Listen to this article

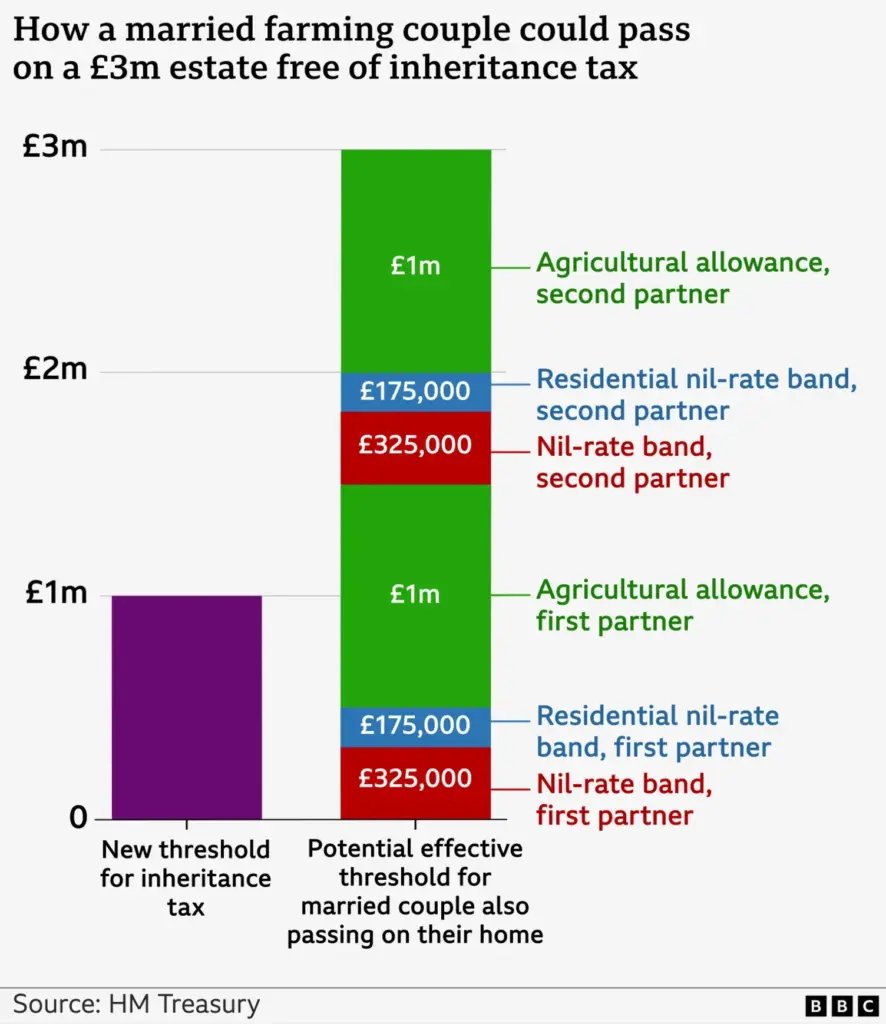

Inheritance tax and farming are emerging as critical topics of concern for the agricultural sector, particularly among farmers who feel increasingly bewildered by the government’s proposed changes. Many individuals within this community are grappling with the implications of the impending 20% tax on farm businesses valued over £1 million, set to take effect in April 2026. This looming financial burden has intensified worries about agriculture profitability issues and the sustainability of their ventures. The independent review of farm profitability brought to light these farmers’ grievances, illustrating the urgent need for government farming reforms to shield their operations from crippling expenses. Encouragingly, the report suggests that sustainable farming incentives could play a pivotal role in securing the farming sector’s future, fostering both productivity and investment in an unpredictable landscape.

When discussing the intersection of agriculture and tax burdens, many farmers are deeply concerned about the repercussions of estate taxes on their livelihoods. The agricultural industry is facing significant profitability challenges, exacerbated by rising costs and unpredictable environmental factors. Given the complexities of transferring farm ownership and maintaining operational viability, alternative financial support mechanisms become increasingly vital. In this context, the implications of tax reform on farming practices, along with sustainable initiatives, cannot be overstated. The call for a more robust partnership between policymakers and the farming community could be the key to overcoming these fiscal hurdles.

