Listen to this article

The UK economy stands at a critical juncture, caught between cautious optimism and looming uncertainties. Recent trends in consumer confidence UK suggest a fragile yet hopeful atmosphere as the nation grapples with the aftermath of Brexit and its associated impacts on economic growth UK. With interest rates UK undergoing fluctuations, both businesses and consumers remain vigilant, observing how these changes shape their financial landscapes. The interplay between political decisions and economic sentiment plays a pivotal role, especially as the nation prepares for upcoming elections that could redefine the political economy UK. As we navigate through the complexities of the current landscape, understanding the nuances of consumer behavior will be essential in forecasting the future trajectory of the UK economy.

The economic landscape of the United Kingdom is currently experiencing a transformative phase, influenced by various internal and external factors. Recent indicators concerning public spending, market confidence, and governmental policies reflect a nuanced perspective on the nation’s financial health. As businesses adapt to shifts in consumer behavior and governmental regulations, the trajectory of growth appears to hinge on both confidence levels among citizens and the political decisions made in Westminster. The ramifications of recent events, particularly the implications of Brexit on the fiscal environment, continue to resonate through the economy. In this dynamically changing situation, assessing factors such as spending habits, economic indicators, and interest rate adjustments will be crucial for understanding the broader implications for the UK’s future.

Understanding Consumer Confidence and Its Impact on the UK Economy

Consumer confidence in the UK serves as a critical indicator of the overall economic health of the nation. It captures how consumers feel about their financial situation and their perceptions of economic conditions. The GfK Consumer Confidence Barometer is pivotal in this dialogue, revealing shifts in spending habits and investment, which are crucial for driving economic growth in the UK. When consumers express confidence, they are more likely to increase their spending, benefiting businesses and, in turn, stimulating wider economic activity. Conversely, declining consumer confidence signals a risk of reduced demand, threatening economic stability and growth.

The interaction between consumer confidence and economic growth in the UK is evident in recent surveys, which highlight the role of younger demographics in the economy. Specifically, an observed rise in confidence among those under 30 showcases a shift in sentiment that could influence future spending patterns. As young individuals increasingly navigate economic uncertainties and make purchasing decisions, their optimism prompts firms to adapt strategies that leverage this renewed consumer interest. Nevertheless, the contrast with the older demographics, who reportedly feel more pessimistic, could lead to divergent spending patterns, ultimately affecting the UK economy’s trajectory in the coming years.

The Role of Interest Rates in Shaping Economic Sentiment

Interest rates play a fundamental role in influencing economic dynamics within the UK. The Bank of England’s policies regarding interest rates determine borrowing costs for households and businesses alike. Low-interest rates typically stimulate economic activity by making loans more affordable, thereby increasing consumer and business spending. Recent decisions to lower interest rates have been beneficial for younger homebuyers and those entering the job market, driving a sense of optimism among these groups. This scenario highlights the importance of monetary policy in supporting economic recovery and fostering growth.

However, the implications of shifting interest rates extend beyond the immediate benefits. Older demographic groups, who often rely more on savings and fixed-income investments, may find themselves adversely affected as lower interest rates correlate with reduced returns on savings. This financial dichotomy can heighten feelings of discontent among older citizens, further influencing overall consumer confidence. As younger individuals take advantage of favourable borrowing conditions, the economic disparities arising from interest rate adjustments could strain the political economy of the UK, propelling policymakers to balance growth with the needs of an aging population.

The Political Economy and its Influence on Economic Outlook

The intersection of political and economic sentiments is particularly vital in the context of the UK’s evolving landscape. The ongoing ramifications of Brexit have dramatically reshaped the political economy, generating varied responses that depend largely on age demographics. Younger voters have aligned more closely with recent governmental policies, fostering a feeling of stability and improving economic sentiments among those groups. In contrast, older voters, who may have felt compromised by the shifts in political directives, often express a sense of pessimism about the current economic climate. Understanding these trends helps illuminate how political decisions intertwine with economic performance.

