Listen to this article

Venezuela oil investment has sparked significant interest among US energy companies, especially in light of the country’s staggering oil reserves, which are the largest in the world. Following President Trump’s tough stance on Venezuela, there is renewed speculation about revitalizing the beleaguered oil industry through foreign investment. The optimistic projections of extraction potential are countered by the daunting obstacles presented by PDVSA’s challenges and the pervasive effects of the Venezuela economic crisis. As US energy firms consider their entry into this market, the complexities of international relations and past investment misadventures weigh heavily on decision-making. Ultimately, the future of Venezuela’s oil sector will hang in the balance as investors assess whether the potential rewards can outweigh the risks in an industry yearning for revitalization.

The recent discussions surrounding investment opportunities in Venezuela’s oil sector hint at a pivotal shift in energy dynamics. With a wealth of untapped resources, the focus has shifted towards how US oil enterprises can engage with a nation beset by economic turmoil and the diminishing condition of its state-owned oil company. Amidst a backdrop of international sanctions and political strife, potential investors are evaluating the viability of capitalizing on what could be a goldmine of crude reserves. However, as energy companies weigh the attractiveness of Venezuelan oil against its considerable hurdles, the dialogue encompasses deeper implications for US foreign policy and economic strategy in Latin America. As this narrative unfolds, it reflects broader themes of geopolitical influence, resource management, and the intricate interplay between investment and national sovereignty.

The Growing Interest in Venezuela’s Oil Reserves

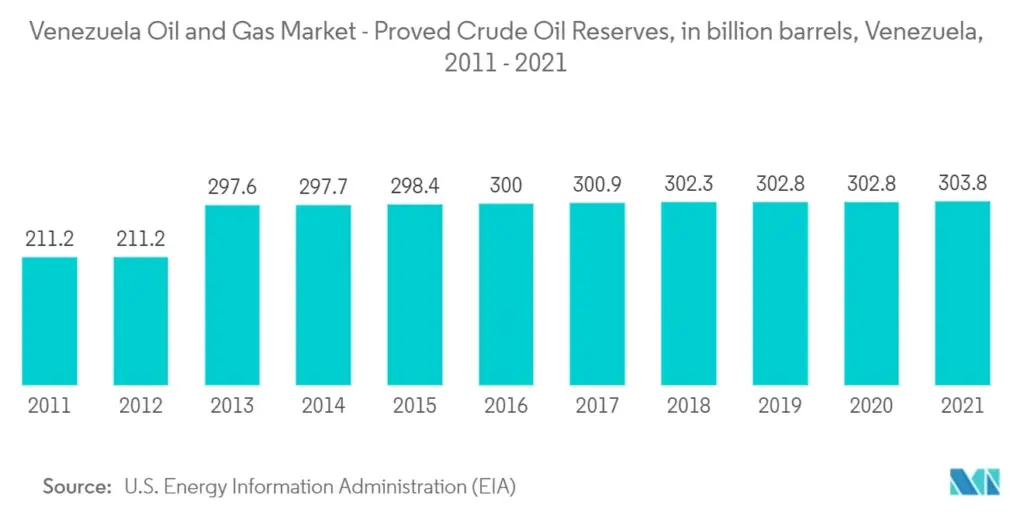

Venezuela is renowned for having the largest oil reserves in the world, a staggering 300 billion barrels. This puts it at a central point in global oil discussions, especially as countries look for reliable sources of energy amidst shifting geopolitical climates. The potential for investment in Venezuela’s oil sector has drawn significant attention, particularly from US energy companies eager to capitalize on a market that has historically been dominated by state control.

However, the reality of tapping into these reserves is fraught with challenges. The country’s oil infrastructure has suffered from years of negligence and mismanagement. Under the leadership of both Nicolás Maduro and Hugo Chávez, funds that could have been allocated for maintenance and upgrades were diverted towards social programs, leading to a significant decline in production levels. Addressing these issues will be key for any US company looking to enter this market.

Challenges Facing US Energy Companies in Venezuela

While the allure of Venezuela’s oil reserves is undeniable, US energy companies are faced with a myriad of hurdles. PDVSA, the state-owned oil entity, has not only seen its production capacity decline drastically but also grapples with a tarnished reputation due to past asset seizures and ongoing government instability. The historical context provides a grim picture; US firms such as ExxonMobil and ConocoPhillips previously had their assets confiscated, creating a significant level of mistrust that any new investment would require overcoming.

