Listen to this article

The landscape of UK cryptocurrency tax regulations has undergone significant transformations, particularly since January 1, when new mandates require crypto users to disclose their account details to tax authorities. This pivotal move by HMRC aims to clamp down on unpaid cryptocurrency taxes, including capital gains tax that arises from trading virtual assets like Bitcoin. With an anticipated collection of over £300 million in unpaid taxes, the new framework increases scrutiny on crypto transactions, highlighting the pressing need for compliance among investors. As the cryptocurrency market continues to evolve, understanding the implications of cryptocurrency taxes in the UK is critical for all crypto users, especially as contenders in the sector seek to adhere to HMRC tax rules cryptocurrency and navigate their Bitcoin tax obligations. With crypto taxes in 2024 on the horizon, individuals must stay informed about the forthcoming financial regulations surrounding cryptocurrency to avoid penalties and ensure rightful reporting of their gains.

As the digital currency market expands, the compliance requirements for investors in the UK have also become more stringent, focusing on tax obligations linked to virtual assets. This ensures that individuals engaging in crypto trading remain compliant with established financial regulations related to cryptocurrency, with a particular emphasis on accurate reporting of gains from their investments. The recent initiatives introduced by HMRC not only aim to gather critical information from users of cryptocurrency exchanges but also reflect a broader trend toward tightening regulations in the sector. By addressing previous challenges in collecting revenue from capital gains on digital currencies, these updates present a noteworthy shift in how crypto taxes are approached in the UK. As such, investors need to familiarize themselves with these updates to properly manage their financial responsibilities in the realm of cryptocurrency.

Understanding UK Cryptocurrency Tax Regulations

The recent updates in UK cryptocurrency tax regulations have brought significant changes for crypto investors. Following the directive from HMRC, individuals purchasing cryptocurrency must now disclose their account details to ensure compliance with the current tax laws. This includes obligations to report any capital gains arising from the buying and selling of cryptocurrencies. Non-compliance can lead to severe penalties, illustrating the UK’s stringent stance on cryptocurrency taxes.

In light of the evolving financial regulations, it’s essential for UK residents involved in cryptocurrency trading to stay informed about their tax responsibilities. With the collection of tax information now being automated through cryptocurrency exchanges, users should expect increased scrutiny. The implementation of these regulations aims not only to recover unpaid taxes but also to deter activities such as tax evasion among crypto investors.

Frequently Asked Questions

What are the new HMRC tax rules for cryptocurrency in the UK?

The new HMRC tax rules for cryptocurrency in the UK require crypto users to provide their account details to tax authorities. This initiative aims to ensure compliance with tax obligations, including capital gains tax on profits from cryptocurrency trades.

How will cryptocurrency taxes in the UK affect Bitcoin investors?

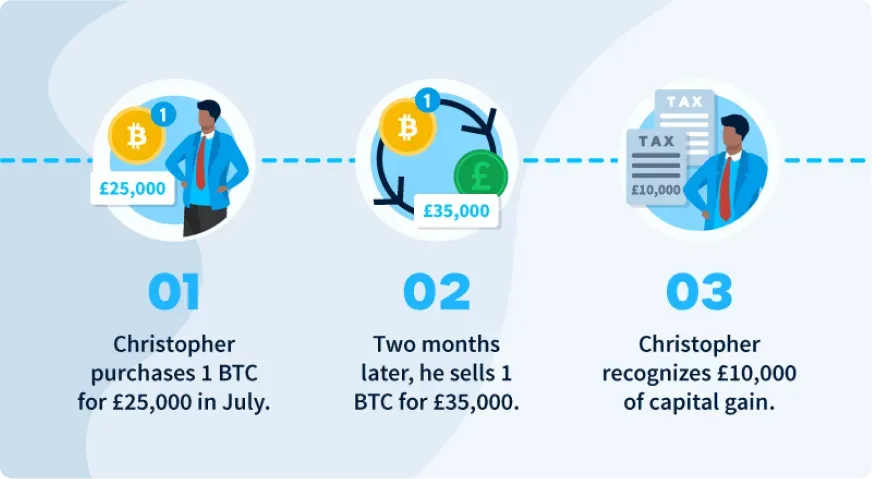

Cryptocurrency taxes in the UK, specifically the capital gains tax, require Bitcoin investors who have made profits to report these earnings to HMRC. Failing to declare such gains could result in penalties, making it crucial for investors to understand their tax obligations.

