Listen to this article

The Help to Save scheme is a groundbreaking initiative designed to empower low-income individuals in the UK to build financial security. By offering a generous government bonus of 50p for every pound saved, this scheme makes it easier for those on universal credit to cultivate a savings habit. With plans to extend eligibility to an additional 1.5 million parents and caregivers starting in 2028, the scheme will become a permanent fixture in the landscape of government savings initiatives. As the Chancellor prepares to unveil these changes in the upcoming Budget, the Help to Save scheme stands out as a vital tool in providing savings incentives for low-income households. With potential ISA changes on the horizon, this program is more important than ever for all those looking to secure their financial future.

The Help to Save initiative is a valuable program aimed at assisting individuals with limited income in enhancing their financial resilience. This government-backed savings plan offers significant perks, including direct bonuses for those setting aside funds, specifically targeting universal credit recipients. As financial support expands to include more stakeholders, particularly parents and caregivers, this scheme reinforces a culture of saving within low-income communities. With anticipated modifications to Individual Savings Accounts (ISAs) in 2028, the role of savings schemes like Help to Save becomes increasingly critical for fostering long-term economic empowerment. By promoting a structured approach to saving, the initiative not only aids individuals in preparing for emergencies but also encourages responsible financial practices.

Understanding the Help to Save Scheme

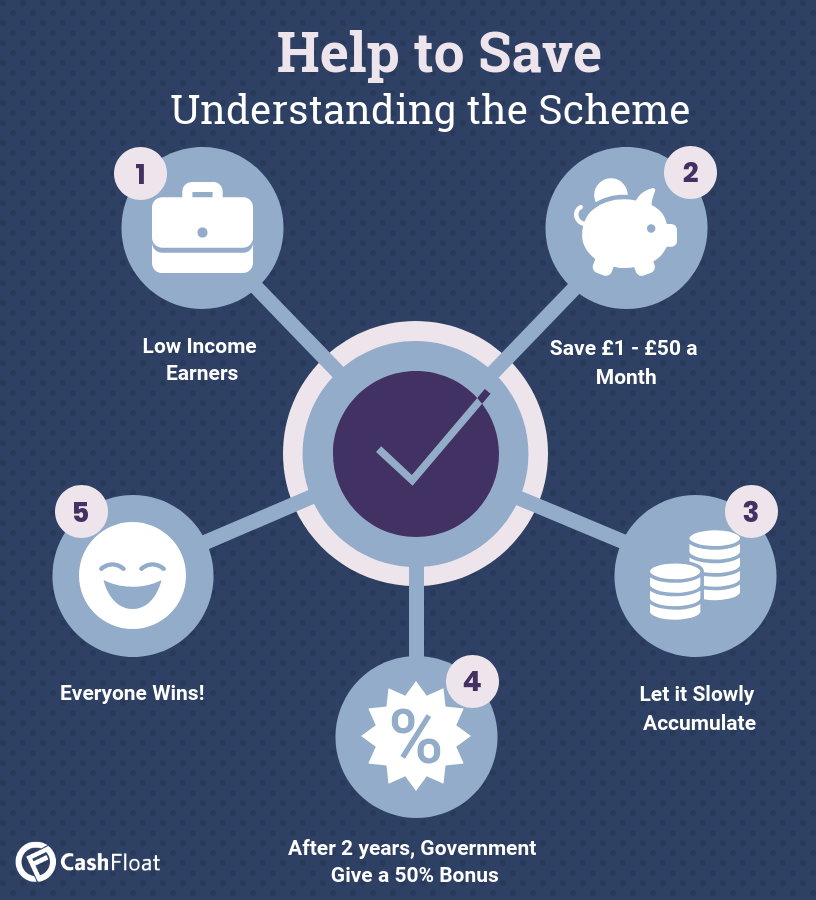

The Help to Save scheme has emerged as a significant initiative aimed at alleviating financial pressures for individuals on low incomes in the UK. By providing a government-backed bonus for savings, it not only encourages prudent financial behavior but also helps recipients better manage their financial situations. The scheme incentivizes individuals to save by offering a return of 50p for every pound saved over a specified period, making it an attractive option for those navigating the challenges of living on universal credit.

Those eligible for the Help to Save scheme can save up to £50 each month, allowing for a potential total accumulation of £2,400 over four years. The government’s contribution can amount to as much as £1,200, significantly enhancing the savings potential for low-income families. This structure is particularly beneficial for individuals who may face economic uncertainties, as it encourages the establishment of a savings habit while offering a financial cushion for emergencies.

