Listen to this article

UK government borrowing costs are currently under intense scrutiny following the chancellor’s controversial decision to forgo an increase in income tax rates. This pivotal move has resulted in a significant spike in the yield on 10-year government bonds, jumping from 5.44% to 5.56% as financial markets reacted to the implications for the nation’s Budget deficit and overall fiscal health. Analysts are concerned about how the government can navigate its spending commitments without raising taxes, especially in light of the Office for Budget Responsibility (OBR) forecasts that suggest a reduced shortfall in public finances. Furthermore, the decision has been met with mixed reactions, as reducing National Insurance could offer some relief but might also instigate further borrowing needs. As the Chancellor prepares for the upcoming Budget, the dynamics of UK government borrowing costs will remain a focal point for investors and policymakers alike.

The financial landscape surrounding the costs associated with government borrowing in the UK is currently facing a significant shift, driven by the chancellor’s recent tax policy decisions. With the yield on long-term UK government bonds experiencing a notable rise, concerns about the Budget deficit and fiscal sustainability come to the forefront. The chancellor’s decision not to raise income tax, while simultaneously proposing a cut to National Insurance, raises questions on how the government plans to fulfill its financial obligations. Investors are keeping a close eye on the projections from the Office for Budget Responsibility (OBR) as they adjust their forecasts amid these developments. As the upcoming Budget approaches, the implications of these fiscal choices will undoubtedly influence market confidence and the broader economic outlook.

Impact of UK Government Borrowing Costs on Financial Markets

The recent increase in UK government borrowing costs is a critical indicator of market sentiment and economic confidence. Following the Chancellor’s decision against raising income tax rates, yields on 10-year government bonds have surged, reaching 5.56%. This uptick signals concerns among investors regarding the government’s ability to manage its responsibilities without implementing higher taxes. As bond yields rise, the cost of borrowing escalates, which can impact public spending and investment across various sectors.

Market analysts are closely monitoring these developments, as they foreshadow potential volatility. When investors perceive uncertainty about government fiscal strategies, particularly in relation to the Budget deficit, they may react by demanding higher returns on bonds. This cycle can exacerbate the financial pressures on the government, affecting future spending decisions and potentially leading to cuts in services or increased taxation to cover the growing costs.

Chancellor’s Income Tax Decision and Its Economic Ramifications

Chancellor Rachel Reeves’ pivotal decision not to increase income tax has sparked a wave of critical analysis regarding its implications for the UK’s overall economic health. While opting against the proposed income tax hike aligned with the government’s manifesto promises, it also raises concerns about how the government plans to navigate its Budget deficit, which stands at approximately £20 billion. The analyses provided by the Office for Budget Responsibility (OBR) suggest an optimistic outlook based on improved productivity forecasts; however, the reality of fiscal shortfalls remains integral to future planning.

This decision has not only affected government borrowing costs but also shifted investor expectations about the sustainability of public finances. Financial experts highlight that the government may soon face difficult choices regarding the implementation of alternative tax measures or cuts in spending, particularly if further deterioration of economic conditions occurs. Maintaining fiscal credibility in the eyes of investors will be essential to avoid spiraling borrowing costs and the associated risks of market instability.

Budget Deficit Forecasts and the Chancellor’s Strategy

As the government grapples with a significant Budget deficit, the OBR’s forecasts play a crucial role in shaping Chancellor Reeves’ strategy. With the anticipated shortfall reduced from £30 billion to around £20 billion, there is a renewed optimism regarding fiscal health. However, sustained economic challenges, including the need for increased public spending and falling productivity in some sectors, complicate how the government plans to bridge this gap moving forward.

Experts have pointed out that failing to address the Budget deficit decisively could result in long-term economic consequences, including increased borrowing costs and diminished confidence among investors. The Chancellor must navigate these challenges carefully, balancing the need for fiscal responsibility with the demands of the electorate and the political landscape that complicates any move towards tax increases.

