Listen to this article

The UK economy forecast presents a cautious outlook, suggesting slower growth than earlier estimates over the next four years. Recently leaked details about Rachel Reeves’ autumn Budget have raised concerns regarding the Chancellor’s economic plans, especially in light of the Office for Budget Responsibility’s (OBR) assessments. Economic growth, which was initially predicted to rise by 1.5% this year, has seen downgrades for upcoming years, reflecting a more temperate trajectory ahead. As debates continue around the implications of these budget leaks, many are scrutinizing how these revelations could affect the broader UK economic landscape. With the Chancellor’s tax policies projected to raise billions in revenue, the implications of this budget leak investigation are set to unfold in the coming weeks.

In examining the future of the British financial landscape, the economic outlook for the UK hints at moderated growth predictions following recent budget discussions. Following the inadvertent release of information regarding the Chancellor’s financial strategy, discussions about fiscal policies and their potential impact on national prosperity have come to the forefront. With alterations to tax thresholds and significant budgetary measures expected to influence both public services and the economy at large, many are left questioning the sustainability of such plans. The conversation has intensified not only about the immediate effects but also the long-term repercussions of these financial assessments, particularly as stakeholders analyze how they will steer the revival of the UK economy in a post-pandemic environment.

UK Economy Forecast: Slow Growth Ahead

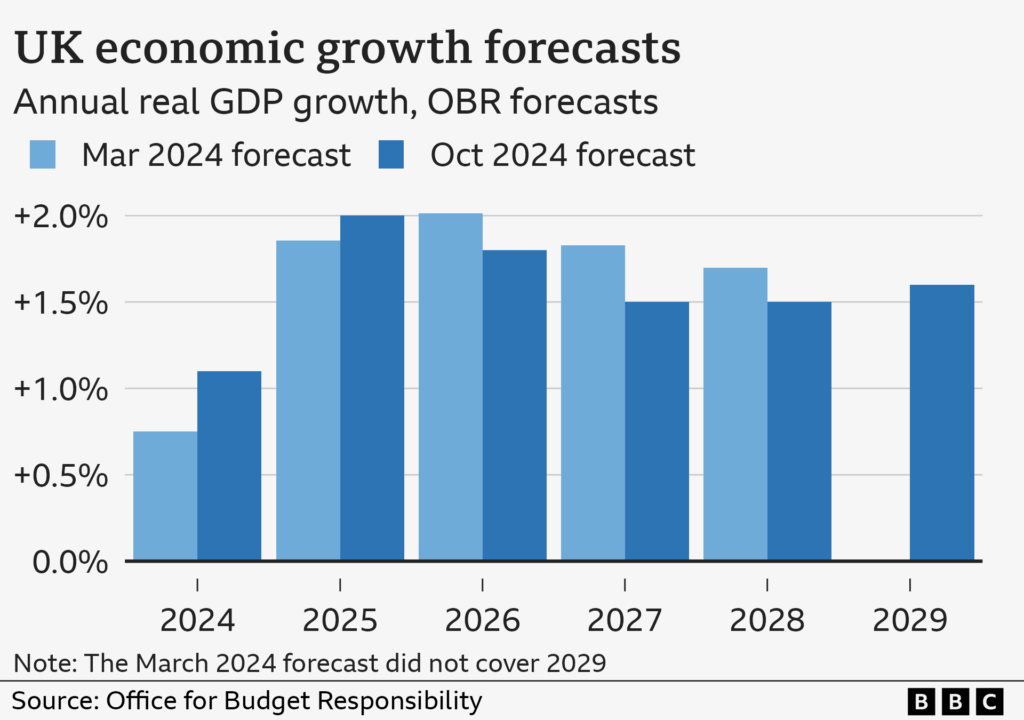

The latest forecast for the UK economy suggests a slowdown in growth compared to earlier estimates. According to the Office for Budget Responsibility (OBR), the gross domestic product (GDP) is now projected to increase by just 1.5% in the current year, a modest improvement from the earlier prediction of 1%. However, this growth is not sustained in the subsequent years, as forecasts have been downgraded significantly for 2026 through 2029, highlighting a potentially troubling trend for the UK economy. With less robust growth on the horizon, concerns about long-term economic stability and planning are raised, especially in the context of recent budget announcements and potential policy changes from the Chancellor.

This slower growth forecast aligns with the wider economic climate, where inflation remains a pressing concern and living costs continue to rise. As analysts study Rachel Reeves’ Autumn Budget, they are cautious about the implications of higher taxes and the freezing of personal tax thresholds, which could further constrain disposable income for households across the UK. This situation raises questions about the government’s broader economic strategies, as the country navigates through a complex post-pandemic recovery phase.

