Listen to this article

The recent council tax increase has stirred significant discussion across England, as seven local authorities have received the green light to raise council tax beyond the standard 5% cap. This government decision comes amid a challenging financial position for many councils, like Worcestershire County Council, which faces an impending financial crisis. Typically, any rise exceeding the cap requires local residents to vote in a referendum; however, these authorities can bypass that process and implement their tax hikes when bills are issued in April. The approval of such increases reflects ongoing trends in UK council tax reforms, where local authority tax hikes are seen as necessary for maintaining essential services. Amidst these changes, many residents are left questioning the implications of these financial adjustments and the broader context of support for councils struggling with unprecedented challenges.

In recent discussions surrounding local government financing, the topic of local tax increases has become increasingly relevant. Several councils, including those in Worcestershire, have been granted permission to implement what some refer to as local authority tax hikes, in a bid to address severe budgetary shortfalls. This move not only questions the effectiveness of existing financial management strategies but also raises concerns about the potential impact on household budgets, particularly for families already facing economic strain. With the government introducing measures such as a council tax cap, the debate continues over what constitutes fair financial support for councils and how public services can be stabilized in the face of rising costs. As local authorities navigate this complex landscape, understanding the implications of council tax increases and potential reforms will be crucial for residents and policymakers alike.

Understanding the Impact of Council Tax Increases

Council tax increases have become a significant topic of discussion among residents and local authorities across the UK. With seven councils being granted permission to raise their council tax by more than the typical 5% cap, the implications of these decisions are far-reaching. This increase is a response to the challenging financial position many councils are currently facing. Residents are understandably concerned about how this decision affects their finances, particularly in areas where local authority tax hikes are more pronounced.

The purpose of these council tax increases is to provide much-needed financial support for councils struggling to maintain essential services. Local governments play a vital role in the economic and social fabric of communities, and without adequate funding, they risk severe service cuts and financial instability. As these councils look to mitigate their financial pressures, it becomes essential for citizens to understand the rationale behind these tax increases and the potential consequences of not funding local services adequately.

Worcestershire’s Financial Challenges and Tax Decisions

Worcestershire County Council is facing significant financial challenges, prompting discussions about a potential 9% increase in council tax bills. This situation has raised eyebrows, especially considering the council’s previous commitments to reducing waste and cutting taxes. The council’s leadership, including Jo Monk, claims they are taking necessary steps to resolve the fiscal issues, but skepticism remains among some residents and political stakeholders. The need for a £71 million emergency bailout from the government underscores the urgency of the situation.

In addition, the local authority has been criticized for its financial management, particularly given the promise made during the local elections to minimize expenses. The council’s potential tax hike has spurred concerns from residents who feel that significant increases in council tax are unjustifiable, especially in economically strained circumstances. The balance between maintaining essential services and ensuring financial responsibility is a tightrope many councils, like Worcestershire, are forced to navigate.

Government Support and Funding for Local Authorities

The government has recognized the need for financial support for local councils, announcing an additional £440 million in recovery grants aimed specifically at economically challenged areas. This funding is intended to ease the pressures faced by councils, allowing them to better plan for the future while providing services to residents. However, the distribution of these funds has garnered criticism, with financial spokespeople indicating that much of the support appears to favor urban areas over county councils, increasing the burden of council tax hikes in less-populated regions.

This financial support is critical as many councils have reported facing bankruptcy, and the additional funds demonstrate the government’s willingness to assist in times of need. While this may provide temporary relief, the long-term sustainability of council finances remains in question. As councils adjust their budgets and tax plans in response to this new funding, residents must stay informed and engaged in local governance to understand the implications of these changes.

Local Authority Tax Hikes: Balancing Needs vs. Resources

Local authority tax hikes are often seen as a necessary evil, balancing the need for quality local services against the financial capacities of residents. As councils struggle with rising costs and insufficient funding, many are left with no choice but to consider increasing council taxes. This reality highlights the importance of transparency and communication between local authorities and their constituents. Residents deserve to understand how their tax money will be spent and what they can expect in terms of public services.

Moreover, councils must find ways to engage their communities in the budget-making process, ensuring that taxpayer concerns are addressed adequately. With increased taxes often leading to pushback from residents, it is essential for local authorities to demonstrate accountability and efficiency in their spending. Building trust through open dialogue can help mitigate the negative perceptions surrounding tax hikes and foster a stronger relationship between residents and their local governments.

The Role of Referendums in Council Tax Increases

Typically, any significant rise in council tax requires a local referendum, allowing residents a voice in the decision-making process. However, the recent exemption granted to seven councils, allowing them to bypass these referendums, has sparked debates about local governance and accountability. Critics argue that without a referendum, residents are deprived of their democratic rights to influence tax increases that directly impact their financial well-being.

