Listen to this article

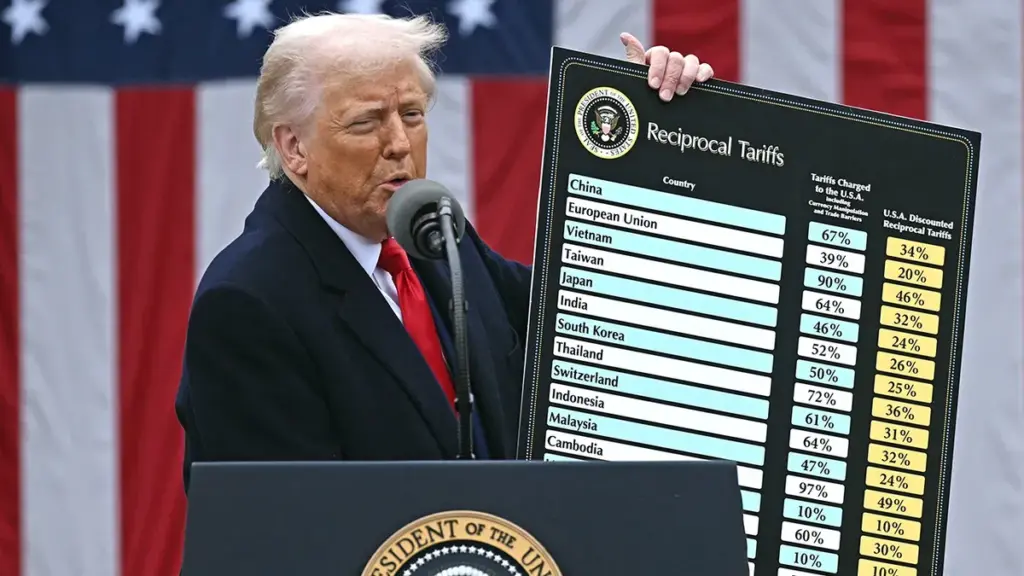

The recent announcement regarding the Trump Iran Trade Tariff has sparked significant interest and concern among economists and political analysts alike. As President Trump imposes a 25% tariff on any trade conducted with Iran, he is leveraging his trade policy in a bid to exert pressure on an already strained Iranian economy. This move comes amidst a backdrop of escalating tensions related to Iran’s oil exports and its ongoing suppression of domestic unrest. With important relations such as US-China dynamics potentially at risk, the implications of this tariff could reverberate through global markets. Understanding the broader consequences of the Trump Iran Trade Tariff is crucial as it may not only affect bilateral trade but also impact international economic stability.

The newly introduced tariff on trade with Iran, as declared by Donald Trump, represents a bold move within the framework of US foreign trade initiatives. This hefty 25% levy on transactions with the Islamic Republic is set against a context of escalating political unrest and economic difficulties in Iran. Such tariffs are often seen as strategic tools in international relations that can influence global supply chains, particularly regarding vital commodities like oil. Moreover, this policy shift could lead to a renewed strain in US-China trade relations, as China remains one of Iran’s largest trading partners. As the ramifications of these tariffs unfold, it will be vital to analyze their potential impact on both the Iranian economy and broader geopolitical landscapes.

Understanding the 25% Tariff on Iran

President Trump has implemented a 25% tariff on all trade with Iran, a strategic move aimed at influencing economic relations and exerting pressure amid existing tensions. This tariff affects any countries participating in commerce with Iran, directly impacting international trade networks. The decision follows Iran’s recent governmental crackdown on protests, indicating a broader strategy to diminish support for the Iranian regime by limiting its economic partnerships. As the United States seeks to curb Iran’s oil exports and diminish its capacity for funding opposition movements, workers and business owners in countries trading with Iran may find this tariff burdensome.

The ramifications of Trump’s trade policy extend beyond Iran itself, as its economy struggles with reliance on oil revenues amidst international sanctions. The 25% tariff could deepen Iran’s economic difficulties, already facing inflation and declining oil exports. With a significant portion of Iran’s economy intertwined with energy exports, this measure not only reflects US policy but also exemplifies the intricate relationship between trade and geopolitical strategy. It’s essential to monitor how these tariffs will materialize and how affected nations will adjust their trade policies in response.

Impact on US-China Relations

The introduction of a 25% tariff on trade with Iran has potential consequences for US-China relations, a dynamic already fraught with tension due to ongoing trade disputes. China, as Iran’s largest trade partner, could be caught in the crossfire of this policy, creating complications for the already strained relations between the US and China. Should the tariff apply to Chinese goods, it may reignite retaliatory measures from Beijing, further escalating trade wars that hurt both economies. China’s historical response to US tariffs has been characterized by its own imposition of duties and restrictions, particularly on essential materials that the US relies on for technology manufacturing.

Adding layers to this dilemma, China already endures an elevated average tariff of 30.8% on its exports to the US. The implementation of an additional 25% tariff would increase import costs significantly, affecting consumer markets and industries that depend on timely imports. This escalation could lead to China adopting more aggressive trade strategies, potentially including measures that could impact US sectors reliant on Chinese exports, such as technology and manufacturing. The international trading landscape becomes increasingly precarious, as both nations vie for advantages in a changing geopolitical climate.

