Listen to this article

Benefit fraud has emerged as a significant concern in the UK, with recent cases revealing the extensive operations of criminal gangs behind fraudulent claims. Notably, a group was implicated in the UK’s largest benefit fraud scam, siphoning off a staggering £54 million in Universal Credit payments. By submitting around 6,000 fake applications, these benefit scammers were able to exploit the system and fund extravagant lifestyles that included luxury cars and designer goods. Despite being convicted and sentenced, the gang’s repayment of just £2 million underscores the challenges in recouping stolen taxpayer money. Authorities remain vigilant, actively tackling such scams to protect the integrity of welfare systems in Britain.

Addressing the issue from a broader perspective, social welfare fraud has become a pressing challenge for regulatory bodies in the UK. The recent exposure of a scheme orchestrated by a network of con artists not only highlights the prevalence of dishonest practices, such as Universal Credit scams, but also the ingenuity of those involved in exploiting loopholes. The fraudulent claims executed by these individuals reveal a disturbing trend, where organized groups perpetrate deceit on an industrial scale. This deception not only defrauds the system but also puts additional strain on resources intended to assist the most vulnerable. As law enforcement intensifies efforts to crack down on these operations, public awareness and vigilance are crucial in combating this pervasive issue.

Understanding Benefit Fraud in the UK

Benefit fraud in the UK has become a significant issue, costing the taxpayer billions of pounds every year. The term refers to individuals or groups that intentionally provide false information to receive financial support from government benefits. This can include misleading details about income, household circumstances, or even using stolen identities to make fraudulent claims. In recent years, well-publicized cases, such as the £54 million Universal Credit scam, have highlighted the elaborate tactics employed by benefit scammers, raising public concern about the integrity of welfare systems.

The rise in benefit fraud is a complex problem rooted in socio-economic factors, such as poverty and unemployment. Many individuals may feel pressured to resort to dishonest means when facing financial hardships. However, the consequences of such actions extend beyond the immediate financial gain; they strain public services and erode trust in social safety nets. Understanding the motivations behind benefit fraud is essential for developing effective prevention strategies and ensuring that support reaches those genuinely in need.

The Scale of Recent Benefit Fraud Cases

Recent investigations into benefit fraud have revealed the alarming scale at which these crimes are being perpetrated. The case involving a criminal gang that swindled nearly £54 million illustrates how organized groups exploit loopholes in the system. By submitting fabricated claims using both real and false identities, the gang was able to successfully deceive the authorities for an extended period. The sheer number of bogus claims—approximately 6,000—highlights the industrial-scale operation that benefits fraud can sometimes become, prompting urgent calls for government intervention.

Authorities in the UK have reported a marked increase in fraudulent claims in recent years. Criminal gangs are often behind these operations, utilizing sophisticated methods and technology to bypass detection. The fallout from such schemes is not only financial; it also undermines the welfare system’s credibility, potentially harming those who genuinely rely on these benefits for support. Continued efforts by the Department for Work and Pensions (DWP) to recover lost funds and tighten regulations are critical to combatting this ongoing challenge.

Consequences and Sentencing of Benefit Fraudsters in the UK and Beyond

The ramifications of being caught for benefit fraud can be severe. In the highlighted case, the members of the gang received significant prison sentences, totaling 25 years, demonstrating the judicial system’s stance on such crimes. Sentences like these serve as warnings to potential fraudsters about the serious legal consequences of their actions. Furthermore, the financial penalties—wherein the gang was ordered to repay only £2 million of the £54 million stolen—prompt discussions about whether the current punitive measures are effective enough to deter future fraud.

Additionally, the impact of imprisonment on the defendants often extends beyond their sentences. Many individuals involved in benefit fraud may face difficulties reintegrating into society post-release, including challenges in finding employment due to their criminal records. This cycle can perpetuate the conditions that lead to financial crime, necessitating a comprehensive approach that includes both punishment and rehabilitation. Efforts to educate those on benefits about the implications of fraud and the importance of honesty within the system are essential components of a long-term strategy to prevent these crimes.

