Listen to this article

The recent Argentina peso deal has stirred significant discussion, particularly within financial circles. US Treasury Secretary Scott Bessent has hailed the transaction a ‘homerun deal,’ emphasizing the successful intervention that managed to stabilize the Argentina currency exchange during turbulent times. By successfully repurchasing American investments in Argentine pesos, the United States not only protected American taxpayer funds but also solidified political support for President Javier Milei ahead of the crucial midterm elections Argentina faced. Critics, however, highlight the perennial risk associated with investing in a nation marked by financial instability, questioning whether the US currency intervention was a sustainable strategy. As the region navigates its complex economic landscape, the implications of this deal could resonate far beyond immediate financial gains, impacting Argentina’s financial stability in the long run.

In light of recent developments surrounding Argentina’s financial landscape, the latest agreement involving the peso surfaces as a focal point of discussion. This financial maneuver is often viewed as a strategic intervention by US officials aimed at counteracting economic downturns and supporting a key ally in South America. With the US winding down its exposure to Argentine pesos, the debate continues regarding the long-term viability of such fiscal engagements, particularly in the context of upcoming political shifts. As the nation grapples with its economic challenges, the outcome of this currency strategy raises broader questions about financial policy and international relations during uncertain times. Thus, understanding the ramifications of these currency exchanges becomes pivotal for analyzing Argentina’s economic trajectory.

US Treasury’s Role in the Argentina Peso Deal

The intervention by the US Treasury in Argentina’s currency crisis is a pivotal event not just for the South American nation but also for the broader context of international finance. Treasury Secretary Scott Bessent labeled the deal with Argentina’s peso a ‘homerun deal,’ which signifies a strategic maneuver aimed at stabilizing the currency and reassuring investors. This move, while controversial, exemplifies how US currency intervention can serve as a stabilizing factor in countries facing financial turmoil. The support provided by the US was intended to prevent a further downward spiral in the Argentine economy, which has historically struggled with volatility and inflation.

In securing this deal, the US has effectively utilized its influence to bolster a friendly regime in Argentina, governed by President Javier Milei. As the nation prepared for its midterm elections, the US intervention became crucial in not only stabilizing the peso but also in maintaining Milei’s political power—aligned with US interests. This situation highlights a broader trend in which nations with significant assets like the US can leverage their financial capabilities to influence political outcomes abroad, raising questions about the ethical implications of such interventions, especially when taxpayer money is involved.

The Impact of Currency Exchange on Argentina’s Economy

When the US engaged in the currency exchange with Argentina, it was not just a matter of buying and selling pesos; it represented a deeper reliance on stable financial practices to sustain growth. The Argentine currency exchange has fluctuated dramatically, particularly as political instability and economic anxiety loom over its landscape. The US intervention aimed to halt the rapid devaluation of the peso, showcasing how strategic financial support can mitigate immediate crises. However, the long-term implications of this exchange remain to be seen, especially considering the resilience of Argentina’s economy and the historical patterns of financial instability.

As the Argentine economy begins to stabilize with the peso gaining ground post-intervention, the government must focus on rebuilding its financial reserves. The reliance on US support, as emphasized by financial analysts, risks creating a complacent attitude that may delay crucial reforms needed for sustainable growth. Countries like Argentina, with a history of economic challenges, must recognize that while US currency interventions can provide short-term relief, they should aim for long-term strategies to avoid debilitating dependencies on foreign financial aid.

Political Implications of US Support in Argentina

The political ramifications of the US’s financial support in Argentina extend well beyond simple economics. Secretary Bessent’s declaration of a ‘homerun deal’ encapsulates a deeper ideological commitment from the US to ensure its allies thrive, particularly leading up to crucial events like the midterm elections. Bessent’s backing of President Milei not only aimed to stabilize the economy but also showcased a willingness to support political allies in critical moments. This push reflects a strategic alignment of interests, where both nations stand to gain: Argentina through financial stability and the US through maintaining its influence and power in the region.

