Listen to this article

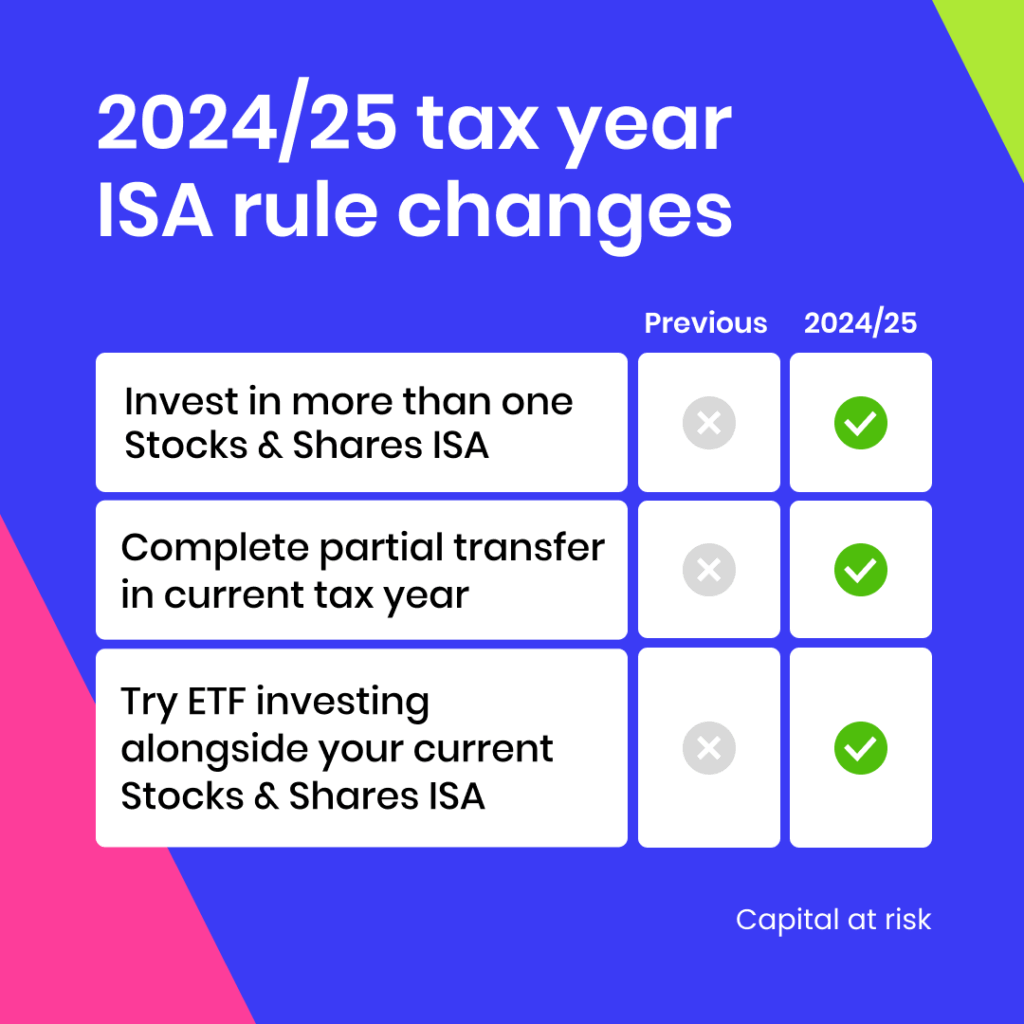

The recent proposed **Isa rules change** has sparked considerable debate among savers and investors alike. Chancellor Rachel Reeves is contemplating a reduction of the annual tax-free allowance in cash ISAs to £12,000, which would significantly impact how individuals manage their tax-free savings. This shift aims to redirect funds towards investment opportunities in stocks and shares ISAs, a move the government believes will invigorate the UK economy. ISAs, or Individual Savings Accounts, allow for tax-free growth and are essential financial tools, making understanding any alterations to their framework crucial for savvy savers. As the landscape of tax-free savings evolves, knowing the implications of UK budget changes could be vital for planning financial futures.