Preventing Benefit Fraud: Strategies and Solutions

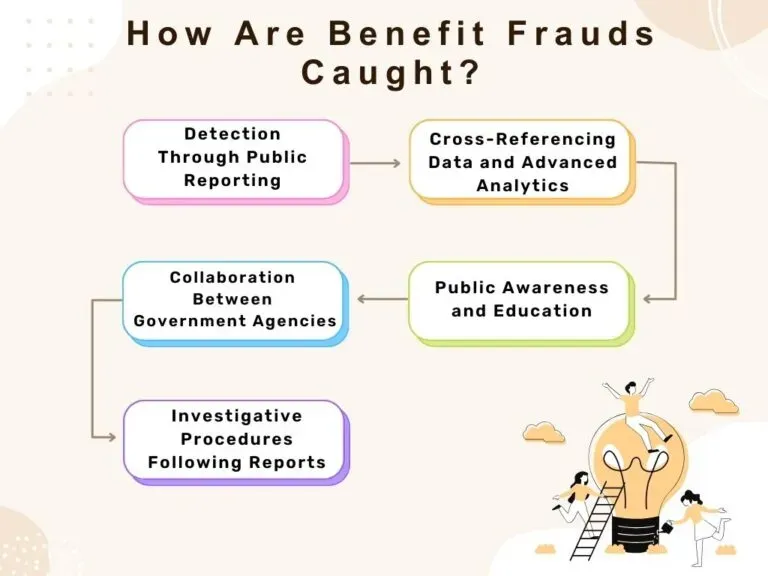

Preventing benefit fraud requires a multi-faceted approach involving advanced technology, stringent regulations, and public awareness campaigns. The UK government has invested heavily in fraud detection systems, which utilize data analytics to identify suspicious claim patterns. Such measures aim to catch fraudulent claims before they are approved, thereby preventing the significant losses seen in cases like the recent £54 million scheme. Additionally, training for personnel involved in processing claims is crucial to ensure they can recognize potential fraud indicators.

Public awareness is also vital in the fight against benefit fraud. By educating the public about what constitutes fraud and its negative impact on society, authorities can encourage whistleblowing and community involvement. Campaigns can help dispel misconceptions about who commits benefit fraud, as the recent cases show that organized criminal gangs are often the main perpetrators, not just individual claimants desperate for support. Creating a culture of honesty and responsibility is key to reducing fraudulent claims and strengthening the public’s trust in welfare systems.

Criminal Gangs and Benefit Scammers: The Hidden Threat

The emergence of criminal gangs focusing on benefit fraud represents a concerning trend within the UK welfare system. These organized groups often employ skilled scammers who are adept at navigating the complexities of the benefits framework, thus posing a significant threat to public resources. As seen in the recent £54 million scam, these gangs employ elaborate schemes that can include identity theft and submission of falsified documentation, creating complex webs that are challenging for authorities to unravel.

Detecting and dismantling such criminal operations requires coordinated efforts from law enforcement and government agencies. The ramifications of these fraud schemes go beyond immediate financial losses; they can also lead to increased scrutiny of welfare programs, making it more difficult for genuine claimants to access necessary support. As a result, authorities must prioritize addressing benefit fraud in conjunction with reforming policies that support legitimate claimants, striking a balance that maintains the integrity of the welfare system.

Government Response to Benefit Fraud: Policies and Enforcement

The UK government has responded to the rising trend of benefit fraud with a series of policies aimed at reinforcing the integrity of welfare payments. Increased investment in fraud detection technology has enabled authorities to identify dishonest claims more effectively. The Department for Work and Pensions (DWP) regularly reviews its policies to refine processes and ensure that fraud and abuse of the system are addressed robustly. Furthermore, partnerships with law enforcement bodies help to apprehend and prosecute individuals involved in large-scale fraud schemes.

Despite these advances, challenges remain. The balance between protecting honest claimants and cracking down on fraud can lead to increased scrutiny and barriers for vulnerable individuals seeking assistance. Continuous outreach efforts are necessary to inform the public about the significance of compliance and the repercussions of committing fraud. Encouraging public assistance in reporting suspected fraud can also bolster enforcement efforts, creating a community-oriented approach in tackling benefit fraud effectively.

The Role of Technology in Combating Benefit Fraud

Technology plays a crucial role in combating benefit fraud in the UK, helping authorities identify fraudulent claims swiftly. The adoption of advanced data analytics enables comprehensive monitoring of transactions, revealing patterns indicative of fraud. For instance, algorithms can assess the legitimacy of claims based on various data inputs, such as income verification and past behavioral patterns. The recent case of the £54 million Universal Credit scam demonstrates the urgent need for improved technological solutions to prevent such elaborate scams from occurring.

Moreover, the introduction of automated systems assists in streamlining the claims process while enhancing security protocols. Robust verification methods, such as biometric identification and electronic signatures, reduce the chances of identity theft and fraudulent applications. However, with the rise of technology in fraud prevention, there is an ongoing discussion about balancing efficiency and security while ensuring accessibility for genuine claimants. Striking this balance will be essential as authorities continue to refine their strategies against benefit fraud.

Public Perception of Benefit Fraud: Misinformation and Reality

Public perception of benefit fraud is often shaped by media portrayals, leading to widespread misinformation about the nature and scope of these crimes. Many people associate benefit fraud primarily with individual cases of deception, such as falsely claiming unemployment benefits. However, as demonstrated by the substantial scams executed by organized criminal gangs, the reality is far more complex. Acknowledging the multifaceted dimensions of benefit fraud can help foster a more informed understanding among taxpayers regarding the issues at hand.

