Listen to this article

Budget tax rises are set to affect millions as Chancellor Rachel Reeves unveils a staggering £26 billion package, aiming to reshape the economic landscape in the UK. High-profile changes include the introduction of a mansion tax targeting properties valued over £2 million, alongside the scrapping of the controversial two-child benefit limit, a move that has been championed by anti-poverty advocates. Other financial revisions involve freezing income tax thresholds, which will push many workers into higher tax brackets as wages increase. Furthermore, significant reforms to gambling taxes are on the horizon, while a fuel duty freeze promises some relief for motorists in the near term. These budget tax rises signal a pivotal shift, aiming for a fairer and stronger Britain amidst economic challenges.

The recent announcement of increased taxation reflects a broader strategy to enhance public finances and address societal disparities. Known alternatively as fiscal adjustments, these budget tax increases span various sectors, implementing a new levy on high-value real estate through mansion tax, and adjusting support systems like the scrapping of the two-child benefit cap. Ensuring a sustainable economic framework, the revisions to income tax thresholds will result in more individuals facing higher taxation as their earnings grow. In addition, the forthcoming changes in gambling regulations and the maintenance of a fuel duty freeze indicate a comprehensive approach to generating revenue while attempting to alleviate financial burdens for certain demographics. As policymakers navigate these complex issues, the primary goal remains to foster a more equitable financial environment for all citizens.

Understanding the Mansion Tax Impact

The mansion tax, newly introduced by the Chancellor, focuses on properties valued over £2 million, imposing an annual surcharge expected to affect between 100,000 to 200,000 high-value homes across the UK. This charge is structured based on a tiered system, ranging from £2,500 to £7,500 depending on the property’s value, making it a significant financial consideration for affluent homeowners. While this tax aims to generate approximately £400 million annually for the Treasury, it’s essential to analyze how it will affect the property market and wealth distribution in the country.

Critics of the mansion tax argue that it could devalue high-end properties and deter investment in premium real estate sectors. Furthermore, the potential burden on affluent homeowners may lead to increased financial strain during a time when property valuations are already volatile. Conversely, proponents claim that funds raised from this taxation could support crucial public services and infrastructure projects, promoting greater social equity in the distribution of fiscal responsibilities. As the implementation date approaches in April 2028, the real estate market will need to adapt to these new financial realities.

The Repeal of the Two-Child Benefit Limit

The Chancellor’s decision to abolish the two-child benefit limit marks a significant shift in family welfare policy, essentially responding to growing calls from anti-poverty advocates. This change, which reverses a policy instituted in 2017, allows families to claim child tax credits and universal credit for all their children, thereby alleviating some of the financial pressures faced by larger families. The government anticipates that this policy revocation will lift around 450,000 children out of poverty, which is a commendable goal aligned with broader social equity efforts.

However, this change comes with a cost to the Treasury, projected at £3 billion by 2029–30. The impact of this financial commitment will be closely monitored, as the associated rise in benefits will also be adjusted to reflect inflation starting in April. The implications of these changes signal a broader reconsideration of how the government supports families, particularly those with multiple children, in an environment where cost of living and economic challenges are increasingly pressing.

Gambling Tax Reforms and Their Implications

The recent announcements regarding gambling tax reforms highlight a significant shift in how the government intends to regulate the gambling industry. The increase in remote gaming duty from 21% to 40% aims to enhance revenue collection from online gambling operators, projected to yield an additional £1.1 billion by 2029–30. This reform is part of a broader strategy to ensure that the burgeoning gambling sector contributes fairly to the economy while addressing concerns about gambling addiction and misuse.

By establishing a new general betting duty for remote betting set at 25%, the government is taking proactive steps to regulate a rapidly expanding industry. However, it’s imperative to strike a balance between generating revenue and protecting vulnerable groups from the adverse effects of gambling. As these new taxes roll out, the government must also ensure that the additional funds raised are directed towards initiatives aimed at addiction support and player safety.

