Listen to this article

The UK inflation rise in December 2024 has stirred significant attention, marking the first increase in five months, as reported by various inflation news outlets. The inflation rate jumped to 3.4%, driven primarily by temporary factors such as heightened tobacco duties and surging airfares, particularly around the festive season. This unexpected rise has left analysts questioning the broader implications for the UK economic outlook, especially as the Bank of England prepares to assess interest rates amidst these new figures. Despite the current spike, many economists suggest that these factors are one-off, indicating that the cost of living in the UK may not face prolonged distress. As we navigate through the ramifications of this inflation hike, it remains crucial for consumers and policymakers alike to monitor how these trends affect the overall economic landscape and consumer confidence in 2025.

In December 2024, the increase in inflation within the UK has highlighted concern over rising prices, particularly within sectors impacted by governmental policy shifts. This rise in the cost of living has sparked discussions around the Bank of England’s interest rates and their potential adjustments in response to economic conditions. Factors contributing to this situation include temporary surges in prices for essentials like fuel and food, which have attracted scrutiny from economists and policymakers alike. Observations of inflation trends in the UK signal not only an immediate concern for consumers but also broader implications for the national economic strategy. As this scenario evolves, the focus will inevitably shift towards understanding both the transient nature of these pressures and their potential impact on long-term financial stability.

UK Inflation Rise in December 2024: Key Drivers Explained

The rise of UK inflation in December 2024 has sparked concern among economists and consumers alike. The rate climbed to 3.4%, driven largely by a surge in tobacco prices and increased airfares during the festive season. Unsurprisingly, these spikes were attributed to temporary factors, including higher duty on tobacco introduced in the recent Budget and the significant demand for flights over Christmas and New Year. The unique circumstances surrounding this period suggest that the inflation bump may not signal a sustained increase in living costs.

Despite the rise, analysts remain cautiously optimistic about the UK economic outlook, emphasizing that such temporary inflation factors should not lead to alarm. The Bank of England is set to review interest rates amid this unexpected inflation increase; however, predictions suggest they will likely hold steady before considering gradual cuts throughout the year. Such a cautious approach aims to avoid exacerbating the cost of living crisis that already has many households feeling the financial pinch.

Economic Factors Influencing Cost of Living in the UK

The recent increase in the UK inflation rate has underlined the critical link between inflation dynamics and the cost of living. Rising prices, particularly for essential items like food and transportation, which saw a notable annual increase of 4%, illustrate the pressures that households are experiencing. The soaring cost of basic groceries, such as bread and cereals, showcases how inflation affects day-to-day expenses, leading to heightened financial strain on consumers.

Economic factors contributing to the cost of living include not just inflation rates but also government policies and global economic events affecting supply chains. The Chancellor announced measures aimed at mitigating the impact of rising costs, such as freezes on rail fares. However, critics argue that ongoing economic mismanagement could result in a prolonged period of inflation, stifling growth and leaving low-income households struggling to manage their budgets.

Implications of Bank of England’s Interest Rate Decisions

As the Bank of England approaches its next meeting, many are closely monitoring how the recent inflation rise will influence interest rate decisions. The Bank has previously lowered borrowing costs to 3.75%, a move aimed at stimulating economic growth amidst rising inflation. Yet, with inflation now at 3.4%, there will be immense pressure to balance economic recovery with the need to control inflationary pressures, which could lead to further challenges in the cost of living for consumers.

Former committee members have suggested that while immediate cuts in interest rates may not be likely, a gradual approach could reflect the ongoing economic conditions. Such cautious strategies are reflective of the Bank of England’s commitment to managing inflation within its target range while still supporting economic growth in the face of ongoing uncertainty.

The Temporary Factors Behind December’s Inflation Spike

The rise in UK inflation to 3.4% in December is primarily linked to temporary factors that reflect seasonal demand peaks rather than long-term trends. Analysts attributed significant increases in airfares and taxes on tobacco as key drivers behind this spike. The timing of flight costs during the holidays played a pivotal role in inflating the inflation rate, as families often rush to book flights during the busy Christmas season.

Additionally, the impact of the tobacco duty increase underlines how budgetary measures can alter consumer prices in a swift manner. While these spikes generate immediate concern, they highlight the complex nature of inflation and the influence of short-lived economic events, thereby giving a clearer picture of the underlying economic health rather than indicating a persistent inflationary trend.

Consumer Sentiment and Economic Stability

Consumer confidence has been considerably affected by rising costs and inflation in the UK. A notable decline in consumer comfort levels has been reported, largely attributed to sustained inflation in essential sectors. Households are feeling squeezed as the cost of everyday items continues to rise, leading to increased scrutiny over economic management by government officials.

