Listen to this article

Britain’s economy is currently facing significant challenges amid political turmoil and shifting tax policies. Recent analyses have spotlighted the impact of Chancellor tax hikes, raising concerns about their effectiveness on economic growth predictions. Critics, including former NatWest chief Sir Howard Davies, argue that the government’s actions, particularly in terms of tax policy impact, are slowing down businesses and fostering an environment of uncertainty. The upcoming UK budget analysis reveals that Labour’s economic strategy may lead to increased taxes on households instead of corporations, a move that could stifle growth. As the economy grows by only a meager 0.1%, the stakes are high for the Chancellor to navigate these turbulent waters while aiming for sustainable economic development.

The economic landscape of the United Kingdom is witnessing notable volatility, which is influencing financial strategies and government planning. With a focus on taxation reform, discussions around potential increases in levies dominate the narratives surrounding fiscal policy. The implications of such changes, especially under Labour’s proposed economic framework, have sparked dialogue regarding their potential to stimulate or hinder growth. Furthermore, analysts are keenly assessing the repercussions of recent fiscal decisions on businesses and households alike, as figures suggest an underwhelming performance in economic advancement. Understanding these dynamics is crucial to grasping the future direction of the UK’s financial health.

The Impact of Tax Policy on Britain’s Economy

Tax policy plays a pivotal role in shaping the economic landscape of any country, and Britain’s economy is no exception. Recent discussions surrounding proposed tax hikes under Labour’s leadership have sparked significant debate among economists and business leaders. Critics, like Sir Howard Davies, argue that the proposed tax increases, particularly on wealth and property, may deter investment and slow economic growth. Increased taxation can lead to uncertainty in the market, making businesses hesitant to expand or hire, which further restrains the potential for economic growth.

Moreover, as the Chancellor seeks to implement a £20 billion increase in National Insurance contributions, concerns mount regarding its impact on employers and overall economic productivity. The balance between tax revenue generation and fostering a conducive environment for business growth becomes crucial. If businesses feel overburdened by taxes, they may curtail investments, negatively affecting Britain’s economy and leading to lower GDP growth projections.

Economic Growth Predictions Amidst Tax Hikes

In light of recent economic data, the predictions for economic growth in Britain have become increasingly cautious. The latest figures indicate a mere 0.1% growth in the July-to-September quarter, falling short of city expectations. This stagnation raises alarms about the effectiveness of the current government’s economic strategy, particularly as they prepare to implement substantial tax increases. Economists fear that such policies could further hamper Britain’s economy, leaving it vulnerable to external shocks and less competitive on the global stage.

The juxtaposition of rising taxes and modest economic growth predictions underscores the dilemma faced by policymakers. While the intention may be to raise revenue for public services, the risk lies in stunting economic momentum. Businesses are calling for a clearer vision that optimizes economic growth while managing fiscal responsibilities, suggesting that a comprehensive approach to tax reform might be necessary to spur investment and confidence among consumers and business owners alike.

The Role of Chancellor Tax Hikes in Economic Strategy

Chancellor Reeves’ proposed tax hikes have emerged as a cornerstone of her economic strategy, aimed at addressing budget shortfalls and funding essential public services. However, this approach has garnered criticism from influential voices in the business community, emphasizing that tax increases could inadvertently hinder economic growth. The narrative surrounding the so-called ‘Mamil Tax’ on cyclists exemplifies how targeted tax measures could disproportionately affect specific demographics, which raises broader questions about equity and economic impact.

As the Labour Government prepares for upcoming budget announcements, the anticipated tax hikes are expected to generate significant revenue but also risk backlash from sectors worried about their viability and growth potential. Critics warn that without a balanced approach, where tax policies encourage rather than discourage economic activity, Britain’s economy may struggle to achieve the desired growth, potentially leading to more significant divisions within the society regarding wealth distribution and economic opportunity.

Labour’s Economic Strategy: Pros and Cons

Labour’s economic strategy under the leadership of Keir Starmer and Rachel Reeves aims to balance public spending with sustainable growth. However, proposals to increase taxes have raised eyebrows among business leaders who argue that such measures could slow Britain’s economy. The government’s insistence on prioritizing tax increases over other possible revenue streams may create an environment of uncertainty that discourages investment, potentially undermining the very objectives they seek to achieve.

