Listen to this article

When examining the average pocket money for children in London, the figures reveal an intriguing landscape that significantly differs from national trends. In 2025, children in London received an average of £10.31 per week, a decline from the previous year’s £12.80. This shift in average pocket money highlights the unique financial conditions of the metropolis compared to other regions in the UK, where average amounts are often higher. Furthermore, insights from the **GoHenry survey on pocket money** support changing economic dynamics, showing children’s pocket money trends have been influenced by factors such as inflation and parenting styles. As children navigate these changes, understanding **UK pocket money statistics**—like the disparity between boys and girls—becomes crucial for parents aiming to manage finances effectively.

In the bustling city of London, the financial landscape for youngsters, particularly regarding their weekly allowances, has undergone notable changes. With discussions revolving around **children’s allowance fluctuations**, current reports indicate that in 2025, children averaged £10.31 in pocket money, marking a noticeable decrease from the prior year. This declining trend contrasts sharply with the **teen pocket money average** observed in other regions, suggesting that children’s financial experiences vary widely across the UK. Moreover, the broader conversations regarding **pocket money 2025** help shed light on how youth are increasingly aware of earning, saving, and spending—even finding joy in completing chores for extra tasks. By exploring these behaviors, families can better understand the significance of financial literacy for their children.

Pocket Money Trends for Kids in 2025

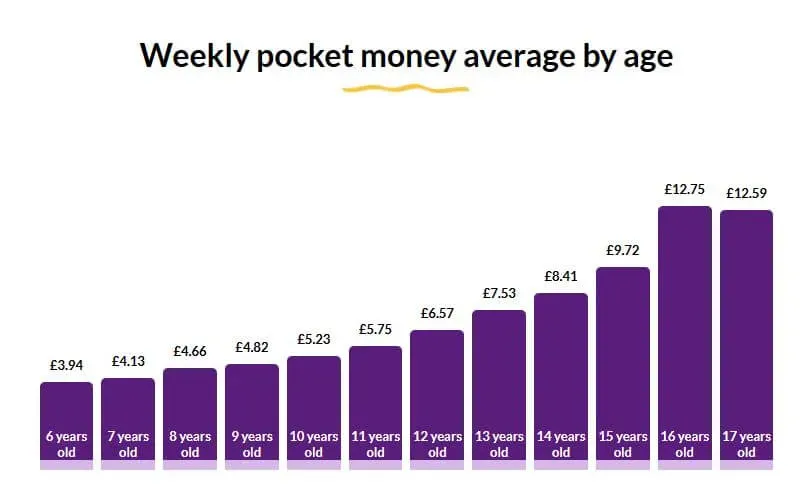

In 2025, the landscape of children’s pocket money has significantly evolved, with an average weekly allowance of £10.73, reflecting an 8% increase from £9.92 in 2024. This rise, influenced by a slowing inflation rate of 3.2% reported by the ONS, indicates a positive trend for young savers. The results from the GoHenry survey on pocket money highlight that children are more financially conscious, with the focus shifting towards understanding the value of money and saving for future goals.

Moreover, the increase in pocket money isn’t uniform across all regions. For instance, while London saw a decrease from £12.80 in 2024 to £10.31 in 2025, this trend contrasts sharply with other areas like the South East, where pocket money surged from £9.87 to £14.30. This indicates that regional differences play a significant role in the financial habits of children, contributing to the continued discourse around UK pocket money statistics.

How Does London’s Pocket Money Compare to the Rest of the UK?

When looking at the average pocket money for children in London, it stands out as notably different compared to many other regions across the UK. In 2024, London children averaged £12.80 per week, but this figure dropped to £10.31 in 2025, suggesting a significant shift in allowance trends. This decline has raised questions about the spending power of children in the capital, particularly considering the economic climate and rising costs of living.

Contrarily, the South East reported a dramatic increase in weekly allowances, reaching £14.30 by 2025. This disparity highlights how children in London might have to manage their finances differently, potentially influencing their choices about spending and saving. It also underscores a broader national conversation about children’s pocket money trends and what influences the variations we see between regions.

Factors Influencing Children’s Pocket Money in 2025

A multitude of factors influence how much pocket money children receive, including family income, regional economic conditions, and parental attitudes towards money management. The latest data reveals that factors such as good behavior and completing household chores are leading to higher allowances. GoHenry’s analysis of average weekly task payouts showcases how children are rewarded for responsibility, with looking after plants earning the highest average payout of £1.91.

Moreover, the research indicates that children’s perception of money is evolving, as they learn to associate their efforts with tangible rewards. The increasing focus on chores, such as pet care and getting ready for school, reinforces positive financial habits at a young age. As kids navigate their finances, they are more inclined towards saving for significant goals, signifying a shift in the narrative surrounding pocket money.

Gender Disparities in Pocket Money Across the UK

Interestingly, 2025 data from the GoHenry survey shows that there is a slight gender disparity in the amount of pocket money children receive. Girls, on average, receive £10.81 per week, while boys receive £10.63. This small difference raises questions about the factors that may contribute to these variations, including societal expectations and parental differences in spending habits.

Understanding these gender disparities can help parents make informed decisions on how to approach their children’s allowances. By recognizing the differences, families can encourage equal financial literacy and responsibility among both genders, ensuring that lessons learned about money management are applied equally, thereby fostering an environment of fairness and equity.

The Impact of Inflation on Kids’ Pocket Money

Inflation plays a critical role in determining the amount of pocket money that children receive each year. In 2025, the average weekly allowance experienced an upward trend despite the broader economic challenges faced in the UK. With CPI inflation having slowed to 3.2%, this meant families had some leeway to increase pocket money, countering the rising costs of living for parents.

