Listen to this article

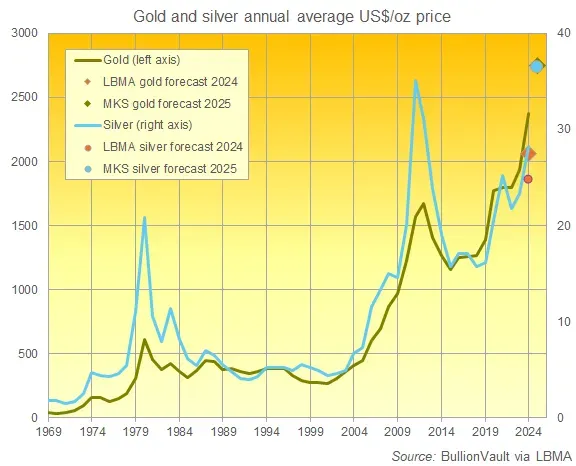

Gold and silver prices have surged to unprecedented levels recently, reflecting the growing uncertainty in the global market. As geopolitical tensions rise and economic conditions remain unstable, investors are increasingly turning to precious metals for security. The gold price today reached a stunning high of $4,689.39 per ounce, while silver notched an impressive $94.08 per ounce. This meteoric rise is not merely a reflection of market trends but also a response to U.S. tariffs that threaten to escalate international trade conflicts. With the silver price forecast hinting at further increases, savvy investors are viewing precious metals investment as a safe haven amid turbulent times.

When discussing the ascent of gold and silver, it’s crucial to note their roles as vital commodities in uncertain economic climates. Recent developments in global politics, particularly the elevation of trade tensions, have significantly influenced the valuation of these valuable metals. Investors typically gravitate toward these assets when there is volatility in stock markets or concerns over international relations. Furthermore, the tariffs introduced by the U.S. administration have spurred a noticeable shift in investor sentiment, compelling many to consider precious metals as a necessary addition to their portfolios. As discussions surrounding the potential for increased tariffs and economic sanctions continue, the allure of gold and silver remains strong.

Understanding Gold and Silver Prices Today

Gold and silver prices have shown remarkable resilience amidst recent economic turmoil, with gold reaching an unprecedented value of $4,689.39 (£3,499) per ounce. This surge is not merely a reflection of market speculation; it is largely driven by investors seeking safety during unpredictable times. The current geopolitical climate, influenced by US tariffs and disputes, has pushed many to prioritize these precious metals, known for their ability to retain value.

On the other hand, silver has also climbed to an impressive peak of $94.08 per ounce, indicating a growing investor interest in precious metals as a hedge against inflation and currency fluctuations. As global tensions rise, particularly with the current political landscape in the United States, the allure of investing in gold and silver is likely to continue. Tracking the gold price today not only reflects its investment viability but also signals shifts in market sentiments due to external factors.

The Impact of US Tariffs on Precious Metals Investment

The recent announcement by President Trump regarding potential new tariffs has had immediate repercussions on the stock market, causing declines in European shares, while simultaneously bolstering gold and silver prices. A proposed 10% tariff on goods from several European nations, which could escalate to 25%, creates an environment of uncertainty. This fear has pushed investors towards precious metals, as they are often viewed as safe havens in tumultuous economic landscapes.

Market analysts emphasize the link between tariffs and precious metals investment; when geopolitical tensions escalate, as they did with the Greenland takeover proposal, gold and silver prices usually soar. The ongoing trade disputes and tariffs not only affect trade relationships but also stir fears of economic downturns, compelling investors to flock towards gold as a protective asset.

Geopolitical Tensions and Market Reactions

Geopolitical tensions significantly influence market dynamics and investor behaviors. The recent escalation surrounding the Greenland takeover not only affected stock indices such as London’s FTSE 100 and FTSE 250 but also resulted in surging prices for gold and silver. As companies in sectors like automotive and technology faced sharp declines due to concerns over tariffs, the demand for precious metals served as a counter-narrative—illustrating how interconnected these markets are.

History shows that during periods of political instability or potential trade wars, precious metals tend to become more attractive investments. Thus, the ongoing geopolitical landscape serves as a bellwether for investor sentiment, indicating a pivot towards secure investments amidst uncertainty.

Forecasting Silver Prices in Uncertain Times

The silver price forecast remains optimistic, especially as the current geopolitical climate fosters uncertainty. Investors are rationally turning to silver not only as a means of wealth preservation but also as an investment with potential upside due to its industrial applications. As economies adapt to a post-pandemic world, increasing demand from various sectors could further buoy silver prices.

Market experts suggest that as the price of silver continues to rise, we might witness a stronger correlation between its price and global economic indicators. If geopolitical conflicts escalate or trade tensions persist, the anticipation for higher silver prices could become a self-fulfilling prophecy as more investors shift their portfolios to include silver to hedge against volatility.

Stock Market Declines Amidst Precious Metals Surge

The recent performance of the stock markets, particularly in Europe, highlights a striking contrast to the rising prices of precious metals. While the FTSE indices faced declines due to fears surrounding US tariffs, gold and silver continued their upward trajectory. This divergence is indicative of a broader trend where stock volatility often drives investors to seek the stability offered by gold and silver.

As seen this week, with the FTSE 100 falling by 0.6% and other European benchmarks following suit, the stock market struggles may not correlate with the strength of precious metals. Hedge funds and investors might see this as an opportunity to increase their holdings in gold and silver, reinforcing these assets’ reputation as a safe haven during times of financial distress.