The Impact of Rachel Reeves’ Budget on Economic Growth

Rachel Reeves’ recent budget has stirred mixed reactions, particularly regarding its potential long-term impact on economic growth. The decision to raise taxes by amending personal tax thresholds is anticipated to generate substantial revenue for the Treasury, estimated at £26 billion by 2029-30. However, with increased taxation comes the risk of dampening consumer spending, a critical driver for economic growth. This raises important questions about balancing fiscal responsibility with stimulating economic activity in light of the OBR’s revised forecasts.

Economists worry that by increasing the tax burden on both basic and higher-rate taxpayers, the budget may inadvertently stifle the very growth it aims to promote. As households grapple with the increase in their financial commitments, there is a potential risk to consumption levels, which could hinder growth in the domestic market. The OBR’s warning about the revisions needed in growth forecasts highlights the urgency for reassessing fiscal strategies to ensure sustainable economic advancement.

Exploring the Budget Leaks Investigation

The recent premature release of budget forecasts raises significant concerns surrounding the integrity of financial communications within the UK government. Following the budget leaks, Sir Keir Starmer has opted not to pursue an investigation, emphasizing the timing of the disclosures just minutes before the official presentation by the Chancellor. Such lapses not only generate confusion but also cast a shadow on public confidence in the economic strategies being implemented, highlighting a need for greater transparency and accountability during budget preparations.

This incident draws attention to the broader implications of budget leaks, particularly how they can affect market confidence and public trust in the government’s economic plans. For the Chancellor, who is tasked with laying out a cohesive strategy for future economic growth, these leaks could undermine the intended impact of proposed fiscal measures, such as enhanced NHS funding and other social programs that aim to improve living standards. Hence, addressing the root causes of these leaks becomes crucial for the government to restore credibility in its planning.

Chancellor’s Economic Plans: Future Strategies

In light of the current economic climate and contrasting projections from the OBR, the Chancellor’s economic plans have come under increased scrutiny. The government’s roadmap includes significant reforms such as freezing personal tax thresholds, which raises substantial revenue but also comes with implications for taxpayers. As the Chancellor outlines future strategies, it’s essential to balance immediate fiscal needs against the longer-term goal of encouraging UK economic growth.

Furthermore, the Chancellor’s commitment to maintain targeted spending on critical public services, like healthcare and education, reflects a dedication to addressing pressing social issues. However, the vitality of these plans hinges on the effective management of resources and the ability to mitigate the negative consequences of imposed tax increases. Moving forward, the Chancellor will need to navigate these challenges to foster an environment conducive to sustainable growth.

The Role of the OBR in Economic Forecasting

The Office for Budget Responsibility (OBR) plays a pivotal role in shaping economic understanding within the UK. Its latest forecasts shed light on critical trends affecting the economy, encompassing gross domestic product projections and fiscal health over the next several years. The OBR’s assessments serve as a trusted reference point for policymakers, investors, and the public, enhancing transparency in economic governance.

In light of the recent budget leaks, the credibility of the OBR’s releases is paramount. The premature publication of the economic and fiscal outlook not only caused confusion but also raised concerns about the integrity of data management within government institutions. As the OBR commits to an internal investigation, it must reinforce its protocols to prevent future occurrences, helping safeguard public trust while providing accurate insights for informed policy-making.

Tax Policy Changes: Implications for Households

The changes in tax policy outlined in Rachel Reeves’ budget are likely to have significant implications for everyday households across the UK. The proposed freeze on personal tax thresholds means that thousands of families will face increased tax burdens as their incomes grow due to inflation rather than actual financial gains. This could exacerbate existing economic pressures, diminishing the disposable income that families have available for essential spending.

Moreover, other tax adjustments, such as those affecting national insurance contributions and dividend tax rates, will further impact individuals and businesses alike. As taxes increase, the potential for decreased consumer spending looms larger, which could stall economic recovery efforts. Policymakers will need to carefully consider how these fiscal changes affect smaller households, particularly as they grapple with a challenging economic landscape.

The Future of UK Economic Stability

As the UK economy braces for a series of adjustments outlined in the recent budget, the focus inevitably shifts toward maintaining economic stability. With growth forecasts revised downwards by the OBR, a crucial aspect of recovery will be evaluating how fiscal policies influence overall economic conditions. Long-term stability will depend on the government’s ability to implement strategies that stimulate growth while simultaneously addressing the needs of a broad swath of the population.

Factors such as rising debt levels and the increasing cost of living pose challenges to achieving this balance. The projected rise in government debt to 96.1% of GDP by the end of the decade calls for prudent fiscal management, ensuring that spending doesn’t outstrip growth. Consequently, the focus should shift toward fostering an adaptable economic environment that is resilient against internal and external shocks.

Challenging Economic Conditions: A Call for Innovation

Given the recent forecasts showing a sluggish economic growth trajectory, there is an urgent need for innovative thinking within government strategy. Policymakers must embrace new approaches to revitalize the economy and react proactively to the changes brought about by the impending budget measures. Encouraging investments in emerging sectors, as well as supporting small and medium-sized enterprises (SMEs), could play a pivotal role in driving growth and creating sustainable jobs.

