Listen to this article

The two-child benefit cap is a crucial aspect of the UK’s welfare system that impacts numerous families across the nation. Introduced to limit claims on universal credit and tax credits, this policy restricts additional benefits for families with more than two children, especially those born after April 6, 2017. Proponents argue that the cap helps maintain fairness in the welfare system by aligning benefits with the financial choices of working families. However, critics highlight that this limit contributes significantly to child poverty, denying support to approximately 1.6 million children in larger families. As discussions around potential reforms in the Budget intensify, understanding the implications of the two-child benefit cap remains vital for evaluating its effectiveness and fairness in the current socio-economic climate.

Often referred to as the two-child limit, this policy has stirred considerable debate among policymakers and advocacy groups. Essentially, it represents a cap on the benefits available to families under the universal credit and tax credits systems, affecting those with three or more children born after a certain date. This contentious regulation is viewed as a way to impose a spending threshold on government assistance, but it also raises concerns about its role in perpetuating child poverty. With reports suggesting that lifting this restriction could alleviate financial strain for many households, the discussion surrounding the policy’s future continues to evolve. As families navigate the complexities of these benefits, the broader implications of the current benefit limit on child well-being and socio-economic equality remain critically important.

Understanding the Two-Child Benefit Cap

The two-child benefit cap, implemented in 2017, limits the amount of financial assistance available to families with more than two children. Under this policy, parents can only claim universal credit or tax credits for their first two children, leaving many with financial strain when they welcome a third or subsequent child into their family. This limitation has affected approximately 1.6 million children in the UK, hindering their access to essential benefits that could alleviate family poverty. The introduction of this cap has sparked widespread discussion about its fairness and its implications for child poverty.

The primary aim of the two-child policy was to encourage families to make financial choices similar to those made by working families, but it has also led to significant criticism. Families affected by the cap may feel unfairly penalized for their decisions, particularly as the cost of living continues to rise. Many advocates argue that this policy should be reassessed, considering the financial challenges faced by low-income families who often find themselves unable to make ends meet.

Impact of the Two-Child Policy on Families

The two-child benefit cap has profound implications for families with larger households, essentially denying them access to crucial financial support. Families with three or more children born after April 6, 2017, have found themselves navigating a complex web of financial limitations. For instance, a family which could have received approximately £4,400 in benefits can now face significant hardships, particularly in times of rising costs. This financial burden can lead to greater vulnerability among low-income families as they struggle to provide for their children’s needs.

Moreover, the emotional and psychological reactions to the two-child policy cannot be overlooked. Many families report feelings of stress and anxiety associated with their financial situation. The pressure to manage without adequate support can exacerbate issues of child poverty and social exclusion. Critics, including various charities, argue that lifting or adjusting this cap could significantly reduce the number of children living in poverty, allowing families to invest in their children’s futures more securely.

Criticism and Support of the Benefits Cap

The two-child benefit cap has attracted considerable criticism from various advocacy groups and political figures. More than 100 charities have signed petitions and written to government officials urging the scrapping of the cap, as they argue it leads to increased child poverty rates. These organizations contend that financial assistance should not be limited based on the number of children a family chooses to have, especially when the impacts of poverty are so widespread. Many backbench Labour MPs have proposed revising or removing the cap, asserting that this policy does not reflect the moral obligation to support families in need.

Supporters of the two-child cap cite fairness in the welfare system as a primary justification. They argue that the cap encourages families to make responsible financial choices, similar to those made by families who rely solely on their incomes from employment. This viewpoint, however, often clashes with the realities many families face, where circumstances beyond their control may require them to have more children. The ongoing debate continues to center around moral, financial, and social implications, reflecting a divide in public opinion regarding welfare policy.

Potential Changes to Benefit Policies

The Chancellor of the Exchequer has suggested that changes may be on the horizon regarding the two-child benefit cap, acknowledging the criticism that has arisen from various sectors of society. These potential changes could include adjustments to universal credit or tax credits for larger families, allowing for partial payments or a different structure based on the number of children in a household. Any modification to the policy could potentially reshape the landscape of family welfare support significantly.