The Significance of Rail Fare Freeze

The announcement of a rail fare freeze is a groundbreaking decision that marks the first of its kind in over 30 years, promising significant savings to commuters and travelers across the UK. With a projected savings of £600 million in 2026/27, this measure aims to enhance the affordability and accessibility of rail travel during a period of rising living expenses. Such a freeze may encourage more people to utilize public transport, reducing reliance on personal vehicles and contributing to environmental sustainability.

Moreover, the freeze on rail fares reflects a government commitment to improving public transport infrastructure and services, especially in light of criticisms against previous fare increases. The long-term effects of this freeze could lead to a revitalized rail system, fostering greater confidence in public transport reliability and efficiency, and making rail travel a more attractive option for everyday journeys.

Impact of Income Tax Threshold Freeze

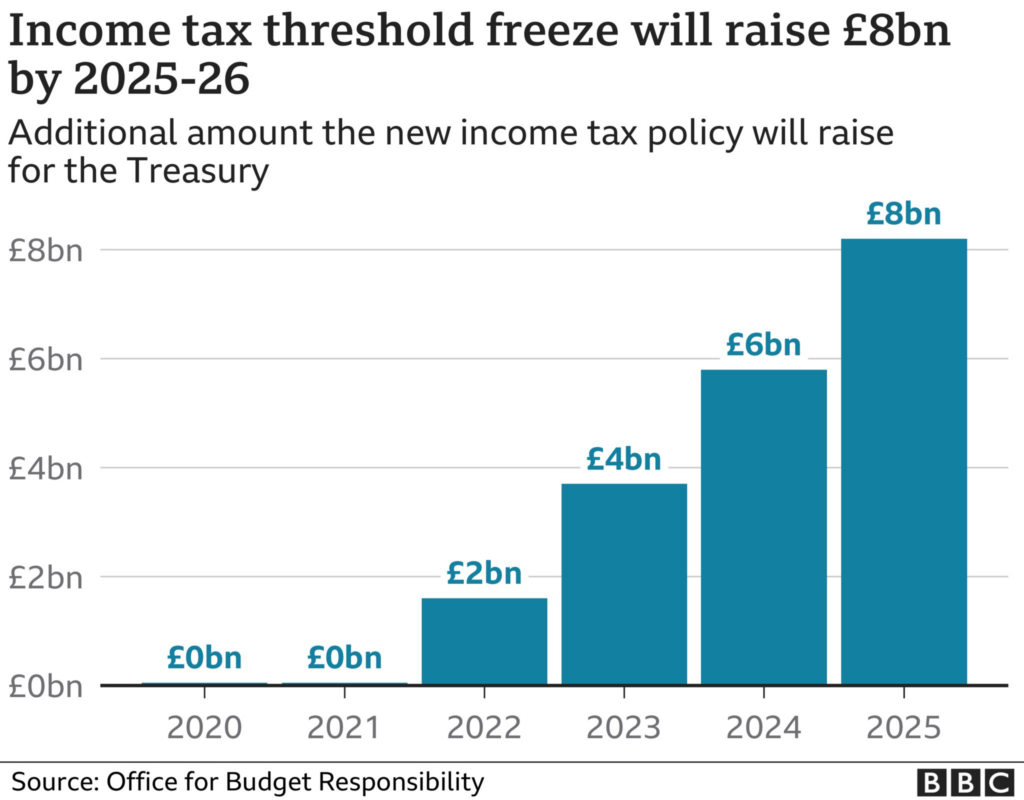

The decision to freeze income tax thresholds until 2030 has far-reaching implications for the UK workforce, impacting over 1.5 million workers who may find themselves pushed into higher tax brackets as wages increase. While this policy aims to bolster government revenues—estimated to yield £56 billion by 2030-31—its immediate effect may dampen the financial growth of many individuals and families. As wages are expected to rise, freezing the thresholds means more people will bear a heavier tax burden, which could lead to decreased disposable income.

