Listen to this article

Dealing with DWP Mistaken Identity Debt can be a harrowing experience, especially for those already burdened by the challenges of everyday life. Sarah McKenzie, a dedicated mother caring for her autistic son, has endured the emotional turmoil of receiving erroneous debt letters from the Department of Work and Pensions for over five years. Misunderstandings like hers, where another individual with the same name is mistaken for the intended recipient, contribute to significant social security issues and mental health stress. Despite receiving constant assurances from the DWP that she did not owe the £5,000 demanded, the relentless letters plagued her, creating a cycle of anxiety and despair. This situation underscores the profound impact that bureaucratic errors can have on individuals, particularly those managing complex caregiving responsibilities.

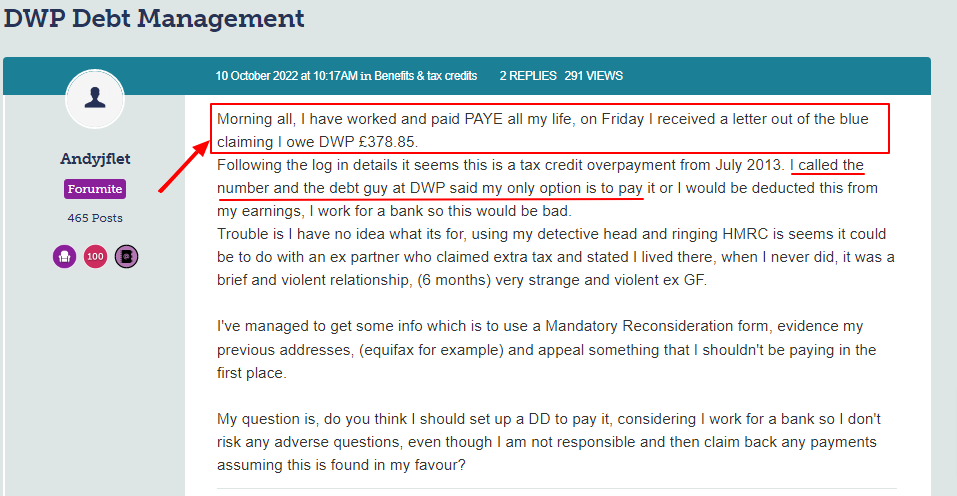

Encountering issues related to mistaken identity with government debts can be distressing for anyone, especially for caregivers like Sarah, who are managing significant responsibilities. Mistaken identity DWP cases often involve distressing correspondence, such as debt letters that wrongly target innocent individuals due to similar names or national insurance numbers. The emotional strain can be overwhelming for those dealing with existing social security challenges while also caring for loved ones, like Sarah’s autistic son, who’s currently undergoing medical treatment. Such circumstances not only complicate personal financial situations but can also exacerbate existing mental health issues. Ultimately, the experience highlights the urgent need for governmental agencies to refine their processes and prevent such painful errors from occurring.

Understanding DWP Mistaken Identity Debt Issues

Mistaken identity debt issues can be particularly alarming, especially when they involve government agencies like the Department of Work and Pensions (DWP). Such cases often revolve around individuals finding themselves burdened by debts that do not belong to them. Sarah McKenzie’s experience with DWP mistaken identity debt sheds light on how bureaucratic errors can lead to severe emotional stress, particularly for vulnerable individuals like single mothers caring for children with disabilities. These mistaken identity situations can not only compromise a person’s mental health but can also create barriers preventing them from accessing essential services.

The implications of receiving incorrect debt letters can be profound. In Sarah’s case, the letters demanded payments despite her consistent clarifications regarding the mistaken identity. For many, such anxiety is compounded by the looming threat of legal action and diminished trust in government systems. This raises serious concerns about the processes in place for verifying debtor identities, leading to social security issues that primarily affect individuals dependent on government support.

Mental Health Stress from DWP Debt Letters

The persistent stress from DWP debt letters can exacerbate existing mental health issues, creating a cycle of anxiety and despondency. Sarah McKenzie articulated her fears when receiving letters that inaccurately demanded thousands of pounds, fostering a feeling of hopelessness. This particularly resonates with caregivers who often juggle multiple responsibilities, such as managing the health care of autistic children while facing exaggerated financial claims. Mental health stress in these scenarios isn’t merely a side effect; it can significantly impact daily functioning and quality of life.