National Insurance Cuts: A Statistical Analysis

The Chancellor’s proposed cut to National Insurance, positioned against the backdrop of income tax discussions, represents a significant alteration in fiscal policy that could have widespread implications. By potentially reducing National Insurance contributions while rejecting a concurrent income tax hike, the government aims to alleviate some burdens on individuals and businesses alike. However, the feasibility of this strategy hinges on the government’s ability to accurately assess its fiscal landscape and ensure that necessary revenue streams remain intact.

Statistical analyses suggest that such tax alterations may generate mixed responses among the public. While immediate relief might attract support, persistence in managing the Budget deficit remains critical. If revenues continue to falter as predicted, maintaining a sustainable fiscal trajectory may necessitate unpalatable future decisions, potentially eroding public trust in the government’s long-term economic strategies.

The Role of OBR Forecasts in Shaping Fiscal Policies

The Office for Budget Responsibility (OBR) forecasts play a pivotal role in the formation of UK fiscal policies, as they provide critical insights into economic performance and trend projections. The Chancellor’s reliance on these forecasts can be seen as both a guiding force and a potential risk. If OBR predictions prove overly optimistic, the government could find itself in a precarious position, facing unanticipated fiscal challenges that may not align with public examination and expectations.

Moreover, the dynamic nature of OBR forecasts necessitates ongoing adjustments to fiscal policies, which can leave revenues unpredictable. The Chancellor must remain responsive to these changes to ensure confidence in policymaking, especially in an environment marked by economic uncertainty and rising borrowing costs. The continuous interaction between OBR estimates and real economic outcomes will inform the government’s ability to effectively manage its fiscal strategy.

Market Reactions to Chancellor’s Fiscal Decisions

Market reactions to the Chancellor’s fiscal decisions, especially those concerning income tax and borrowing costs, have proven to be significant barometers of economic sentiment in the UK. After the announcement regarding the abandonment of an income tax rise, market volatility surged, reflecting investor uncertainty over the government’s ability to manage its Budget deficit effectively. Financial institutions reacted swiftly, raising borrowing costs, which could curtail public projects and essential services.

Additionally, the reaction of gilt markets demonstrates how closely linked investor confidence is to government fiscal policies. As analysts anticipate the impact of potential future deficit management strategies, understanding market perceptions becomes increasingly crucial. In times of fiscal tightrope walking, maintaining stable financial conditions while instilling confidence in government decisions is paramount to sustain economic growth.

Future Tax Considerations in the Budget

As speculation builds around possible tax modifications in the UK’s autumn Budget, analysts are weighing the implications of the Chancellor’s decision not to increase income taxes against the need for fiscal sustainability. This annual fiscal event presents an opportunity for the government to recalibrate its tax policies, particularly in light of feedback from the OBR and market conditions. A refusal to consider other tax options, such as VAT or capital gains tax adjustments, could present challenges going forward.

In this context, careful examination of how these considerations can address the ongoing Budget deficit will be essential. If the government can present a comprehensive strategy that balances public expectations with economic realities, it may navigate through this uncertain financial landscape successfully. Otherwise, the pressure for alternative measures to support public finances could prompt a reconsideration of previously abandoned tax proposals, creating even more market uncertainty.

Considerations of Investor Confidence in Government Policies

Investors’ confidence in government policies, particularly those surrounding fiscal strategies and taxation, has a profound impact on the overall stability of financial markets. As the Chancellor navigates complex budget discussions, the perception of fiscal responsibility can either bolster investor sentiment or exacerbate fears of unsustainable fiscal practices. This dual-edged nature of investor confidence becomes especially relevant when considering how predictions surrounding borrowing costs and fiscal outcomes evolve in an uncertain landscape.

Continued analysis and understanding of market dynamics regarding government policies will likely influence decisions made within fiscal corridors. If confidence wanes due to perceived inconsistencies or overly optimistic projections from key institutions like the OBR, the government may confront escalated borrowing costs and struggles to manage the Budget deficit effectively. Therefore, the attention placed on investor perceptions highlights the delicate balance required to underpin sustainable economic growth.