Understanding Inheritance Tax Concerns for Farmers

Farmers across the UK are increasingly expressing their bewilderment and fear regarding the impending changes to inheritance tax, particularly as they face significant financial strain from increasing costs and unpredictable weather patterns. The government’s plan to impose a 20% inheritance tax on farm businesses valued over £1 million beginning in April 2026 has raised serious alarms within the agricultural community. According to an independent review of farm profitability, this taxation could significantly hinder farmers’ ability to transfer their businesses to the next generation, amplifying concerns about sustainability and the long-term viability of their operations.

The issue of inheritance tax has emerged as the foremost concern among farmers, according to Baroness Minette Batters. Many believe that a fair system that considers the unique challenges within the agriculture sector is essential. Often these farmers operate on thin profit margins, making them particularly vulnerable to additional tax burdens. Additionally, the continuous rise in costs—expecting to increase by 30% by 2026—further compounds their anxieties. As they grapple with the implications of this tax reform, it becomes clear that urgent dialogue is needed to address these critical issues.

The Impact of Government Farming Reforms on Profitability

As the government contemplates significant changes to farming regulations and policies, the agricultural sector is closely watching how these reforms may impact profitability. The recent report outlining 57 recommendations to enhance farming productivity is a step in the right direction, emphasizing that farmers do not seek state handouts but rather an environment that allows them to thrive. These recommendations include the establishment of a new farming and food partnership board dedicated to driving growth, productivity, and long-term profitability, which could provide the framework for farmers to operate successfully within a challenging economic landscape.

However, the effectiveness of these proposed reforms remains uncertain. Farmers need clarity on how these changes will play out in real terms, particularly concerning sustainable farming incentives and fairness in supply chains. There is a pressing need for immediate actions to support the agricultural sector, including transparency around future sustainable farming incentive schemes. Without addressing fundamental concerns over profitability and operational viability, the farming community risks losing the backbone of British agriculture.

Navigating Agriculture’s Future in the Face of Profitability Challenges

The future of the farming sector in the UK appears precarious, with profitability issues looming large amidst rising operational costs and lack of funding. Farmers are already contending with high input costs driven by inflation and fluctuating market prices, challenging their ability to maintain profitability. The concerns are magnified by fears surrounding extreme weather events and the consequences of post-Brexit agricultural policies, which further complicate planning and investment in the sector.

In this environment of uncertainty, fostering a future-oriented mindset becomes crucial for farmers. Collaboration with government bodies to outline clearer regulations and introduce supportive measures, such as incentivizing sustainable practices and reforming inheritance tax, will be key. As the report suggests, when farming thrives, it sets in motion a positive ripple effect across the rural economy, ensuring food security and responsible environmental stewardship. It is vital for farmers to engage actively in shaping the future of agriculture, pressing for reforms that address their immediate concerns and long-term viability.

The Role of Sustainable Farming Incentives

Sustainable farming incentives are increasingly recognized as essential for the agricultural sector, enabling farmers to adapt to changing environmental regulations and consumer expectations. These incentives provide financial support for farmers who implement practices that promote environmental stewardship, such as reducing carbon footprints and enhancing biodiversity. However, as highlighted in the recent reviews, uncertainties around the future of these incentives, particularly in a post-Brexit landscape, have caused considerable anxiety among farmers. A clear and consistent framework for sustainable incentives is not only necessary for promoting eco-friendly practices but also for ensuring the economic viability of farms.

Farmers are eager to embrace sustainable practices but require assurances from the government about the availability and structure of these incentives. With many farm businesses facing tight financial margins, sustainable farming initiatives must strike a balance between environmental goals and economic realities. The challenge lies in establishing a reliable system that farmers can trust for their long-term planning and investment strategies. Ultimately, meaningful reforms that prioritize sustainability while addressing profitability issues can foster a thriving agricultural sector that benefits both farmers and the broader community.

