Listen to this article

Business rates play a pivotal role in shaping the financial landscape for enterprises across the UK, particularly for high street shops, independent retailers, and the hospitality sector. As discussions intensify surrounding business rates relief, politicians face mounting pressure to address the growing financial burdens on these establishments. Notably, UK pubs have come under scrutiny, as they prepare for significant increases in their business rates, prompting outrage from owners and customers alike. The prospect of rising bills has sparked a heated debate, raising questions about fairness and the implications for small businesses struggling with hospitality tax issues. With calls for comprehensive reform to the business rates system, the conversation is not only timely but critical for the survival of many local businesses.

The taxation system that governs business rates encompasses various fees that establishments must pay based on their property value, impacting both venues and retailers alike. As the focus sharpens on providing financial relief particularly to pubs, there is an increasing discourse about the implications for independent shops and other sectors feeling the weight of rising costs. Alternative terms such as local business levies and property taxes are also relevant in this context, underscoring the systemic challenges faced by many in the hospitality and retail industries. Stakeholders are advocating for expansive reforms that transcend short-term fixes, ensuring a viable future for all kinds of businesses amid the shifting economic landscape. Addressing the complexities involved will require a collaborative effort that balances the needs of various sectors facing heightened financial scrutiny.

The Impact of Business Rates on UK Pubs

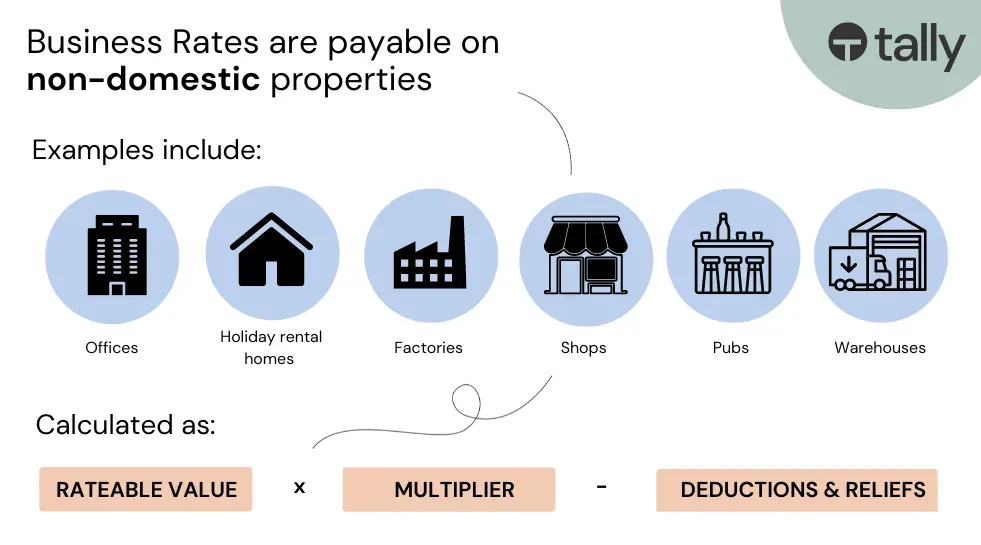

Business rates, a tax levied on most non-domestic properties, continue to significantly impact pubs across the UK. With recent changes announced by the Chancellor, many pubs are facing steep increases in their business rates bills. These hikes come after a period of substantial support during the pandemic, leaving landlords in a precarious position as they grapple with both rising costs and dwindling customers. Without swift intervention from the government, many iconic pubs may struggle to survive in the ever-challenging hospitality landscape.

As the government prepares to implement new business rates adjustments, the pub industry is rallying for more comprehensive reforms to ensure equitable treatment amid rising operational costs. The disproportionate focus on pubs could lead to an unbalanced recovery across the hospitality sector, potentially disadvantaging other critical venues such as live performance spaces and music venues. Stakeholders assert that while support for pubs is vital, it shouldn’t overshadow the struggles faced by other business sectors equally affected by increased business rates.