As children receive a boost in pocket money, it becomes essential to teach them about managing finances in an inflationary environment. Educating kids on the implications of inflation can help them understand the value of saving and the need for budgeting. Hence, families are not just giving allowances; they are imparting crucial financial wisdom to the next generation.

Children’s Spending Habits and Choices

The types of purchases children make with their pocket money reveal evolving spending habits. In 2025, food stores and supermarkets ranked as the most popular places for children to spend their money, indicating a trend towards practical spending. This could reflect a desire for independence in choosing their snacks and treats, as parents enable children to exercise their financial agency.

Additionally, children’s common savings goals—ranging from electronics to holidays—show a shift towards valuing experiences and material goods. Encouraging children to set savings targets can foster a sense of responsibility, guiding them toward making wise financial decisions. By teaching children the significance of saving for what they truly desire, parents can nurture healthy financial habits early on.

The Role of Parental Contributions to Savings

Parental contributions to children’s savings accounts, such as GoHenry Junior ISAs, significantly impact kids’ financial growth. In 2025, averages showed that boys received slightly more at £28.56 per month compared to girls at £27.85. Notably, contributions varied widely by region, with the South East seeing higher contributions averaging £39 per month versus just £20.67 in Wales.

These contributions, paired with children’s own savings habits, can create a robust foundation for future financial independence. Parents can play an essential role by encouraging kids to save, potentially matching their savings to reinforce the value of financial education. Such strategies not only promote the habit of saving but also foster a sense of community within families as they work together toward common financial goals.

Financial Literacy Among Young Savers

Financial literacy is becoming increasingly essential for young savers, especially in a world where they often have to navigate complex spending environments from a young age. In 2025, GoHenry reported a total of £88,000 in donations made by young savers to organizations like NSPCC, indicating a growing sense of social responsibility among children. This reflects how children’s pocket money management goes beyond personal gain and towards community contributions.

Teaching children financial literacy equips them with the skills needed to make informed decisions about money, from budgeting to understanding investment options. With the right guidance, today’s youth can develop habits that not only enhance their personal financial situations but also encourage a broader sense of societal contribution.

Celebrating Good Behavior with Financial Rewards

In 2025, the correlation between good behavior and financial rewards became tangible as children learned the benefits of earning through task completion. The top-earning chore—plant care—averaging £1.91, showcased how children are rewarded for being responsible and proactive in their homes. This approach not only incentivizes good behavior but also teaches children the value of hard work in financial terms.

By integrating chores with their pocket money, parents can cultivate key life skills in their children, fostering an early understanding of earning and responsibility. When children can connect positive actions with financial gain, it lays the groundwork for a lifelong appreciation of honest work and financial management.

Frequently Asked Questions

What is the average pocket money for children in London in 2025?

In 2025, the average pocket money for children in London is £10.31 per week. This marks a decrease from £12.80 in 2024, highlighting the differences in pocket money trends within the UK.

How does London’s average pocket money compare to other regions in the UK?

Children in London received an average of £10.31 in pocket money per week in 2025, which is significantly lower than the average in the South East at £14.30. This illustrates a notable disparity in the average pocket money amounts across different regions in the UK.

What are the key factors influencing children’s pocket money trends in the UK?

Children’s pocket money trends in the UK, including those in London, are influenced by economic factors such as inflation rates, as demonstrated by the Consumer Prices Index (CPI). The GoHenry survey on pocket money also reveals that parental contributions to children’s finances and regional economic conditions play significant roles.

How much pocket money do teenage children receive on average in London?

For teenagers, the average pocket money varies by age. In 2025, fifteen-year-olds in London receive an average of £18.18 per week, while sixteen-year-olds average £19.67. This differs from the overall lower averages seen in younger children.

What chores earn children pocket money in London?

In London, children can earn pocket money through various chores. The top earning task in 2025, according to GoHenry, is plant care, which pays £1.91. Other common tasks include being tidy (£1.12) and helping around the house (£1.18), contributing to children’s understanding of earning and managing money.

How is the average pocket money for children in London trending over the years?

The average pocket money for children in London has seen a decline from £12.80 in 2024 to £10.31 in 2025. This contrasts with increases in other regions, indicating that London’s children’s pocket money trends may be unique in the UK’s broader context.

What do children in London typically save their pocket money for?

Children in London often save their pocket money for various goals, with holidays being the most common. Electronics and birthday gifts follow, reflecting common interests and aspirations among children when managing their pocket money.

How much more pocket money do girls receive compared to boys in London?

In 2025, girls in London receive slightly more pocket money than boys. Girls average £10.81 per week, while boys average £10.63, showcasing a minor gender difference in children’s pocket money trends.

| Age | 2024 Average Weekly Pocket Money (£) | 2025 Average Weekly Pocket Money (£) |

|---|---|---|

| Six | 3.69 | 4.05 |

| Seven | 3.82 | 4.25 |

| Eight | 4.14 | 4.58 |

| Nine | 4.71 | 5.14 |

| Ten | 5.62 | 6.02 |

| Eleven | 7.36 | 7.83 |

| Twelve | 9.71 | 10.42 |

| Thirteen | 12.31 | 13.36 |

| Fourteen | 14.57 | 15.84 |

| Fifteen | 16.98 | 18.18 |

| Sixteen | 17.89 | 19.67 |

| Seventeen | 17.13 | 18.74 |

| Eighteen | 14.52 | 16.60 |

Summary

The average pocket money for children in London is notably lower this year at £10.31, a decline from the £12.80 received in 2024. This trend is quite striking compared to increases in other regions, where the South East saw a significant rise in average pocket money to £14.30. Despite this decrease, children are increasingly earning money through chores and understanding the value of saving and philanthropy, showcasing a shift towards more responsible financial habits. Overall, while the average pocket money for children in London has decreased, it reflects broader economic trends and changing attitudes towards financial literacy.