Ensuring Fairness in the Agricultural Supply Chain

One of the most pressing issues affecting farmer profitability is the fairness of the agricultural supply chain. Many farmers feel they receive inadequate returns for their produce, often struggling against unfavorable pricing while facing escalating production costs. The recent NFU report emphasizes the need for reforms that promote fairness within the supply chain, ensuring that farmers can receive a fair price for their products and ultimately sustain their businesses. Achieving transparency and equitable practices within these transactions is crucial to restoring trust and viability in the farming community.

The call for supply chain fairness extends beyond just pricing; it encompasses access to resources, financing, and market opportunities. Farmers need support navigating complex supply chain dynamics, and government intervention might be necessary to eliminate structural barriers that favor larger corporations at the expense of smaller producers. Through collaborative efforts, stakeholders can work together to promote an agricultural landscape where fairness thrives, enabling farmers to focus on growth and sustainability rather than merely surviving in a challenging economic environment.

Addressing Climate Concerns in Farming Practices

Climate change presents a myriad of challenges to the agricultural sector, including increased frequency of severe weather events that can devastate crops and jeopardize livelihoods. Farmers are at the forefront of these climate concerns, and many are looking for ways to adapt their practices sustainably. The need for innovative farming solutions that mitigate the effects of climate change is more urgent than ever, as weather patterns continue to shift unpredictably. Government partnerships and investment in research for climate-resilient farming methods could lead to more sustainable practices that not only secure food production but also protect the livelihoods of farmers.

By integrating climate-smart agriculture concepts, farmers can enhance their productivity while reducing environmental impacts. This requires significant investment in technology, training, and resources to prepare farms for the changing climate. Ultimately, addressing climate concerns through effective farming practices benefits not just the individual farmer, but also the ecological health of the countryside and the sustainability of food systems. As the agricultural sector advances, tackling climate change collaboratively will pave the way for a more resilient farming future.

Exploring Investment Opportunities in Agriculture

Investment in the agricultural sector can significantly boost productivity and profitability, yet many farmers struggle to access the capital needed for growth. The recent reports highlight the necessity of unlocking investment opportunities that enable farmers to modernize their operations, improve infrastructure, and adopt innovative technologies. This is particularly important for enhancing resilience to ongoing challenges such as climate change and market volatility. Effective government policies and financial incentives can play a crucial role in incentivizing investments that support long-term sustainability within the farming community.

Moreover, the establishment of public-private partnerships could open new avenues for funding, providing farmers with the resources needed to navigate a changing agricultural landscape. Building relationships with financial institutions and investing in agricultural education programs could help equip farmers with the knowledge to leverage different funding opportunities effectively. As investments become more readily available, the potential for improved profitability and growth within the agricultural sector becomes a reality, ensuring a vibrant farming landscape well into the future.

The Future of Farming: Challenges and Solutions

Looking forward, the future of farming in the UK depends on the sector’s ability to address a myriad of challenges, including profitability issues, changing governmental regulations, and climate change implications. Farmers find themselves grappling with all these variables while striving for a sustainable and thriving agricultural environment. The previously mentioned independent review has outlined multiple recommendations, focusing on the necessity of a collaborative approach between the government and farmers to tackle these urgent issues.

Finding effective solutions to these challenges will require innovative thinking and a willingness to adapt. Initiatives aiming to enhance sustainability, improve supply chain fairness, and reform inheritance tax could pave the way for a more resilient agricultural sector. Farmers must remain engaged in discussions about policy changes and continue to advocate for their needs and rights. By embracing a proactive stance towards the challenges ahead, the farming community can work collectively toward securing a successful future.

Long-Term Viability of Farming Businesses

The long-term viability of farming businesses hinges on the ability to adapt to market and environmental changes while ensuring profitability. Farmers are navigating an increasingly complex array of regulations and consumer demands, leading to questions about the sustainability of traditional farming models. Understanding the economic landscape, including factors such as inflation and market trends, is vital for developing strategies that promote both financial and ecological viability.