Furthermore, the constant barrage of correspondence from the DWP can trigger feelings of inadequacy and despair. For individuals already under pressure, like Sarah, who is caring for a son in need of immediate medical attention, the extra stress from mistaken identities can be overwhelming. Addressing mental health needs as a part of resolving mistaken identity debt is crucial; appropriate support systems need to be in place to assist victims in navigating both emotional distress and bureaucratic challenges.

The Emotional Toll of DWP Debt on Caregivers

For caregivers such as Sarah, the emotional toll of dealing with DWP debt correspondence is compounded by their existing responsibilities. Juggling caring for a disabled child and addressing financial concerns builds a situation ripe for mental health challenges. The emotional upheaval caused by receiving threatening letters about debts that are not owed can lead to feelings of inadequacy as a provider, fears regarding financial instability, and an overall sense of helplessness.

Additionally, the demands of parenting, especially in the context of caring for children with autism, can leave caregivers feeling isolated. The burden of fighting against a bureaucratic entity like the DWP while managing personal and familial needs creates a dire situation. Sarah’s experience is a stark reminder of how financial stress and mistaken identity issues are not just numbers on a piece of paper; they have real-life implications that impact family dynamics and individual well-being.

Navigating Social Security Issues with DWP

Navigating social security issues can be daunting, particularly when one is already mired in confusion and anxiety about mistaken identity debts. When the DWP issues letters demanding payment for debts not owed, it signifies not only a clerical error but an urgent need for clearer communication from social security organizations. Individuals like Sarah McKenzie often find themselves stuck in a loop of communication with the DWP, often leading to more confusion and stress, rather than resolution.

Detailed understanding and management of social security issues require advocacy and often legal support. The emotional and financial instability stemming from such misunderstandings highlights the need for more robust protections for individuals against bureaucratic errors. Social security systems should prioritize transparency and responsiveness to safeguard the rights and mental health of individuals relying on public assistance.

Legal Recourse for Mistaken Identity Debt

In the case of mistaken identity debt, individuals have the right to seek legal recourse to address inaccuracies. For victims like Sarah McKenzie, understanding one’s rights regarding debt disputes is essential in advocating against wrongful claims. Legal avenues can include formal complaints to the DWP, seeking legal representation, and possibly pursuing compensation for the emotional distress caused by these wrongful demands.

Engaging with legal professionals who understand the intricacies of social security and debt relief can provide victims necessary guidance and the assurance that their situation will be addressed appropriately. Knowing that there are legal channels to rectify such issues offers a sense of control amidst chaos, particularly for those facing mental health challenges related to their experiences with incorrect debt claims.

The Impact of DWP Errors on Family Stability

Errors by the DWP, especially regarding debts, can destabilize not just individuals, but entire families. For caregivers like Sarah McKenzie, these mistakes introduce a layer of financial insecurity, threatening the stability essential for families caring for disabled children. The prospect of having to cope with incorrect accusations of debt can lead to a cascade of negative outcomes—including the inability to focus on essential family needs.

Familial stress can escalate when faced with ongoing demands from the DWP. Such administrative errors can prevent families from participating in community activities or seeking medical care available under social security protections. Ensuring that bureaucracy does not undermine family stability is imperative, and more mechanisms should be established to quickly resolve such errors in identity and debt claims.

Strategies for Responding to DWP Demands

When faced with erroneous demands from the DWP, it is vital to have a clear response strategy. For individuals like Sarah who receive repeated debt letters, keeping meticulous records of all correspondence and establishing a timeline of events can be instrumental in demonstrating a case of mistaken identity. Clear documentation can help substantiate claims and facilitate straightforward communication with DWP representatives.

Additionally, seeking assistance from local advocacy groups or organizations specializing in disability rights can fortify responses. These entities can sometimes offer direct support or advice on handling erroneous correspondence more effectively, ensuring that mistaken identity issues are resolved swiftly, minimizing the emotional and mental toll on individuals and their families.

Building a Support Network During Debt Challenges

Building a robust support network is essential for individuals grappling with mistaken identity debt and its implications. For caregivers like Sarah McKenzie, friends, family, and community organizations can provide not only emotional support but practical help in addressing financial or bureaucratic issues. Having advocates who understand the complexities of such situations can significantly reduce feelings of isolation and helplessness.

