Listen to this article

Critical minerals are increasingly recognized as the backbone of modern technology and energy solutions, playing a pivotal role in everything from smartphones to electric vehicles. With global mineral demand skyrocketing, nations are racing to secure their supply chains and tap into essential resources like lithium and rare earth elements. The urgency is underscored by initiatives such as U.S. President Donald Trump’s interest in mining agreements in Greenland and Ukraine, aiming to reduce dependence on foreign supplies. However, the reality remains that China dominates mineral processing, presenting challenges for countries looking to bolster their positions in the burgeoning market. Understanding the dynamics of the critical minerals landscape is essential for securing advanced manufacturing and sustainable energy futures.

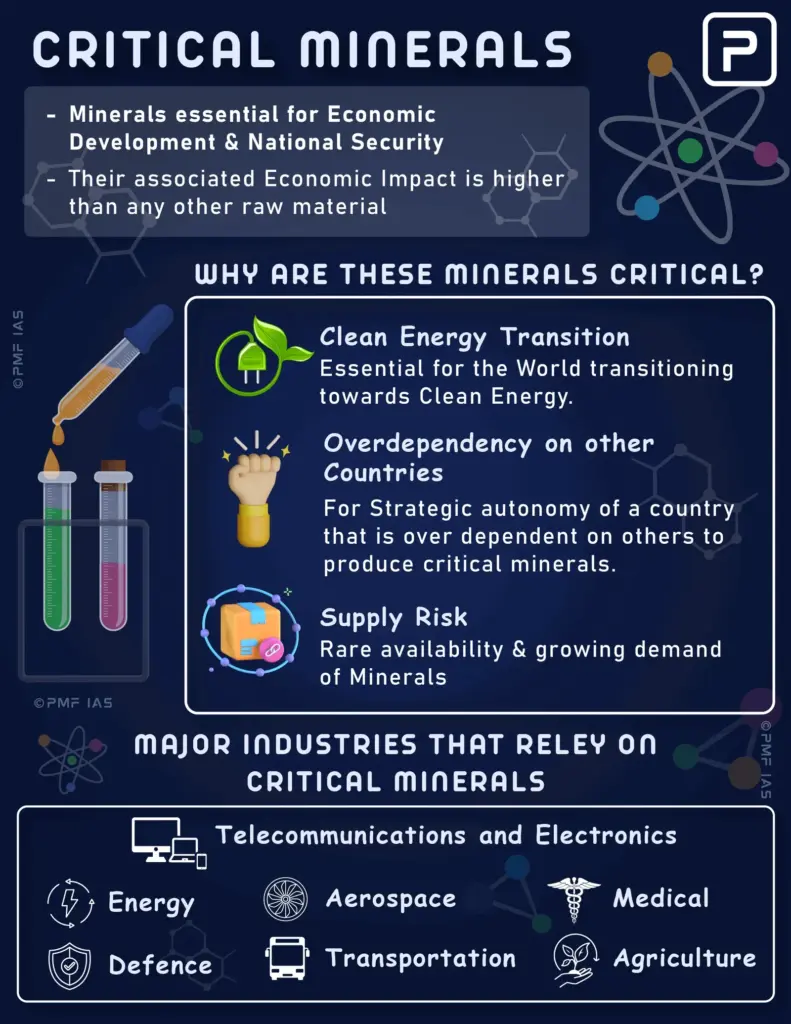

The term ‘strategic minerals’ encompasses a range of materials deemed essential for economic growth and security, including lithium, cobalt, and rare earth elements. These vital resources are necessary for achieving advancements in technology and enhancing energy efficiency across various industries. As nations strive to fortify their supply chains, the emphasis is placed on securing reliable sources of these advantageous minerals, which are pivotal in powering electric vehicles and facilitating renewable energy transitions. Additionally, the heavy reliance on foreign processing, particularly by China, raises concerns over stability and self-sufficiency in the global mineral supply chain. Ensuring access to these critical raw materials is not only a matter of economic interest but also crucial for national security and technological leadership.

Understanding the Importance of Critical Minerals

Critical minerals are vital components for various industries and fundamentally support the modern economy. These minerals, which include lithium, cobalt, copper, and rare earth elements, are essential for producing advanced technologies such as smartphones, electric vehicles, and renewable energy systems. As global energy demands shift towards more sustainable solutions, securing a reliable supply of these minerals has become crucial for national security and technological advancement.

Countries are shifting their focus to develop mining agreements and strategic partnerships to enhance their access to critical minerals. For example, U.S. President Trump’s initiatives in Greenland and Ukraine are designed to diversify sources and reduce dependency on dominant players like China. As the demand for critical minerals continues to grow, especially with the push for electric vehicles and renewable energy infrastructure, countries are recognizing the need to invest in exploration, extraction, and processing capabilities.