Investment Strategies for Precious Metals

Given the current market conditions, formulating effective investment strategies for precious metals is essential. Investors are advised to analyze both gold and silver’s historical performances against global economic trends and current events, such as US tariff announcements and geopolitical issues. Diversification remains crucial; holding a mix of gold and silver can mitigate risks while capitalizing on their potential growth.

Additionally, keeping abreast of market news and forecasts will empower investors to make informed decisions. As we navigate through fluctuating markets, understanding the implications of US tariffs and international relations will be key to optimizing precious metals investments. With careful planning, investors can harness the safe haven attributes of gold and silver, ensuring their portfolios remain resilient.

Political Climate and Its Effect on Precious Metals

The political climate, particularly regarding US domestic and international policies, has a profound effect on precious metals like gold and silver. With President Trump’s threatening stance on new tariffs towards European nations, the unpredictability of such actions leads to immediate reactions in the market. Investors can become skittish and thus, tend to pull towards gold and silver for their relative safety.

As global leaders navigate these tensions, it is essential for investors to understand that the intricacies of geopolitical maneuvers can greatly sway precious metal prices. By keeping an eye on both current events and political developments, investors can make better-informed decisions, anticipating how these factors might influence the prices of gold and silver in the near future.

Responding to Economic Uncertainty with Precious Metals

Economic uncertainty often drives investors toward gold and silver, viewed traditionally as ‘safe haven’ assets. The recent spike in their prices can be attributed to a collective investor response to the potential risks posed by evolving trade relationships and political decisions. As the global landscape shifts, the perceived security that gold and silver provide only strengthens their appeal amidst market volatility.

Investment in precious metals becomes particularly strategic as fear grips the stock markets. History shows that in periods of economic disruption, commodities like gold and silver often outperform more volatile assets, underscoring the value in maintaining a diversified portfolio that includes these metals.

Market Behavior: Monitoring Precious Metals Trends

Monitoring market behavior in relation to precious metals can yield critical insights for investors. The recent trends indicate that while stocks may falter, gold and silver consistently rally in times of heightened uncertainty. This relationship suggests that savvy investors should stay vigilant, tracking market fluctuations related to political tensions, economic forecasts, and tariff implications.

By paying close attention to changes in gold and silver prices, investors can anticipate movements and strategically position themselves ahead of the curve. Understanding these trends and their drivers, including geopolitical developments, is paramount for those looking to make informed investment decisions.

Frequently Asked Questions

What is the gold price today and how does it relate to geopolitical tensions?

As of today, the gold price reached a record high of $4,689.39 per ounce, largely driven by escalating geopolitical tensions. Investors often flock to gold as a ‘safe haven’ asset during uncertain times, which has contributed to its rising value.

How will US tariffs impact gold and silver prices?

The proposed US tariffs on European countries, particularly concerning the Greenland dispute, are expected to create economic uncertainty which typically boosts gold and silver prices. As seen recently, the gold price surged in response to these geopolitical threats, reflecting investor concerns.

What is the current silver price forecast amidst market volatility?

The latest silver price forecast indicates a rise, with silver recently peaking at $94.08 per ounce. This increase comes amid market volatility triggered by geopolitical issues and trade tensions, suggesting ongoing demand for precious metals.

Why are precious metals investments becoming more appealing?

Precious metals investments, like gold and silver, are becoming more appealing due to their reputation as safe havens during economic uncertainty and geopolitical tensions. As conflicts and tariffs escalate, investors often turn to these metals to hedge against market fluctuations.

In what ways do geopolitical tensions influence gold and silver prices?

Geopolitical tensions increase market volatility and uncertainty, leading investors to seek safe havens such as gold and silver. This demand typically results in higher prices for these precious metals, as seen during times of heightened international conflict.

What historical trends can we expect in gold and silver prices during economic uncertainty?

Historically, gold and silver prices tend to rise significantly during periods of economic uncertainty, typically surpassing previous highs as investors look to protect their wealth. Recently, gold surged by more than 60% over the past year due to growing global tensions, confirming this trend.

| Key Point | Details |

|---|---|

| Gold and Silver Prices Reach Highs | Gold reached $4,689.39 per ounce, silver peaked at $94.08 per ounce due to increased demand for safe haven assets amidst geopolitical concerns. |

| Impact of Trump’s Tariff Threat | A 10% tariff on imports from eight European countries could escalate to 25%, raising investor concerns and affecting stock prices. |

| Stock Market Reactions | European markets declined with London’s FTSE 100 down 0.6% and car manufacturers experiencing significant losses. |

| Investor Behavior | Increased uncertainty led investors to shift towards gold and silver, viewing them as safer investments. |

| Experts’ Opinions | Analysts note that gold is becoming an increasingly attractive safe haven due to US trade policies and geopolitical tensions. |

Summary

Gold and silver prices have soared to unprecedented levels recently, driven by escalating geopolitical tensions and uncertainties surrounding trade policies. As investors seek refuge in these precious metals, their values have surged dramatically, reflecting a broader market trend where safety is prioritized over traditional investments. This scenario underscores the importance of monitoring geopolitical developments as they can significantly influence market dynamics, particularly the prices of gold and silver, which serve as benchmarks for financial security during turbulent times.