The government’s stance on limiting referendums to certain councils speaks to the urgency of their fiscal needs but raises critical questions about the principles of self-governance. Allowing councils to exceed tax caps without resident approval could set a concerning precedent, where local authorities may prioritize fiscal decisions over community interests. Ensuring residents remain informed and empowered in future discussions about council tax increases is vital to maintaining trust and accountability.

Exploring the Council Tax Cap and its Implications

The council tax cap, which typically restricts local authorities from raising taxes beyond a set percentage, aims to protect residents from excessive financial burdens. However, in light of increasing financial pressures, governments have occasionally adjusted this cap to provide councils with the flexibility needed to address urgent fiscal challenges. The recent allowance for some councils to exceed the 5% cap without a referendum demonstrates a shift in policy reflecting the pressing needs of local authorities.

This shift raises questions about long-term implications for residents and local government finance. While raising the cap may provide immediate relief for struggling councils, it also risks normalizing higher tax rates and could lead to a pattern of increasing financial demands on residents. As the government navigates these adjustments, it must balance support for local services with the economic realities of the communities they serve.

Public Response to Increased Council Tax Proposals

Public response to recent council tax increase proposals has been mixed, with many residents expressing concern over the financial burden lieing ahead. In regions like Worcestershire, where leaders are advocating for significant tax hikes, community members are voicing their frustrations, citing the economic strain on households already facing rising costs. This reaction emphasizes the importance of addressing resident concerns sincerely and creating open channels for dialogue.

Moreover, the reactions from public representatives reveal a broader discontent with the increasing trend of tax hikes. Councillors who voice opposition to significant increases illustrate the disconnect that can occur between local authority decisions and public sentiment. It’s crucial for councils to not only consider their financial stability but also the feedback from their constituents, fostering an inclusive approach to budget planning.

Future of Council Funding in the UK

The future of council funding in the UK is poised for transformation, as many local authorities grapple with financial instability. As councils like Worcestershire request exceptional financial support, it raises pressing questions about sustainable funding solutions moving forward. The reliance on temporary government grants may only provide a short-term fix while compounding the challenges of budget planning in subsequent years.

Moreover, the landscape of local government finance in the UK may soon require a comprehensive review, focusing on equitable funding distribution that accounts for the unique needs of all councils—urban and rural alike. As dialogues surrounding council tax and government support continue, it is critical for local authorities to advocate for lasting solutions that will ensure fiscal sustainability while adequately addressing the needs of their communities.

The Importance of Financial Transparency in Local Governments

Financial transparency within local governments is foundational to building trust and accountability with residents. As councils announce tax increases to alleviate budget shortfalls, providing clear insights into financial decisions and projections is paramount. Residents have the right to understand how their tax contributions are being utilized, and transparency can significantly mitigate opposition to necessary tax hikes.

Local authorities must prioritize effective communication strategies to engage their communities in discussions about fiscal health. Empowering residents with information surrounding budgetary pressures encourages dialogue and can lead to more informed public responses. Establishing trust through transparency ultimately strengthens the relationship between councils and citizens, making the tax increment discussions more collaborative.

Frequently Asked Questions

What are the reasons behind the council tax increase in the UK?

The council tax increase in the UK is primarily due to a challenging financial position faced by local authorities. Seven councils, including Worcestershire County Council, have been granted permission to raise their council tax above the usual 5% cap to mitigate financial pressures and sustain essential services.

How does the council tax cap affect local authority tax hikes?

The council tax cap limits local authorities to a standard increase of 5%, requiring a referendum for any increase beyond this threshold. However, recent reforms have allowed certain councils, particularly those facing significant financial challenges, to exceed this cap without holding a referendum.

What financial support for councils is available to help with council tax increases?

The government has announced £440 million in recovery grants for financially struggling councils, in addition to £272 million aimed at addressing homelessness. This financial support is crucial for councils like Worcestershire, which are seeking ways to manage their budgets while dealing with council tax increases.

What implications do the recent UK council tax reforms have for residents?

Recent UK council tax reforms permit selected councils to raise taxes beyond the typical cap, which may lead to higher bills for residents. The local authorities will be implementing these increases without the need for a public referendum, which could raise concerns among residents about affordability and council management.

How does the council tax increase impact residents in Worcestershire?

In Worcestershire, the council tax increase could significantly affect residents, as local leaders have warned of financial distress. With the council facing potential bankruptcy and seeking a £71 million government bailout, the proposed increase of up to 10% may place additional financial burdens on residents already struggling to manage their budgets.

What measures are in place to address concerns about council tax increases?

The government has ordered that regional authorities must communicate clearly the rationale behind council tax increases. In addition, local councils are expected to align funding with deprivation in order to support sectors most adversely affected by financial pressures, aiming to ensure that communities receive equitable treatment despite council tax hikes.