Political confidence can indirectly affect consumer confidence as voters’ perceptions drive their economic outlook. The tendency of younger individuals to remain optimistic amid political changes suggests a growing disconnect between generations regarding economic perceptions. Such discrepancies can challenge traditional economic models that hinged on unified consumer sentiment, and they raise questions about the stability of future policy-making in light of these diverging views. As the UK heads toward the 2024 General Election, the outcomes of these personal and political dynamics will play a significant role in shaping consumer confidence and, by extension, the trajectory of the UK economy.

Brexit’s Continuing Impact on Consumer Confidence

One of the key long-term influences on the UK economy remains the aftermath of Brexit. The vote to leave the EU has fundamentally altered consumer confidence, especially among older demographics who may feel more nostalgic for the predictability of pre-Brexit days. This psychological shift has manifested in a marked decline in confidence levels among those over 50, reflecting their apprehension about the evolving economic landscape. For younger consumers, however, the narrative is different; they are more adaptable to changing circumstances, possibly moderating the adverse impacts that Brexit has had on economic sentiment.

The effects of Brexit on consumer attitudes may also correlate with financial behaviours. Research indicates that younger generations might be more willing to embrace the uncertainties brought on by Brexit, which allows them to maintain higher levels of consumer confidence and spending. This divergence not only underscores the significant role generational perspectives play in the UK economy but also raises important questions for policymakers about addressing the specific concerns of differing age groups. Ultimately, understanding and mitigating the long-lasting impacts of Brexit is essential for nurturing a balanced and sustainable recovery for the UK economy.

Retail Sector Resilience Amid Economic Uncertainties

Despite fluctuations in consumer confidence and broader economic challenges, the UK retail sector has demonstrated remarkable resilience. Many retailers have outperformed pessimistic sales predictions, reflecting a clever adaptation to changing consumer behaviours. Businesses like Mitchells & Butlers and Fullers have reported significant sales growth, driven by strategic decisions that cater to evolving consumer expectations. This retail performance illustrates the vitality of specific sectors in countering overarching economic uncertainties, providing a beacon of hope for the broader economy moving forward.

Retail success stories amid an uncertain economic backdrop highlight the importance of consumer engagement and innovation. As retailers strive to meet the demands of their clientele in an evolving market, they create opportunities for growth that can, in turn, bolster the UK’s economic outlook. Easing inflation rates contribute to this positive narrative, as they allow consumers to regain confidence and feel more inclined to spend. The balance of this relationship between the retail sector and overall economic health showcases the interconnected nature of consumer confidence, spending, and growth within the UK economy.

Forecasting Economic Growth in 2024 and Beyond

As we look ahead to 2024, key factors will play a significant role in shaping the UK economy’s growth trajectory. Recent reports suggest an encouraging growth of 0.3% in November, which surpasses initial forecasts. Such optimistic projections can influence consumer confidence, encouraging spending as individuals weigh the economic landscape and adjust their financial behaviour accordingly. The potential for sustained economic growth hinges not only on consumer sentiment but also on the government’s commitment to effective policies that promote investment, innovation, and job creation.

Furthermore, as inflation gradually veers toward target levels, this creates a more favourable environment for businesses and consumers alike. With anticipated government actions aimed at stimulating growth, including the introduction of new infrastructure projects, there lies the possibility of an investment boom. By addressing the economic uncertainties that have made consumers hesitant to spend, the government can bolster consumer confidence, which in turn can support robust economic growth in the UK. As policymakers and financial institutions align their strategies for the future, 2024 holds the potential for a transformative period in the UK’s economic journey.

The Importance of Tailored Economic Policies for Different Age Groups

Recognizing the diverse economic sentiments prevailing among different age groups is essential for implementing effective economic policies. Policymakers must carefully consider how the needs and expectations of each demographic influence consumer confidence and economic behaviour. Building strategies that account for the distinct financial experiences of younger and older individuals can foster a more balanced approach to economic recovery in the UK. By aiming to create equitable opportunities and addressing the unique challenges faced by each group, economic policies can bridge the generation gap in consumer confidence.