This move raises concerns regarding fairness in taxation, especially for those on the lower end of the income spectrum who may struggle as costs continue to increase. Policymakers must consider the long-term economic consequences of this approach, ensuring that fiscal measures support not just government revenue but also the financial well-being of the workforce.

Changes to Electric and Hybrid Vehicle Charges

The impending charge on electric and hybrid vehicles, set to begin in April 2028, is a significant development in the government’s efforts to adapt taxation to shifting transportation landscapes. This new mileage-based tax, projected to be around half of the current fuel duty rate, presents a unique challenge and opportunity for electric vehicle (EV) owners. As the adoption of electric cars grows, it’s crucial that tax structures align with evolving technologies, reflecting the environmental benefits these vehicles provide.

Notably, this change will generate an anticipated £1.4 billion for the Treasury, but it also instigates discussions about the future of transportation funding. As traditional fuel sources diminish due to the rise of electric vehicles, government revenue from fuel taxes may decline, necessitating a revision of overall vehicle taxation strategies. This approach requires careful consideration to ensure sustainability while incentivizing green technologies.

Energy Bill Reductions and Households

With households set to receive an average reduction of £150 in their energy bills starting in April, the government aims to provide crucial support amid rising energy costs. The decision to scrap the previous Conservative ECO scheme, which had not effectively addressed fuel poverty for many, reflects a pivot towards more targeted relief for struggling families. This shift could play a vital role in enhancing energy security and affordability, especially for those most affected by the cost-of-living crisis.

By focusing on reducing energy bills, the government signals its commitment to ensuring that families are not unduly burdened by exorbitant costs. The new measures are expected to foster consumer confidence as well as stimulate economic activity within communities adversely affected by energy price surges. However, it’s important to monitor the long-term sustainability and effectiveness of these policy changes to ensure they provide lasting benefit.

Enhancements in Pension and State Support

The forthcoming increase in state pensions by approximately £550 per year, aligned with inflation and average earnings, is a significant boon for millions of pensioners in the UK. This increase under the triple lock guarantee—where pensions rise by the higher of average earnings, inflation, or a minimum of 2.5%—ensures that the most vulnerable demographics are safeguarded against cost-of-living increases. Such measures are essential in promoting financial security for retirees.

However, as the government allocates over £300 million towards improving pensions, it will need to balance this expenditure with other fiscal responsibilities. Ensuring that pensioners receive adequate support while maintaining fiscal stability is crucial in addressing the aging population’s needs without compromising broader economic health.

Fuel Duty and Worker Pay Initiatives

The recent decisions surrounding fuel duty and pay hikes reveal a careful approach to managing the economy amid fluctuating costs of living. The retention of the 5p cut in fuel duty until 2026, followed by a gradual reversal, provides temporary relief for drivers while facilitating ongoing discussions about sustainable transportation funding. This adjustment is essential in maintaining a balance between revenue generation and affordability for consumers.

On the employment front, the announcement of pay increases for approximately 2.7 million workers signifies a commitment to fostering wage growth in the UK economy. This development is crucial in light of rising inflation and job market pressures, as it ensures that workers receive compensation that reflects increased living costs. However, as these policies are rolled out, their long-term sustainability and impact on overall economic growth should be closely monitored.

Expansion of the National Minimum and Living Wage

The forthcoming increases in the national minimum and living wage represent a significant step towards enhancing worker rights and improving living standards across the UK. With the National Living Wage set to rise to £12.71 per hour for those over 21, along with comparable increases for younger workers, this policy is expected to alleviate some financial pressure for low-income earners. The increase not only aims to boost disposable income for millions but also reinforces the government’s commitment to reducing inequality.

