Listen to this article

Venezuela oil investment has been a topic of heated discussion as the South American nation grapples with a turbulent economic landscape and political turmoil. With its vast energy reserves, Venezuela offers a lucrative opportunity for oil companies eager to tap into one of the world’s wealthiest oil sources. However, US sanctions on Venezuela oil complicate the investment climate, making many executives hesitant to commit. Despite President Trump’s ambitious proposal for at least $100 billion in investments, significant challenges and uncertainties must be addressed first. The future of Venezuela’s oil industry—along with the fate of US oil companies operating in the country—hinges on resolving critical issues related to governance, security, and international relations.

Investment in Venezuela’s petroleum sector has become increasingly crucial as the country struggles with economic instability and external pressures. The potential of Venezuela’s extensive oil fields has captured the interest of major energy players, sparking debates about the viability of future partnerships. However, the current landscape is marked by stringent US sanctions targeting Venezuela’s oil exports, which further complicates the ability for firms to operate profitably. As the situation in the region evolves, discussions surrounding diplomatic relations and energy cooperation remain forefront among industry leaders. As companies weigh the risks and rewards, the question of whether Venezuela can reclaim its position as a key player in the global oil market continues to loom.

The Need for Venezuela Oil Investment

Investment in Venezuela’s oil industry is considered critical given the nation’s vast energy reserves. Despite the potential profitability, the landscape remains challenging, particularly due to the turbulent political climate and the impact of U.S. sanctions on Venezuela’s oil sector. Leading U.S. oil executives have been hesitant to make substantial financial commitments, citing the nation’s current status as ‘un-investable’. They argue that without significant political and economic reforms, the potential for risk and loss is too high to justify their investments.

President Trump’s call for at least $100 billion in oil investment for Venezuela comes as a response to the current energy crises affecting global markets. His strategy includes the hope of leveraging trimmed prices resulting from a reformed Venezuelan oil industry. However, major players like ExxonMobil and Chevron require specific guarantees regarding legal security and sales processes before they consider substantial re-investment in Venezuela. The push for investment, while rooted in opportunity, is closely tied to political geopolitical dynamics.

Challenges in the Venezuela Oil Industry

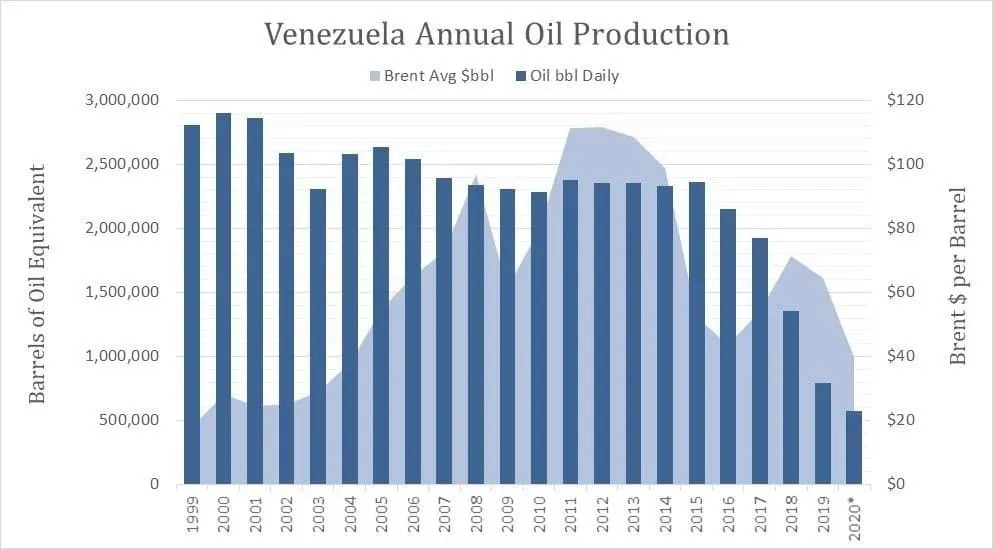

The challenges facing the Venezuelan oil industry are manifold, ranging from historical mismanagement to the effects of stringent U.S. sanctions. Over the years, the country’s oil production capabilities have drastically diminished, leading to a situation where, currently, Venezuela contributes less than one percent of the global oil supply. Executives from companies such as Chevron and Repsol acknowledge that before any real enhancement of production can take place, the overarching issues of reliability and operational efficiency must first be addressed.