Tailored economic policies can help mitigate the widening gap in consumer confidence tied to generational differences. For instance, initiatives aimed at supporting older individuals, such as increased access to financial education and resources that improve their financial security, could help foster a more optimistic outlook. Meanwhile, targeted investments in education, job training, and affordable homeownership opportunities for younger generations can additionally uplift their consumer confidence. In this way, developing inclusive policies is paramount for ensuring a cohesive economic environment that encourages participation and optimism across all demographics.

Navigating Economic Realities in a Post-Pandemic World

The aftermath of the COVID-19 pandemic continues to influence consumer confidence and economic conditions in the UK. As society adjusts to the new realities, businesses must remain adaptable and responsive to the evolving landscape. Factors such as supply chain disruptions and the push for innovation will shape the future economy. These changes create both challenges and opportunities for consumers, as they must navigate a shifting economic terrain while bearing the weight of residual uncertainty from the pandemic.

Consumer confidence in this context is not just a reflection of individual financial beliefs; it becomes intertwined with national sentiment and response to economic challenges. The gradual recovery from the pandemic, marked by gradual inflation decline, demonstrates the resilience of a society eager to rebound. However, awareness and action towards the wider implications of economic policies are crucial for ensuring sustained recovery. Ultimately, understanding how to maintain consumer confidence in a post-pandemic world will set the tone for the UK’s economic strength as it continues to adapt and reinvent itself.

Harnessing the Power of Data in Economic Forecasting

Leveraging data analytics is becoming increasingly vital for accurately forecasting economic trends and understanding consumer behaviour in the UK. By utilizing insights from consumer confidence surveys, businesses and policymakers can strategize and make informed decisions that propel the economy forward. The GfK Consumer Confidence Barometer exemplifies the importance of data-driven decision-making, as it reveals invaluable insights that can predict shifts in spending and investment trends.

Moreover, data management enables targeted responses to emerging economic challenges and opportunities. By monitoring changes in consumer sentiment, businesses can customize their products and services to better meet market demands, while governments can implement policies that foster an economic environment conducive to growth. In an ever-changing economic landscape, effectively harnessing the power of data will be pivotal for supporting sustained economic growth and reinforcing consumer confidence in the UK economy.

Frequently Asked Questions

What is the current state of consumer confidence in the UK economy?

The current consumer confidence in the UK economy reflects a mixed outlook, as revealed by the GfK Consumer Confidence Barometer. While younger groups show improving sentiments, particularly post-2024 elections, older demographics exhibit declining confidence, largely influenced by political sentiments and economic conditions.

How does Brexit impact the economic growth of the UK?

