Listen to this article

The impending wave of high street brands closures in 2026 is set to reshape the UK retail landscape dramatically. Among the significant casualties, River Island is planning to shutter 32 stores as it grapples with a £33.2 million loss and a sharp decline in sales. Similarly, Poundland’s restructuring will see it eliminate branch locations, contributing to a total of over 100 anticipated closures this year. As major retailers shut their doors, customers and communities alike are left to ponder the implications of these store closures on local economies and shopping habits. The evolution of UK high street retail news signals a pivotal moment in which the impacts of shifting consumer preferences and operational challenges are more tangible than ever.

As we navigate the challenges faced by beloved high street entities, 2026 marks a significant turning point in the retail sector. Renowned names like River Island and Poundland are part of a larger trend of major retailers reducing their market presence, which speaks volumes about changing shopping behaviors. The closures are not just numbers; they symbolize the shifting dynamics within the UK shopping experience, where traditional brick-and-mortar stores grapple with increasing operational costs and rising digital competition. This consolidation of physical retail spaces highlights an urgent need to address the store closures impact on towns and communities. Anticipated upheavals ahead call for keen awareness of retailer strategies and consumer adaptability in the evolving marketplace.

Impact of River Island Store Closures in 2026

The impending closure of 32 River Island stores in 2026 signifies a crucial turning point for the brand, reflecting its struggle against changing consumer behaviors. The decision comes as a response to significant financial losses, with a reported £33.2 million deficit last year due to a 19% drop in sales. As consumers continue to favor online shopping, physical stores are becoming less viable for many retailers, leading to a widespread reevaluation of brick-and-mortar strategies and an increased focus on digital sales.

This shift not only affects River Island but also creates a ripple effect across the high street. The closures will likely lead to a decline in foot traffic in the affected areas, exacerbating existing challenges for neighboring businesses. As customers gravitate towards convenience and competitive online pricing, other retailers must adapt quickly or face similar fates. With major retailers shutting stores, the landscape of UK high-street retail is evolving rapidly, prompting discussions on the future of urban shopping.

Poundland Closures in 2026 and Their Implications

Poundland is set to close 32 stores by February 2026, compounding the losses seen across the high street. The closures are a direct result of a strategic restructure following a nominal sale of the retailer. As it’s streamlined its operations, the planned reduction will consolidate its store estate, impacting communities that rely on these affordable shopping options. The clearance sales currently underway, with discounts reaching up to 40%, are unmistakable indicators of the brand’s urgent transition.

The implications of Poundland’s closures stretch beyond mere numbers, as they signify shifts in consumer habits towards discount retailing under financial pressures. As one of the affordable staples of the UK high street, its departure from various localities may hone in on the affordability gap in low-income areas and could trigger increased footfall in other discount retailers. The closures could also contribute to a larger conversation about the sustainability of budget retail amid economic fluctuations, mirroring the struggles of other major high street brands.

The Rising Trend of Major Retailers Shutting Stores

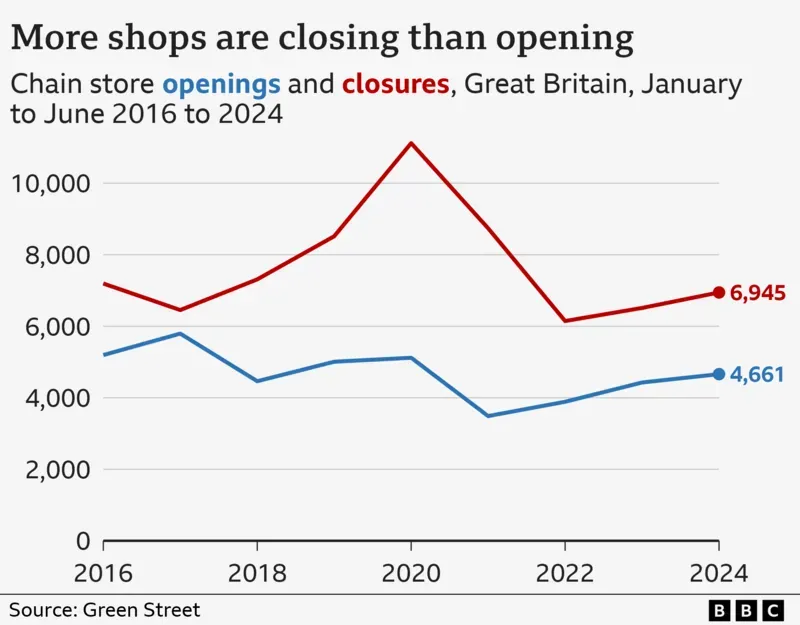

The number of major retailers shutting stores continues to rise, illustrating a broader trend that’s reshaping the UK retail landscape. Continuous shifts toward online shopping prompted by changing consumer preferences have left many established high street brands struggling to maintain profitability. As seen with River Island and Poundland, these closures often follow a cycle of declining sales and mounting operational costs, highlighting the urgent need for innovation and adaptation in retail strategies.