However, this alliance is not without criticism. Opposition voices highlight the risk of misusing taxpayer dollars in another country with persistent economic woes. As Democrats raised concerns, the fine line between financial support and political maneuvering became apparent. It underscores a geopolitical strategy where economic gestures are intertwined with political favoritism, raising questions about the ethicality of such interventions and their potential to influence domestic politics in both nations.

Challenges Facing Argentina’s Economic Stability

Despite the apparent success of the US bailout for Argentina’s peso, long-term economic stability remains fraught with challenges. The reliance on foreign monetary support can lead to short-sighted financial planning, where governments might hesitate to make the necessary reforms to bolster their economies. As Bessent highlighted, ‘getting your money back is a straightforward definition of success,’ but the reality may be less optimistic considering Argentina’s history of economic mismanagement. Analysts express concern about Argentina’s ability to maintain currency stability post-intervention and whether the government can effectively manage its economic agenda amid external pressures.

Additionally, indications of a problematic reliance on US Treasury interventions suggest a potential risk for future economic crises. With the central bank’s struggles to rebuild reserves and the fluctuating performance of the peso, Argentina faces the arduous task of navigating its complex economic landscape. The challenge lies in translating short-term successes into a coherent long-term strategy, thereby avoiding the pitfalls of prior economic initiatives that have historically stymied growth.

US Treasury and Argentina’s IMF Support

The collaboration between the US Treasury and Argentina involves not only direct financial support but also the assistance linked to the International Monetary Fund (IMF). Recent reports indicate the US provided $872 million in support involving reserves managed by the IMF, which is crucial for Argentina as it navigates its financial recovery. This multi-faceted approach illustrates the interconnectedness of economic strategies between nations, especially for those like Argentina that require substantial backing to stabilize their financial systems. Such partnerships underscore the importance of international support in preserving financial stability, which in turn has significant implications for political relations.

Furthermore, the US’s involvement with the IMF highlights a critical balancing act in international finance. While immediate cash influxes can provide stability, the sustainability of that support is dependent on Argentina’s willingness to undertake necessary reforms. The dependence on external financial resources speaks volumes about the underlying issues within the Argentine economy, including governance and fiscal responsibility. Moving forward, the relationship between the US Treasury, Argentina, and the IMF will play a crucial role in determining the nation’s economic trajectory and overall stability in the coming years.

