Listen to this article

Credit card debt is a pervasive issue affecting millions worldwide, causing financial strain and emotional distress. As more individuals turn to credit cards for everyday purchases and emergencies, the consequences of overspending become increasingly evident. For many, managing credit card debt feels like an uphill battle, as the weight of accumulating interest can amplify repayment struggles. Understanding the impact of credit cards on finances is crucial for those looking to regain control over their spending. Thankfully, there are strategies available on how to reduce credit card debt and reclaim financial stability amid this growing crisis.

Personal credit obligations, often termed financial liabilities, have reached alarming proportions, especially amidst the relentless pursuit of convenience in modern consumerism. The temptation to leverage various credit instruments has left countless individuals grappling with mounting financial obligations, thus revealing the hidden perils of revolving payment structures. These monetary pursuits often lead to overwhelming repayment challenges that can affect one’s creditworthiness. Recognizing the detrimental effects of these financial products is paramount for anyone hoping to mitigate their fiscal responsibilities and restore their economic health. Consequently, exploring effective techniques for diminishing outstanding balances has become increasingly important in today’s economic landscape.

Understanding Credit Card Debt: Challenges and Struggles

Credit card debt is a significant challenge for many individuals, especially in today’s financial landscape. As seen in the case of Amanda, who accumulated £10,000 of credit card debt, the struggle to manage repayments can be overwhelming. Despite her efforts to keep track of her finances using a credit rating service, she found herself bombarded with enticing offers from credit card companies, which only compounded her existing debt. This scenario is not uncommon, as millions of people in the UK face similar situations where the allure of additional credit leads to further financial strain.

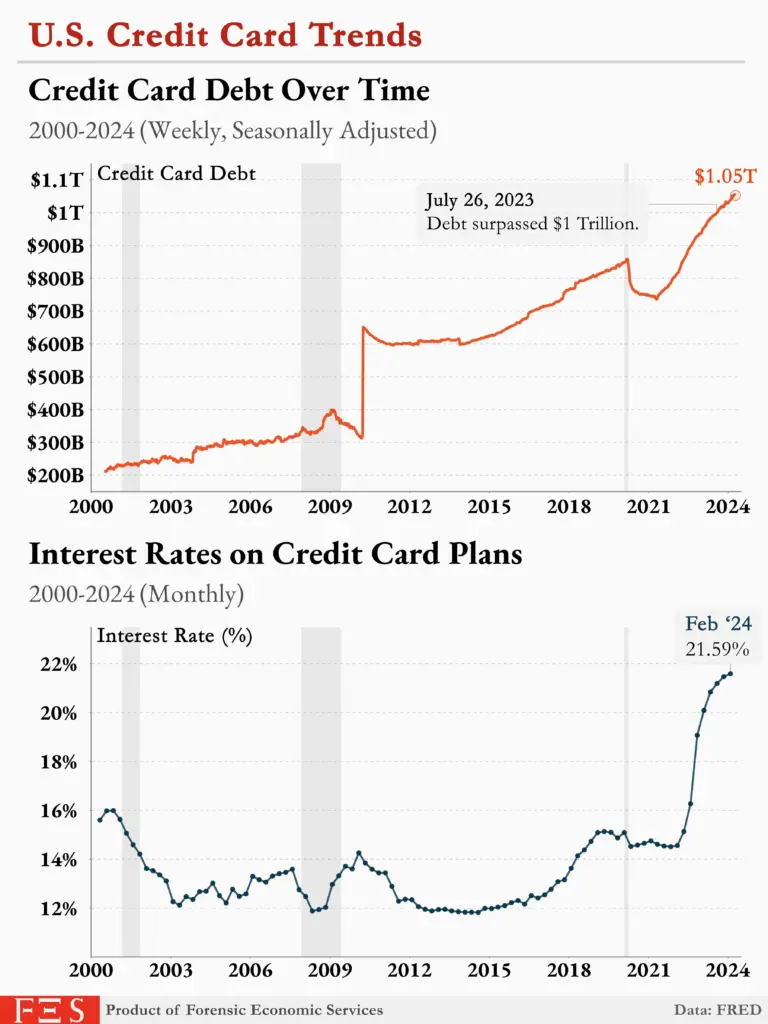

The impact of credit cards on personal finances can be profound, with high-interest rates making it difficult for individuals to escape the cycle of debt. Many find themselves in a position where they are making only minimum payments each month, which can elongate the repayment period and increase the amount paid in interest. Reports from organizations such as the Financial Conduct Authority highlight that a substantial portion of credit card holders are stuck in a persistent cycle of debt, spending more in interest than they initially borrowed. Understanding the challenges associated with credit card debt is crucial for individuals seeking to regain control of their finances.

Frequently Asked Questions

What are effective strategies for managing credit card debt?

To effectively manage credit card debt, consider methods such as creating a budget to track expenses, prioritizing high-interest debts for faster repayment, and negotiating lower interest rates with your credit card company. Utilizing balance transfer cards with 0% interest offers can also reduce debt cost over time.

How do credit cards impact my overall finances?

Credit cards can significantly impact your finances by influencing your credit score, affecting your borrowing capacity, and potentially leading to debt accumulation if not managed carefully. High-interest rates on outstanding balances can create a cycle of debt that strains both your finances and mental well-being.

What are common struggles people face with credit card repayment?

Common struggles with credit card repayment include making only minimum payments, experiencing financial hardships such as job loss or medical expenses, and facing pressure from credit companies to take on more debt. Many individuals find themselves in a cycle of increasing debt due to high-interest rates on credit card balances.

What credit rating services exist to help with credit card debt?

Credit rating services like Experian, Equifax, and TransUnion provide consumers with credit reports and scores. These services can help you monitor your credit card debt’s impact on your overall credit standing and offer tools to improve financial management and debt repayment strategies.

How can I reduce my credit card debt effectively?

To reduce credit card debt effectively, focus on paying more than the minimum payment, consider consolidating debts through personal loans or balance transfers, and utilize budgeting methods to cut unnecessary expenses. Moreover, seek advice from credit counseling services to create a personalized debt repayment plan.

| Key Point | Details |

|---|---|

| Experian’s Role | Experian, a credit-rating service, encouraged a woman with £10,000 of credit card debt to take on more credit, sending marketing offers that exacerbated her financial issues. |

| Vulnerability of Consumers | Millions in the UK are facing difficulties with credit card repayments, with many feeling pressured into taking on more debt from credit-scoring agencies. |

| Dangers of Minimum Payments | 1.6 million people only make minimum monthly payments of 2-5% on their outstanding balance, leading to increased interest and extended debt duration. |

| Rising Credit Limits | Research shows that many lenders offer credit limit increases without consideration of borrowers’ financial struggles, further complicating their repayment efforts. |

| Role of Debt Advising | Seeking advice from trained debt advisors or organizations can help individuals manage credit card debts and find sustainable repayment plans. |

Summary

Credit card debt has become a pressing issue for many consumers in the UK, impacting millions as they struggle with repayments while being bombarded by offers for additional credit. This cycle leads to further financial strain and stress, as highlighted by various personal accounts and studies. It’s crucial for those in debt to seek help and explore options available to regain control of their finances.