Listen to this article

The UK economic forecast presents a complex picture as Chancellor Rachel Reeves navigates through significant challenges in the nation’s finances. With the Office for Budget Responsibility (OBR) acknowledging a more optimistic outlook, there remains a substantial weight on the Chancellor’s shoulders to address ongoing budget challenges effectively. Recent reports indicated a total of £26 billion in tax increases within the latest Budget, raising questions about the long-term implications for public finances UK. Amid accusations of misleading information, Reeves maintains that her characterization of the fiscal landscape is accurate, underscoring the intricate balancing act of policy decisions against a backdrop of economic uncertainty. As political tensions rise, understanding the nuances of the UK economic forecast becomes essential for navigating the potential impacts on everyday citizens.

Examining the prospective economic landscape of the United Kingdom reveals a myriad of obstacles facing financial policymakers, particularly in light of recent statements from Chancellor Rachel Reeves. The current state of the fiscal environment bears scrutiny, especially with the Office for Budget Responsibility (OBR) indicating challenges that may complicate effective governance. Discussions surrounding budgetary adjustments and tax reforms reflect the growing concerns about public finances in the UK, as Reeves advocates for responsible fiscal management amid increasing taxation debates. Furthermore, the political ramifications of these economic assessments are profound, as scrutiny intensifies over potential miscommunication regarding fiscal realities. Overall, analyzing the UK’s economic trajectory requires careful consideration of both governmental strategies and the underlying economic indicators.

UK Economic Forecast: Understanding the Challenges Ahead

As the UK’s economic landscape shifts, the recent comments by Prof. David Miles from the Office for Budget Responsibility (OBR) provide critical insights into the UK’s economic forecast. Chancellor Rachel Reeves characterizes the public finances as “very challenging”, a description that aligns with the current reality detailed by Miles. This reflection hints at the pervasive budget challenges while demonstrating the Chancellor’s commitment to transparency amidst scrutiny. With rising concerns regarding tax increases and their implications on citizens, an accurate perception of public finances is paramount.

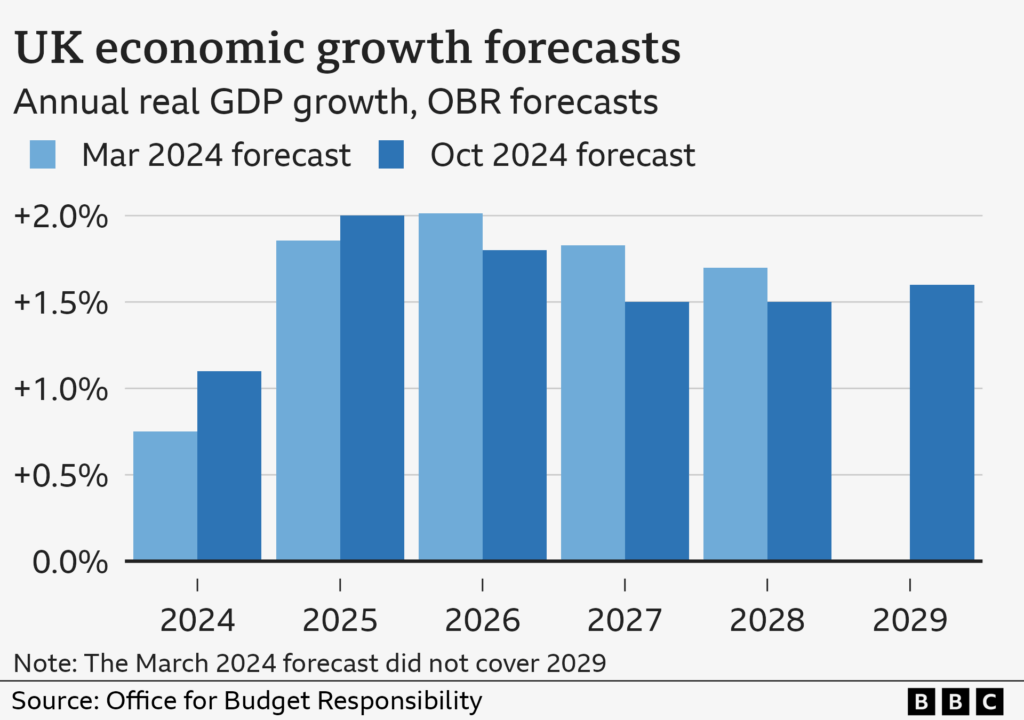

The OBR’s revelations that the overall forecast has improved is a double-edged sword. On one hand, it suggests that the government’s fiscal position might be less dire than previously thought; however, the pressing budget challenges remain. The Chancellor’s acknowledgment of these difficulties reveals the evasive nature of public discourse around taxation policy and fiscal responsibility. As debates continue around welfare spending and potential increases in income tax rates, the populace watches closely how these economic forecasts will translate into policy decisions.

