Listen to this article

The recent announcement regarding the contactless card limit is set to revolutionize the way consumers handle payments, granting flexibility previously unseen. As of March, banks and card providers will gain the authority to establish their own card payment limits, potentially removing the £100 ceiling that has been in place since October 2021. This change comes amid increasing consumer reliance on contactless payments, which allow for quick and convenient transactions without needing to input a PIN. However, the Financial Conduct Authority (FCA) encourages financial institutions to prioritize user control, enabling individuals to set their own limits or disable contactless payment options entirely. While many welcome the innovation, experts caution about the implications of unrestricted spending, urging a balance between convenience and security in the age of modern mobile payments.

In the evolving landscape of digital transactions, the lifting of the contactless card limit opens up discussions about flexible payment options and consumer empowerment. This change could lead to significant transformations in how people make payments, as individuals might now dictate their personal card payment thresholds with unprecedented freedom. The Financial Conduct Authority’s guidelines will play a pivotal role in shaping these new policies, ensuring that banks are equipped to manage both risks and customer preferences effectively. As we delve deeper into the implications of these adjustments, it’s essential to consider how such advancements can enhance user experience while safeguarding against potential financial pitfalls that unlimited payment capabilities might introduce.

Understanding the New Contactless Card Limit Regulations

The recent announcement letting banks set custom contactless card payment limits has sparked significant discussion among consumers and financial institutions alike. As the Financial Conduct Authority (FCA) prepares to implement new regulations, from March onwards, customers may have the chance to have no limit at all on their contactless purchases. This flexibility could allow individuals to tailor their spending according to their lifestyle but raises important questions about consumer behavior and financial safety.

As we delve deeper into the implications of lifting the £100 contactless card limit, it’s crucial to understand the wider context of this decision. Contactless payments have surged in popularity due to their convenience, especially in today’s fast-paced world. The FCA aims to balance this growing preference for card payments with the necessary protections against fraud, ensuring that both consumers and companies can adapt to a digital-first economy.

The Impact of Contactless Payments on Consumer Spending Habits

With the potential for unlimited contactless payment limits, many fear a shift in consumer behavior. Studies indicate that the ease of tapping a card may lead to impulsive buying, where shoppers spend beyond their means without a second thought. This could be particularly concerning with credit cards, where borrowers accumulate debt faster without the pause of entering a PIN. In contrast, traditional payment methods often require more reflection before spending.

Concerns about financial management extend beyond personal spending habits. Various consumer advocates highlight that unlimited contactless capabilities could pave the way for financial abuse, allowing malicious individuals to exploit vulnerable partners. Financial conduct organizations stress the need for strong regulations to safeguard against such abuses, while urging financial literacy and caution among consumers.

FCA’s Role in Regulating Contactless Payment Changes

The Financial Conduct Authority (FCA) has a critical role in maintaining the balance between convenience and security in the evolving landscape of contactless payments. By granting banks the ability to establish their own card payment limits, the FCA aims to encourage innovation and adaptability in the payment industry. While this move could benefit customers by offering personalized limits, the FCA’s responsibility also includes protecting consumers from potential risks associated with increased spending flexibility.

The journey from a modest £10 limit in 2007 to the present £100 is a testament to the growing acceptance and reliance on contactless transactions. The FCA’s study reveals a mixed sentiment among the public, with many preferring to maintain the current limits despite the regulatory changes. This highlights the need for ongoing dialogue between financial institutions and consumers to ensure that any modifications to contactless payment policies serve the best interest of all parties.

Balancing Convenience and Security in Mobile Payments

As mobile payment technologies continue to advance, the lines between convenience and security are increasingly blurred. While the ability to make purchases without a PIN can simplify transactions, it also raises concerns about fraud and unauthorized access. Mobile wallets, which often utilize biometrics like thumbprints and facial recognition, are seen as a solution to these issues but are not foolproof. Consumers must remain informed about the potential risks, ensuring they take steps to protect their financial information.

In a world where immediate gratification often drives spending, the security features embedded in mobile payment systems become paramount. By enabling users to set their limits, the financial industry not only promotes safer spending habits but also aligns with the broader trends of personal finance management. Educating users on how to leverage these technologies responsibly will be critical as contactless payment etiquette evolves.

Consumer Sentiment Towards Contactless Payment Changes

Despite the benefits of increased flexibility, recent surveys indicate that a substantial majority of consumers are hesitant to embrace changes to contactless card limits. The FCA’s findings show that 78% of respondents are content with the current £100 transaction cap, reflecting a widespread reluctance to adopt a model that may encourage overspending or financial irresponsibility. This sentiment suggests that while convenience is king, many users prioritize security and controlled spending.