Furthermore, farmers are increasingly seeking strategies that emphasize diversification and innovation in their business models. Exploring alternative markets, adopting modern technologies, and focusing on sustainable practices can significantly contribute to their long-term success. As the agricultural sector evolves, the emphasis will likely shift towards resilience and adaptability, enabling farmers to not only survive but thrive in a dynamic environment. Addressing these interconnected factors will be crucial in ensuring that farming remains a profitable and sustainable endeavor for future generations.

Frequently Asked Questions

What are farmers’ concerns regarding inheritance tax and its impact on agriculture profitability?

Farmers are increasingly worried about inheritance tax changes that may impose a 20% rate on farm businesses valued over £1 million starting in April 2026. This tax burden could severely affect agricultural profitability, as many farmers face rising costs and low commodity prices, potentially exceeding their annual profits.

How might proposed government farming reforms affect inheritance tax for farmers?

While the government’s proposed reforms aim to enhance productivity and profitability in the farming sector, the changes to inheritance tax could counteract these efforts. Farmers are calling for clarity and action on how these tax changes will impact their financial viability amidst other pressing costs and regulatory pressures.

What role do sustainable farming incentives play in the context of inheritance tax concerns for farmers?

Sustainable farming incentives are crucial for supporting farmers, especially as they navigate potential inheritance tax liabilities. However, uncertainty over the future of these incentives adds to farmers’ anxiety, as they seek ways to enhance profitability while facing significant tax burdens.

What is the relationship between agriculture profitability issues and inheritance tax for farming businesses?

The relationship is significant; as farmers deal with agriculture profitability issues due to rising costs and environmental challenges, the impending inheritance tax changes exacerbate their financial concerns. Many fear that these taxes will hinder their ability to invest in their businesses and sustain operations.

How are farmers planning for the future amid changes to inheritance tax and agriculture profitability?

Farmers are being urged to plan strategically for the future, taking into account the upcoming changes to inheritance tax and the overall state of agriculture profitability. This includes adapting farming practices, seeking sustainable incentives, and participating in discussions around government reforms to ensure their businesses can thrive.

What can farmers do to address concerns about inheritance tax and the farming sector’s future?

Farmers can actively engage in advocacy for fair tax policies, seek financial and legal advice to manage estate planning effectively, and participate in industry initiatives aimed at addressing farming sector challenges. By collaborating with government and agricultural organizations, they can help shape policies that support their long-term viability and profitability.

Why is clarification on the future of sustainable farming incentives important concerning inheritance tax?

Clarification on sustainable farming incentives is vital as it directly impacts farmers’ financial planning amidst looming inheritance tax changes. Knowing how these incentives will work will help farmers navigate their finances more effectively, potentially offsetting some of the tax burdens and ensuring their agricultural practices remain profitable and sustainable.

| Key Point | Details |

|---|---|

| Farmers’ Concerns | Farmers are feeling bewildered and frightened about the future due to proposed changes to inheritance tax. |

| Government Report | An independent review reveals 57 recommendations to enhance profitability, investment, and resilience in farming. |

| Baroness Batters’ Commentary | She expressed that there is no simple solution for farm profitability, urging farmers not to seek state handouts. |

| Inheritance Tax Changes | Upcoming changes will impose a 20% inheritance tax on farm businesses valued over £1 million starting April 2026. |

| Industry Reactions | Concerns about profitability due to high costs, low commodity prices, and uncertain environmental regulations. |

| Government’s Response | The government plans to work closely with the farming sector to improve supply chain fairness and expedite necessary reforms. |

Summary

Inheritance tax and farming are critical issues that significantly impact the agricultural sector. As revealed in the recent government report, farmers are grappling with the upcoming changes to inheritance tax, which could further threaten their already precarious profits. The report outlines a need for immediate action to ensure that farmers can thrive and remain vital to the nation’s food security and rural economy. Ensuring fair pricing, reducing input costs, and addressing tax implications are essential steps to support sustainable farming practices and bolster the farmers’ long-term viability.