What is the deadline for filing cryptocurrency taxes in the UK for 2024?

The deadline for filing cryptocurrency taxes in the UK for the 2024-25 financial year is January 31, 2025. Taxpayers must use the new section in the self-assessment form dedicated to reporting gains from cryptocurrency transactions.

What penalties exist for not complying with cryptocurrency tax regulations in the UK?

Under the new UK cryptocurrency tax regulations, penalties may be imposed on users who fail to provide accurate account details or who do not report their earnings from cryptocurrency transactions, as enforced by HMRC.

How can crypto users in the UK rectify unpaid taxes from previous years?

HMRC offers a disclosure facility for crypto users in the UK to voluntarily report any undeclared gains and unpaid taxes before April 2024, allowing taxpayers to rectify their tax situations without facing penalties.

What is the Cryptoasset Reporting Framework (CARF) relevant to cryptocurrency taxes in the UK?

The Cryptoasset Reporting Framework (CARF) is a set of regulations being implemented across countries, including the UK, to enhance international cooperation among tax authorities. It mandates cryptocurrency exchanges to share user transaction data with HMRC to ensure compliance with cryptocurrency tax regulations.

What role does the Financial Conduct Authority play in UK cryptocurrency regulations?

The Financial Conduct Authority (FCA) is conducting a public consultation to establish new regulations for the cryptocurrency sector in the UK. This includes standards for crypto exchanges and measures aimed at protecting consumers while fostering innovation within the market.

How do UK cryptocurrency tax regulations affect international users?

UK cryptocurrency tax regulations may affect international users who trade on UK exchanges, as these users are still subject to reporting requirements imposed by HMRC. This could facilitate greater compliance across borders as international cooperation through frameworks like CARF unfolds.

What are the tax implications for NFT transactions under UK cryptocurrency tax regulations?

Under UK cryptocurrency tax regulations, profits made from the buying and selling of Non-Fungible Tokens (NFTs) are subject to capital gains tax. NFT creators and investors should be aware of their tax obligations related to these digital assets.

What resources are available for understanding cryptocurrency tax obligations in the UK?

Individuals seeking to understand their cryptocurrency tax obligations in the UK can refer to HMRC’s official guidance, consultation documents from the FCA, and professional tax advisory services that specialize in crypto taxation.

| Key Point | Details |

|---|---|

| Account Details Requirement | Crypto users in the UK must share their account details with tax officials to avoid penalties, effective from January 1. |

| Aim of Regulations | To ensure all relevant taxes on buying and selling cryptocurrencies are paid, including capital gains tax. |

| HMRC’s Information Collection | HMRC will automatically collect information from cryptocurrency exchanges to recover unpaid taxes. |

| Impact on Bitcoin Investors | Investors who sold Bitcoin at higher prices must pay taxes, with challenges in previous collections. |

| Cryptoasset Reporting Framework (CARF) | These regulations aim for international cooperation in tax reporting among various countries. |

| Tax Generation Estimate | HMRC anticipates generating at least £300 million through the new rules over the next five years. |

| Filing Tax Returns | Taxpayers with realized gains must file by January 31 using a new section in the self-assessment form. |

| Public Consultation | The Financial Conduct Authority is consulting on new regulations for cryptocurrencies until February 12. |

Summary

UK cryptocurrency tax regulations now necessitate that users disclose their account details to tax authorities, aiming to ensure compliance and collect unpaid taxes on digital assets. With these changes effective from January 1, investors face new obligations, impacting how they manage their cryptocurrency investments. The HMRC’s initiative to recover millions in taxes is complemented by ongoing consultations regarding further regulations, thus shaping a more structured landscape for cryptocurrency trading in the UK.