Navigating Budget Decisions Amidst Fiscal Constraints

Navigating through the complexities of budgetary decisions amidst fiscal constraints is a significant challenge for any government, and the current UK administration is no exception. The Chancellor must wrestle with public expectations while addressing a growing Budget deficit that threatens the financial stability of the government. The decision to cut National Insurance while forgoing an income tax increase reflects an attempt to alleviate some burdens while maintaining fiscal discipline, yet it raises tough questions about long-term sustainability.

As the Chancellor prepares for the upcoming Autumn Budget, the need for a coherent strategy to address these fiscal challenges is paramount. Balancing the expectations of the electorate and the scrutiny of economic analysts will determine the effectiveness of the government’s strategy. With rising borrowing costs typically linked to diminishing investor confidence, presenting a solid plan to manage the economic forecast will ultimately define the Chancellor’s legacy.

Frequently Asked Questions

How do UK government borrowing costs relate to government bonds and fiscal policy?

UK government borrowing costs are primarily indicated through yields on government bonds, specifically gilts. When borrowing costs rise, it means that the yield on these bonds increases, reflecting market concerns about the government’s ability to manage its Budget deficit and fiscal responsibilities. Recent decisions by the Chancellor, such as not raising income tax, have direct implications on these borrowing costs, as investors speculate on future fiscal stability.

What impact does the OBR’s forecast have on UK government borrowing costs?

The Office for Budget Responsibility (OBR) provides crucial forecasts that influence UK government borrowing costs. An improved OBR forecast can ease market fears about the Budget deficit and potentially lower borrowing costs, as seen when the government faced less public finance shortfall than initially expected. Conversely, if the OBR forecast reflects significant economic challenges, it could push borrowing costs higher due to investor concern over fiscal sustainability.

Why did UK government borrowing costs increase following the Chancellor’s tax decisions?

UK government borrowing costs surged after the Chancellor decided against an income tax hike, raising concerns among investors about how the government would fulfill its budgetary obligations. This decision led to an increase in gilt yields, signaling apprehension in financial markets regarding the lack of new revenue sources to address the existing Budget deficit.

How do changes in National Insurance impact UK government borrowing costs?

Changes in National Insurance can influence UK government borrowing costs by altering the revenue landscape. For instance, if the Chancellor reduces National Insurance while forgoing an income tax increase, it might lead to fears of rising borrowing costs as the government seeks to maintain fiscal balance amidst a Budget deficit.

What are the implications of a rising Budget deficit on UK government borrowing costs?

A rising Budget deficit typically results in higher UK government borrowing costs because it raises concerns about the government’s fiscal health and ability to repay debt. As investors grow wary of a larger deficit, they may demand higher yields on government bonds, which translates to increased borrowing costs for the government when it issues new debt.

What role do market speculations about tax increases play in UK government borrowing costs?

Market speculations regarding potential tax increases can significantly affect UK government borrowing costs. If investors believe that tax hikes are imminent, they may adjust their expectations of future yields on government bonds, leading to fluctuations in borrowing costs. For instance, the recent speculation around income tax decisions led to immediate responses in gilt yields, illustrating the sensitivity of borrowing costs to fiscal policy debates.

How might the Chancellor’s future tax decisions affect UK government borrowing costs?

The Chancellor’s future tax decisions can either alleviate or exacerbate UK government borrowing costs. If new taxes or revenue-generating measures are implemented to stabilize the Budget deficit, borrowing costs may decrease as market confidence is restored. Conversely, indecision or unfavorable tax changes could lead to increased borrowing costs due to heightened investor skepticism.

Why do UK government borrowing costs matter for economic stability?