Proponents of Labour’s plan argue that targeted tax increases can help fund essential services, driving growth in the long run. Nonetheless, the diverging opinions highlight a critical debate in economic policy: how to effectively finance public services while stimulating economic growth. As the country navigates these challenges, the implications of Labour’s economic strategy will be scrutinized closely, particularly as they prepare for the forthcoming budget that could reshape the economic landscape for years to come.

Public Response to Proposed Tax Changes

The public response to the proposed tax changes has been mixed, reflecting the complexity of the issues at hand. Many citizens express concern about the potential impact on their finances, especially with the prospect of increased taxes discussed by the Chancellor. Those who rely on public services funded by tax revenue may support increases, while others, particularly those in higher income brackets or small business owners, fear additional financial burdens will stifle economic activity and reduce disposable income.

This duality in public opinion can complicate the Labour government’s efforts to justify its economic policies. Engaging in transparent dialogue about how these tax changes will affect everyday lives and the broader economy is essential. As the narrative unfolds, it remains to be seen how effectively the government will communicate the rationale behind its financial decisions, and whether these changes will ultimately harmonize with the goal of sustainable economic growth.

The Influence of Global Economic Factors on Britain

Britain’s economy does not operate in a vacuum, and global economic factors play a significant role in shaping its performance. The recent discourse surrounding tariffs, particularly those imposed by the US, and the shifts in international trade dynamics have had tangible effects on the UK’s GDP growth. As Energy Security Secretary Ed Miliband pointed out, global turbulence can contribute to national economic challenges and must be considered when evaluating the government’s policies.

Understanding these external influences is crucial for developing realistic economic strategies. Policymakers need to remain agile and responsive to global trends while simultaneously addressing domestic policies that impact growth. This intricacy underscores the importance of a cooperative approach between national policies and international economic realities to bolster Britain’s economic resilience moving forward.

The Need for Comprehensive Budget Analysis

An in-depth analysis of the upcoming budget is critical for understanding the full implications of the proposed tax hikes. Stakeholders from various sectors—including business leaders, economists, and the public—will be closely analyzing how the Labour government intends to allocate resources and manage public spending amidst rising taxation. The careful balancing act of maximizing revenue while fostering a growth-friendly environment is paramount to ensuring that the budget not only addresses immediate fiscal needs but also nurtures long-term economic stability.

Through a comprehensive budget analysis, potential impacts on various sectors can be assessed, allowing for informed dialogue and debate about the government’s economic strategy. This transparency will be essential for building trust with the public, especially as conflicting opinions about tax increases emerge. By engaging in thorough evaluation and discussion, the government can aim to create a budget that is not only more acceptable to the populace but also conducive to sustainable economic growth.

Chancellor’s Fiscal Measures and Their Implications

The Chancellor’s fiscal measures, particularly the proposed tax increases, represent a bold attempt to shift the economic landscape in Britain. However, the implications of these measures are a point of contention. Critics argue that the increases will lead to a burdensome environment for businesses, potentially curtailing investment and job creation. As the government tries to position itself as a protector of public services, the trade-off between adequate funding and economic efficiency remains contentious.

On the other side, the Chancellor seeks to reassure the public that these measures are designed to sustain essential services while addressing issues of inequality. A balanced view of the benefits versus risks associated with these fiscal changes will be imperative in the months leading up to the budget announcement. As stakeholders await clarity on the specifics of the plan, the economic community continues to emphasize the need for carefully crafted tax policies that support recovery and growth.

Navigating Economic Uncertainty and Policy Effectiveness

In a climate of economic uncertainty, the effectiveness of government policies is under increased scrutiny. As Britain faces challenges from within and outside its borders, the ability of policymakers to address these issues through effective tax strategies and spending priorities becomes critical. With the government’s tax hikes facing opposition, the urgent question is whether these measures will truly enhance growth or inadvertently serve to impede it.

Thus, ongoing assessment of the policies implemented will be vital in ensuring that the government’s strategies align with the goal of fostering a resilient economy. A proactive approach, where feedback from businesses and the public is considered, will help navigate these turbulent waters. Through a collaborative effort, Britain can aim to bolster economic growth while managing the delicate balance of fiscal responsibility.

Frequently Asked Questions

What is the impact of the latest tax policy on Britain’s economy?

The recent tax policy changes in Britain, particularly the £20 billion increase in National Insurance contributions proposed by the Chancellor, significantly impact the economy. These tax hikes, aimed at funding public services, have raised concerns among businesses about potential growth hindrances and increased hiring costs.

How do recent economic growth predictions affect public confidence in Britain’s economy?