How can residents voice their concerns regarding council tax increases?

Residents can express concerns about council tax increases by engaging with their local councils through meetings, public consultations, and by directly contacting their representatives. Many councils provide platforms for residents to give feedback or raise issues related to council tax and service provisions.

Will the council tax increases affect services provided by local councils?

Yes, the necessity for council tax increases arises in part from funding cuts that have led to reduced services. While the additional funds from tax hikes may help maintain some services, there are also concerns that rising costs could result in further reductions in other areas, particularly in councils struggling financially.

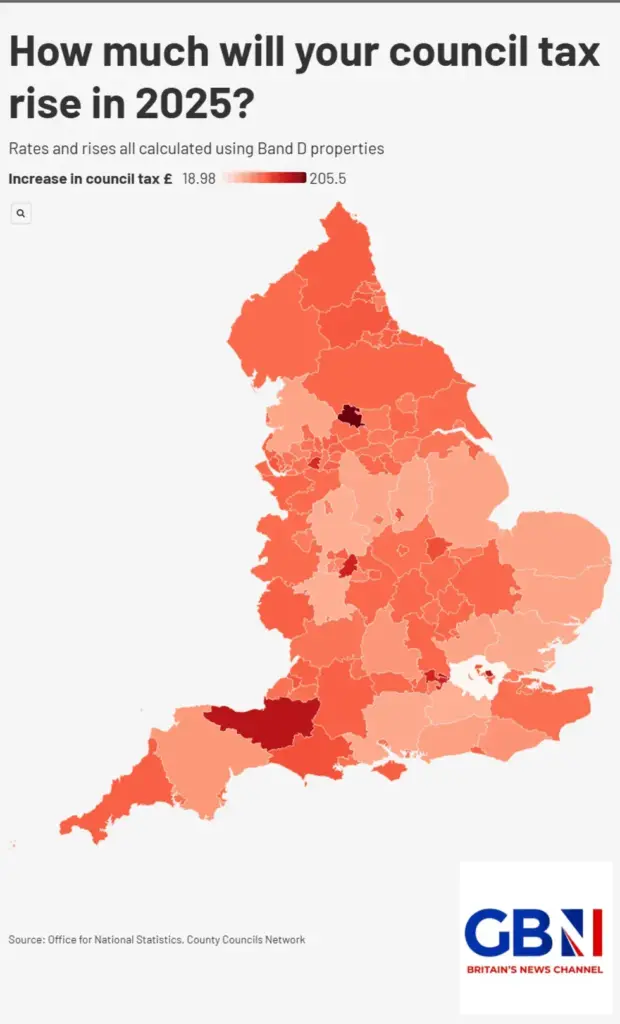

How do council tax rates in different UK regions compare?

Council tax rates vary significantly across different UK regions based on local authority needs, financial health, and government funding. Councils authorized to exceed the average increase, such as those in Worcestershire and North Somerset, demonstrate how local financial conditions can lead to differing rates and taxation policies.

What steps are councils taking to manage their budgets amidst council tax increases?

Councils are seeking a mix of government financial support and council tax increases to manage their budgets. This may include striving for efficiencies, cutting unnecessary expenditures, and responding to residents’ needs while navigating the complexities of rising financial pressures and the caps set by the government.

| Authority Name | Expected Tax Increase (%) | Political Control | Notes |

|---|---|---|---|

| Worcestershire County Council | 9 | Reform | Facing bankruptcy; requested £71 million bailout. |

| Shropshire | 9 | Liberal Democrats | Allowed to exceed cap without referendum. |

| North Somerset | 9 | Lib Dem coalition | Increase helps mitigate financial pressures. |

| Trafford | 7.5 | Labour | No elections in May; adjusting to budget needs. |

| Warrington | 7.5 | Labour | Increase part of local council budget resolution. |

| Windsor and Maidenhead | 7.5 | Lib Dem | Council plans a raise to address funding gaps. |

| Bournemouth, Christchurch and Poole | 6.75 | Lib Dem coalition | May raise tax up to 6.75% without referendum. |

Summary

The council tax increase is a significant topic as seven local authorities in England have been permitted to raise their tax rates beyond the standard 5% cap to address financial challenges. This move, approved by the government, aims to alleviate the fiscal pressures these councils face without requiring a referendum for residents. Councils like Worcestershire and Shropshire, anticipating substantial hikes of 9%, highlight the urgent need for financial stabilization. Meanwhile, the approved increases remain lower than initial requests from these councils, ensuring that taxpayer bills do not exceed the national average. As the government introduces new funding measures for struggling areas, the balance between local revenue generation and community support remains a pivotal concern.