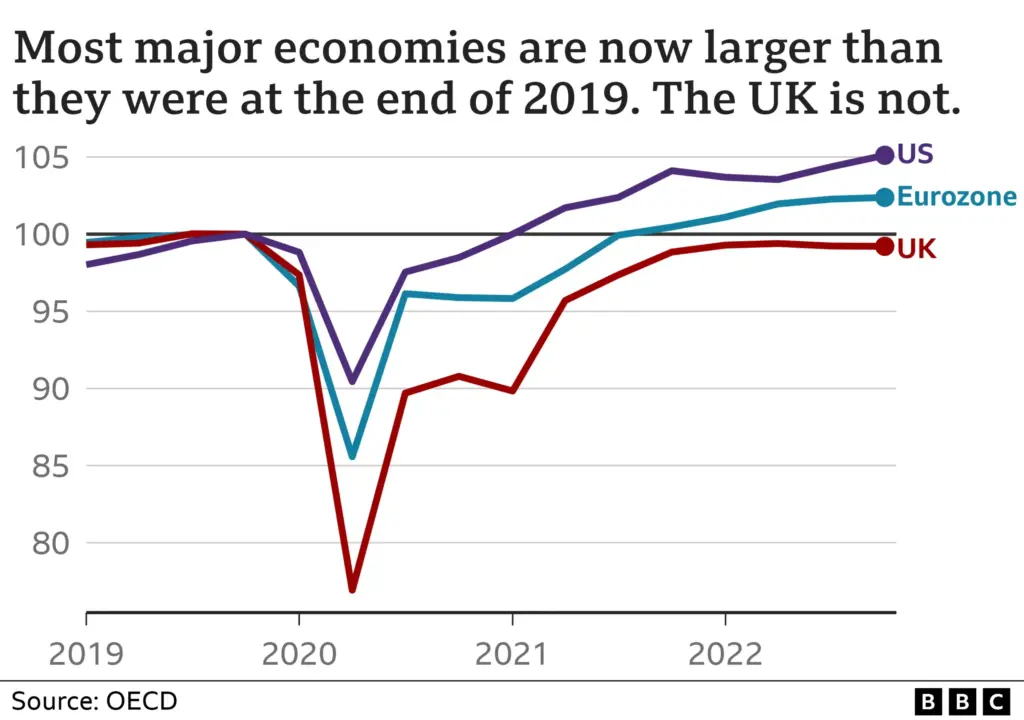

The impact of Brexit on the UK economy has been significant, leading to a decline in consumer confidence across various age groups. Post-Brexit uncertainties affected investment, trade, and overall economic growth, with many businesses adapting to new trading conditions.

What role do interest rates play in the UK economy?

Interest rates in the UK, set by the Bank of England, play a crucial role in shaping the economy. Recent decisions to lower interest rates have sparked optimism among younger consumers and homebuyers, while adversely affecting older savers. Lower rates aim to stimulate spending and investment, impacting overall economic growth.

What effect do political sentiments have on the UK economy?

Political sentiments heavily influence the UK economy, as evidenced by shifting consumer confidence. Younger voters, feeling optimistic about government actions, report better financial outlooks, whereas older voters often express dissatisfaction, reflecting a change where financial feelings align with political preferences.

How does consumer confidence correlate with economic recovery in the UK?

Consumer confidence is a key indicator of economic recovery in the UK. Increased optimism about personal finances and purchasing intentions can drive spending, leading to economic growth. Current trends suggest a potential rebound as younger consumers show renewed confidence, despite challenges faced by older demographics.

What are the current challenges facing the UK economy?

The UK economy faces several challenges, including high prices, inflation, and a lingering division in consumer confidence across age groups. Economic growth has been modest, and while retailers show strong sales, the overall financial sentiment remains fragile due to external pressures like geopolitical conflicts and inflationary trends.

How do savings rates affect the UK economy?

High savings rates in the UK indicate a cautious approach among older demographics, impacting GDP as consumer spending declines. While younger individuals may be inclined to spend due to improving sentiments, older residents are hoarding savings, reflecting disillusionment with the economy and potentially stalling economic recovery.

What is the forecast for the UK economy in 2024?

The forecast for the UK economy in 2024 suggests potential growth as consumer confidence among younger individuals increases and anticipated interest rate cuts aim to stimulate the housing market. However, the overall economic landscape will depend on addressing the disparities in consumer sentiment across different age groups.

| Key Points |

|---|

| The state of the UK economy reveals mixed signals with consumer confidence being a critical measure. |

| Consumer confidence, tracked by the GfK Consumer Confidence Barometer, indicates how people feel about future economic prospects. |

| A notable trend shows younger demographics expressing increasing economic optimism, while older individuals exhibit declining confidence. |

| The divergence in consumer confidence across age groups can be linked to political sentiments, particularly ahead of the 2024 General Election. |

| The Bank of England’s potential interest rate cuts could compound economic disparities between younger and older populations. |

| Despite economic challenges, some sectors are seeing resilient performance, indicating that not all aspects of the UK economy are faltering. |

| Inflation is trending down and government efforts aim to manage price increases, which could improve economic prospects. |

| The UK economy is expected to experience continued growth, accompanied by cautious optimism about investment in infrastructure. |

Summary

The UK economy has shown signs of resilience amidst fluctuating consumer confidence, revealing a complex narrative. Understanding these dynamics is crucial, particularly as younger generations express growing optimism while older populations remain apprehensive. The political landscape significantly influences these sentiments, especially with the upcoming elections in 2024. Additionally, expected interest rate cuts may provide relief, fostering a more favorable environment for economic growth. While challenges persist, the underlying fundamentals of the UK economy suggest a potential for recovery and revitalization.