Listen to this article

The average house price in the UK has officially crossed the £300,000 mark for the first time, a significant milestone reported by Halifax. This news reflects the current trends in the UK housing market, where house prices saw a notable rise, reaching £300,077 in January 2023. For many, particularly first-time buyers, this could present challenges in terms of property affordability, as the dream of owning a home becomes increasingly costly. Despite the elevated average house prices, wage growth has outpaced inflation, offering a glimmer of hope for prospective buyers navigating this landscape. As lenders adapt, more attractive mortgage products are emerging, aimed at easing the burden for those entering the property market.

As the landscape of real estate in the UK evolves, home values have reached unprecedented levels, with the property market exhibiting notable fluctuations and trends. January 2023 marked a pivotal time as average prices climbed beyond £300,000, influencing the dynamics for many individuals looking to secure their first mortgage. The ongoing discussion surrounding housing affordability highlights the strains faced by new buyers, who are adapting to these surging values and market conditions. Moreover, wage growth has provided a buffer against steep price increases, indicating a nuanced relationship between earnings and property costs. Overall, as more competitive mortgage options emerge, the opportunities for homeownership are becoming progressively diverse, albeit still influenced by the challenges of the current economic climate.

Current Trends in the UK Housing Market

The UK housing market has been witnessing significant changes, with the average house price rising above £300,000 for the first time, according to Halifax. This milestone presents a complex picture for buyers and sellers alike, particularly first-time buyers who are facing unprecedented hurdles in entering the property market. As house prices soared in January 2023, many potential homeowners are questioning their ability to secure funding and navigate the increasingly competitive landscape.

Despite the eye-watering average house prices, there is a silver lining for aspiring homeowners. Wage growth has been exceeding house price inflation since late 2022, which is a beacon of hope for affordability. Lenders are adjusting to this dynamic by offering more attractive mortgage options that require smaller deposits, catering specifically to the needs of first-time buyers. This shift indicates a responsive market that is recognizing the challenges posed by rising house prices.

Average House Price UK: Analyzing the Figures

As of January 2023, the average house price in the UK stands at £300,077, marking a significant threshold that poses both opportunities and challenges in the real estate sector. Halifax’s data shows an increase of 0.7% from the previous month and a year-on-year growth of 1%. Such statistics highlight the resilience of the UK housing market, even amidst economic uncertainties. For many, especially those who are looking to buy their first home, this scenario can feel daunting as property affordability remains a pressing issue.

Furthermore, a comparative analysis with other lenders indicates differing views on house prices. Nationwide, for example, registered an increase of only 0.3% in January, yielding an average price of £270,873. This discrepancy underscores the various methodologies used in measuring house prices and emphasizes the ongoing complexity within the UK housing market. As buyers assess their options, understanding these figures becomes essential for making informed decisions.

Challenges Faced by First-Time Buyers in 2023

As the average house price exceeds £300,000, first-time buyers in the UK are contending with substantial challenges that threaten their aspirations of home ownership. The marked increase in property prices has led to concerns about property affordability, as many find themselves priced out of desirable areas. Even as mortgage rates see much-needed declines, they remain elevated compared to the ultra-low rates previously enjoyed, creating an environment of cautious optimism among potential buyers.

Industry experts like Karen Noye stress the compounded pressure on first-time buyers, whose situation has been described as ‘one nail in the coffin’ for homeownership possibilities. As rising house prices pair with fluctuating mortgage rates, buyers need to reassess their financial strategies. This could involve seeking government support schemes or considering properties outside of their immediate preferences to navigate the challenging landscape.

Affordability Factors in the Current Market

Affordability remains a critical factor in the UK housing market as average house prices continue their upward trajectory. With Halifax indicating increasing wages outpacing property price inflation, there is a glimmer of hope for buyers. However, the reality is that many prospective homeowners still experience significant barriers due to high property values. The competition among lenders has intensified, leading to more innovative mortgage products that may enhance accessibility for first-time buyers.

Halifax’s predictions suggest a possible 1% to 3% rise in house prices this year, further complicating the landscape of property affordability. While the Bank of England may adjust interest rates to support growth in the housing sector, the reality is that wage increases are not yet demonstrably sufficient to mitigate the impacts of rising prices. Therefore, it is imperative for consumers to closely analyze their financial positions and consider how ongoing economic developments may impact their buying power.