The Future of the Argentina Peso

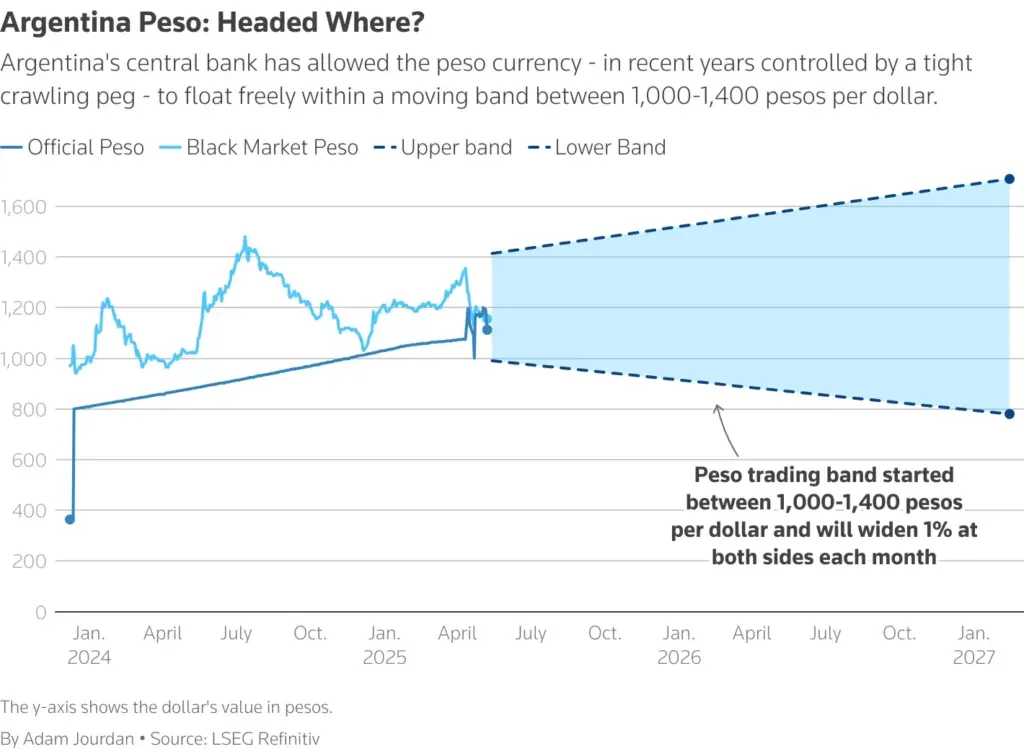

As the Argentina peso fluctuates amidst the effects of recent US interventions, the future of the currency remains uncertain. While immediate gains may have been achieved, currency stability is often a reflection of broader economic confidence and political stability within the country. Observers are keenly watching how Argentina will manage its monetary policy in the wake of these interventions and the extent to which it can fortify its economic structures. The government’s response to the lingering impacts of US support may dictate whether the peso can maintain a resilient foothold in the international markets.

Moreover, the success of the peso in the future will depend profoundly on domestic economic reforms and a departure from reliance on foreign interventions. Addressing ongoing inflation and creating a robust economic strategy that prioritizes sustainability will be critical. As Argentina navigates these challenges, the interplay of domestic policy decisions and international financial partnerships will remain crucial determinants in the quest for a stable and flourishing economy.

US Financial Strategy and Argentina’s Political Landscape

The US financial strategy regarding Argentina signals a deliberate attempt to influence the political landscape of an ally amidst crucial electoral periods. As seen in the recent US interventions, the drive for stability not only showcases economic priorities but also reflects the intentions behind them—the preservation of friendly governance in foreign nations and the promotion of geopolitical stability. Leaders like Milei must now navigate the complexities of governing while being acutely aware of the external influences at play. The alliance may yield benefits but also brings the risk of increased scrutiny and dependence on foreign powers.

In the face of upcoming elections, these interventions complicate national discourse on sovereignty and financial independence. Critics argue that heavy reliance on US support could undermine Argentina’s ability to govern independently and to respond proactively to its citizens’ economic needs. As political agendas clash with economic realities, the true test for Milei’s administration will revolve around leveraging US support while ensuring Argentina’s long-term fiscal autonomy.

The Role of Elections in Argentina’s Financial Decisions

The timing of the US’s intervention in Argentina’s finances closely correlates with the urgency created by impending national elections. The necessity of financial stability in the lead-up to the midterm elections illustrated the intertwining of fiscal policy and political strategy. For President Milei, navigating these electoral waters while maintaining economic confidence became essential, as the health of the economy often directly influences electoral success. The US, recognizing the susceptibility of Argentina’s currency to political shifts, stepped in to stabilize the situation, reflecting how financial actions are often weighted by political motives.

Looking ahead, the outcomes of future elections will significantly shape Argentina’s economic policies. If Milei’s party remains in power and continues to align closely with US interests, it may lead to further interventions and financial partnerships. Conversely, a shift in the political landscape could complicate international relations, influencing how attractive Argentina is for foreign investment and financial support. Ultimately, the synergy between political stability and financial soundness will dictate Argentina’s trajectory, illustrating the inseparable nature of economics and democracy.

Sustainable Solutions for Argentina’s Economic Crisis

Amidst the flurry of US interventions and currency stabilization efforts in Argentina, there lies an urgent need for sustainable solutions to the underlying economic crisis. Despite short-term financial boosts, the Argentine government must prioritize long-term structural reforms in its economy to avoid future crises. Reliance on foreign payments, including those from the US and the IMF, can only take the nation so far; robust policies addressing inflation, debt, and trade deficits are essential for lasting change.