The recent adjustments to Individual Savings Accounts, known commonly as ISAs, signal a notable shift in the UK’s approach to personal finance. The Chancellor’s plan to alter the allowable contributions for cash ISAs directly affects the tax-free savings available to everyday investors. By incentivizing more individuals to explore investment through stocks and shares ISAs, the government seeks to mobilize private capital for economic growth. This potential overhaul reflects a broader trend in how citizens can effectively manage their savings and investments amidst changing financial regulations. Understanding this transition is key for anyone looking to navigate the varying rules governing tax-efficient accounts.

Understanding Individual Savings Accounts (ISAs)

An Individual Savings Account (ISA) serves as a government-endorsed vehicle for tax-free savings and investments, making it an essential financial tool for individuals in the UK. ISAs allow taxpayers to shield their savings from income tax and capital gains tax, which greatly enhances their appeal. Currently, the annual ISA allowance is set at £20,000, which can be allocated across various types of ISAs, including cash ISAs, stocks and shares ISAs, and innovative finance ISAs. This flexible model means that savers can tailor their accounts to meet their personal financial goals, whether it be immediate savings or long-term investment growth.

The funds held within an ISA do not automatically close at the end of the tax year, encouraging continuous investment and savings accumulation. As a mainstay of UK personal finance, ISAs have provided millions of savers with opportunities for tax-free growth since their inception in 1999. Ensuring you are aware of the contributions limits and tax advantages can help you make the most of your ISA investments, thereby enhancing your overall financial strategy.

The Impact of Potential ISA Rules Change

Recent reports indicate that the Treasury may soon implement significant changes to the ISA structure, specifically reducing the annual tax-free limit for cash ISAs to £12,000. This shift appears to be motivated by the government’s desire to redirect savings into more dynamic investment channels, such as stocks and shares ISAs. By making cash ISAs less appealing, the government hopes to persuade savers to invest their funds in equities, which could, in turn, catalyze growth in the UK economy.

This potential change has sparked a lively debate among personal finance experts and economic policymakers. Proponents of the change argue that cash ISAs, while inherently safe, often yield low returns due to the interest rate environment, leading to stagnation in personal wealth. By incentivizing shifts to stocks and shares ISAs, the government aims to unleash dormant savings that could drive economic expansion. However, critics caution that not everyone is comfortable with investment risks, and this move could leave many savers feeling vulnerable. Overall, these proposed ISA rules changes may reframe how individual saving strategies are approached.

Differences Between Cash ISAs and Stocks and Shares ISAs

Cash ISAs and stocks and shares ISAs represent two distinct avenues for UK savers looking to maximize their tax-free returns. A cash ISA operates much like a conventional savings account, where individuals deposit money and earn interest over time, all without incurring taxes. This simplicity and safety make cash ISAs an attractive option for conservative investors, particularly those who prioritize liquidity and security over potentially higher returns.

In stark contrast, stocks and shares ISAs involve investing in various assets such as shares, bonds, and funds. While these investments come with increased risk due to market fluctuations, they also offer the potential for greater returns over the long term, as any profits are also free from capital gains tax. Many financial advisors recommend diversification, meaning that incorporating both cash ISAs and stocks and shares ISAs into a financial strategy can provide a balance between safety and growth potential.

Other Types of ISAs Available

Beyond the traditional cash and stocks and shares ISAs, the UK offers several other types of ISAs that cater to varied financial goals and age groups. Junior ISAs, for example, are designed for under-18s to save and grow their funds tax-free until they reach adulthood. Parents can invest on behalf of their children, fostering financial literacy from a young age. Meanwhile, Lifetime ISAs (LISAs) stand out as a tailored product for those saving for their first house or retirement, with a government-funded bonus of 25% on annual contributions of up to £4,000.