Innovation can also be fostered through collaborative efforts between private and public sectors. By promoting partnerships and integrating modern technologies into existing frameworks, the government can support transformative initiatives that result in measurable economic benefits. As the nation faces mounting challenges, leveraging innovative solutions may prove to be the key to steering the UK economy toward a more prosperous future.

Political Reactions and Economic Implications

The political landscape is heavily influenced by the recent budget discussions, especially considering the differing opinions among party leaders. Sir Keir Starmer’s caution in addressing the budget leaks reflects the uncertainty surrounding the dissemination of budget details and its implications for economic confidence. Responses from leaders like Kemi Badenoch highlight the perceived impact of these leaks, emphasizing the need for accountability and the potential effects on policy direction.

As discussions evolve, the potential for policy shifts may significantly influence the economic situation, particularly as parties assess the reactions from constituents and stakeholders. The political discourse surrounding the budget is expected to shape the public’s perceptions of the economic strategies laid out, potentially impacting future elections as parties position themselves on how best to navigate the UK’s economic challenges.

Frequently Asked Questions

What is the UK economy forecast following Rachel Reeves’ Budget?

The UK economy forecast indicates a slower growth than earlier expectations. According to the Office for Budget Responsibility (OBR), GDP is projected to increase by 1.5% this year, which is a slight improvement from the previous forecast of 1%. However, growth forecasts for subsequent years, such as 2026 and beyond, have been downgraded.

How has Rachel Reeves’ autumn Budget impacted the UK economic growth outlook?

Rachel Reeves’ autumn Budget has resulted in a revised UK economic growth outlook, with forecasts downgraded for the years 2026 to 2029. While the immediate GDP growth is set at 1.5% for this year, the longer-term projections reflect a cautious view, emphasizing the need for sustainable economic strategies.

Are there any implications from the budget leaks investigation on the UK economy forecast?

The budget leaks investigation has raised concerns about transparency and trust, which could impact investor confidence in the UK economy. While the immediate economic forecast remains unchanged, the implications of these leaks may have longer-term effects on economic stability and growth.

What key changes in Chancellor’s economic plans were revealed in the UK economy forecast?

The Chancellor’s economic plans, as outlined in Rachel Reeves’ Budget, include significant tax changes that are expected to raise around £26 billion by the 2029-30 fiscal year. These plans incorporate freezing tax thresholds and adjustments to national insurance that could reshape the economic environment.

How does the OBR economic outlook affect projections for UK economic growth in the coming years?

The OBR economic outlook suggests a tempered forecast for UK economic growth, with revisions showing decreasing growth rates from previous estimates for the years 2026 through 2029. This ongoing assessment may affect fiscal policies and government spending strategies aimed at driving future growth.

What are some of the tax changes anticipated in Rachel Reeves’ Budget based on the UK economy forecast?

The UK economy forecast under Rachel Reeves’ Budget anticipates tax changes that include freezing personal tax thresholds, which will increase the number of taxpayers and generate about £8 billion for the Exchequer. Other adjustments include increased national insurance on pension contributions and higher tax rates on dividends.

What factors contribute to the UK economy’s projected slower growth rate according to the recent budget forecast?

Several factors contribute to the UK economy’s projected slower growth, including the downgrading of long-term GDP growth projections by the OBR and potential uncertainties linked to the recent budget leaks. Additionally, the raising of taxes and spending limits set in the Budget may influence economic activities.

How might the changes in income tax as outlined in the economic forecast affect UK households?

The changes in income tax from Rachel Reeves’ Budget, particularly the freeze on tax thresholds, are expected to create additional burdens for many households, leading to an increase in basic-rate and higher-rate taxpayers, which could influence disposable income and overall economic wellbeing.

| Key Point | Details |

|---|---|

| UK Economy Growth Forecast | Forecasted growth downgraded for the coming years; GDP expected to rise by 1.5% this year but lower than prior estimates. |

| Impact of Budget Leaks | Early release of key forecast information raises concerns; calls for accountability from political opponents. |

| Budget Tax Increases | Tax changes estimated to raise about £26 billion by 2029-30 with various measures including freezing tax thresholds. |

| NHS Improvements | Government promotes achievement of more NHS appointments, reducing waiting lists, and expanding children’s services. |

| National Debt Projections | Debt expected to rise from 95% of GDP now to 96.1% by the end of the decade. |

Summary

The UK economy forecast indicates a slowdown in growth compared to earlier expectations, presenting significant implications for fiscal policy and public services. With the economy set to grow by just 1.5% this year and revised downward for subsequent years, the government faces mounting pressure to address economic challenges while managing tax increases that could impact a wide demographic by 2029-30. The situation is compounded by premature budget disclosures prompting discussions about political accountability in the economic realm.