The Role of Rare Earth Elements in Technology

Rare earth elements (REEs) play a central role in modern technology, featuring in everything from smartphones to military applications. These elements, which comprise a subset of critical minerals, have unique magnetic and electrical properties that make them indispensable for manufacturing high-performance components such as microchips, lasers, and batteries. For instance, neodymium is crucial for creating the powerful magnets used in electric motors and wind turbines, showcasing the synergy between these materials and the transition to green energy.

Despite the name ‘rare earth,’ these elements are not as scarce as one might assume; instead, the challenge lies in their extraction and processing, which are heavily concentrated in a few countries, particularly China. This concentration has raised concerns about supply chain vulnerabilities, necessitating a comprehensive understanding of rare earth availability and the potential for new sources to emerge globally. Efforts to develop alternatives and enhance recycling processes are underway, aiming to reduce reliance on imports.

Global Distribution of Critical Minerals

The distribution of critical minerals is uneven worldwide, with specific countries holding significant reserves that are critical for meeting global demands. For instance, China has the largest known reserves of rare earth elements, estimated at around 44 million tons, while Australia and Brazil also hold substantial quantities of various minerals. This geographic concentration drives strategic interests and fosters international collaborations to secure supply chains.

Moreover, countries like Australia and Chile are vital players in the lithium supply chain, which is pivotal for battery production. Australia’s leading position in generating lithium underscores the competitive nature of mineral resources. The global race for securing critical minerals has intensified as nations strive to bolster their economies and technological capabilities, and this disparity in resource distribution often leads to mining agreements and geopolitical negotiations aimed at diversification and security.

China’s Dominance in Mineral Processing

China’s dominance in the processing of critical minerals poses significant challenges for other countries aiming to establish self-sufficient supply chains. Although the Democratic Republic of Congo produces a substantial portion of the world’s cobalt, a significant amount of it is sent to China for refining. This pattern holds true for lithium as well—while a majority comes from Australia and Chile, the bulk of refining is conducted in China due to their advanced processing infrastructure.

This level of dependency raises strategic concerns, as disruptions in the supply chain could have far-reaching implications for global technology sectors. Critics argue that China’s environment regulations are often lax, allowing for cheaper production costs that other countries cannot compete with. As nations like the U.S. and those in the European Union push for self-sufficiency in critical mineral processing, investments in environmental sustainability and technological advancements in processing will be essential.

Investing in Sustainable Mining Practices

As the demand for critical minerals surges, the need for sustainable mining practices has never been more urgent. Environmental concerns associated with mining operations, such as deforestation, soil erosion, and toxic waste, call for stringent regulations and innovative solutions. For example, by adopting eco-friendly mining practices and improving waste management, countries can mitigate the negative impacts of mining while still meeting global mineral demands.

Investments in cleaner technologies and alternative materials also play a critical role in promoting sustainability within the mining sector. Countries can initiate policies to encourage recycling, which not only reduces the pressure on existing mineral reserves but also promotes a circular economy approach. Collaboration between governments, industries, and environmental organizations can lead to the development of best practices that ensure the responsible extraction of critical minerals, while safeguarding ecological integrity.

The Future of Global Mineral Demand

The global demand for critical minerals is projected to increase dramatically as the world transitions towards a greener economy and an electrified future. With advancements in electric vehicles and renewable energy technologies, the necessity for materials such as lithium, cobalt, and rare earth elements is expected to multiply. This surge in demand will challenge existing supply chains and force countries to reevaluate their natural resource management strategies.

To address this anticipated growth, nations will need to establish strategic reserves, enhance domestic production capabilities, and invest in international mining partnerships. Countries that can effectively navigate these challenges will position themselves as leaders in the global economy, capitalizing on the growing need for critical minerals while ensuring that environmental standards are maintained and sustained.

Securing Mining Agreements for Strategic Resources

Securing mining agreements has become a crucial strategy for countries aiming to bolster their access to critical minerals. These agreements often involve collaborations with mineral-rich nations to develop mutual interests in exploring and extracting resources. For instance, President Trump’s focus on negotiating mining deals with Greenland and Ukraine highlights the urgency of diversifying mineral supplies, especially in the context of weakening dependencies on dominant suppliers like China.

These mining agreements have significant implications for energy security and technological innovation. By fostering relationships with countries that hold untapped mineral reserves, nations can enhance their resource stability while promoting economic growth. Moreover, such agreements can lead to shared expertise, aiding in the development of sustainable practices and technologies that benefit both parties involved.