Innovative Finance ISAs represent yet another option, allowing individuals to invest in peer-to-peer lending opportunities without the need for banking intermediaries. This type of ISA is particularly appealing to tech-savvy investors looking for alternatives to traditional savings routes. Overall, the array of ISA options available to UK residents enhances opportunities for tax-efficient savings and investments, potentially catering to a vast spectrum of financial lifestyles.

The Government’s Rationale for Encouraging Investing

The UK government has articulated a clear intention behind the proposed changes to ISA regulations: to catalyze personal investing among the populace. With reports indicating that a significant percentage of the population holds limited or no savings, the chancellor’s push towards SIPs aims to encourage individuals to unlock capital by investing it into the stock market, which could provide a boost to British companies and overall economic growth.

Promoting stocks and shares ISAs appeals to policymakers who recognize that there is an enormous potential for surplus cash simply sitting idle in cash ISAs. By motivating savers to allocate these funds into equity markets, the government believes that this shift could rejuvenate the economy and foster new job creation. By doing so, they hope to reinforce a culture of saving and investment that can sustain long-term financial growth for individuals and the nation.

Concerns About the Changes to ISA Regulations

While the government aims to stimulate investment, there are notable concerns regarding the potential cooling effect the changes to cash ISAs may have on overall savings behavior. Critics assert that diminishing the attractiveness of cash ISAs may lead to a substantial number of individuals choosing not to save at all, potentially resulting in even fewer people engaging in investments in stocks and shares ISAs. This apprehension stems from a fear that many consumers may feel overwhelmed by investment risks.

Furthermore, analysts have raised alarms about the impact on building societies and banks that rely on cash deposits for lending. A reduction in cash ISA popularity could ultimately lead to increased borrowing costs and potentially less financing available for mortgages or personal loans. Such consequences could undermine the perceived benefits of transitioning towards more aggressive investment strategies, highlighting a complex dynamic that policymakers must navigate in the wake of any ISA regulations change.

Guidance for Maximizing Your ISA Contributions

In light of potential ISA rule changes, it becomes increasingly crucial for savers to optimize their ISA contributions strategically. Individuals are encouraged to review their current financial situations and make informed choices about how to allocate their ISA allowances. With the annual limit potentially changing, being proactive in contributing the full amount available can help secure tax-free growth opportunities. For those considering a diversified approach, splitting contributions between cash ISAs and stocks and shares ISAs could capitalize on both immediate liquidity and long-term wealth growth.

Moreover, it’s essential to stay informed about one’s investing preferences and risk tolerance, particularly as market conditions fluctuate. Engaging with a financial advisor can provide tailored insights and ensure that savings align with overall financial goals. As the landscape of personal finance evolves, vigilance and adaptability will be key to ensuring optimal utilization of ISAs and long-term financial security.

Importance of Regularly Reviewing Your ISA Strategy

As the financial landscape changes, particularly with regards to ISAs, reviewing your saving and investment strategy becomes critical. Regular assessments of your ISA accounts can ensure you are maximizing your tax-free allowances and reallocating investments according to current market conditions. This practice not only aids in understanding the performance of your current investments but also allows for the adaptation of your strategy based on any new government regulations affecting ISAs.

Additionally, reviewing your ISA strategy encourages proactive engagement with your financial future. As individual circumstances evolve—such as changes in income, financial goals, or risk tolerance—updates to your ISA allocations can yield benefits that enhance your overall financial security. Taking time to analyze and adjust your ISA approach, especially in light of potential rule changes, will better support your aspirations for wealth accumulation in a tax-efficient manner.

Frequently Asked Questions

What are the potential implications of the Isa rules change on cash ISAs?

The Isa rules change could significantly impact cash ISAs by reducing the annual tax-free allowance from £20,000 to £12,000. This adjustment aims to motivate savers to convert their cash savings into investments like stocks and shares ISAs, thus potentially boosting economic growth by encouraging more significant investment in the market.

How will the Isa rules change affect tax-free savings?