UK government borrowing costs are critical for economic stability as they reflect the cost of financing government operations. High borrowing costs can limit government spending on essential services and infrastructure, impacting overall economic growth. Furthermore, rising costs may signal to investors that fiscal policies are not sustainable, possibly leading to lower market confidence and higher risks in the economy.

| Key Points | Details |

|---|---|

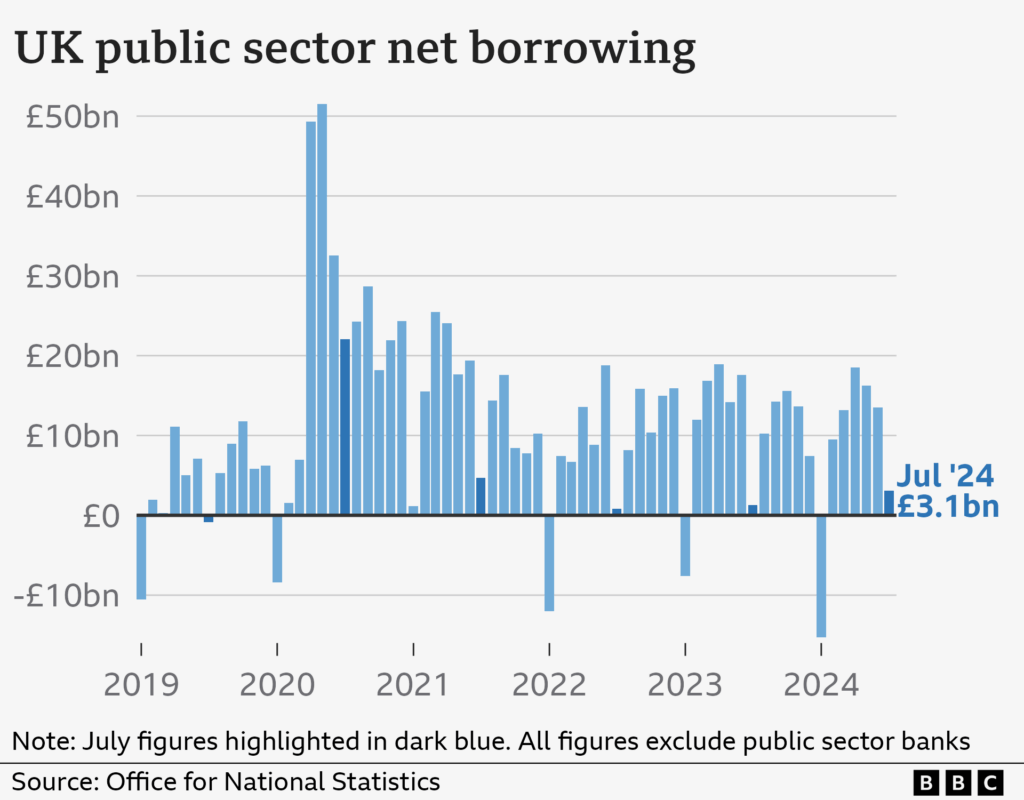

| Government borrowing costs rise | UK government borrowing costs increased due to the chancellor’s decision not to raise income tax rates. |

| Yield on 10-year bonds | The yield surged from 5.44% to 5.56%, indicating rising concerns in financial markets. |

| Chancellor’s decision | Chancellor Reeves opted not to increase income tax rates by 2p, despite previous discussions. |

| Government deficit | The deficit is estimated to be around £20bn, reduced from £30bn due to improved forecasts. |

| Market reaction | Strong initial market reaction to the tax decision, which moderated slightly after new OBR forecasts. |

| Concerns about fiscal policy | Economists warn that failure to address the deficit could negatively impact market confidence and borrowing costs. |

| Chancellor’s Budget responsibilities | Reeves must identify funds without increasing borrowing for day-to-day expenses. |

Summary

UK government borrowing costs have seen a significant increase due to Chancellor Reeves’ decision not to implement an income tax hike. This situation highlights the delicate balance the government must strike to maintain market confidence while managing public finances effectively. As the government faces pressures to address its budget deficit, the implications of these decisions on future borrowing costs and fiscal credibility remain paramount for investors and policymakers alike.