Listen to this article

Friendly fraud is an alarming trend that has started to plague many businesses, particularly in the UK. This type of fraud occurs when customers make purchases using credit cards but later dispute the charges, claiming they never made the transactions. According to Rusty Nart, owner of two South London establishments, he has witnessed a notable rise in these chargeback scams, which not only drain his finances but also erode trust with genuine customers. With the financial toll of credit card fraud totaling over £551 million in 2023 alone, it’s crucial for businesses to adopt robust fraud prevention strategies. As this issue escalates, understanding the mechanics of friendly fraud becomes imperative for safeguarding business interests and maintaining customer relationships.

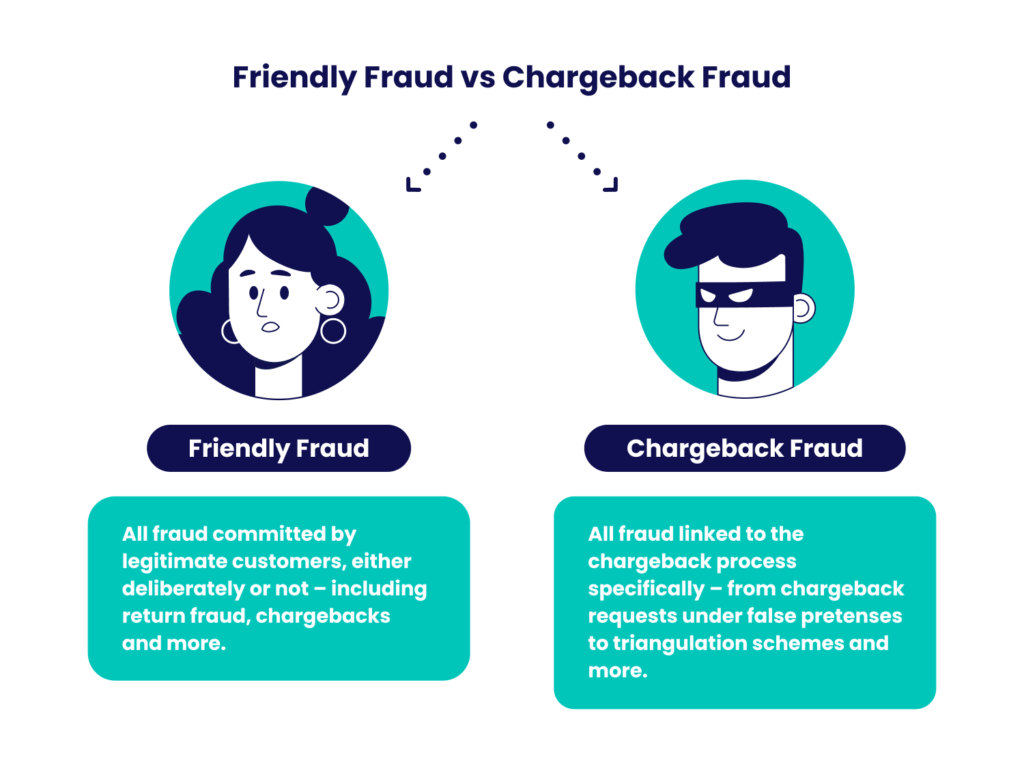

In recent years, the term ‘first-party fraud’ has gained traction as a synonym for friendly fraud, illustrating the growing concern over this deceptive practice. Rather than falling under traditional definitions of theft, this form of fraud often involves customers who purposely mislead businesses into reversing legitimate payments. As documented in industry reports, the surge in fraudulent claims has become a pressing issue for merchants, particularly as chargeback scams are now rampant across the finance landscape. Understanding the implications of what is considered business scams is essential for entrepreneurs navigating financial risks. Facing such challenges head-on is vital, prompting many to explore effective preventative measures to combat these increasing instances of credit card fraud.

Understanding Friendly Fraud: A Growing Concern for Businesses

Friendly fraud, often referred to as first-party fraud, is a major issue plaguing businesses, especially in the UK. It occurs when a customer makes a legitimate purchase using their credit card, but later disputes the charge, claiming they never authorized it or did not receive the goods. Rusty Nart, owner of Green Monkey London and Fingers Kebab shop, highlights the frustration of this trend. He has personally experienced numerous chargebacks, noting that the damage extends beyond financial losses, as fraud can erode customer trust and loyalty for small businesses.

For small business owners like Mr. Nart, the rise in friendly fraud cases is not only about the immediate financial hit—such as chargeback fees and the hassle of refunds—but also about the broader implications for their operations. With financial technology firm Worldpay noting that credit card fraud costs UK businesses over £551.3 million in 2023, it is clear that many are losing significant revenue to these scams. As friendly fraud incidents rise, businesses must understand how to navigate these challenges and implement effective fraud prevention strategies.