With the Isa rules change proposing a lower tax-free allowance for cash ISAs, savers may find less incentive to keep large sums in these accounts. This could lead to a shift, whereby individuals may choose to invest in stocks and shares ISAs for potentially higher returns without the burden of income tax and capital gains tax.

What is the difference between cash ISAs and stocks and shares ISAs amidst the Isa rules change?

The main difference lies in their operation: cash ISAs are traditional savings accounts offering fixed interest rates without tax implications, while stocks and shares ISAs involve investment in equities, potentially yielding higher returns but also carrying higher risks. The Isa rules change may encourage more people to consider stocks and shares ISAs, shifting investments from cash accounts.

What types of ISAs will be influenced by the Isa rules change?

The Isa rules change will primarily influence cash ISAs, as the reduction in tax-free allowances is aimed at redirecting funds towards stocks and shares ISAs. However, it may also affect the appeal and growth of other types of ISAs, such as Lifetime ISAs and Innovative Finance ISAs, as savers reassess their investment strategies.

Why might the government implement the Isa rules change?

The government is likely implementing the Isa rules change to stimulate the economy by urging savers to invest in stocks and shares. This strategy seeks to utilize idle cash savings to promote long-term investment in businesses, aiming for sustainable economic growth while reducing reliance on low-interest cash ISAs.

How can investors adapt to the Isa rules change?

Investors can adapt to the Isa rules change by exploring stocks and shares ISAs that offer tax-free growth potential. They should consider re-evaluating their investment approach, possibly focusing on long-term strategies that prioritize higher returns and align with their financial goals, especially as cash ISAs become less favorable.

What feedback has been received regarding the Isa rules change proposals?

Feedback regarding the Isa rules change has been mixed. Supporters argue it could stimulate investment in the economy, while opponents caution it may discourage overall saving. Critics also highlight that individuals might face increased tax burdens on non-ISA accounts if they move away from cash ISAs entirely.

What is the maximum investment allowed in ISAs following the Isa rules change?

Following the Isa rules change, the maximum investment in cash ISAs would lower to £12,000 annually, compared to the current allowance of £20,000. Investors may need to strategize on how to best allocate their contributions between cash ISAs and other investment options like stocks and shares ISAs.

Will the Isa rules change affect Junior ISAs or Lifetime ISAs?

While the primary focus of the Isa rules change is on cash ISAs, there could be indirect effects on Junior ISAs and Lifetime ISAs as investors reassess their overall ISA strategy. However, specific changes to these accounts have not been highlighted in the proposed Isa rules change.

What should savers consider in light of the Isa rules change?

Savers should consider reviewing their current ISA portfolios in light of the Isa rules change. They may need to evaluate the benefits of transitioning to stocks and shares ISAs to maximize their tax-free investment potential, especially given the reduced attractiveness of cash ISAs due to the lower limit.

| Key Points | Details |

|---|---|

| What is an Isa? | An Individual Savings Account (Isa) is a tax-efficient savings or investment product available to UK residents. |

| Current Tax-Free Allowance | The current tax-free allowance for cash Isas is £20,000, set to be reduced to £12,000. |

| Types of Isas | Cash Isas, Stocks and Shares Isas, Junior Isas, Lifetime Isas (Lisas), and Innovative Finance Isas. |

| Difference between Cash Isas and Stocks and Shares Isas | Cash Isas earn tax-free interest. Stocks and Shares Isas invest in market assets, with returns protected from taxes but are riskier. |

| Reasons for Rule Changes | To encourage investments in stocks and shares, promoting UK economic growth and making better use of savings. |

| Concerns about the Changes | Critics argue the alterations may deter saving and increase borrowing costs, as banks rely on funds from cash Isas. |

Summary

The Isa rules change will significantly impact how individuals save and invest in the UK. Reducing the tax-free allowance for cash Isas intends to motivate savers to invest in stocks and shares, driving economic growth through increased investments. While the goal is to promote a healthier financial landscape, there are valid concerns that these changes may deter savings and affect borrowing costs negatively.