This trend underscores the challenges faced not just by one or two brands, but the entire sector. As iconic names withdraw from their traditional storefronts, it raises significant questions about the future of high street shopping, especially in light of economic factors and the relentless advance of e-commerce. Remaining retailers must take strategic actions to ensure survival, whether through enhancing their online presence, diversifying product offerings, or improving in-store consumers’ experiences.

UK High Street Retail News: Store Closures in 2026

Recent UK high street retail news has been dominated by announcements of store closures, particularly as retailers like River Island and Poundland prepare to shut down numerous locations in 2026. With the looming closure of over 100 stores, it becomes evident that many retailers are grappling with both market saturation and the not-so-slow evolution of consumer preferences. Shoppers are increasingly opting for the convenience of online shopping, placing immense pressure on high street businesses with significant overheads associated with physical retail locations.

The impact of these closures will resonate through local economies, with many communities reliant on these retailers for jobs and economic activity. As more high street names announce their exits, local councils and economic planners are tasked with finding alternatives to rejuvenate shopping districts. The importance of adapting to these changes cannot be overstated as stakeholders must engage in proactive measures to revitalize the high street experience.

Adapting to the Store Closures Impact on Communities

The closure of multiple high street stores, including those recently announced for 2026, poses significant challenges for local communities. The loss of accessible retail spaces can lead to reduced job opportunities and diminished shopping options for residents. Many areas, especially in small towns, are heavily dependent on these businesses for economic stability and employment, making these closures particularly hard-hitting.

Moreover, the ramifications extend beyond just economic indicators. Socially, the closure of popular retailers like River Island can affect the community’s vibrancy and social engagement. Empty storefronts can deter foot traffic, exacerbating a cycle of decline for remaining businesses. Communities may need to explore innovative approaches, such as repurposing unused retail spaces, to address the gaps left by these major brand exits.

The Future of UK High Street Brands: A Shifting Landscape

The future of UK high street brands appears increasingly precarious as closures accelerate. Retailers are reviewing their positions and frequently rethinking their business models amidst the persistent threat posed by online competitors. The trend witnessed with closures at River Island and Poundland exemplifies the challenges traditional brick-and-mortar stores face, forcing them to adapt or risk extinction.

As more retailers acknowledge the shifting landscape, there’s an opportunity for introducing more agile, customer-focused business strategies. Retailers that merge their physical presence with strong online channels will likely find a way to coexist within this changing market. However, the urgency of navigating these transformations cannot be underestimated for any brand hoping to secure a place on the high street in the coming years.

Restructuring Plans for Affected Retailers in 2026

In response to the financial challenges posed by changing consumer behavior, several high street retailers are implementing restructuring plans aimed at mitigating the risk of further losses. River Island’s decision to close numerous stores and renegotiate rent agreements is a classic example of a brand attempting to recalibrate its physical retail strategy in a digital-first economy. Such measures are essential for sustaining operations amid mounting pressures from online competitors.

Similarly, Poundland’s restructuring demonstrates how brands are attempting to maintain market share during turbulent times. By reducing the number of branches, they aim to concentrate their resources and streamline operations while still appealing to its core customer base. This strategic approach highlights the growing importance of adaptability in the retail sector as brands face the daunting task of revamping their identities and operations to thrive in the 21st century.

Consumer Behavior Changes Leading to High Street Store Closures

The evolving consumer behavior has played a significant role in the narrative surrounding high street store closures. Shoppers are increasingly favoring online shopping for its convenience, accessibility, and breadth of choice. This shift has compelled high street brands to reassess their strategies, recognizing that maintaining a large physical presence may no longer align with consumer expectations or shopping habits.

As more customers turn to digital channels for their everyday shopping needs, the implications for physical store locations can be detrimental. Brands like Cancer Research UK are experiencing the consequences first-hand, closing stores and launching plans to diversify their business models to include superstores. The interplay between evolving consumer preferences and the urgent need for retailers to adapt defines the retail environment of 2026 and beyond.