As households navigate the impact of rising prices, analysts warn of potential stagnation in economic growth. The government’s approach to addressing these concerns through budget measures is crucial to restoring consumer faith and ensuring a stable economic environment. Ultimately, a focus on both inflation control and consumer support will be necessary to improve overall economic sentiment in the UK.

Food Inflation and its Broader Impact on Households

The rise in food prices and inflation has particularly impacted household budgets across the UK. With a reported annual price increase of 4.5% on food and non-alcoholic beverages, families are finding it increasingly difficult to manage expenses. The surge in prices, especially for basic staples like bread and cereals, highlights the ongoing challenge for many who are already feeling the repercussions of higher costs on their daily lives.

Moreover, the increasing cost of food comes amid rising economic pressures from both domestic and international fronts. Geopolitical tensions and supply chain disruptions continue to fuel costs, leaving many households uncertain about future price movements. Addressing food inflation must be prioritized in the wider context of the government’s economic policy to ensure that families can manage their budgets effectively.

Comparative Inflation Rates: The UK versus Europe

When analyzing inflation, the UK stands in stark contrast to its European counterparts. December 2024 saw the UK inflation rate recorded at 3.4%, whereas Germany and France reported significantly lower rates of 2% and 0.7%, respectively. This discrepancy raises questions about the underlying economic strategies adopted by various countries and challenges the UK to implement more effective measures to control inflation.

The stark difference in inflation trends illustrates the importance of targeted economic policies by national governments. With predictions suggesting a substantial drop in UK inflation by spring, there lies an opportunity for the UK to align more closely with its G7 counterparts. Striking the right balance between stimulating growth and managing inflation will be key to improving the UK’s economic standing moving forward.

Future Projections for UK Inflation and Economic Recovery

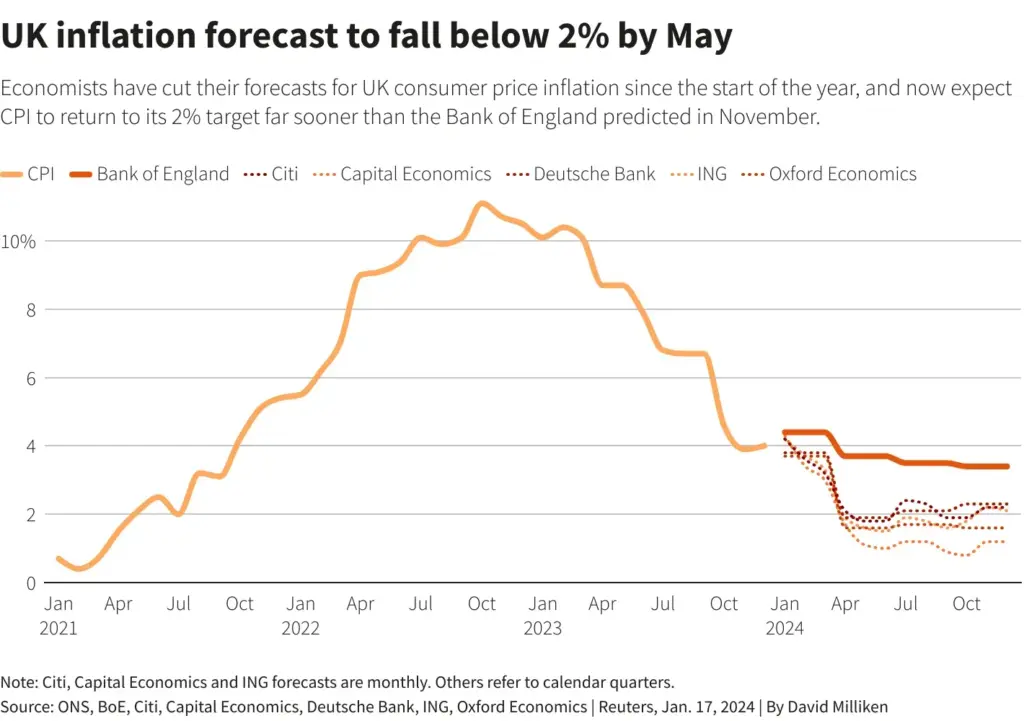

As economic analysts project a significant decline in UK inflation for early 2025, there remains cautious optimism about the country’s recovery. Predictions indicate that the inflation target of 2% set by the Bank of England could become attainable in the coming months. Such forecasts rely on the assumption that temporary factors driving the recent inflation spike will dissipate, allowing the economy to stabilize.