Moreover, securing investments requires not only confidence in the operational environment but also political stability. Analysts have noted that assurances must be in place regarding regulatory frameworks, fiscal policies, and the security of investments. As President Trump indicated a willingness to selectively lift U.S. sanctions, the industry remains watchful for signals that genuine reform may be on the horizon, which could catalyze renewed investment interest and operational improvements.

The Role of U.S. Sanctions on Venezuela’s Oil Sector

U.S. sanctions have had a dramatic impact on Venezuela’s ability to engage in foreign investment within its oil sector. These restrictions have not only hindered international companies from operating traditionally but also directly affected Venezuela’s oil production and export capabilities. As the U.S. continues to impose limits on transactions with Venezuela, this has led to a scenario where many investors remain hesitant to commit capital, effectively stifling any potential growth in oil production.

Recently, however, the White House has signaled a willingness to recalibrate its stance on these sanctions, proposing a review of their applicability. This development raises questions about future collaborations and the reopening of exploration and production activities by major oil companies. With a more favorable approach to investment and engagement, Venezuela could see an influx of capital that would restore its status as a key player in the global oil market.

Future Prospects for Venezuela’s Oil Production

The future of Venezuela’s oil production hinges significantly on how the political landscape evolves. U.S. oil executives have expressed readiness to engage with Venezuela, contingent upon clear signals of stability and reform. Encouraging indications from the U.S. administration regarding the lifting of sanctions could pave the way for resuming operations at a much larger scale. Given that companies like Chevron and ExxonMobil maintain a vested interest in rekindling relationships, the right conditions could attract substantial investment, possibly leading to a resurgence in production levels.

However, alongside potential investments, analysts caution that rebuilding Venezuela’s oil infrastructure and operations requires a multi-faceted commitment from both local authorities and foreign investors. This involves addressing long-standing infrastructural deficiencies and fostering a competitive environment. The overarching sentiment remains that while investment enthusiasm exists, tangible improvements will require concerted efforts to stabilize the political environment and instill confidence among potential investors.

Comparative Insights: Venezuelan Oil and Global Markets

Despite its enormous energy reserves, Venezuela’s contribution to global oil markets has plummeted over the years. Many analysts often compare Venezuela’s situation with other oil-rich nations; however, political instability and past economic mismanagement have placed Venezuela at a distinct disadvantage. Unlike other countries that have managed to attract foreign investment to harness their resources, Venezuela has effectively seen its output diminish due to external pressures, primarily from U.S. sanctions.

Opportunity still lurks in the expansive fields of Venezuela’s oil industry, which could have a pronounced effect on global oil prices if effectively managed. Should the proposed investments materialize and the necessary reforms take place, Venezuela’s oil could once again become a significant player in the international arena. The expectation is that with an influx of capital and support from foreign oil companies, Venezuela could dramatically increase its output, ultimately leading to lowered prices in global markets.

Investment Risks: Assessing Venezuela’s Oil Landscape

Anyone considering entering the Venezuelan oil market must weigh the associated risks very carefully. The repeated history of asset seizures and the volatile political climate represent substantial hurdles. Prominent figures in the oil industry, such as Exxon’s CEO, describe the landscape as challenging and fraught with uncertainty. Potential investors are increasingly cautious, reflecting concerns about regulatory environments and operational viability under current conditions.

Industry leaders assert that any prospective investment must be underpinned by legal frameworks that provide security and certainty. This concern remains crucial for attracting capital into Venezuela’s oil industry. The general sentiment suggests that without clear reassurances and a strategic investment framework, major oil companies will remain reluctant to engage deeply with Venezuela’s oil resources.

International Stakeholders and Their Views on Venezuela Oil

Stakeholders in the international oil market are closely monitoring developments in Venezuela. Oil companies from across the globe are casting their eyes on the region, hoping for signs of reform and opportunity. Companies like Repsol and Eni, already engaged in Venezuela, provide insights into how various international firms view the potential of operating in this complex environment. Their experiences can serve as valuable lessons for new investors.

Additionally, the tone of communications from U.S. officials and the messages sent from the White House shape the perceptions of these international stakeholders. Mixed signals from the U.S. regarding sanctions and engagement can either deter or attract investment. As clarity emerges, we may witness shifts in how these stakeholders position themselves in relation to Venezuela’s oil prospects and adjust their strategies accordingly.

