Listen to this article

Newham council tax collection issues have come to the forefront as the council grapples with an alarming shortfall of nearly £31 million in uncollected council tax, which has persisted since 2018. This financial hiccup is particularly concerning as Newham Council strives to balance its budget amidst looming cuts amounting to £53 million. With a tax collection rate that ranks the lowest among all London boroughs, the challenges are mounting, particularly when the council considers a substantial tax increase of 8.99% for the upcoming year. Interim chief executive Paul Martin acknowledged that the pandemic disrupted collection efforts, signaling a critical need for better financial management to ensure essential services are funded adequately. As residents seek clarity, the repercussions of budgetary constraints and council tax collection failures continue to ripple through the community, demanding immediate attention and resolution.

The persistent challenges surrounding local taxation in Newham, particularly the ineffective collection of council rates, have sparked significant concerns among residents and officials alike. Struggling with a staggering amount of uncollected council tax, the borough is now at a crossroads, facing potential budget cuts that threaten vital community services. As Newham deliberates on how best to address these fiscal shortfalls, including considering options to increase tax rates, the implications for local governance and service provision are profound. Councillors and financial managers emphasize the importance of robust financial oversight and improved collection strategies to avoid further complications. This ongoing situation not only highlights issues with Newham’s revenue collection practices but also reflects broader challenges faced by urban councils in London managing conflicting demands amidst budgetary pressures.

Newham Council Tax Collection Issues

Newham Council has been facing significant challenges in its council tax collection efforts, with nearly £31 million left uncollected since 2018. This alarming figure highlights a neglect in financial management that could lead to severe budgetary implications for the local government. The statistics reveal that Newham Council has one of the lowest tax collection rates in London, which not only affects their ability to provide essential services but also places additional financial strain on residents who do pay their dues.

The council’s interim chief executive, Paul Martin, acknowledged this shortfall, noting that the disruptions caused by Covid-19 led to a lapse in tax collection procedures. As they work toward a balanced budget amidst discussions of raising council tax by 8.99% and implementing spending cuts, it is clear that the council must develop more effective strategies for council tax collection. Improved financial management and rigorous follow-ups on outstanding payments will be crucial in recouping these losses.

Impact of Newham Budget Cuts on Services

As Newham Council grapples with its budgetary constraints, significant cuts in public services are being considered. After admitting to a council tax collection deficit of £31 million, the council is now in search of £53 million to balance its budget for the forthcoming year. This has led to proposals that could significantly affect essential community services, such as reducing waste collection frequency and potentially closing youth centers. Such cuts may disproportionately impact low-income households, who rely on these services.

The implications of these budget cuts underscore a broader trend within London councils, where financial management is increasingly strained. Councillor Carleene Lee-Phakoe emphasized the vital role council tax plays in funding crucial services. If residents continue to face diminished support from their local council due to budget cuts, the overall quality of life in Newham may suffer, exacerbating existing socioeconomic challenges.