Reactions from Mortgage Experts and Market Predictions

Experts in the mortgage sector have had varied reactions to the recent surge in average house prices, with many voicing concerns for first-time buyers amidst the evolving landscape. According to Amanda Bryden of Halifax, the housing market remains on stable ground; however, the rising prices suggest persistent affordability challenges. Mortgage professionals are advocating for potential buyers to remain vigilant as the market continues to fluctuate, emphasizing the need for careful financial planning and timing.

The general sentiment from market analysts is one of cautious optimism, as declining mortgage rates could signal a gradual improvement in market conditions. Despite current challenges, experts suggest that if inflation trends downward, price growth might stabilize in the coming months. However, stakeholders are urged to manage their expectations as the housing market grapples with various influencing factors.

Comparing Halifax and Nationwide House Price Reports

The differences in house price reports between major lenders such as Halifax and Nationwide illustrate the complexities of the UK housing market. Halifax reports an average price exceeding £300,000, while Nationwide’s figures are lower, averaging around £270,873. These variations can lead to confusion among buyers, making it crucial for them to understand how these averages are determined and what implications they hold for their purchasing decisions.

Such discrepancies highlight the need for potential buyers to consult multiple sources and find clarity in their objectives. Analyzing data from various lenders not only provides a comprehensive view of the market but also assists buyers in making informed decisions, especially when faced with rising house prices and varying mortgage rates. Understanding these fluctuations can be pivotal for first-time buyers in effectively navigating their home-buying journey.

Encouragement for Prospective Homeowners

Despite the hurdles posed by rising average house prices in the UK, prospective homeowners are encouraged to remain hopeful. Many industry experts highlight that while the current market is challenging, effective strategies can enable first-time buyers to succeed. By staying informed about market trends, exploring various mortgage offers, and assessing affordability diligently, buyers can still find ways to achieve their dream of home ownership.

Moreover, potential homeowners should consider the long-term implications of their investment decisions. As affordability improves through wage growth and competitive market offerings, the future might bring better opportunities for new buyers. Remaining resilient and adaptive in the face of challenges can be key to seizing the right moment when buying a property becomes feasible again.

The Role of Government Support in Housing Affordability

Government initiatives aimed at improving housing affordability play a pivotal role in the current UK property market. Programs designed to assist first-time buyers, such as equity loans and shared ownership schemes, can significantly ease the financial burden of entering the housing market. As house prices continue to rise, the importance of such support mechanisms becomes increasingly pronounced.

Additionally, the government’s ongoing commitment to increasing housing supply through various policies is integral to fostering a more balanced market. With rising average house prices, ensuring that sufficient affordable housing options are available is critical for first-time buyers looking to establish themselves in the market. By leveraging these support structures, buyers can better navigate the challenges of rising property prices and find suitable housing.