If the two-child limit is amended, it may not only benefit those directly impacted but could also stimulate broader discussions about child poverty reduction strategies in the UK. The government could explore options that allow families to receive lower-level financial assistance for additional children, ensuring that no child is left without support, regardless of family size. By adopting a more flexible approach, the Chancellor could alleviate pressures on families, promote financial stability, and address the concerns raised by advocates fighting against child poverty.

Understanding Universal Credit in Relation to the Cap

Universal credit is a comprehensive benefit intended to support low-income individuals and families, replacing multiple older benefits with a single monthly payment. However, under the two-child benefit cap, families can only receive this credit for two children born after the specified date. This creates a disparity where larger families may find it increasingly difficult to manage day-to-day expenses, which is particularly concerning given the current economic climate.

The implications of such a system can be far-reaching, contributing to higher rates of child poverty. The realm of universal credit is complex, and many families may not fully understand their entitlements under the current policy. There is an urgent need for enhanced communication and guidance to ensure families are aware of what they can claim, and how eventual changes to the benefit system might alter their financial stability.

Exploring Tax Credits and Their Role

Tax credits have historically been a crucial component of financial support for low-income families, providing additional assistance that can be used for various expenses related to raising children. However, with the introduction of the two-child benefit cap, families may find themselves excluded from receiving tax credits once they exceed the limit on the number of children. This exclusion not only exacerbates financial difficulties but also places an emotional burden on families who may already be struggling.

In light of these challenges, there are calls for reconsideration of how tax credits operate within the framework of the two-child policy. Advocates suggest revisiting the parameters of tax credit eligibility to accommodate larger families, emphasizing that all children deserve support regardless of family size. Addressing these concerns can lead to a more equitable welfare framework that acknowledges the complexities of modern family life.

Examining Child Poverty Related to the Benefit Cap

The relationship between the two-child benefit cap and child poverty is a critical area of focus for policymakers and advocacy groups alike. Many studies indicate that children from larger families are disproportionately affected by poverty due to the limitations placed on available financial support. Parents who find themselves without necessary benefits can liken their situation to being trapped in a cycle of poverty, which can have lasting impacts on children’s education and future prospects.

Understanding how the benefit cap contributes to child poverty requires a comprehensive look at family dynamics and socioeconomic factors. With approximately 3.6 billion pounds expected to be saved by the Treasury due to the cap, many argue that these funds could be better utilized by supporting families and creating opportunities for economic advancement rather than perpetuating cycles of disadvantage that affect innocent children.

Government Responses and Future Directions

In response to increasing pressure from charities and the general public, government officials must navigate the challenging landscape of welfare reform concerning the two-child benefit cap. Discussions surrounding potential reform are gaining momentum, with proposals focusing on either a complete overhaul of the existing policy or incremental changes that would better accommodate large families while considering budgetary constraints. Understanding the potential for legislative change can empower advocates to engage in constructive dialogue with policymakers.

Future directions regarding the two-child benefit cap will likely involve a thorough analysis of existing data, consultations with families affected by the cap, and assessments of the potential economic impact of any changes. Developing a framework that recognizes the realities faced by larger families in today’s economy will be essential in crafting effective policies that promote child welfare and support families in their efforts to provide for their children.

Frequently Asked Questions

What is the two-child benefit cap and how does it affect families?

The two-child benefit cap restricts parents from receiving universal credit and tax credits for any children beyond the first two, affecting families whose third or subsequent children were born after April 6, 2017. This policy impacts approximately 1.6 million children in larger families, potentially costing them over £4,400 in benefits annually, contributing to increased child poverty.

How did the introduction of the two-child benefit cap change family benefit entitlements?

Introduced by former Chancellor George Osborne, the two-child benefit cap limits financial support under universal credit and tax credits to the first two children. Families with additional children born after April 6, 2017, do not receive these means-tested benefits, which has resulted in significant financial strain for affected households.

Does the two-child benefit cap impact child benefit payments?

No, the two-child benefit cap specifically applies to universal credit and tax credits, not child benefit. This common misconception arises from the term ‘benefit cap.’ Families still receive full child benefit regardless of the number of children.