Challenges of Council Tax Collection in London

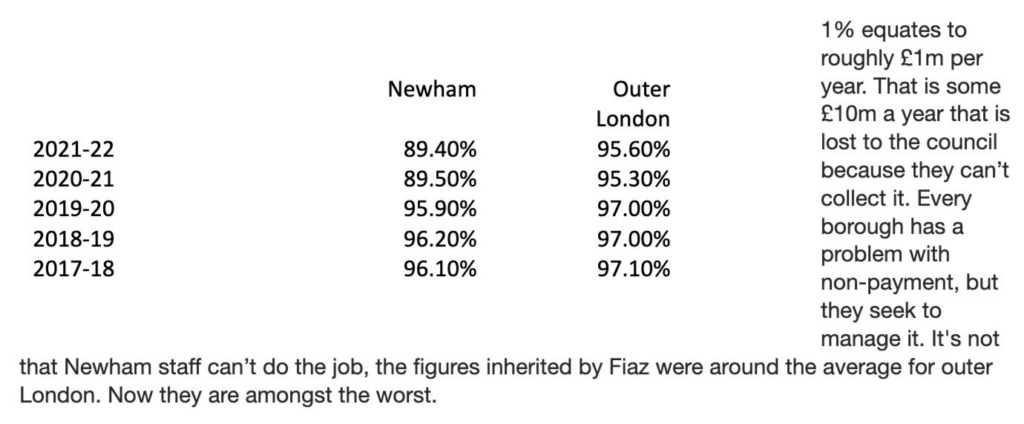

The struggles faced by Newham Council in collecting council tax reflect a wider trend across London boroughs. With the average collection rate in London at 94.9%, Newham’s rate of 89.9% indicates serious inefficiencies and highlights the difficulty many local councils face in managing their finances, especially post-pandemic. The statistics reveal that uncollected council tax is not just a Newham issue but a significant concern that could hinder overall municipal stability.

Moreover, the increased volume of calls to the council’s support center indicates that while the council has ramped up its efforts in tax collection, it has inadvertently led to frustrations among residents. As many received incorrect notices of arrears, this highlights the need for better communication and operational effectiveness within council management. Improving these processes will be critical in restoring resident trust and improving tax collection rates.

Financial Management Challenges Post-Pandemic

The financial management challenges that Newham Council faces today can largely be attributed to the effects of the Covid-19 pandemic. The crisis forced many local governments to reassess their budgets, highlighting vulnerabilities in their financial systems. Newham’s admission to taking its eye off the ball is indicative of broader issues seen across numerous councils, where the focus on service delivery often overshadowed revenue collection efforts.

As Newham continues to experience the fallout from its inadequate council tax collection methods, prioritizing financial vigilance and proactive management will be essential. Councils must develop strategic plans to recover uncollected taxes while maintaining high service standards for their residents. This way, local governments can navigate the post-pandemic recovery phase without sacrificing the quality of essential services.

Improving Council Tax Collection Efforts in Newham

In response to the ongoing council tax collection issues, Newham Council has acknowledged the need to enhance its recovery strategies. Recently implemented measures, such as proactive outreach via letters and texts, have begun to show that sustained efforts can lead to improvements in collection rates. Despite these fluctuations in demand, especially amid increasing call volumes to the council’s support center, the focus remains on encouraging timely payments from residents who owe council tax.

As councils look for innovative methods to improve their financial management, Newham’s experience could serve as a crucial learning point. By leveraging technology and streamlining communication with residents, Newham can significantly bolster its collection efficiency. Achieving a council tax collection rate closer to the London average will not only improve revenue flows but also enhance public services funded by these taxes.

Crisis Management and Recovery Plans

The current crisis surrounding Newham Council’s tax collection reveals significant gaps in crisis management practices. As officials work to uncover lost revenue and balance the budget, there is a pressing need for transparent recovery plans. These plans must prioritize accountability and involve the community in discussions about budget cuts and service reductions. This collaborative approach can foster trust and support among residents, especially in times of financial strain.

Furthermore, effective crisis management must include planned contingencies—offset strategies to mitigate the impacts of future shocks, like another pandemic or economic downturn. By preparing for unforeseen challenges, Newham Council can stabilize its finances and enhance public confidence in its governance strategies. Building a resilient system will be vital for both current recovery efforts and sustainable future prosperity.

Community Response to Council Tax Increases

Residents of Newham are acutely aware of the council’s potential plans to raise council tax by nearly 9 percent. While council members argue that this increase is vital for maintaining essential services, community feedback has been mixed. Many residents are already struggling financially and may find it difficult to absorb the additional burden, leading to anxiety and unrest among the population.

Understanding community sentiment is crucial for the council as it seeks approval for the proposed tax hike. Conducting structured consultations with residents and communicating the rationale behind the tax increase could potentially alleviate concerns. The council must ensure that any funds collected are allocated transparently to enhance public services, demonstrating a commitment to community welfare and financial responsibility.

The Role of Technology in Council Tax Collection

As Newham Council seeks to enhance its council tax collection rate, adopting technology could play a pivotal role in modernizing and streamlining processes. By implementing digital platforms for residents to access their tax information, make payments, and communicate with council staff, efficiency may be greatly improved. Automated systems can send reminders, track payments, and provide tailored support to ensure residents are informed about their obligations.