The Impact of Chargeback Scams on Small Businesses

Chargeback scams impose a particularly heavy burden on small businesses, which may lack the financial resources of larger firms to absorb losses. After a customer makes a purchase and later disputes the charge, business owners are not just left to refund the purchase amount—they also face steep fees imposed by credit card providers, such as the £28 plus VAT chargeback fee mentioned by Mr. Nart. This double financial blow can severely impact the bottom line of a small café or retailer.

Furthermore, chargebacks can force business owners to redirect valuable time and resources into managing disputes rather than focusing on service and growth. The logistical nightmare of tracking down a fraudulent claim can detract from the overall customer experience, eventually leading to a decrease in repeat business. As Rusty Nart experienced, combating this pervasive issue requires not only a meticulous record-keeping strategy but also an understanding of changing consumer behaviors and implementing preventative measures that can safeguard against these fraudulent claims.

Fraud Prevention Strategies Every Business Should Implement

In light of the ever-growing challenge posed by friendly fraud, small businesses must adopt robust fraud prevention strategies to mitigate risks. Keeping meticulous records of all transactions is paramount. Implementing practices such as using couriers who provide proof of delivery ensures there’s clear evidence to support claims against fraudulent chargebacks. Moreover, adhering to fraud prevention guidelines can significantly reduce the likelihood of falling victim to such scams.

Additionally, businesses should consider creating transparent customer-friendly terms that allow for refunds or exchanges outside of the chargeback process. Encouraging customer satisfaction through exceptional service can lead to fewer disputes and, consequently, lower instances of both genuine and fraudulent chargebacks. By prioritizing clear communication and establishing a seamless refund process, businesses stand a better chance of protecting themselves against chargeback scams.

The Role of Technology in Combatting Credit Card Fraud

As technology evolves, so too do the strategies employed to combat credit card fraud. Many financial technology firms are stepping up to provide solutions specifically designed for businesses facing the threat of friendly fraud. For example, entrepreneurs like Ariel Chen have pivoted their focus to developing tools and services aimed at helping businesses address chargeback issues effectively. With the increase in transaction-based fraud, utilizing advanced payment technologies can enhance security and provide business owners with the tools needed to combat fraud more efficiently.

Investing in fraud detection tools can also serve as a deterrent. Many of these tools utilize artificial intelligence and machine learning to identify patterns typical of fraudulent behavior, thus allowing businesses to flag suspicious transactions before they result in chargebacks. In turning to technology, businesses not only protect their bottom line but also contribute to broader efforts to combat rising trends in credit card fraud, reinforcing consumer confidence across the market.

Understanding the Legal Implications of Friendly Fraud

While friendly fraud might seem victimless, it carries significant legal implications for those who choose to engage in such deceptive practices. According to UK legal experts, credit card fraud falls under the Fraud Act 2006 and can be prosecuted as fraud by false representation, which can result in sentences of up to ten years in prison if pursued in court. This stark reality highlights the severity of friendly fraud, and emphasizes the importance for consumers to recognize the potential consequences of their actions.

The legal framework aims to strike a balance between protecting genuine consumers and punishing fraudulent behavior. Adam Scarrot of UK Finance points out that while chargebacks are necessary for protecting bona fide customers, every instance of fraud ultimately has victims. As such, consumers must be educated about the repercussions of attempting to exploit chargeback systems, fostering a more accountable marketplace that discourages fraudulent behavior.

Promoting Transparency: Building Trust with Customers

Building trust with customers is critical for combating issues like friendly fraud. Transparency in business practices, especially regarding payment, return, and refund policies, fosters a positive relationship that encourages customers to engage honestly. When customers feel valued and well-informed, they are less likely to resort to chargebacks if a dispute arises. Simple practices can include clearly marking return policies on receipts, having easily accessible customer service channels, and ensuring that customers are aware of the steps they can take if they experience an issue.

Moreover, encouraging open communication about expectations surrounding purchases can further strengthen customer loyalty. By prioritizing customer service and ensuring that your business policies are straightforward, trust can be built, which not only aids in reducing chargebacks but also enhances overall satisfaction with your brand. Managers and business owners should actively seek feedback and engage with their customer base to identify areas for improvement, thus creating a collaborative environment that promotes ethical consumer behaviors.

Consumer Education: Reducing the Impact of Friendly Fraud

Educating consumers about the ramifications of friendly fraud is essential in minimizing its prevalence. Many individuals do not understand that their actions can have serious implications not only for businesses but also for their own credit histories. Increasing awareness about how friendly fraud operates, such as the potential for account closure and negative credit rating implications, can deter consumers from engaging in such behaviors. Forums, workshops, and online content can help bridge the knowledge gap and empower consumers to make informed choices.

Furthermore, consumer education around the rights and responsibilities associated with credit card use can help foster a culture of accountability within the marketplace. By promoting the concept that every transaction has a ripple effect, the focus can shift from opportunistic behaviors to responsibly navigating the landscape of online and in-person shopping. As businesses engage in consumer education initiatives, they can play a critical role in shaping a fair and honest financial ecosystem.

