Listen to this article

As the UK economy forecast suggests a more tempered outlook for growth in the coming years, there are plenty of factors influencing this shift. The Office for Budget Responsibility (OBR) recently modified its projections, indicating a slight increase in growth for this year, but a downward trend thereafter. Amidst the backdrop of an anticipated inflation rate in the UK that has compelled the government to reassess its strategies, Chancellor Rachel Reeves is expected to address these concerns in her upcoming budget speech. Importantly, the government’s decision to maintain UK tax thresholds until 2031 will have profound implications on financial planning for individuals and businesses alike. This complex web of tax policies and economic projections reiterates the need for careful observation of the UK economy and its trajectory moving forward.

With the future of Britain’s financial landscape in focus, the latest projections for the UK economic outlook underscore a cautious approach amidst evolving conditions. As analysts sift through the newly released data by the Office for Budget Responsibility, the implications for fiscal policies and the forthcoming Chancellor’s budget speech are paramount. Expectations of further shifts in inflation, as well as the stability of tax brackets, play a crucial role in shaping public sentiment and market response. While the prospect of economic growth is present, the anticipated adjustments to tax thresholds and rising cost pressures may complicate the path forward. As stakeholders navigate these turbulent waters, understanding the broader implications of these forecasts becomes essential for devising effective strategies to bolster the nation’s economic resilience.

UK Economic Growth Projections

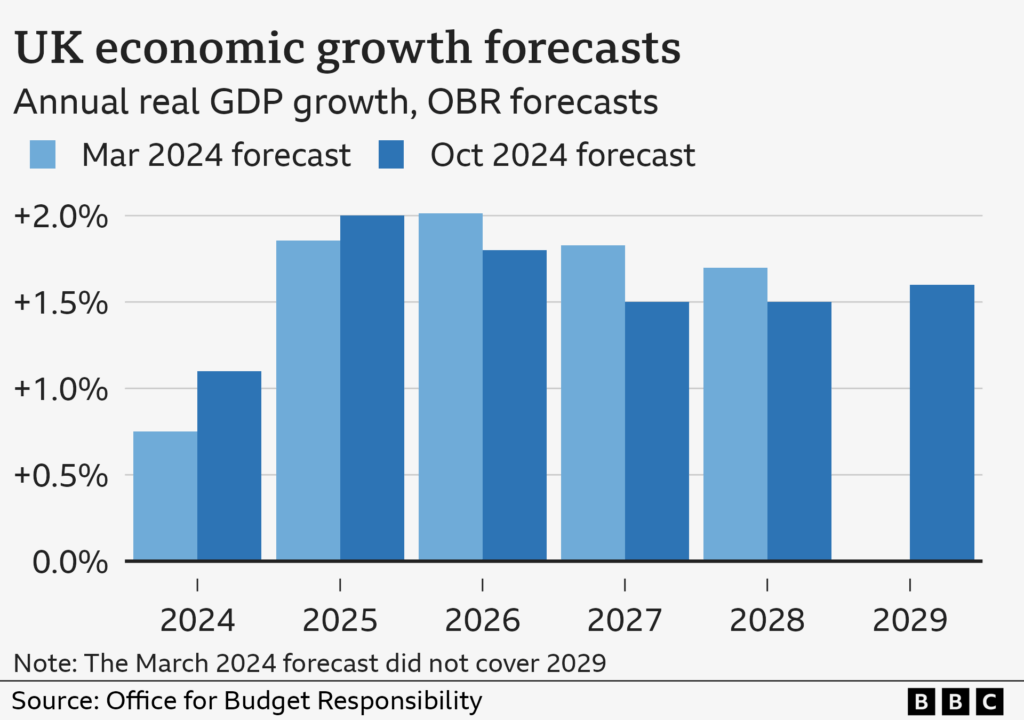

The UK economy’s growth forecast has taken a new direction with the Office for Budget Responsibility (OBR) projecting a modest growth rate of 1.5% for this year. This estimate marks an increase from its previous prediction but is accompanied by downgrades for subsequent years. The OBR’s insights reflect a response to mounting challenges that could hinder this growth trajectory, such as geopolitical tensions and fluctuating consumer confidence. Despite this, the government expresses optimism that it can enhance economic performance through strategic fiscal measures.