Budget Challenges Facing Chancellor Rachel Reeves

Chancellor Rachel Reeves faces formidable budget challenges as she navigates the economic terrain following the recent OBR assessments. Despite assertions of a recovering economy, the Chancellor has been cautious, emphasising the substantial hurdles linked to public finances, especially in light of the recent £26 billion in tax increases. These decisions can significantly affect the public’s perception of the government’s economic strategy and the political implications surrounding it.

The dialogue around Reeves’s approach has elicited strong reactions from both sides of the political spectrum. While critics within the Conservative Party argue that her strategy is aimed at tax hikes for welfare spending, supporters maintain that her caution stems from a necessary acknowledgment of the economic realities outlined by the OBR. The tensions reveal that the road ahead for the Chancellor involves not just fiscal management but also careful navigation of public sentiment and political opposition.

The Role of the Office for Budget Responsibility

The Office for Budget Responsibility plays a pivotal role in shaping the UK’s fiscal strategy, acting as an independent body that scrutinizes governmental forecasts and public financial health. As highlighted by Prof. David Miles, their assessments help clarify the challenges that Chancellor Rachel Reeves must confront in her Budget decisions. The interplay between the OBR’s findings and the Chancellor’s public statements feeds directly into discussions about financial accountability within the UK government.

However, the OBR’s forecasts come with their own set of complexities. While Miles confirmed the overall economic predictions appear favorable, the degree of improvement is marginal, with significant caveats. The purported buffer of £4.2 billion, although seen as progress, is hardly a robust safety net compared to historical standards. As debates arise over this modest surplus, it becomes evident that the OBR’s role extends beyond mere forecasting; it’s also about the facilitation of informed discourse on fiscal policy.

Public Finances UK: The Current State

The state of public finances in the UK is a topic of increasing concern, with fiscal metrics continually scrutinised against the backdrop of economic realities. While recent analyses from the OBR suggest slight improvements, the overall picture remains precarious. The Chancellor’s warnings about the economy’s challenges point to critical issues such as productivity and tax revenue, which highlight the fragile state of public finances.

These conversations about public finances are not just abstract figures; they affect everyday citizens and their perception of the government’s effectiveness. The ongoing debates surrounding tax increases as a means to bolster public spending raise important questions about sustainability and fairness in fiscal policy. As Chancellor Reeves contends with these pressures, the public awaits transparent communication regarding the implications of such financial decisions.

Tax Increases and Economic Implications

The recent announcement of a £26 billion tax increase has set the stage for significant economic implications across the UK. With the freeze on income tax and National Insurance thresholds extended for three more years, citizens are left grappling with the reality of higher taxes amid a backdrop of stagnant economic growth. The Chancellor’s rationale for these tax increases — tied to the difficult economic landscape — leads to contention among various political factions.

Critics have responded by accusing the Chancellor of using a bleak economic outlook as justification for raising taxes to cover welfare spending. This sentiment echoes throughout the political arena, with suggestions that such measures may infringe upon individuals’ financial stability. It remains to be seen how these tax increases will affect consumer behavior and overall economic growth in the coming months, presenting yet another layer of uncertainty.

Chancellor Rachel Reeves: Navigating Public Sentiment

Chancellor Rachel Reeves is acutely aware of the political stakes involved as she navigates public sentiment regarding the economy and fiscal policies. Amid accusations of misleading rhetoric surrounding the state of public finances, Reeves’s insistence on the necessity of tax increases presents a paradox. She seeks to maintain transparency within a populace that is concerned about rising financial burdens and possible implications for welfare programs.

Maintaining public trust in the face of scrutiny is no small task, especially when projections from the OBR suggest a narrowing economic margin. As the Chancellor emphasizes the significance of difficult choices in the budget, the discord among political factions underscores the complexity of her position. Striking a balance between fiscal responsibility and public perception will be vital for Reeves as she moves forward with her economic agenda.

Economic Productivity and its Detrimental Effects

Chancellor Rachel Reeves’s acknowledgment of a downgrade in the UK’s economic productivity comes at a crucial juncture, highlighting its detrimental effects on public finances. The correlation between productivity levels and tax receipts is critical, as lower productivity may lead to fewer resources available for essential public spending. This reality emphasizes why keeping an eye on economic productivity remains central to the Chancellorship.

In her pre-Budget speeches, Reeves’s warnings drawn from the OBR’s assessments illustrate the complexities she faces in adhering to existing borrowing rules. With diminished tax receipts impacting financial strategy, the Chancellor’s focus on productivity becomes a pivotal aspect of her approach to managing economic expectations while fulfilling political commitments.

The Controversy Surrounding Public Financial Disclosure

The transparency of public financial disclosure has entered into heated debate following Chancellor Rachel Reeves’s budget announcements. Critics argue that the government’s dissemination of information surrounding fiscal positions has been misleading, citing the disparity between the perceived bleak outlook and the actual projections provided by the OBR. This commentary reflects a widening chasm between government messages and public understanding of fiscal health.