The Consequences of Tariffs on Global Trade

The ramifications of Trump’s tariff announcement extend well beyond the borders of the US and Iran, influencing global trade dynamics. Such tariffs can lead to increased costs for consumers and businesses worldwide, as countries reconsider their supply chains and trade agreements. Importers and businesses that rely on goods from nations engaging in trade with Iran must grapple with rising prices and potentially reevaluate their partnerships. Moreover, this could result in a rise in inflation rates in countries indirectly affected by these tariffs, shaping consumer behavior and spending patterns.

Furthermore, the economic strain from tariffs often leads to decreased global trade volumes, affecting various markets around the world. Commodity prices, particularly oil, could be influenced as countries adjust to new tariff structures and reduce imports from nations like Iran. Regional economies that have become dependent on Iranian goods may face significant challenges, pushing them to form new trade alliances or seek alternatives in other markets. The delicate balance of international trade is disrupted as each nation responds to the shifting landscape dictated by tariff policies.

Economic Turmoil in Iran Amid Global Pressures

Iran’s economy, once bolstered by vast oil reserves, is currently facing a tumultuous period accentuated by both internal and external pressures. Despite being one of the world’s top oil producers, years of mismanagement and relentless international sanctions have wreaked havoc on the Iranian economy. The 25% tariff on trade with its partners could significantly hamper Iran’s ability to maintain its oil revenue—a critical component of its economy. As global oil markets react to Trump’s trade policy, Iran’s fiscal stability could further deteriorate, impacting everyday life for its citizens.

By witnessing a decrease in oil exports and increased inflation rates—reportedly reaching 48.4%—ordinary Iranians are increasingly disenfranchised. With persistent economic hardship leading to protests and calls for governmental reform, the implications of the tariffs may exacerbate social unrest. Families struggling to afford basic goods and utilities may face further challenges as import costs soar. The complexities involved in improving Iran’s economic situation make the future uncertain, highlighting the interconnectedness of domestic politics, international relations, and economic health.

Examining the Legal Framework Behind Tariffs

The legal authority and procedural framework surrounding the implementation of Trump’s 25% tariff on trade with Iran are critical aspects that remain ambiguous. Tariff policies in the US often fall under international trade laws and legislative acts, such as the International Emergency Economic Powers Act, which empowers the government to impose such tariffs during national emergencies. The lack of clarity surrounding Trump’s announcement raises questions about the legal grounds for this tariff and how it would be enforced against nations trading with Iran.

This absence of specific implementation details creates uncertainty for both the US and its trading partners. Many traders and economists are left speculating about the range of countries that will be affected and the legal processes needed to enforce these tariffs. Additionally, the political climate surrounding the decision could face challenges through legal channels, particularly given recent tensions at the Supreme Court concerning similar trade policies. The evolution of these tariffs could shift if legal obstacles arise, leading to potential revisions or complete retractions of the policy.

Iran’s Economic Future: A Tumultuous Landscape

As the 25% tariff on trade looms, the economic landscape for Iran appears increasingly precarious. Years of poor financial governance, paired with the erosion of oil sales due to sanctions and tariffs, have stripped the country of its financial resilience. President Trump’s trade policy could further aggravate the situation, reducing Iran’s already limited capacity for international trade. The country’s struggle to stabilize its economy amidst rising inflation and diminished consumer purchasing power is set against a backdrop of national protests—a reminder of the growing dissatisfaction among citizens.

The outlook for Iran’s economy hinges largely on the decisions made by its trading partners in response to the new tariff. If key nations such as China, Iraq, and Turkey reconsider their dealings, the ramifications for Iran could be disastrous. Essential imports could become scarce, and the impact on public services and consumer markets may result in greater instability. As global trade dynamics shift in response to Trump’s policies, Iran’s economic future could be one of further decline and hardship for its populace.

Analyzing the Role of Oil Exports in Iran’s Economy

Oil exports are the lifeblood of Iran’s economy, with international sales providing critical revenue to support various sectors and government functions. However, recent trade tariffs imposed in response to Iran’s geopolitical maneuvers threaten to cut crucial channels for these oil exports. With global demand fluctuating and new barriers erecting against Iranian oil sales, the country may face a financial crisis. The challenges posed by the 25% tariff underlines the precarious nature of Iran’s reliance on a single commodity, marking the importance of diversifying its economic base.

The disruption of oil exports and the resultant revenue stream will not only affect Iran’s economy but also the global oil market, as Iran remains a significant player in international oil supply chains. As prices potentially rise due to anticipated shortfalls in Iranian oil, the interconnectedness of energy markets reveals how decisions made by one country can reverberate worldwide. Policymakers must thus consider the comprehensive consequences of tariffs that could lead to elevated costs and shortages, impacting consumers and economies far beyond Iran’s borders.