What exceptions exist to the two-child benefit cap policy?

There are several exceptions to the two-child benefit cap. Parents can claim for additional children if they are twins or triplets following the first child or in cases of children born from rape or coercive relationships. Additional payments may also be granted for adopted children or those in your care.

What criticisms have been raised regarding the two-child benefit cap?

The two-child benefit cap has faced criticism from over 100 charities and various MPs who argue it exacerbates child poverty. Critics claim that removing the cap could lift hundreds of thousands of children out of poverty, although this would create financial challenges for the Treasury, potentially necessitating tax increases or cuts elsewhere.

What potential changes to the two-child benefit cap might be considered in government budgets?

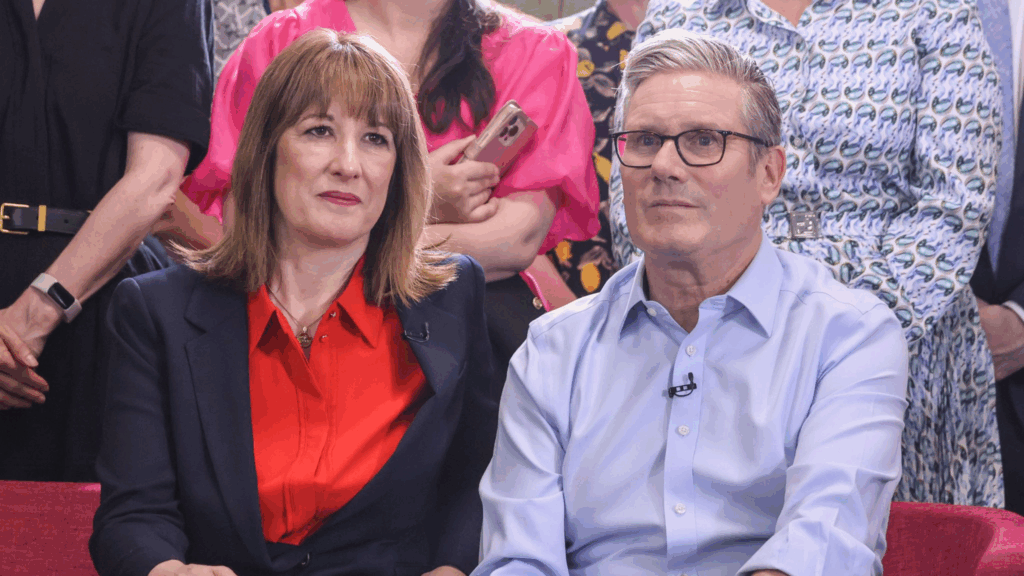

Chancellor Rachel Reeves indicated a willingness to reconsider the two-child benefit cap, suggesting options like allowing some benefit for additional children at a reduced rate or offering partial payments. These changes would aim to lessen the financial burden on larger families while balancing governmental savings.

| Key Points | Details |

|---|---|

| What is the two-child benefit cap? | A policy restricting universal credit or tax credits for families to only the first two children born after April 6, 2017. |

| Who does it affect? | Approximately 1.6 million children from larger families are impacted, losing out on average benefits of £4,400 per family per year. |

| Misconception clarified | The cap does not affect child benefit payments, only universal credit and tax credits. |

| How does it work? | Families with a third child born after the cap introduction do not receive additional benefits; exceptions exist for multiple births and children born from specific circumstances. |

| Criticism of the cap | Over 100 charities and Labour MPs argue for the cap’s removal, citing it exacerbates child poverty. |

| Potential changes in the Budget | Chancellor hinted at changes, possibly providing benefits for larger families at a reduced level or offering partial payments. |

Summary

The two-child benefit cap is a significant policy affecting low-income families by limiting financial support to only the first two children. Introduced by Chancellor George Osborne, the cap excludes third or subsequent children born after April 6, 2017, impacting 1.6 million children. Although criticized for contributing to child poverty, the policy raises substantial savings for the Treasury. As discussions around potential changes arise, it remains a contentious topic in the political landscape, with advocates urging for reforms that could alleviate financial strain for larger families.