Calls for greater scrutiny into the accuracy of financial disclosures have gained momentum as citizens demand clarity amidst rising taxes and shifting economic policies. The conversation about transparency is not merely political; it directly impacts societal trust in governmental institutions. As the discourse evolves, constructive dialogue will be essential in restoring faith in the public financial governance.

The Path Forward: Balancing Fiscal Duties and Public Needs

As the UK positions itself for the future amidst a challenging fiscal landscape, finding the right balance between fiscal responsibilities and the needs of the public is essential. Chancellor Rachel Reeves’s recent budget suggests a government grappling with competing priorities, aiming to maintain financial stability while addressing the welfare of its citizens. As discussions unfold related to productivity, tax hikes, and the role of the OBR, a cohesive path forward is crucial.

Navigating these complexities will require astute policymaking, reflected in both budgetary policies and communication strategies. The interplay between governmental fiscal objectives and public perception must be carefully managed to foster trust and stability. Moving forward, it will be pertinent for Reeves and her team to ensure that economic decisions align with an equitable vision for the UK.

Frequently Asked Questions

What did Chancellor Rachel Reeves say about the UK economic forecast before the recent Budget?

Chancellor Rachel Reeves described the UK economic forecast as ‘very challenging’ ahead of the Budget. This statement was supported by Prof. David Miles from the Office for Budget Responsibility, who noted that her comments were consistent with the public finances situation, which faces significant budget challenges.

How did the Office for Budget Responsibility (OBR) assess Chancellor Rachel Reeves’s comments on public finances?

The Office for Budget Responsibility indicated that Chancellor Rachel Reeves’s comments regarding the state of public finances were not misleading. Prof. David Miles affirmed that despite a slightly improved economic forecast, the challenges in the Budget remained considerable, reflecting the ongoing budget challenges the UK faces.

What tax increases were included in the UK Budget, as forecasted by the OBR?

The recent UK Budget forecasted a total of £26 billion in tax increases, which included extending the freeze on income tax and National Insurance thresholds for an additional three years, thus affecting public finances UK significantly.

Why is the UK’s economic productivity downgrade significant for public finances?

Chancellor Rachel Reeves highlighted the UK’s economic productivity downgrade as it complicates adherence to borrowing rules, leading to reduced tax receipts. This development is critical in understanding the overall UK economic forecast and the fiscal challenges ahead.

What are the implications of the OBR’s warnings regarding the recent Budget?

The implications of the OBR’s warnings suggest that while there is a forecasted £4.2 billion surplus for the UK, it is minimal compared to historical figures. This indicates a tightening budgetary environment for Chancellor Rachel Reeves as she navigates public finances and makes difficult budget choices.

How did political reactions shape the narrative around the UK economic forecast?

Political reactions have been intense, with the Conservative Party accusing Chancellor Rachel Reeves of painting an overly pessimistic UK economic forecast as a justification for tax increases. This has sparked a debate around the accuracy of the information shared concerning public finances.

What challenges does Chancellor Rachel Reeves face following the OBR’s forecast?

Chancellor Rachel Reeves faces the dual challenges of managing a Budget that includes significant tax increases while addressing public concerns about the UK’s fiscal health, as even the slight positive figures in the OBR’s forecast are accompanied by substantial uncertainties regarding public finances UK.

What does the £4.2 billion buffer in the forecast indicate about future economic choices?

The £4.2 billion buffer, while a positive element in the UK economic forecast, suggests that Chancellor Rachel Reeves has limited room for maneuvering in future economic choices, reinforcing the notion that the public finances are under strain and that her decisions will be scrutinized.

| Key Point | Details |

|---|---|

| Chancellor’s Statements | Rachel Reeves described public finances as ‘very challenging’, a view supported by Prof. David Miles from the OBR. |

| Economic Forecast | The OBR indicated a more favorable outlook than previously thought, though warned of a difficult Budget ahead. |

| Political Reactions | Opposition claimed Reeves misled the public, while she reiterated her comments on public finances. |

| Tax Increases | The recent Budget included £26 billion in tax increases, with significant changes to income tax and benefit caps. |

| Productivity Concerns | Reeves indicated a downgrade in economic productivity impacting tax revenues and borrowing rules. |

| Buffer and Surplus | OBR suggested a £4.2 billion buffer, much smaller than historical figures, emphasizing fiscal challenges. |

Summary

The UK economic forecast remains a topic of debate, with Chancellor Rachel Reeves facing scrutiny over her statements regarding the challenging state of public finances. While the Office for Budget Responsibility has provided a somewhat improved economic outlook, significant tax increases and productivity concerns loom large, raising questions about future fiscal policy. The discussions are critical as they highlight the necessity for transparency and clarity on the economic situation amidst the current political climate. This forecast indicates that the government will need to tread carefully as it navigates through these complexities.