Recent economic growth predictions indicate a sluggish increase of just 0.1% for the previous quarter, which may undermine public confidence in Britain’s economy. Analysts warn that ongoing uncertainty, coupled with potential tax increases, could further dampen investment and consumer spending.

What are the implications of Chancellor tax hikes for businesses in Britain?

Chancellor tax hikes, particularly regarding property, gambling, and potentially even ‘Mamil Tax’ for cyclists, create an environment of uncertainty for businesses. This uncertainty can lead to caution in spending and hiring, ultimately slowing down economic growth.

How is the UK budget analysis reflecting on Britain’s economic health?

UK budget analysis reveals significant challenges for Britain’s economic health, with proposed tax increases and high public sector wage growth potentially limiting the Bank of England’s ability to reduce interest rates. This could stifle investment and consumer spending, leading to slower economic progress.

What is Labour’s economic strategy, and how does it aim to tackle Britain’s economic challenges?

Labour’s economic strategy, spearheaded by Chancellor Rachel Reeves, aims to tackle Britain’s economic challenges through public spending reforms and tax increases on wealthier individuals. However, critics argue that these strategies may not effectively drive economic growth and could exacerbate existing uncertainties.

| Key Points | Details |

|---|---|

| Tax Increases | Proposed tax hikes including the ‘Mamil Tax’ and increases in National Insurance for employers. |

| Impact on Growth | Criticism from Sir Howard Davies regarding government policies slowing down economic growth. |

| Public Spending | Public sector wages set to rise significantly compared to the private sector, affecting overall economic stability. |

| Labour’s Approach | Reeves claims to have a plan for growth, but lacks concrete measures; focus on future promises rather than immediate solutions. |

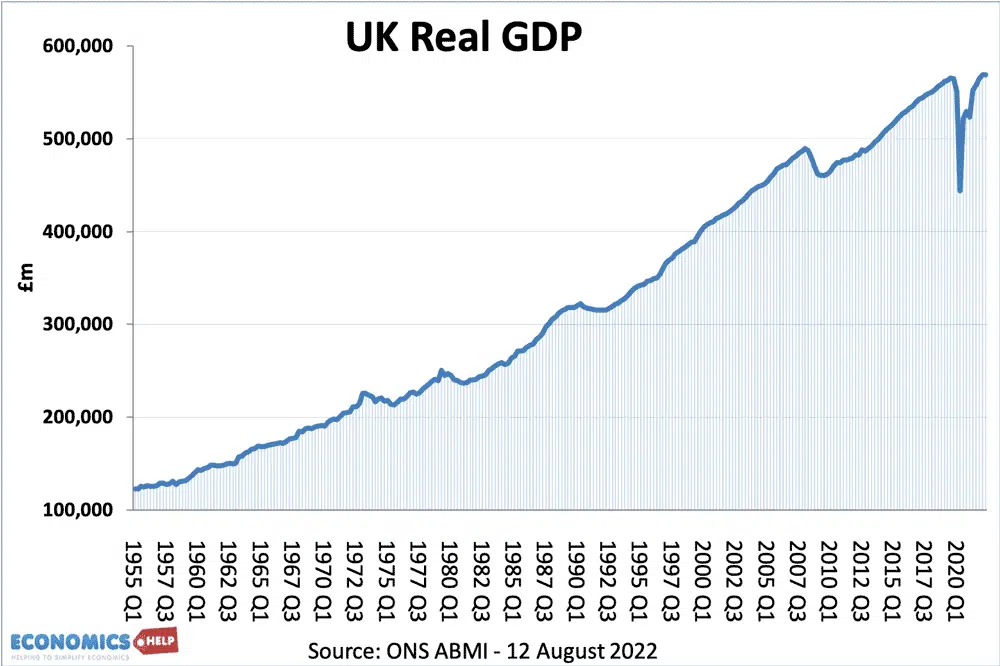

| GDP Growth | Recent figures showed only a 0.1% growth in the economy in previous quarters. |

| Global Factors | Government cites global economic turbulence as a contributing factor to economic challenges. |

Summary

Britain’s economy faces significant challenges as the government grapples with rising tax burdens and public spending policies that may hinder growth. Critics, including former NatWest chief Sir Howard Davies, argue that the current administration’s conduct is detrimental to economic stability. The proposed fiscal measures, which include a range of tax increases and public sector wage hikes, have raised concerns about their impact on businesses and overall growth. As GDP growth remains sluggish, the government’s approach to taxation and public spending continues to draw scrutiny, reflecting a critical juncture for Britain’s economic future.