Additionally, using data analytics can help identify patterns in non-payment, allowing for more targeted approaches to collection. As council tax collection strategies evolve, technology stands out as a powerful ally in improving recovery rates while reducing the administrative burdens often faced by council staff. This innovative approach could be a game changer in restoring Newham’s financial health and enhancing its reputation among London boroughs.

Long-Term Strategies for Sustainable Financial Management

To navigate current challenges and prevent future council tax collection issues, Newham Council must develop long-term strategies aimed at sustainable financial management. This includes comprehensive fiscal policy reviews and community integration to promote collective responsibility for municipal services. Understanding community needs and fostering partnerships can lead to better service delivery while aiding in the quest for financial stability.

Moreover, councils must be adaptable in their budgeting processes to account for unexpected external factors, such as economic downturns or public health crises. By diversifying revenue streams and investing in local initiatives, Newham could create a more resilient financial landscape. Sustainable practices not only enhance fiscal health but also strengthen community ties, ensuring that residents feel invested in their local government’s success.

Frequently Asked Questions

What are the recent issues regarding Newham council tax collection?

Newham Council has failed to collect approximately £31 million in council tax since 2018, ranking the lowest in tax collection rates among London boroughs with a 2024/25 collection rate of just 89.9 percent compared to the London average of 94.9 percent. This issue stems from insufficient management and a lapse in proactive collection efforts, exacerbated by the pandemic.

How is Newham council addressing the uncollected council tax issue?

To address the uncollected council tax issue, Newham Council has implemented measures such as sending letters and text reminders to residents with outstanding balances. They’ve also increased staff in their call center to better manage the influx of inquiries from frustrated residents, aiming for a collection target of 94 percent by March.

Why is Newham council considering raising council tax?

Newham Council is considering raising council tax by nearly 9 percent to help bridge a £53 million budget gap for the upcoming year. The council has been seeking ways to fund essential services that residents rely on amidst financial difficulties, highlighted by the significant amount of uncollected council tax.

What impact have Newham budget cuts had on council tax collection efforts?

Newham budget cuts have strained financial resources, making effective council tax collection more challenging. As services face reductions, the council’s financial management efforts have had to adapt, which in turn affects their ability to pursue uncollected council tax vigorously.

How can residents report issues with Newham council tax arrears notifications?

Residents who receive incorrect arrears notifications from Newham Council should promptly contact the council’s call center. Given the spike in call volumes, patience may be required, but additional staff have been allocated to handle inquiries more efficiently.

What are the broader implications of Newham council tax collection issues on local services?

The ongoing Newham council tax collection issues directly impact the funding for local services. With a significant portion of council tax uncollected, it jeopardizes the council’s ability to offer essential services, leading to potential service cuts that affect residents’ daily lives.

How does Newham’s council tax collection performance compare to other councils in London?

Newham’s council tax collection performance is notably low, with a collection rate of 89.9 percent for 2024/25, making it the worst in London. This is a stark contrast to the average collection rate of 94.9 percent across the capital, indicating a pressing need for increased financial management and collection strategies.

| Key Point | Details |

|---|---|

| Uncollected Council Tax | Newham has failed to collect £31 million in council tax since 2018. |

| Budget Challenges | The council faces a £53 million shortfall while considering a potential council tax increase of nearly 9%. |

| Collection Rate | Newham’s tax collection rate for 2024/25 is the lowest in London at 89.9%, compared to the London average of 94.9%. |

| Impacts of COVID-19 | The pandemic caused disruptions leading to reduced tax collection efforts, as admitted by interim chief executive Paul Martin. |

| Council’s Response | Efforts to improve collection included sending reminders to residents, but resulted in higher call volumes at the council’s contact center. |

| Community Services Funding | Council tax funds essential local services, which are at risk due to funding shortfalls. |

Summary

Newham council tax collection issues have led to a significant impact on the local budget and service provision. With £31 million uncollected since 2018 and the council’s collection rate lagging behind other London boroughs, Newham faces financial challenges that threaten essential services. The interim leadership acknowledges the detrimental effect of the COVID-19 pandemic on collection efforts and is attempting to rectify the situation. However, increased demands on council resources and community frustrations continue to highlight the importance of effective taxation and resource management in ensuring that local needs are adequately met.