Impact of Trump’s Trade Policy on International Partnerships

Trump’s trade policy, notably the decision to impose tariffs on businesses engaging with Iran, poses risks to longstanding international partnerships. Countries will need to navigate a complex web of trade agreements and tariffs that could strain relations between nations that have previously conducted business with Iran without fear of retribution. As nations reevaluate trade flows, the ramifications will echo throughout global markets, compelling countries to adapt to a new reality defined by uncertainty and redirected trade routes.

Furthermore, the evolving nature of US trade relations can shift alliances and partnerships, resulting in new coalitions forming in response to the tariffs. Nations may reconsider their economic strategies, leading to a potential realignment in global trade dynamics, where nations that continue to trade with Iran may simultaneously strengthen their ties with Tehran. The interplay between Trump’s tariff policy and international partnerships remains fundamental in shaping how countries will respond to emerging global challenges in trade.

Frequently Asked Questions

What is the 25% tariff on Iran announced by Trump?

The 25% tariff on Iran, announced by President Trump, applies to all countries that conduct business with Iran. This tariff is part of Trump’s broader trade policy which aims to exert economic pressure in response to Iran’s actions, particularly against anti-government protests. The tariff is effective immediately and seeks to influence international relations and Iran’s economy.

How will the Trump Iran Trade Tariff impact trade with China?

The Trump Iran Trade Tariff is likely to complicate US-China relations. If enforced, the tariff would mean Chinese goods exported to the US could face an additional 25% tax, on top of existing tariffs averaging 30.8%. This could provoke China, prompting retaliatory measures, and further escalate the ongoing trade tensions between the two countries.

What are the implications of the Trump trade policy on Iran’s economy?

The Trump trade policy, particularly the 25% tariff on Iran, could exacerbate challenges facing Iran’s economy. As a country heavily reliant on oil exports, increased tariffs could lead to reduced trade volumes and heightened inflation. This is critical given Iran’s existing economic struggles, including high inflation rates and significant public discontent due to rising living costs.

How might the 25% tariff affect Iran’s oil exports?

The 25% tariff on countries trading with Iran could negatively impact Iran’s oil exports, which are vital to its economy. As the largest oil producer and with a substantial portion of its trade tied to oil, the tariff might hinder Iran’s ability to sell its oil, especially if trading partners reconsider their engagement under the threat of increased costs.

What countries are affected by Trump’s 25% tariff on Iran?

Trump’s 25% tariff on Iran affects any country conducting business with Iran, with China being the largest trading partner. Other countries such as Iraq, the UAE, and Turkey are also involved in significant trade with Iran. The exact implementation details and which countries will be specifically targeted remain unclear.

What challenges could arise in enforcing the Trump Iran Trade Tariff?

Enforcing the 25% tariff on Iran poses significant challenges, especially considering that Iran has developed mechanisms to circumvent sanctions, such as using shadow shipping and accepting payments in Chinese yuan. The complexities of international trade and the need for legal frameworks to enforce such tariffs could hinder effective implementation.

How does the Trump Iran Trade Tariff relate to international reactions?

The Trump Iran Trade Tariff is likely to provoke international reactions, particularly from countries like China that may oppose such unilateral measures. China has previously shown a readiness to retaliate economically, raising concerns about escalating trade tensions and impacting global trade dynamics surrounding Iran.

What economic conditions in Iran are contributing to unrest amid the Trump trade policy?

Amid the Trump trade policy and the newly announced 25% tariff on Iran, the country faces severe economic conditions, characterized by high inflation at 48.4%, shrinking household spending, and a declining employment rate. These factors contribute to widespread dissatisfaction and protests, as citizens struggle with rising costs of living.

Why has Trump proposed a 25% tariff on Iran at this time?

Trump has proposed the 25% tariff on Iran amid escalating tensions regarding Iran’s treatment of anti-government protests and its growing military influence. By imposing this tariff, Trump aims to exert economic pressure on Iran while simultaneously addressing broader trade negotiations with other nations affected by Iran’s trade practices.

| Key Point | Details |

|---|---|

| Trump’s Announcement | Countries doing business with Iran will be subject to a 25% tariff on all trade with the US, effective immediately. |

| Countries Affected | More than 100 countries trade with Iran, with China being the largest partner, importing over $14 billion worth of Iranian products. |

| Implementation Challenges | Details on the execution of the tariffs remain unclear, including which countries will be covered and how existing tariffs will interact. |

| Impact on US-China Relations | The new tariffs could escalate tensions between the US and China, with existing tariffs averaging 30.8% already in place. |

| Economic Context in Iran | Despite vast oil reserves, Iran’s economy struggles with high inflation, declining oil sales, and international sanctions leading to rising costs of living. |

Summary

The Trump Iran Trade Tariff has emerged as a crucial development in international relations and economics, where President Trump’s recent announcement of a 25% tariff on countries trading with Iran marks a significant escalation of US policy against Iran. This tariff is intended to pressure Iran amidst its ongoing political unrest, yet it raises questions about its implementation and potential backlash from trading partners, particularly China. Compounding these issues, Iran’s already fragile economy faces additional strain from these tariffs, risking greater instability in the region.