Yet, as the wage structure adjusts, businesses may face challenges in adapting to higher labor costs, which could lead to mixed reactions in the job market. It’s crucial to ensure that these wage increases do not inadvertently hinder job creation or lead to layoffs, necessitating supportive measures for businesses to balance wage growth with economic sustainability.

Introducing Changes to Cash ISA Limits

A recent decision to reduce the annual Cash ISA limit to £12,000 from April 2027 for younger savers signifies the government’s strategy to adjust savings incentives amidst changing financial landscapes. Maintaining the overall ISA limit at £20,000 illustrates a continued effort to encourage investment in both cash and stock components. Although this could make saving less attractive to younger individuals, it aligns with broader fiscal policy goals of channeling resources into dynamic investment areas.

Adjusting the ISA limits poses questions for future saving schemes and highlights the importance of adaptable financial policies. For over-65s, the exemptions from these changes will ensure that older savers can continue to take advantage of favorable savings rates—a crucial aspect in supporting their financial security as they approach retirement.

New Hotel and Accommodation Tax Implementation

The introduction of a new £2-per-night tax on overnight stays in hotels and holiday accommodations is set to commence, impacting travelers across the UK, including those using platforms like Airbnb. This move aims to generate additional revenue for local authorities, allowing them to invest in community services and tourism infrastructure. The decision reflects an evolving approach to taxing the growing gig economy and the booming short-term rental market.

With regional Mayors or local authorities determining how this revenue is spent, there is potential for targeted investments that enhance local tourism and infrastructure. However, industry stakeholders argue that additional taxes may dissuade tourists and could negatively impact the hospitality sector, necessitating a balanced approach to ensuring tourism remains a vital economic engine.

NHS Investment for Future Health Improvements

The government’s commitment of £300 million towards NHS technology improvements marks an important investment in the future of healthcare in the UK. By focusing on establishing 250 new neighborhood health centers by 2030, the initiative aims to decentralize healthcare services, making them more accessible and community-oriented. These enhancements are crucial for fostering a healthcare system that prioritizes the needs of local populations and addresses the increasing demand for services.

Investing in advanced technological solutions not only streamlines patient care but also supports the broader health agenda aimed at reducing hospital congestion and improving health outcomes. As the NHS grapples with rising pressures, such investments are essential in building a resilient healthcare system that prepares for future challenges.

Strategic Infrastructure Investments for Growth

The ongoing strategic infrastructure investments highlighted by projects like the Lower Thames Crossing and Midlands Rail Hub exemplify the government’s commitment to enhancing connectivity throughout the UK. By investing in transportation upgrades and corridor development, the government hopes to stimulate economic growth and create jobs across various regions. These projects are critical for ensuring that the UK can sustain its economic momentum and remain competitive on a global scale.

Furthermore, infrastructure investments in such projects can lead to improved quality of life for residents by reducing travel times and enhancing access to essential services. As these projects gain momentum, their impact on local economies and employment opportunities will be closely watched, solidifying the importance of sound infrastructure in driving national prosperity.

Frequently Asked Questions

What is the newly introduced mansion tax as part of the Budget tax rises?

The mansion tax is a new charge implemented on high-value homes worth over £2 million, set to affect approximately 100,000 to 200,000 properties. The tax will range from £2,500 to £7,500 annually depending on the property’s value, starting in April 2028. This measure aims to generate around £400 million yearly for the Treasury as part of the broader Budget tax rises.

How will the scrapping of the two-child benefit limit affect families amidst the Budget tax rises?

The removal of the two-child benefit limit allows families to receive child tax credits and universal credit for all children, not just the first two. This change is expected to reduce child poverty by 450,000 children, costing the Treasury roughly £3 billion by 2029-30. It is a significant aspect of the Budget tax rises aimed at supporting families in need.

What are the details of the gambling tax reforms included in the Budget tax rises?