To cultivate a more resilient economy, Argentina must also leverage its strengths, including natural resources and agricultural potential, to position itself competitively in global markets. Strengthening investor confidence through transparency and accountability will attract foreign capital, reducing dependence on external aid. Encompassing both fiscal prudence and strategic partnerships will allow Argentina to forge a path towards lasting stability and prosperity, moving beyond mere survival to economic rejuvenation.

Frequently Asked Questions

What is the significance of the Argentina peso deal for US currency intervention?

The Argentina peso deal signifies a critical US currency intervention where the Treasury Department, led by Secretary Scott Bessent, supported the Argentine peso to stabilize its economy. This intervention aimed to prevent further decline of the currency amidst election uncertainty and has reportedly led to profits for the US, demonstrating a successful strategic alliance in financial stabilization.

How did the Argentina peso deal impact Argentina’s financial stability?

The Argentina peso deal positively impacted Argentina’s financial stability by halting the dramatic fall of the peso through US intervention and support. This initial stabilizing effort provided crucial backing to Argentina’s central bank and facilitated a swap line, thereby fostering an environment conducive to maintaining economic stability during political shifts.

Who is US Treasury Secretary Scott Bessent and how does he relate to the Argentina peso deal?

US Treasury Secretary Scott Bessent is pivotal in the Argentina peso deal, where he orchestrated the US government’s intervention to purchase Argentine pesos. His actions were aimed at stabilizing the currency and supporting President Javier Milei’s government amid political pressures, which he described as an ‘America First homerun deal’ that ultimately yielded profit for American taxpayers.

What were the criticisms surrounding the US intervention in the Argentina peso deal?

Critics, predominantly from the Democratic Party, accused Secretary Bessent of risking taxpayer money on an unstable financial venture. They raised concerns about the historical volatility of Argentina’s economy, questioning the long-term viability of the Argentina peso deal and fearing insufficient precautions were taken in this high-stakes currency intervention.

How did the Argentina midterm elections influence the peso deal?

The Argentina midterm elections significantly influenced the peso deal as political uncertainties led to currency volatility. US intervention came at a time of heightened anxiety regarding President Milei’s party facing potential setbacks in the elections. Post-election results bolstered confidence in the peso, illustrating how political events intertwined with key economic interventions like the currency deal.

What were the financial outcomes of the Argentina peso deal for both the US and Argentina?

The financial outcomes of the Argentina peso deal included the US successfully recovering investments made in Argentine pesos, resulting in tens of millions of dollars in profits. Meanwhile, Argentina benefited from the US support that helped stabilize its currency, although economists also caution about ongoing economic challenges that the country still faces despite this short-term success.

| Key Point | Description |

|---|---|

| US Treasury’s Investment | The US invested in the Argentine peso to stabilize its currency and support President Javier Milei. |

| Claim of Success | Treasury Secretary Scott Bessent proclaimed the investment a ‘homerun deal’, indicating successful financial recovery. |

| Criticism and Controversy | The move faced backlash from Democrats who questioned the risk to taxpayer money due to Argentina’s financial instability. |

| Financial Outcome | The US was able to recover its investment with tens of millions in profit, though the long-term success is questioned. |

| Impact on Argentina | The intervention helped stabilize the peso temporarily but raised concerns about Argentina’s reliance on US support. |

Summary

The Argentina peso deal has emerged as a pivotal point in US-Argentina relations, showcasing the complexities of international financial aid and intervention. By investing in Argentina’s currency, the US aimed to foster stability and support a key political ally, yet this has sparked significant debate about the long-term health of the Argentine economy. Ultimately, while the immediate results may be positive, the ongoing challenges facing Argentina imply that the sustainability of such financial maneuvers remains in question.