Sanjay Raja of Deutsche Bank has speculated that the UK’s inflation trajectory will improve compared to other major economies, suggesting that the nation could experience the most significant decline in inflation rates amongst G7 countries. This potential downward trend hinges on addressing both temporary inflation factors and underlying economic conditions, which will be crucial in restoring confidence among consumers and businesses alike.

Government Measures to Combat Rising Costs

In light of the recent inflation increases, the government has articulated its commitment to implementing measures designed to alleviate the financial pressures faced by UK households. Initiatives, such as freezing rail fares and prescription charges, aim to provide immediate relief and stem the cost of living crisis. These steps, however, must be viewed in the larger context of broader economic policy to foster sustainable growth.

Moreover, the effectiveness of these measures will depend heavily on the government’s ability to navigate economic challenges while keeping inflation in check. As public sentiment grows increasingly skeptical, continued transparency and accountability in financial management will be key to maintaining trust and supporting the UK’s recovery from present inflation pressures.

Frequently Asked Questions

What caused the UK inflation rise in December 2024?

The UK inflation rise in December 2024 to 3.4% was primarily driven by higher tobacco prices due to duty increases and inflated airfares during the holiday season. These factors are considered temporary and not indicative of a lasting upward trend, as analysts suggest.

How will the UK economic outlook be affected by the December 2024 inflation rise?

The UK economic outlook could face short-term fluctuations due to the December 2024 inflation rise, yet analysts do not expect it to disrupt the overall trend. The rise, influenced by one-off factors, is not seen as the start of a prolonged increase in inflation.

What impact does the December 2024 inflation rise have on Bank of England interest rates?

The December 2024 inflation rise precedes the Bank of England’s January meeting on interest rates. While there are concerns about high inflation and pay growth, many experts believe that significant cuts in interest rates might not occur immediately, focusing instead on gradual reductions throughout the year.

Are there any temporary factors contributing to the UK inflation rise in December 2024?

Yes, the UK inflation rise in December 2024 is largely attributed to temporary factors such as increased airfares over the holiday period and higher tobacco taxes. These elements are not expected to lead to a sustained increase in inflation.

What does the rise in UK inflation mean for the cost of living?

The rise in UK inflation to 3.4% in December 2024 places additional pressure on the cost of living, as higher prices for tobacco and airfares are passed on to consumers. However, measures from the government aim to alleviate some cost burdens, including a freeze on certain charges.

How does the December 2024 inflation rise compare to inflation in other European countries?

As of December 2024, the UK inflation rate stood at 3.4%, significantly higher than Germany’s 2% and France’s 0.7%. This indicates that the UK’s economic conditions are currently less favorable compared to its European neighbors.

What should consumers expect regarding inflation trends following the December 2024 report?

Consumers should expect a potential decline in inflation rates following the December 2024 report. Analysts anticipate that UK inflation may decrease significantly in early 2025, possibly bringing it closer to the Bank of England’s 2% target by spring.

What government measures are being implemented in response to the December 2024 inflation rise?

In response to the December 2024 inflation rise, the UK government has emphasized budget measures to alleviate the cost of living, such as freezing rail fares and prescription charges, although critics argue these steps may not be sufficient to tackle the root causes of inflation.

| Key Factor | Impact on Inflation | Comments |

|---|---|---|

| Higher Tobacco Prices | Increased by 3.4% | Driven by tax increases in the Budget. |

| Airfares | Significant contributor to inflation | Related to holiday travel timing. |

| Rising Food Costs (Bread, Cereals) | Contributed to overall inflation rise | Due to increased consumer prices. |

| Energy Prices | Moderated impact | Eased compared to previous months. |

| Housing and Household Services | 4.9% increase, down from 5.1% | Moderated rent increases observed. |

| Comparison with EU | UK higher at 3.4%, Germany at 2%, France at 0.7% | UK inflation has not been lower than Germany for a year. |

Summary

The UK inflation rise in December 2024 marked a notable change, climbing to 3.4% for the first time in five months, largely driven by temporary factors like increases in tobacco prices and airfares during the festive season. Despite this unexpected rise, many economists do not anticipate a sustained upward trend in inflation. Analysts are cautious, recognizing that elements like airfares were influenced by holiday travel timing and tobacco prices by tax changes. Moving forward, the focus will be on the implications for interest rates set by the Bank of England, which meets in February. In light of the current financial landscape, the government continues to face scrutiny regarding its handling of economic pressures, as rising costs impact household budgets. Overall, while December’s figures show an increase, the outlook for inflation in 2025 remains a focal point as key economists predict potential declines, reaffirming the importance of monitoring economic policies and consumer sentiment.