Eligibility Criteria for Help to Save Scheme

To qualify for the Help to Save scheme, individuals must meet specific criteria, primarily centered around their income sources. Applicants must be current recipients of universal credit with a minimum monthly take-home pay of £1. This accessibility ensures that the scheme serves those who are in the most need of financial support. Furthermore, the upcoming expansion in 2028 will bring in an additional 1.5 million parents and caregivers, making the initiative even more inclusive.

The eligibility requirements are designed to foster inclusivity while motivating individuals to save. By targeting those receiving universal credit, the scheme acknowledges the unique financial struggles faced by low-income families. As the program evolves, it’s likely to support even more individuals, thereby contributing to broader financial security and stability among the most vulnerable demographics.

Benefits of the Help to Save Scheme for Low-Income Individuals

The Help to Save scheme stands out as a powerful financial tool for low-income individuals, primarily by mitigating financial anxiety associated with unexpected expenses. The unique structure of the program, which rewards savers with a generous government bonus, not only enhances their overall savings but also instills a sense of financial empowerment. This financial encouragement is essential for low-income households trying to build a safety net while juggling living costs and daily expenses.

Moreover, the program fosters a culture of saving among individuals who may traditionally find it challenging to set aside funds. The direct cash bonuses provided for consistent saving habits help individuals recognize the value of creating an emergency fund. With the Help to Save scheme, families can hope to improve their financial resilience over time, ensuring they are better prepared for financial emergencies or other unexpected circumstances.

Government Savings Scheme and Its Impact

The Help to Save scheme represents a broader governmental commitment to promote savings among lower-income households. As a government savings scheme, it underscores the importance of financial education and provides tangible incentives for individuals to save. The effectiveness of this initiative lies in its ability to address financial barriers that often dissuade low-income families from saving, allowing them to benefit from the system and secure their futures.

Further, the government’s strategy to make the Help to Save scheme permanent illustrates a long-term vision towards enhancing financial literacy and independence. The policy reinforces the idea that saving should be prioritized, particularly in economically fragile contexts where the stability of income is frequently in flux. By equipping low-income individuals with the means and motivation to save, the government aims to foster a financially stable populace that is less reliant on immediate financial assistance.

Changes to Cash ISAs and Their Relevance

With impending changes to Individual Savings Accounts (ISAs) anticipated in the upcoming Budget, it’s essential to consider how this will interact with initiatives like the Help to Save scheme. The reduction in the annual allowance for cash ISAs from £20,000 to £12,000 could impact how low-income individuals allocate their savings. The government’s intention behind this move is to stimulate investment in more varied financial products, but it raises concerns regarding access and feasibility for low-income savers.

These changes may lead individuals who currently benefit from cash ISAs to rethink their savings strategies, potentially diverting funds away from effective saving initiatives like Help to Save. As savings incentives for low-income families become less favorable, there runs the risk of decreased participation in such schemes. Understanding the implications of ISA changes alongside the Help to Save initiative is vital for ensuring that low-income families continue to see value in saving and are not deterred by regulatory alterations.

Expanding Access to Help to Save Scheme

The planned expansion of the Help to Save scheme in 2028 marks a significant step towards increasing financial accessibility for more families. By including an additional 1.5 million parents and caregivers, the government acknowledges the financial strains faced by those in caregiving roles and aims to offer additional support through savings incentives. This expansion is pivotal as it aligns with broader goals of inclusivity within financial services.

With more individuals eligible for the scheme, the potential to create a stronger cohort of savers increases. It helps set a precedence that savings should be a priority for everyone, regardless of income levels. Expanding access ensures that everyone has a chance to take advantage of the benefits that come from saving, further bridging gaps in financial literacy and stability across the nation.

Encouraging Financial Independence Through Saving

One of the overarching goals of the Help to Save scheme is to promote financial independence among low-income individuals. By providing substantial bonuses tied to saving activities, the scheme motivates participants to engage in proactive financial behavior that can help them escape cycles of debt and financial insecurity. The approach fosters valuable habits that can lead to long-term financial stability and reduce reliance on government support.

Cultivating a savings culture is crucial to empowering low-income families to envision a brighter financial future. With the Help to Save scheme, not only do individuals learn to prioritize saving, but they also reap the rewards of their efforts in tangible financial benefits. As they monitor their progress and bonuses, it reinforces the notion that saving money is not just a necessity, but a rewarding endeavor.

Navigating Future Financial Landscapes

As the financial landscape continues to evolve, initiatives like the Help to Save scheme serve as essential tools for low-income families to adapt and thrive. With potential changes on the horizon, it’s important for individuals to stay informed about savings options that best suit their needs. By providing guidance and awareness around available programs, families can make educated choices about their financial futures.