Looking at future projections, the OBR anticipates that growth will dip to 1.4% by 2026, followed by a steady pattern of around 1.5% for the subsequent years. These figures indicate a sustained but sluggish improvement in the UK economy, demonstrating the complexities of navigating through high inflation and potential tax increases. The challenge for policymakers will be to implement measures that stimulate growth while managing public expectations and addressing the underlying economic pressures.

Frequently Asked Questions

What is the latest UK economy forecast by the Office for Budget Responsibility?

The latest UK economy forecast by the Office for Budget Responsibility (OBR) predicts a growth of 1.5% this year, up from a previous estimate of 1%. However, forecasts for the next four years have been downgraded, with expected growth at 1.4% in 2026 and 1.5% in subsequent years.

How will the freeze on UK tax thresholds affect the economy?

The freeze on UK tax thresholds is projected to significantly impact the economy, resulting in approximately 780,000 new basic-rate taxpayers and 920,000 more individuals entering the higher tax bracket by 2029-30. This freeze, leading to increased tax revenues, is expected to elevate the overall tax take to a historic high of 38% of GDP.

What key points did the Chancellor emphasize in her budget speech related to the UK economic growth?

In her budget speech, Chancellor Rachel Reeves highlighted that the government had outperformed the previous UK economic growth forecasts. She expressed confidence in further improvements, stating, “we will do it again,” reinforcing the commitment to boost the UK economy amidst ongoing concerns over tax increases and geopolitical uncertainties.

What does the OBR predict about the inflation rate in the UK for the coming years?

The OBR has revised its forecast for the UK inflation rate upward, estimating it at 3.5% for the current year and 2.5% for next year, compared to earlier projections of 3.2% and 2.1%, respectively. Inflation is expected to gradually decrease to 2% in subsequent years, having peaked at 3.6% in October.

How does the UK economy forecast impact living standards in the UK?

The UK economy forecast, as outlined by the OBR, is critical for living standards, as the government prioritizes economic growth. With projected tax increases due to frozen thresholds, the anticipated rise in income taxation could impact disposable income for many households, thus influencing overall living standards across the UK.

What are the implications of the OBR’s downgraded economic growth forecast for the UK?

The downgraded economic growth forecast by the OBR suggests a more challenging environment for the UK economy, with anticipated low business and consumer confidence. This may lead to slower growth rates than previously expected, contributing to concerns over fiscal sustainability and the potential for increased tax burdens on individuals and businesses.

Why was the Office for Budget Responsibility’s report on the UK economy forecast published early?

The Office for Budget Responsibility’s report on the UK economy forecast was mistakenly published ahead of Chancellor Rachel Reeves’ budget presentation due to an inadvertent upload to their website. This premature release provided insight into critical forecasts, such as tax thresholds and growth predictions.

| Point | Details |

|---|---|

| UK Economy Growth | Predicted to grow at 1.5% this year, up from 1%, but projected to decline to 1.4% by 2026. |

| Tax Policy Changes | Income tax thresholds will remain frozen until 2030-31, leading to increased taxpayers in various brackets. |

| Tax Increases | Expected tax increases are projected to total £26 billion by 2029-30. |

| Inflation Forecast | Inflation is estimated to be 3.5% this year, with a slight increase to 2.5% next year before decreasing to 2% thereafter. |

| Geopolitical and domestic impact | Low business and consumer confidence due to geopolitical uncertainties and tax hikes. |

Summary

The UK economy forecast suggests a period of slower growth than previously anticipated, with the Office for Budget Responsibility predicting only 1.5% growth this year. However, amid ongoing uncertainty and rising taxes, future growth rates are expected to dip. These economic realities highlight the government’s challenges as it strives to enhance living standards while managing fiscal policies effectively.