Frequently Asked Questions

What are the current challenges related to business rates for UK pubs?

UK pubs are facing significant challenges with business rates due to planned increases in their tax liabilities. After a reduction in business rate discounts from 75% to 40% in the November Budget, many landlords are anticipating steep hikes in their bills, driven by upward adjustments to rateable values. This situation has sparked political pressure for broader business rates relief that addresses not just pubs but also independent retailers and other sectors suffering from similar economic strains.

How will the recent changes in business rates affect independent retailers?

Independent retailers are voicing concerns over their exclusion from business rates relief discussions, especially while pubs are set to receive potential exemptions. These retailers face the same cost challenges as pubs, making the case for equitable business rates support across all sectors, including high street shops and cafes, essential for their survival.

What is the implication of the government’s retreat on business rates for pubs specifically?

The government’s anticipated retreat on business rates is expected to provide some relief specifically to pubs, amidst growing unrest from landlords and owners against looming tax increases. However, this selective approach has drawn criticism as it does not extend the same considerations to the broader hospitality sector, leaving many businesses, including independent retailers, at a disadvantage.

Why is the current system of business rates considered ‘not fit for purpose’?

The British Retail Consortium has criticized the existing business rates system as ‘not fit for purpose’, calling for comprehensive reform rather than piecemeal fixes. The reliance on outdated assessments and the lack of support for diverse business types contribute to the increasing financial burdens on various sectors, particularly those reliant on footfall, such as hospitality and retail.

What are the broader implications of increased business rates on the hospitality sector?

Increased business rates could lead to dire economic consequences for the hospitality sector. Higher costs are likely to be passed on to consumers, resulting in increased prices, reduced services, job losses, and potentially the closure of establishments. This poses a risk not only to pubs but also to restaurants, cafes, and entertainment venues, which are crucial to community vitality.

How is the government addressing hospitality tax issues in light of business rates concerns?

The government claims to be collaborating with the hospitality sector to address tax issues related to business rates, recognizing the financial strain many businesses are facing. However, details on a comprehensive support package remain vague, prompting calls from various MPs and industry leaders for more transparent and inclusive measures to alleviate the financial burdens imposed by rising rates.

| Key Point | Details |

|---|---|

| Call for Action | High street shops, pharmacies, and music venues urge the government, specifically Rachel Reeves, to halt increases to business rates. |

| Pub Sector Relief | Government retreat on pub business rates is expected, amidst protests from landlords and pub owners, some of whom have banned Labour MPs. |

| Rate Adjustments | The Chancellor cut business rate discounts from 75% to 40% and plans to eliminate them by April, leading to increased bills for landlords. |

| Independent Retailers Excluded | Bira criticized the exclusion of independent retailers from any potential relief, highlighting similar challenges faced by all businesses. |

| Fairness Issue | Surinder Arora pointed out that exemptions solely for pubs are unfair, as his hotel business faces massive rate hikes. |

| System Ineffectiveness | The BRC stated that the current business rates system fails to meet the needs of the economy. |

| Concerns from Various Sectors | The pharmacy sector could see a 140% rate hike, with similar warnings from gyms regarding potential 60% increases. |

| Urgent Need for Consultation | MPs express urgency for transparency and further discussions on alternative support for struggling industries. |

| Reeves’ Support for Pubs and High Streets | Rachel Reeves acknowledged the challenges faced by many pathways and emphasized ongoing collaboration to support affected sectors. |

Summary

Business rates have come under scrutiny as high street shops, pharmacies, and music venues rally for the government to prevent substantial increases that could threaten their viability. Despite the anticipated relief for pubs, concerns persist across various sectors about the fairness and effectiveness of the proposed changes. The reduction in discounts and the looming hike in rates chime loudly for many businesses which could face severe financial pressures. As the discourse evolves, it remains critical for the government to provide equitable support for all affected industries, ensuring a balanced approach to the complex issue of business rates.