E-commerce Growth and Brick-and-Mortar Decline

The meteoric rise of e-commerce has undeniably contributed to the decline of brick-and-mortar establishments, as highlighted by the recent surge in high street store closures. Online shopping offers unparalleled convenience, often attracting consumers who prioritize speed and accessibility over traditional retail experiences. Brands unprepared for this seismic shift, such as River Island and Poundland, are witnessing the immediate consequences, leading to widespread restructuring efforts.

As online platforms continue to expand and improve, the challenge for physical stores lies in finding a balance that preserves their presence while adapting to new market demands. Retailers must invest in technology and enhance the in-store experience to ensure a sustainable future—one that embraces both their physical roots and the inevitable embrace of online trade. Tackling the question of how to harmonize these elements is critical in curbing the store closures trend.

Assessing the Long-term Effects of High Street Brand Closures

As we project further into the future, assessing the long-term effects of high street brand closures in 2026 is essential for stakeholders across the retail ecosystem. The loss of household names like River Island and Poundland could alter not only market dynamics but also the shopping habits of consumers who may need to seek alternatives. Manufacturers and suppliers, too, will have to recalibrate their partnerships and strategies in response to these significant changes in distribution channels.

Additionally, the community impact cannot be understated; with fewer stores and brands to choose from, consumers may feel a sense of loss regarding their shopping experiences. The iconic high street, once bustling with activity, risks becoming diluted if immediate actions to reimagine these spaces are not taken. Retailers, local councils, and community leaders will need to collaborate and innovate to ensure that the high street remains a viable option for shopping and social interaction.

Frequently Asked Questions

What are the reasons behind high street brands closures in 2026?

The closures in 2026, including those of major retailers like River Island and Poundland, are primarily driven by financial difficulties exacerbated by the shift to online shopping and rising operating costs. River Island, for example, reported a significant £33.2 million loss in 2023, leading to the decision to close 32 stores.

How many stores will River Island close in 2026?

In January 2026, River Island will close 32 stores across England, Scotland, Wales, and Northern Ireland as part of their restructuring strategy to address financial losses and adapt to changing consumer preferences.

What impact will Poundland’s store closures in 2026 have on the UK high street?

Poundland’s plan to close 32 stores by February 2026 is part of a larger restructuring effort that will reduce its total store count by up to 100. This reduction is likely to impact foot traffic and retail diversity on the UK high street, reflecting broader trends in the retail sector.

Which other major retailers are shutting stores in 2026 besides River Island and Poundland?

In addition to River Island and Poundland, Cancer Research has announced plans to close around 90 branches by May 2026, with the possibility of up to 100 additional closures by 2027. Trespass is also set to close one store in 2026.

What are the expected outcomes of the high street brands closures in 2026?

The closures of high street brands in 2026 are expected to streamline operations for struggling retailers and adapt to a growing preference for online shopping. Financially, brands aim to minimize losses and shift to a sustainable business model that aligns better with current consumer habits.

What steps are being taken to manage the fallout from high street brands closures in 2026?

Many brands, such as River Island and Poundland, are implementing restructuring plans to manage store closures and reduce operational costs. This includes renegotiating rent prices and liquidating stock through clearance sales to mitigate the financial impact of the closures.

How might the closures of major retailers affect consumers in 2026?

The closures of major retailers in 2026 may limit shopping options for consumers, leading to fewer physical stores available for in-person shopping. However, it may also encourage consumers to explore online alternatives more frequently.

Are there any plans for new store openings amid the high street brands closures in 2026?

Yes, while significant closures are occurring, some retailers like Cancer Research are planning to open new ‘superstores’ on retail parks by 2028, indicating a potential shift in their business model to adapt to consumer trends.

| Brand | Number of Closures | Reasons for Closure | Estimated Closure Date |

|---|---|---|---|

| River Island | 32 | Restructuring, shift to online shopping, high operational costs | January 2026 |

| Poundland | 32 | Restructuring, rising operating costs | February 2026 |

| Cancer Research | ~90 | Rising operating costs, changing consumer behavior | By May 2026 (more closures possible by April 2027) |

| Trespass | 1 | Business review | March 2026 |

Summary

High street brands closures in 2026 are set to significantly impact the retail landscape as major retailers like River Island and Poundland announce plans to close a combined total of over 100 stores. These closures reflect broader industry trends, including a shift towards online shopping and increasing operational costs. With iconic brands restructuring to adapt to changing consumer behaviors, the high street is undergoing a notable transformation that could reshape shopping experiences in the coming years.