Looking ahead, the impact of policies such as the Help to Save scheme will be crucial in shaping the ability of individuals to save effectively amidst changing economic conditions. As the government carefully considers its approach to savings and investments, the ongoing evolution of this scheme reflects a commitment to financial education and accessibility for all, paving the way for a more financially literate society.

The Role of Government in Promoting Savings

The government plays a pivotal role in promoting savings through various initiatives and programs designed to assist low-income individuals in building financial stability. The Help to Save scheme exemplifies how government policies can provide the necessary incentives for people to start saving. By offering a government-backed bonus for savings, the scheme effectively encourages behavior that many may not consider viable due to financial constraints.

Through support initiatives like this, the government aims to foster a culture of saving, particularly focused on those who seek financial independence. An essential aspect of this initiative involves education and outreach, ensuring that eligible individuals are aware of such opportunities and understand the benefits they offer. By actively promoting these savings schemes, the government strengthens its commitment to supporting lower-income families in their financial journeys.

Frequently Asked Questions

What is the Help to Save scheme in the UK?

The Help to Save scheme is a UK government initiative designed to encourage low-income individuals, particularly those on universal credit, to save money. It offers savers a significant government bonus of 50p for every pound saved, helping to foster a savings habit.

Who is eligible for the Help to Save scheme?

To be eligible for the Help to Save scheme, individuals must be receiving universal credit and have a take-home pay of £1 or more in their latest monthly assessment period. This includes an anticipated expansion in 2028 that will allow an additional 1.5 million parents and caregivers to participate.

How does the Help to Save scheme work?

Under the Help to Save scheme, participants can save up to £50 each month, totaling £2,400 over four years. The government rewards savers with bonuses after two and four years, up to a maximum of £1,200, which is 50% of the highest amount saved during those periods.

What changes are expected for the Help to Save scheme by 2028?

By 2028, the Help to Save scheme will expand to include an additional 1.5 million low-income individuals who are universal credit claimants with children in education or caregivers providing substantial care to disabled individuals, thus increasing the reach of this government savings scheme.

How do savings incentives in the Help to Save scheme benefit low-income individuals?

The savings incentives provided by the Help to Save scheme help low-income individuals build a financial safety net. The scheme encourages regular saving habits through significant government bonuses, making it easier for participants to save for emergencies and support their financial well-being.

What is the impact of ISA changes on the Help to Save scheme?

Upcoming ISA changes, which may reduce the tax-free annual saving limit from £20,000 to £12,000, may push individuals towards the Help to Save scheme. As cash ISAs become less attractive due to lower tax incentives, savers could find the bonuses offered by the Help to Save scheme more beneficial.

When does the Help to Save scheme end?

The Help to Save scheme, originally set to end in 2027, will now be made permanent. This decision reflects the government’s commitment to supporting low-income individuals in their saving efforts through this valuable government savings scheme.

Can I open more than one Help to Save account?

No, individuals are only allowed to open one Help to Save account. The account will remain active for four years, during which savers can accumulate bonus money from the government based on their savings.

What is the maximum bonus I can receive from the Help to Save scheme?

The maximum bonus you can receive from the Help to Save scheme is £1,200. This bonus is earned through saving £2,400 over the four-year period, with the government adding 50p for every pound saved.

Are there any limitations on withdrawals from a Help to Save account?

While you can withdraw money from your Help to Save account, it is crucial to manage your withdrawals carefully. Frequent withdrawals could affect your total savings and, consequently, the bonuses you receive at the end of the saving periods.

| Key Points | Details |

|---|---|

| Help to Save Scheme Expansion | The scheme will expand to include 1.5 million additional parents and caregivers starting in 2028. |

| Current Eligibility | Approximately three million individuals on universal credit currently qualify for the scheme. |

| Government Bonus Structure | For every pound saved, the government adds 50p after two and four years, with a maximum bonus of £1,200. |

| Monthly Savings Limit | Savers can deposit up to £50 each month, totaling £2,400 over four years if the maximum is saved. |

| Account Duration | The account remains active for four years; no new accounts can be opened afterwards. |

| ISA Changes | The maximum tax-free savings allowance for cash ISAs is expected to decrease from £20,000 to £12,000. |

| Industry Concerns | Experts worry that reducing the ISA limit might deter savings and create unnecessary complexity. |

Summary

The Help to Save scheme aims to stimulate savings among low-income individuals by providing substantial government bonuses. With an expansion planned for 2028, the initiative will benefit additional families and caregivers, promoting financial stability and encouraging a culture of saving. By allowing eligible participants to save a fixed amount monthly while receiving a government bonus after two and four years, more individuals will be empowered to set aside funds for emergencies and future needs.