The gambling tax reforms will see the remote gaming duty increase from 21% to 40% by April 2026, with a new general betting duty for remote betting set at 25% starting April 2027. These adjustments are part of the anticipated revenue increase of £1.1 billion by 2029-30, contributing to the overall Budget tax rises.

How has the fuel duty been impacted by the recent Budget tax rises?

The Budget tax rises maintain a freeze on fuel duty until September 2026, retaining a 5p cut, after which it will be gradually reversed. This decision aims to provide some relief to motorists while potentially raising revenue for the Treasury.

What will happen to income tax thresholds due to the Budget tax rises?

Income tax thresholds will be frozen until 2030, likely pushing more individuals into higher tax brackets as wages increase. This measure is expected to generate around £56 billion by the end of the freezing period, significantly affecting over 1.5 million workers as part of the Budget tax rises.

Are there any changes to the living wage announced in light of Budget tax rises?

Yes, the National Living Wage will increase to £12.71 per hour for workers over 21, reflecting an annual increase of approximately £900. Similarly, the National Minimum Wage will rise to £10.85 per hour for employees aged 18 to 20, as part of the broader economic adjustments associated with Budget tax rises.

What are the implications of the new hotel and accommodation tax introduced in the Budget tax rises?

A new £2-per-night tax will be applied to overnight stays in hotels and holiday accommodations, including Airbnb rentals. Local authorities will decide how to allocate the revenue generated from this tax, which is another component of the recent Budget tax rises.

How will the NHS funding be affected by the Budget tax rises?

The NHS will see an infusion of £300 million for technological improvements and plans for 250 new neighborhood health centers to be established by 2030. This funding is part of the increased financial measures outlined in the Budget tax rises.

What is the forecast for energy bills as a result of changes in the Budget tax rises?

Average household energy bills are set to decrease by about £150 from April, addressing concerns over fuel poverty. This move comes alongside the scrapping of the previous Energy Company Obligation scheme, representing a shift in support strategies in response to Budget tax rises.

Will there be any changes to the Cash ISA limits under the new Budget tax rises?

Yes, the annual Cash ISA limit will be reduced to £12,000 from April 2027 for younger savers, while the overall ISA limit remains at £20,000. This adjustment signifies the nuanced approach to managing tax and savings reforms amid the Budget tax rises.

| Key Policy | Description | Impact |

|---|---|---|

| Mansion Tax | New tax for homes worth over £2 million, ranging from £2,500 to £7,500 annually based on value. | Expected to raise £400 million a year. |

| Two-Child Benefit Limit | Scrapping limit imposed in 2017 on child tax credits and universal credit. | Aims to reduce child poverty by 450,000 at a cost of £3 billion by 2029-30. |

| Gambling Tax Reforms | Increases in remote gaming duty to 40% and introduction of 25% general betting duty for remote betting. | Projected revenue of £1.1 billion by 2029-30. |

| Income Tax Threshold Freeze | Freezing rates until 2030 will push more earners into higher tax brackets. | Estimated yield of £56 billion by 2030-31. |

| Rail Fare Freeze | First freeze in rail fares in 30 years, saving passengers £600 million. | Positive shift for over a billion journeys. |

| Energy Bill Reductions | Average £150 reduction in energy bills starting April. | Aims to reduce the cost of living for households. |

| NHS Investment | £300 million allocated for technology improvements and 250 new health centres. | Expansion of community-based services by 2030. |

| New Hotel Tax | £2 per night tax for overnight stays in hotels and Airbnbs. | Revenue usage determined by local authorities. |

Summary

Budget tax rises have emerged as a significant development, with Rachel Reeves announcing a comprehensive set of reforms that will raise £26 billion annually. Key measures include the introduction of a mansion tax, the abolishment of the two-child benefit limit, and a freeze on income tax thresholds. This new fiscal approach is designed to enhance revenue while aiming to address child poverty and increase investments in public services such as the NHS. Overall, this budget reflects a shift towards a more equitable tax system and can be seen as a response to the current economic climate.