Connecting with others who have faced similar situations can also yield valuable insights and coping strategies. Support groups for single parents or those caring for disabled children can be a hub for sharing resources, which may include advice on dealing with DWP letters and navigating the often-overwhelming landscape of social security benefits. This sense of community fosters resilience during challenging times.

Preventing Mistaken Identity Issues with DWP

To prevent mistaken identity issues with the DWP, it is crucial for individuals to regularly check and update their personal information with the department. Maintaining accurate records of transfers, name changes, and even significant life events helps safeguard against potential errors that could lead to confusion and unnecessary debt claims. Proactive engagement with the DWP can also facilitate smoother communications should misunderstandings arise.

Furthermore, a decentralized approach to identity verification can be beneficial. By enhancing the mechanisms for confirming identities beyond name matching—like incorporating additional identifiers—it may reduce occurrences of mistaken identity with government agencies. Improved systems can not only alleviate stress for individuals but reinforce trust in governmental processes.

Frequently Asked Questions

What should I do if I receive DWP debt letters for mistaken identity?

If you receive DWP debt letters for mistaken identity, like the case of mistaken identity DWP impacting many individuals, contact the Department of Work and Pensions immediately. Explain your situation, provide your national insurance number, and clarify that the debt does not belong to you. Keep a record of your communications and any assurances received from the DWP regarding the resolution of your issue.

How can mistaken identity DWP debts affect mental health?

Mistaken identity DWP debts can significantly affect mental health, as experienced by individuals like Sarah McKenzie. The stress and anxiety of receiving repeated debt letters can lead to feelings of hopelessness and despair, especially for single parents or caregivers of vulnerable individuals. It’s essential to seek support and guidance from mental health professionals when facing such distressing situations.

What are common reasons for receiving DWP debt letters addressed to someone else?

Common reasons for receiving DWP debt letters addressed to someone else include clerical errors, shared names, and similar national insurance numbers, leading to mistaken identity. This often occurs without the recipient’s knowledge, causing undue stress and confusion, as seen in many mistaken identity DWP cases.

How can I prove I am not responsible for a DWP debt?

To prove you are not responsible for a DWP debt, gather evidence such as your national insurance number, any previous correspondence with the DWP confirming the mistake, and documentation showing the correct recipient of the debt. Present this information during your communication with the DWP to resolve the mistaken identity issue.

What impact can DWP mistakenly pursuing debt have on caregivers?

DWP mistakenly pursuing debt can have a profound impact on caregivers, particularly those caring for individuals with additional needs, such as an autistic son. The stress from dealing with unwarranted debt claims can exacerbate existing challenges, leading to increased mental health strain and added pressure on caregivers who are already managing significant responsibilities.

How can I prevent DWP debt letters from affecting my family?

To prevent DWP debt letters from affecting your family, promptly address any issues of mistaken identity by notifying the DWP of the errors. Regularly monitor correspondence and maintain clear communication with the department. Additionally, seek legal help or advocacy if necessary to protect your family’s welfare.

Can the DWP correct mistaken identity issues on their own?

Yes, the DWP can correct mistaken identity issues on their own upon receiving proper notification from the affected individual. It is important to provide your information and any supporting documents that clarify the mistake. Once acknowledged, the DWP will update their records to cease sending debt letters to the incorrect person.

| Key Point | Details |

|---|---|

| Mistaken Identity Case | Sarah McKenzie is not the debtor; another woman with the same name is. |

| Debt Amount | Sarah received demands for £5,000 that she did not owe. |

| Impact on Mental Health | The stress from constant demands affected Sarah’s mental wellbeing, especially as she cares for her disabled son. |

| DWP Response | DWP confirmed records were corrected to stop the letters. |

| Duration of Issue | The mistaken identity issue has persisted for five years, causing ongoing distress. |

Summary

DWP Mistaken Identity Debt has become a serious issue for many individuals, as highlighted by the distressing experience of Sarah McKenzie. The case illustrates the complications arising from administrative errors within the Department of Work and Pensions, leading to undue stress and mental health strain on innocent victims. Proper corrections in records are essential to prevent such incidents and ensure that individuals do not face the burden of debts they do not owe.