Best Practices for Documenting Transactions and Disputes

Maintaining comprehensive records is crucial for defending against chargebacks. Businesses should adopt best practices such as digitally archiving all transaction receipts, ensuring every detail is accurately captured. Regular audits of transaction records and monitoring any unusual patterns in chargebacks can help identify issues before they escalate. Additionally, businesses should document any communication with customers regarding disputed transactions, as this can serve as critical evidence when contesting a charge.

Moreover, integrating technology solutions for transaction documentation can streamline this process. Using software that automatically tracks sales, delivery confirmations, and customer communications can facilitate a more organized approach to record-keeping. This proactive stance not only aids in minimizing fraudulent chargebacks but also enhances overall efficiency in business operations, freeing up resources that can be better spent on growth initiatives.

The Implications of Chargebacks for Consumer Trust

Chargebacks, while a necessary tool for customer protection, can inadvertently damage trust between consumers and businesses. When customers initiate a chargeback, it creates a question of integrity, and businesses often find themselves navigating a landscape of suspicion and potential loss of reputation. As noted by financial experts, understanding that all chargebacks contribute to the broader narrative of consumer trust is imperative for both parties involved in a transaction.

For businesses, maintaining transparency and fostering genuine customer relationships becomes paramount in counteracting the negative impact of chargebacks. Implementing customer feedback initiatives and ensuring follow-up contact after purchases can help reinforce trust and rapport. By addressing customer concerns promptly and effectively, businesses not only reduce the likelihood of disputes but also build a loyal customer base that values and supports the brand.

Frequently Asked Questions

What is friendly fraud and how does it impact businesses?

Friendly fraud refers to situations where a customer makes a legitimate purchase but later disputes the charge, claiming it was unauthorized. This type of fraud can significantly impact businesses, as they not only lose the product or service provided, but also incur chargeback fees, leading to financial losses.

How do chargeback scams relate to friendly fraud?

Chargeback scams are closely associated with friendly fraud. In these scams, customers dispute a transaction through their credit card issuer after receiving the goods or services. This reversal can harm businesses financially and often leads to additional penalties from payment processors.

What are some common strategies for preventing friendly fraud in UK businesses?

Businesses in the UK can implement several fraud prevention strategies to combat friendly fraud, including keeping detailed records of transactions, using couriers with proof of delivery, and confirming orders through multiple channels to enhance verification processes.

How does friendly fraud affect small businesses in the UK?

Friendly fraud, including chargeback scams, can be particularly harmful to small businesses, as they often lack the resources to absorb the losses from chargebacks and associated fees. This can threaten their financial health and sustainability.

What precautions should businesses take when accepting credit card payments to avoid credit card fraud?

To mitigate the risk of credit card fraud, businesses should implement strong verification processes, maintain thorough transaction records, provide clear return policies, and engage in proactive customer service.

Why is friendly fraud a growing concern for businesses in the UK?

The rise of friendly fraud in the UK can be attributed to economic pressures that tempt consumers to commit such fraud. Financial technology data indicates a significant increase in friendly fraud, making it essential for businesses to address this growing issue.

What legal consequences can individuals face for attempting friendly fraud?

Individuals caught engaging in friendly fraud can face serious legal repercussions under the Fraud Act 2006. Such actions are considered fraudulent and can lead to account closure, negative credit effects, and potentially up to 10 years in prison.

How are businesses advised to handle disputes related to friendly fraud?

When handling disputes related to friendly fraud, businesses are advised to gather all necessary documentation that can prove the transaction was legitimate, utilize effective communication with customers, and maintain a professional demeanor throughout the dispute resolution process.

| Key Point | Description |

|---|---|

| Definition of Friendly Fraud | Friendly fraud occurs when customers deny making a purchase, leading to chargebacks, despite having received the goods or services. |

| Impact on Businesses | Friendly fraud has significantly harmed small businesses like Rusty Nart’s café and kebab shop, which are losing money through chargebacks and associated fees. |

| Financial Statistics | Friendly fraud costs UK businesses £551.3 million in 2023, indicating a growing trend of chargebacks due to economic pressures. |

| Business Owner’s Response | Rusty Nart has taken personal action by documenting receipts and investigating claims to combat the issue, although he advises against such measures for safety reasons. |

| Legal Consequences | Friendly fraud is considered theft; penalties can reach up to 10 years in prison under the Fraud Act 2006. |

| Prevention Strategies | Businesses are encouraged to keep meticulous records, use proof of delivery, invest in fraud prevention tools, and ensure clear refund processes. |

Summary

Friendly fraud is a growing concern for businesses today, impacting operations and finances. Rusty Nart’s experience highlights the serious nature of this issue, as it not only causes financial loss for business owners but also leads to increased charges and operational challenges. As friendly fraud continues to rise, it is imperative for businesses to adopt effective strategies to mitigate its effects and safeguard their interests.