Additionally, logistical challenges abound in Venezuela’s current economic climate. With critical local expertise having fled the country during the economic crisis, there is a severe shortage of skilled labor necessary to revitalize the oil industry. The lack of guarantees from the Trump administration regarding protections for US investors further complicates the matter, leaving companies hesitant to invest heavily without clear incentives.

Frequently Asked Questions

What are the main challenges facing US energy companies investing in Venezuela’s oil industry?

US energy companies looking to invest in Venezuela’s oil industry face significant challenges, including the poor condition of PDVSA, the state-owned oil firm, which requires extensive infrastructure rebuilding. Additionally, US sanctions and a lack of security guarantees from the current Venezuelan regime further complicate the investment landscape.

How do Venezuela’s oil reserves compare to other countries?

Venezuela boasts the world’s largest oil reserves, officially estimated at 300 billion barrels. However, its exports have dramatically decreased, with only 211.6 million barrels exported in 2023, contrasting sharply with Saudi Arabia’s more profitable exports despite having fewer reserves.

What economic impacts could a revival of Venezuela’s oil sector have?

Reviving Venezuela’s oil sector could potentially stabilize the Venezuelan economy and generate revenue for a more favorable government. Increased production could lower global oil prices, impacting markets but offering needed economic relief for Venezuela following years of mismanagement and crisis.

What role did the Trump administration play in shaping Venezuela oil investment opportunities?

The Trump administration has pushed for increased investment in Venezuela’s oil sector, presenting it as an opportunity for US energy companies. However, conflicting policies and lack of security guarantees have made the environment less appealing for investment.

What happened to US oil firms with investments in Venezuela before?

In 2007, major US oil firms like ExxonMobil and ConocoPhillips had their assets seized in Venezuela after refusing to yield majority control to PDVSA. They pursued legal recourse and were awarded damages that remain unpaid, creating a lingering caution about future investments.

What are the geopolitical implications of US investment in Venezuela’s oil sector?

Investing in Venezuela’s oil sector carries significant geopolitical implications, as it reflects US interests in resource control and influences relations with other Latin American countries. The Trump administration’s assertive approach has raised concerns about potential resource exploitation and local backlash.

How can Venezuela achieve a favorable environment for oil investment?

To attract investment in its oil industry, Venezuela needs to rebuild trust with foreign companies, ensure legal protections for investments, improve infrastructure, and create a stable political climate that encourages long-term commitments from US energy firms.

What are the prospects for Venezuela’s oil industry under the current conditions?

The prospects for Venezuela’s oil industry remain uncertain due to ongoing economic crises, infrastructure deterioration, and political instability. While there is potential for recovery with foreign investment, significant challenges must be addressed to realize these opportunities.

| Key Point | Details |

|---|---|

| Venezuela’s Oil Reserves | Venezuela has the world’s largest oil reserves at 300 billion barrels. |

| Current State of the Oil Industry | The oil industry has been neglected and PDVSA, the state-owned company, is in poor condition due to years of lack of investment. |

| Trump’s Interest | President Trump aims to tap into Venezuela’s oil resources, seeing it as a major business opportunity for the US. |

| Investment Challenges | US oil companies face significant obstacles including past nationalizations, deteriorating infrastructure, and security concerns. |

| Economic Viability | There are doubts over the profitability of investing in Venezuela’s oil, especially with current low oil prices. |

| Geopolitical Concerns | Revitalizing Venezuela’s oil sector may create geopolitical tensions and uncertainties. |

| Future Prospects | Despite potential, US investment in Venezuela’s oil sector remains uncertain without significant changes in political and economic conditions. |

Summary

Venezuela oil investment presents a complex opportunity for US companies, given the country’s vast reserves but troubled oil industry. Despite the promise of significant returns, ongoing challenges such as outdated infrastructure, political instability, and historical grievances against foreign investment create hesitation for US energy firms. As the Venezuelan government seeks to open its doors to foreign investment, the real question remains: will these companies find the financial and operational incentives compelling enough to invest in the revitalization of Venezuela’s oil sector?