Understanding consumer sentiment is vital as banks and financial institutions navigate the potential changes ahead. Listening to the concerns raised by users will be essential in crafting policies that enhance customer trust and satisfaction. The ongoing discourse regarding the implications of higher card payment limits highlights the complexity of adapting to modern payment preferences while maintaining essential financial safeguards.

Diverse Perspectives on Contactless Spending Limits

The conversation surrounding contactless spending limits is multifaceted, drawing input from various stakeholders including banks, consumer advocacy groups, and the general public. Some banks, capitalizing on the new regulatory flexibility, are eager to provide customers with the option to set their limits, reflecting a shift towards catering to individual preferences. Meanwhile, advocates emphasize the need for financial education and awareness regarding the risks of unchecked spending.

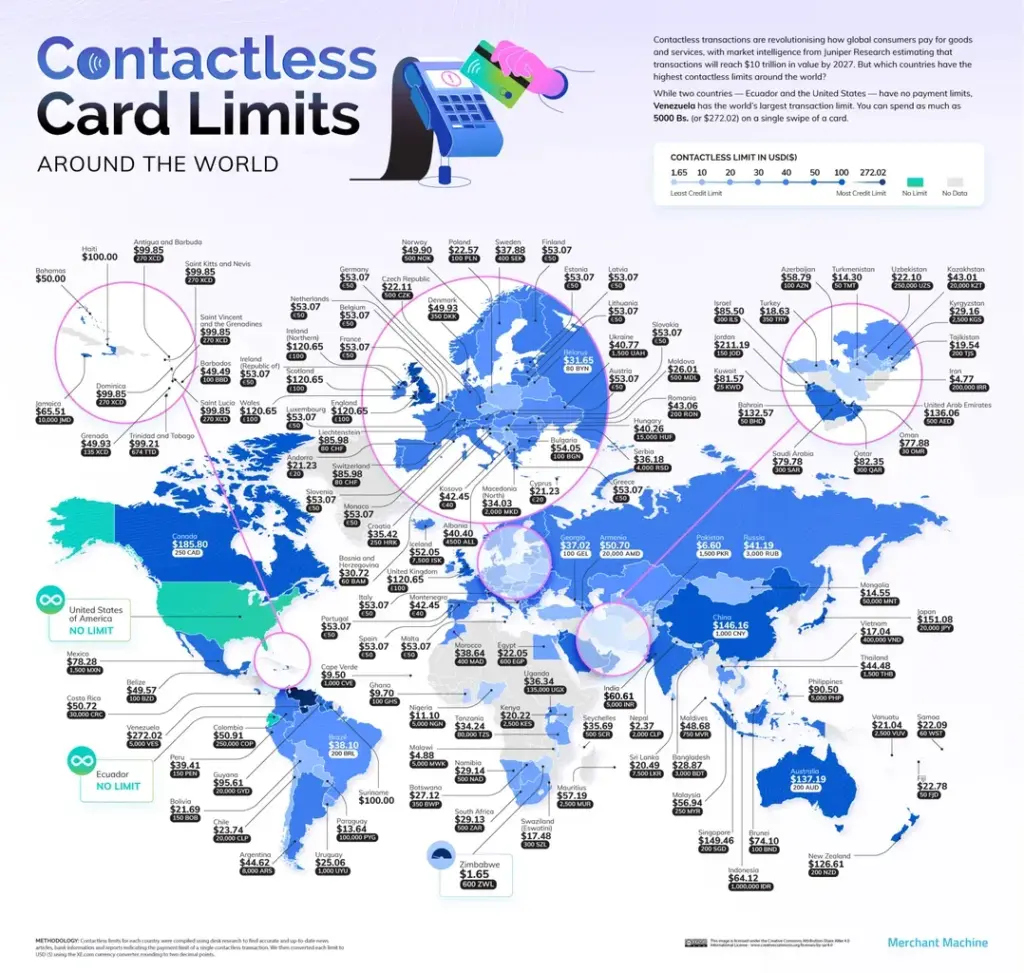

As different countries have adopted varying approaches to contactless payment limits, the UK is at a crossroads. Observations from places like Canada and New Zealand paint a picture of how increased limits can be managed effectively with strong security measures in place. Encouragingly, the FCA is urging UK banks to tread carefully as they consider adapting their limits, ensuring any changes are backed by robust fraud prevention strategies.

The Rise of Cashless Transactions: A Double-Edged Sword

The rapid rise of cashless transactions, propelled by contactless payment technology, presents both advantages and disadvantages for consumers. On the one hand, cashless payments are incredibly efficient, streamlining shopping experiences and minimizing the need for physical cash handling. However, the pressure to go entirely cashless raises significant concerns, particularly for those who rely on cash for budgeting or who are vulnerable to financial exploitation.

Financial abuse survivors and advocates argue that unrestricted contactless spending could further jeopardize individuals in precarious situations by giving abusers unfettered access to their finances. Striking a balance between promoting technological advancements in payments and ensuring that vulnerable populations are protected is essential as we navigate this transition towards a predominantly cashless society.