Addressing misconceptions and providing clear, factual information about benefit fraud is crucial. Misinterpretations can lead to stigmatization of legitimate beneficiaries, creating an environment of distrust in welfare programs. By shifting the narrative to highlight the significant impact of large-scale fraud on public finances and the measures being put in place to combat it, authorities can help the public navigate the complexities of welfare systems more effectively. Ultimately, fostering open discussions about benefit fraud is a vital step toward promoting accountability and encouraging community involvement in fraud prevention.

Future Directions in the Fight Against Benefit Fraud

Looking ahead, it is crucial for the UK to enhance its strategies for combating benefit fraud. The increasing sophistication of fraudsters necessitates ongoing advancements in detection and prevention mechanisms. Authorities must adapt to evolving tactics used by scammers, particularly as technology continues to evolve. Collaborating with other countries can provide valuable insights into effective practices for tackling benefit fraud on a global scale.

Additionally, there is a growing need for systemic changes that simplify the benefits system while deterring fraudulent activities. Streamlining application processes and improving communication between agencies will not only help prevent fraud but also support genuine claimants efficiently. It is imperative that the focus remains on building a welfare system that minimizes opportunities for exploitation while ensuring its sustainability for future generations.

Frequently Asked Questions

What is UK benefit fraud and how does it occur?

UK benefit fraud refers to the unlawful acquisition of state benefits, such as Universal Credit, by submitting fraudulent claims. This can occur through various methods, including using stolen identities, fake documents, or duplicating applications until they are approved.

What are the consequences of committing benefit fraud in the UK?

Committing benefit fraud in the UK can lead to severe legal consequences, including hefty fines and imprisonment. Offenders may also be required to repay the fraudulent claims, often facing criminal charges like fraud and money laundering.

How prevalent is Universal Credit scam activity in the UK?

Universal Credit scams are a significant concern in the UK, with some operations involving criminal gangs committing fraud on an ‘industrial scale’. Recent cases have involved claims of millions of pounds in stolen benefits, highlighting the seriousness of the issue.

What actions are taken against benefit scammers in the UK?

The UK government actively pursues benefit scammers through investigations, arrests, and prosecutions. Following significant fraud cases, like that involving a £54 million scam, authorities work to recover stolen funds and deter future fraudulent claims.

How can individuals report suspected benefit fraud in the UK?

Individuals can report suspected benefit fraud by contacting the Department for Work and Pensions (DWP) directly. They can provide information about fraudulent claims or behaviors anonymously to help combat benefit fraud effectively.

What measures does the UK government employ to prevent benefit fraud?

To prevent benefit fraud, the UK government implements various strategies, including thorough background checks, data matching, and collaboration with law enforcement to detect suspicious activity and protect taxpayer funds.

What should I do if I suspect I am a victim of a Universal Credit scam?

If you suspect you are a victim of a Universal Credit scam, report the incident to the DWP immediately. Provide them with any relevant information you have regarding fraudulent claims made in your name or any unexpected correspondence.

What penalties do gang members face for large-scale benefit fraud?

Members of gangs involved in large-scale benefit fraud can face substantial prison sentences, as demonstrated in recent cases where offenders received combined sentences amounting to decades in jail, in addition to being ordered to repay a fraction of the stolen funds.

Are there specific signs that indicate a fraudulent claim in benefit applications?

Yes, suspicious indicators of fraudulent claims may include repeated applications for benefits using similar identities, discrepancies in personal documentation, or claims for high amounts without supporting evidence. Authorities look for these patterns to identify potential fraud.

How does the criminal justice system handle cases of fraudulent claims related to benefits?

The criminal justice system addresses fraudulent claims related to benefits by investigating allegations, prosecuting offenders, and enforcing penalties. High-profile cases reveal the serious nature of benefit fraud and the system’s commitment to deterring such criminal activity.

| Key Point | Details |

|---|---|

| Total Fraud Amount | £53.9 million in Universal Credit payments |

| Gang Members | Galina Nikolova, Stoyan Stoyanov, Tsvetka Todorova, Gyunesh Ali, and Patritsia Paneva |

| Convictions | Admitted to fraud and money laundering; received a combined prison sentence of 25 years |

| Amount Ordered to Repay | £2 million, approximately 1% of total stolen |

| Method | Submitted around 6,000 bogus claims using real people and stolen identities |

| Operation Duration | Four years, exposed in May 2021 |

| Authorities’ Response | The Department for Work and Pensions is actively pursuing additional recovery of funds |

Summary

Benefit fraud has emerged as a significant issue in the UK, especially highlighted by the recent case where a gang orchestrated the largest benefits fraud in the nation’s history, stealing nearly £54 million. Despite their extravagant lifestyles funded through deceit, the criminals have been ordered to repay only a small fraction of what they wrongfully obtained, prompting ongoing efforts by authorities to recover the lost funds. With continued vigilance like that from the Department for Work and Pensions, the fight against benefit fraud remains a critical endeavor.