations. Their backgrounds provide a unique perspective on the money laundering issue.

What prompted George Cottrell to write ‘How to Launder Money’?

George Cottrell’s personal experiences, including his arrest and conviction related to money laundering, fueled his desire to write ‘How to Launder Money.’ He aims to share insights from both sides of the issue — as someone who has faced legal repercussions and as an advocate for better understanding the complexities of money laundering among law enforcement and the public.

What is the intended audience for ‘How to Launder Money’?

‘How to Launder Money’ targets law enforcement officials, prosecutors, policymakers, and the general public interested in understanding money laundering. The authors hope to catalyze discussion about the failures of current regulations and inspire changes to enhance the effectiveness of anti-money laundering efforts.

How does ‘How to Launder Money’ address law enforcement challenges?

‘How to Launder Money’ addresses law enforcement challenges by highlighting the convoluted nature of current anti-money laundering laws and their often counterproductive effects. Through their analysis, Cottrell and Burke Files provide insights on improving strategies to combat money laundering, thereby aiding law enforcement in their efforts.

What does George Cottrell say about his past related to money laundering?

George Cottrell openly discusses his past experiences, including his arrest for money laundering conspiracy, during the promotion of ‘How to Launder Money.’ He emphasizes that the book aims to provide valuable perspectives on money laundering without endorsing criminal activity, instead focusing on lessons learned for better enforcement and regulatory practices.

| Key Points | Details |

|---|---|

| Book Title: How to Launder Money | Co-authored by George Cottrell and Lawrence Burke Files, published by Biteback. |

| Author Background | George Cottrell, a close aide to Nigel Farage, has a criminal background related to wire fraud. Lawrence Burke Files brings 40 years of finance expertise as an investigator. |

| Launch Event | The book was launched at the Raffles hotel in London, attended by notable figures from Reform UK including Nigel Farage. |

| Book’s Purpose | Aims to educate law enforcement, prosecutors, and policymakers about money laundering, using insights to stimulate discussion on anti-money laundering regulations. |

| Key Themes | The book criticizes anti-money laundering laws as complicated and ineffective, advocating for a review of their impact on legitimate businesses. |

| Quote from Authors | ‘Are we cheerleaders for crime? No. Quite the opposite,’ signaling their intent to aid law enforcement with insights from the criminal perspective. |

| Discussion of De-banking | Reflects on how political views can impact banking relations, citing Farage’s experience with Coutts bank as an example of the influence of social belief systems on banking decisions. |

Summary

How to Launder Money is a provocative exploration of money laundering from the perspective of its authors, George Cottrell and Lawrence Burke Files. Their book provides valuable insights not only into the mechanics behind money laundering but also the failures of current anti-money laundering laws. Through their experiences and research, Cottrell and Burke Files aim to engage law enforcement and policymakers in productive discussions about reforming these systems. The book challenges the reader to rethink the implications of finance, legality, and morality in modern society.