The Impact of Geopolitics on Mineral Supply Chains

Geopolitical tensions significantly affect the global supply chains of critical minerals, with factors such as trade policies, territorial disputes, and diplomatic relations playing pivotal roles. Countries are increasingly recognizing the strategic importance of securing their mineral resources to mitigate vulnerabilities arising from geopolitical disruptions. The interdependence among nations in the context of critical minerals entails a complex balancing act, where foreign relations and trade agreements directly influence resource availability.

As seen with the ongoing U.S.-China trade tensions, there is a growing urgency to develop independent and resilient supply chains for critical minerals. The harmonization of policies between producing nations and consuming countries will be essential to reduce reliance on any single source and ensure a stable flow of materials crucial for technological advancements. Understanding these geopolitical dynamics will be key for industry leaders and policymakers when planning the future of mineral resource management.

Developing Local Processing Capabilities

Developing local processing capabilities for critical minerals is a strategic move that many countries are pursuing to reduce dependency on imports. Establishing domestic refining facilities can significantly enhance resource security and create local jobs, ultimately fostering economic growth. This is particularly pertinent given the current heavy reliance on countries like China, which dominate the processing of a vast majority of globally sourced minerals.

Investing in research and development for efficient processing technologies is crucial for countries looking to build their capabilities. Collaborations with mining companies, technology firms, and academic institutions can lead to innovative solutions that not only improve processing efficiency but also adhere to stringent environmental standards. By taking these steps, nations can work towards achieving a self-sufficient and environmentally responsible critical minerals industry.

Frequently Asked Questions

What are critical minerals and why are they important?

Critical minerals are vital resources essential for economic stability and national security, often found in advanced technologies like smartphones and electric vehicles. With rising global demand for these minerals, especially lithium and rare earth elements, countries are increasingly focused on securing reliable mining agreements to enhance their supply chain and technological independence.

How do rare earth elements fit into the critical minerals category?

Rare earth elements are a subset of critical minerals known for their unique electrical and magnetic properties, crucial in manufacturing microchips, electric vehicles, and renewable energy technologies. As global demand for these applications grows, securing sources of rare earths is key for countries aiming to maintain technological leadership.

Where are the key sources of critical minerals found globally?

Critical minerals, including crucial resources like lithium and cobalt, are found across various countries, with China leading in reserves and processing capabilities. Australia and Chile also play significant roles in the mining of these minerals, but the processing industry remains heavily reliant on China’s infrastructure and expertise.

Why does China lead in the processing of critical minerals like lithium and rare earths?

China’s dominance in processing critical minerals stems from its established infrastructure and lower environmental standards, allowing for cost-effective refinement. Despite being a major producer of lithium and rare earth elements, countries like Australia and the Democratic Republic of Congo often send these materials to China for processing, creating a dependency that poses risks to global supply chains.

What steps are being taken to reduce dependency on China for critical minerals?

To mitigate dependency on China for critical minerals, countries like the U.S. are prioritizing mining agreements and enhancing local processing capabilities. Initiatives such as the U.S.-Australia critical minerals agreement aim to secure supply chains and reduce vulnerabilities linked to geopolitical disruptions, particularly in crucial sectors like defense and advanced technology manufacturing.

How is the global demand for lithium affecting the supply chain?

The soaring global demand for lithium, key for energy storage in electric vehicles, is significantly impacting the supply chain dynamics. Countries are keen to establish direct mining agreements and develop local processing industries to ensure a steady supply of lithium, reducing reliance on dominant players like China for refinement.

What environmental concerns are associated with rare earth mining in China?

Rare earth mining in China has raised serious environmental concerns, including widespread deforestation, soil erosion, and toxic waste management issues. These environmental challenges highlight the need for countries to seek more sustainable practices and alternatives in their pursuit of securing critical minerals.

| Key Points | Details |

|---|---|

| Definition of Critical Minerals | Essential minerals for economy and security, hard to acquire. Examples include copper, lithium, cobalt. |

| Demand Growth | Increasing demand across sectors such as technology and renewable energy. |

| Dominance of China | China is the largest processor, handling over 90% of global cobalt and significant amounts of lithium. |

| Geographic Distribution | Key reserves located in China, Brazil, and Australia. Australia leads in various minerals including lithium and copper. |

| Environmental Concerns | China’s mining practices impact the environment significantly, raising concerns globally. |

| U.S. Strategy | The U.S. seeks to boost production to reduce reliance on China, signing agreements with countries like Australia. |

Summary

Critical minerals are vital to modern technology and energy production, driving countries to secure their supply chains in the face of growing geopolitical risks. As nations strive to mitigate reliance on dominant suppliers like China, the focus on developing local resources and processing capabilities intensifies. The race for critical minerals isn’t just about economic interests; it’s also a strategic necessity to ensure national security and support sustainable technologies.