Future Trends in Contactless Payment Technologies

Looking ahead, the landscape of contactless payments is poised for further evolution, driven by advancements in technology and consumer demand. The introduction of customizable limits may herald a new era of convenience, but it underscores the necessity for ongoing vigilance against fraud and misuse. As banks adapt to the FCA’s new guidelines, innovation in security measures such as encryption and biometric verification will likely become more prominent.

We can anticipate a future where payment systems not only evolve to match consumer preferences but also incorporate stringent safeguards. With developments like shared banking hubs aimed at facilitating access to cash, the shift towards digital transactions will continue alongside efforts to ensure that all consumers, especially the vulnerable, are empowered and protected in their financial dealings.

Practical Advice for Consumers Navigating Contactless Payments

As the dynamics of contactless payments change, it’s vital for consumers to remain proactive in managing their finances. This might include understanding how to set personal limits on their contactless card payments if applicable, ensuring they do not overspend impulsively. Financial literacy is key; being aware of spending habits, potential pitfalls of credit use, and the significance of regular financial check-ins can help consumers maintain healthy financial practices in a contactless world.

Furthermore, consumers are encouraged to take full advantage of the security features offered by mobile payment applications. Utilizing methods such as biometric authentication and staying updated on transaction alerts can empower users to safeguard their financial information. In this new payment era, informed consumers will be better equipped to navigate the balance between convenience, security, and responsible spending.

Frequently Asked Questions

What is the current contactless card limit in the UK?

As of now, the contactless card limit in the UK is set at £100. This limit allows consumers to make card payments without the need for entering a PIN, streamlining the checkout process for low-value transactions.

Will the contactless card limit be lifted in the near future?

Yes, banks and card providers will have the flexibility to lift the contactless card limit starting in March. However, the Financial Conduct Authority (FCA) encourages financial institutions to consider customer preferences and security risks when making adjustments.

How can I set my own contactless payment limits?

Under new regulations encouraged by the FCA, many banks will allow cardholders to set their individual contactless payment limits or even disable contactless payments altogether. Check with your bank to see if this feature is available.

Are there concerns about the contactless card limit being increased?

Yes, there are concerns that increasing the contactless card limit could make cards more appealing to thieves and increase the risk of fraud. The FCA has acknowledged these apprehensions and emphasizes strong security protocols to mitigate risks.

How do mobile payments compare to contactless card limits?

Mobile payments do not have the same limits as contactless card payments. Users can make higher-value transactions without a PIN, thanks to security features like fingerprint and face recognition, which some consumers prefer over contactless card payments.

What security measures are in place for contactless payments?

To protect consumers, contactless payments have security features such as PIN prompts after a series of consecutive transactions, as well as fraud protection policies that ensure consumers are reimbursed for unauthorized transactions.

Can consumers still opt for a low contactless payment limit?

Yes, consumers can opt for a lower contactless payment limit or disable contactless functionality entirely if they prefer greater control over their spending, as encouraged by the Financial Conduct Authority.

Will the FCA change the contactless card rules?

While the FCA is providing flexibility to banks regarding contactless card rules, it does not anticipate immediate changes to the current £100 limit, reflecting consumer surveys that indicate low demand for increases.

How does the recent contactless limit impact financial abuse concerns?

The potential for unlimited contactless spending raises concerns among financial abuse charities, as it could offer abusers easier access to a victim’s funds without restrictions. This issue underscores the importance of maintaining a balance between convenience and consumer safety.

What is the history of the contactless card limit in the UK?

The contactless card limit has gradually increased from £10 in 2007 to £100 as of October 2021. This evolution reflects changing consumer behaviors and the growing popularity of contactless payment methods in everyday transactions.

| Key Point | Details |

|---|---|

| Contactless Card Limit Changes | £100 limit can be lifted, giving consumers the option to set their own limits. |

| Regulatory Authority | The Financial Conduct Authority (FCA) will encourage banks to provide flexibility for customers. |

| Historical Limits | The contactless limit rose from £10 in 2007 to £100 in October 2021. |

| Security Concerns | Higher limits may increase risks of fraud and theft; existing security measures are in place. |

| Consumer Sentiment | A survey showed that 78% of respondents prefer the current £100 limit. |

| Vulnerable Groups | Unlimited contactless spending may put vulnerable individuals at risk of financial abuse. |

| Global Context | Other countries allow variable limits for contactless payments, balancing convenience with security. |

Summary

The contactless card limit is set to change, allowing for more personalized payment options. Consumers will soon have the ability to set their own contactless card limit, or even opt for unlimited payments, enhancing convenience in everyday transactions. However, concerns regarding fraud and spending habits persist. As this new policy unfolds, ensuring robust security measures remains crucial while also considering the perspectives of consumers who value their current limits.