Prospective Trends in UK Property Values

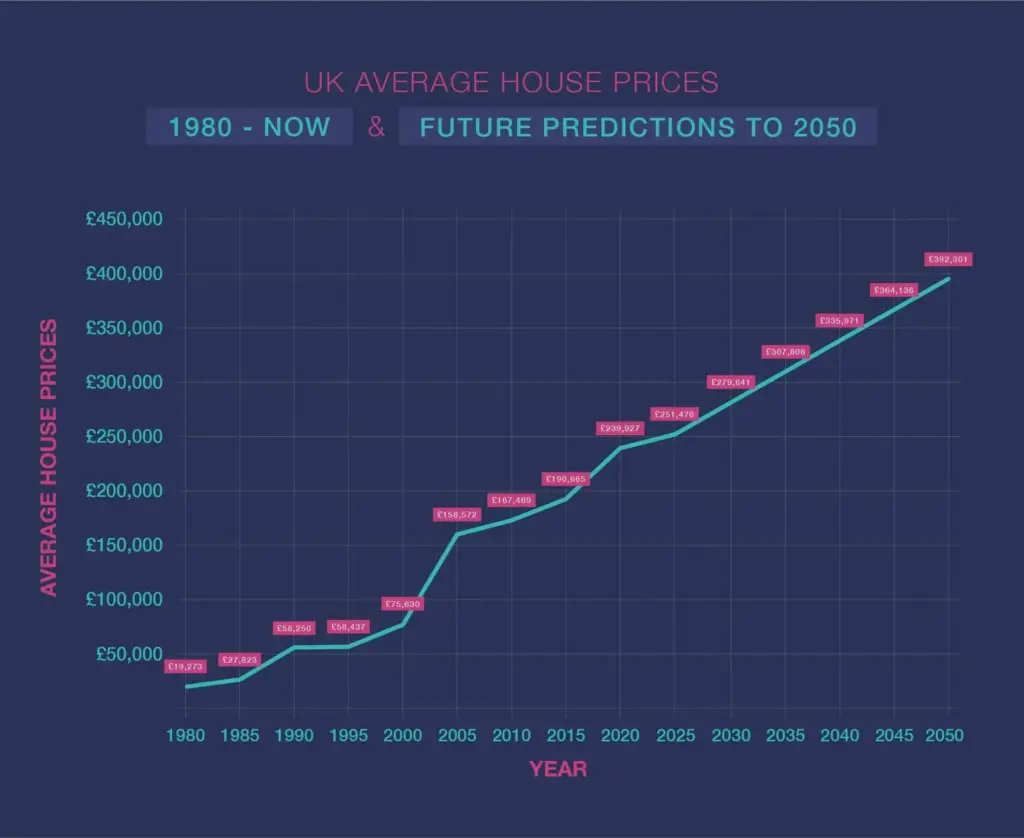

Looking ahead, the trajectory of UK property values remains a topic of great interest among both consumers and investors. The anticipated rise in average house prices by 1% to 3% this year, as predicted by Halifax, could reflect resilience in the market, but it also raises critical questions about future affordability. As economic factors such as inflation and interest rates continue to evolve, the implications for property values could be significant.

Buyers need to remain informed about potential trends in the UK housing market, particularly as they anticipate how changes may affect property values in their desired regions. Engaging with financial advisors, leveraging market insights, and staying abreast of economic developments can help potential homeowners make informed decisions tailored to their unique circumstances.

Frequently Asked Questions

What is the average house price in the UK as of January 2023?

As reported by Halifax, the average house price in the UK has reached £300,077 in January 2023, marking the first time it has exceeded £300,000.

How do the latest average house prices affect first-time buyers in the UK?

The rise in average house prices in the UK, surpassing £300,000, poses affordability challenges for first-time buyers who may struggle with higher costs and deposit requirements.

How does the UK housing market impact property affordability?

The UK housing market’s recent surge in average house prices influences property affordability, especially for first-time buyers, despite wage growth helping to mitigate some pressures.

What trends are affecting Halifax house prices in 2023?

Halifax has reported a 0.7% increase in average house prices last month, reversing a decline, and suggests that despite rising prices, improving wage growth may enhance affordability.

Are there any mortgage deals available for first-time buyers in the current housing market?

Yes, lenders are competing for first-time buyers by offering mortgage products with lower deposit requirements, making it easier for them to enter the UK housing market.

What are the predictions for average house prices in the UK for 2023?

Halifax anticipates a modest rise in average house prices of approximately 1% to 3% throughout 2023, depending on various economic conditions and potential changes in interest rates.

How does Halifax’s average house price compare to Nationwide’s report?

Halifax reports an average house price of £300,077, while Nationwide’s recent figures indicate an average of £270,873, reflecting different calculations based on their mortgage lending practices.

What factors are currently influencing the UK housing market?

In the UK housing market, factors such as rising average house prices, inflation trends, and wage growth are influencing property affordability and mortgage rates, creating a complex landscape for buyers.

| Key Point | Details |

|---|---|

| Average House Price | The average house price in the UK has reached £300,077, marking a new high. |

| Impact on First-Time Buyers | First-time buyers are facing challenges due to increased prices and stretched affordability. |

| Wage Growth vs House Price Inflation | Wage growth has outpaced house price inflation since 2022, which might improve affordability moving forward. |

| Mortgage Market Competition | Lenders are offering competitive products with smaller deposits aimed at first-time buyers. |

| Future Trends | Halifax predicts house prices may rise by 1-3% this year, depending on inflation and Bank of England rates. |

| Current Economic Conditions | While mortgage rates have decreased slightly, they remain higher than the past decade, affecting buyer confidence. |

Summary

The average house price in the UK has now exceeded £300,000, a significant milestone that poses challenges for first-time buyers seeking affordable homes. Despite wage growth keeping pace with house prices, the elevated average price may still deter prospective homeowners. The current mortgage landscape shows lenders competing for first-time buyers, making it crucial to explore options available. As the year progresses, a stable yet cautious market is expected, with house prices projected to rise modestly.