Examining Oil Production Goals and Strategies

Venezuela’s stated ambitions to enhance its oil production are ambitious yet fraught with obstacles. Energy consultants suggest that to achieve the goal of tripling production by 2040, investments must rise significantly from current levels. Analysts at Rystad Energy outline the requirement for substantial annual investments, suggesting that $8 billion to $9 billion would be necessary to realize such output goals. Without these investments, the dream of a revitalized Venezuelan oil industry remains just that—a dream.

Effective strategies to overcome existing challenges must incorporate both financial commitment and logistical planning. Major oil companies interested in re-entering the market will have to devise innovative approaches to manage the unique risks associated with operating in Venezuela. This could imply engaging collaboratively with the Venezuelan government to address operational barriers and fostering an environment that is supportive of international investment.

Environmental Considerations in Venezuela’s Oil Sector

As Venezuela contemplates revitalizing its oil industry, environmental considerations should be front and center. As global attention shifts towards sustainable practices, the potential environmental impacts of increased oil production cannot be overlooked. Industry experts stress the importance of adopting modern technologies and practices that minimize ecological harm, which is crucial for ensuring long-term viability.

An investment strategy that focuses on environmentally sustainable practices could offer Venezuela a competitive edge in the international market. By prioritizing eco-friendly methods of extraction and production, Venezuela could not only appeal to a growing base of environmentally-conscious investors but also improve its standing on the global stage in a time where energy policies are increasingly scrutinized for their ecological footprint.

Frequently Asked Questions

What is the current state of Venezuela oil investment opportunities?

The current state of Venezuela oil investment opportunities is challenging. Due to US sanctions, mismanagement, and past asset seizures, many major oil companies consider Venezuela to be ‘un-investable’ at this time. Despite its vast energy reserves, substantial changes and assurances regarding security and legal frameworks are necessary to attract significant investment.

How do US sanctions impact oil companies in Venezuela?

US sanctions on Venezuela significantly limit oil companies’ ability to operate. These sanctions restrict the sale of Venezuelan oil and pose risks to foreign entities considering investment, as they may face secondary sanctions. Recent discussions suggest the possibility of selectively lifting these sanctions, which could create new investment opportunities for oil companies in Venezuela.

What potential benefits could arise from increased Venezuela oil investment?

Increasing Venezuela oil investment could lead to several benefits, such as enhancing global oil production, reducing energy prices, and revitalizing the Venezuelan economy. However, these potential benefits hinge on overcoming current political instability and ensuring a secure investment environment.

Which oil companies are currently operating in Venezuela?

As of now, Chevron is the last major American oil company still operating in Venezuela, while international companies like Spain’s Repsol and Italy’s Eni remain active in the oil sector. These companies are assessing potential opportunities for expansion, particularly if US sanctions are lifted.

What challenges must be addressed for investment in Venezuela’s oil industry?

For foreign investment in Venezuela’s oil industry to be viable, key challenges must be addressed, including the need for legal stability, assurance of physical security, and a competitive fiscal framework. Many executives from oil companies express that these conditions are currently insufficient to justify large-scale investments.

What did Trump propose regarding Venezuela oil investments?

President Trump proposed a staggering $100 billion investment to revitalize the Venezuela oil industry, with the aim of leveraging the country’s substantial energy reserves. However, this proposal has met skepticism from oil executives, who demand significant political and economic reforms before committing financial resources.

What is the outlook for Venezuela’s oil production in the near future?

The outlook for Venezuela’s oil production remains uncertain. With current output around one million barrels per day, analysts suggest that substantial investments—estimated at $8 billion to $9 billion annually—would be needed to triple production by 2040. Political stability and investment incentives will play crucial roles in determining the future of Venezuela’s oil industry.

How could a stable political situation affect Venezuela oil investment?

A stable political situation in Venezuela could significantly enhance oil investment by providing the legal certainty and security that companies require. This, in turn, would likely lead to increased investment commitments and revitalization of Venezuela’s oil production, ultimately benefiting both the economy and global energy markets.

Is it feasible to expect lower oil prices from Venezuela’s situation?

While there is hope that increased investment in Venezuela’s oil industry could lower oil prices, experts caution that substantial commitments and production increases are unlikely in the immediate future. It may take years of stabilized political conditions and incentives for significant changes in oil prices to occur.

What role does Trump’s administration play in Venezuela’s oil investments?

Trump’s administration plays a critical role in shaping the future of Venezuela’s oil investments by determining which companies are allowed to operate and by controlling the lift of US sanctions. The administration’s policies and decisions will significantly influence the level of foreign investment coming into Venezuela’s oil industry.

| Key Point | Details |

|---|---|

| Investment Request | US President Trump has called for at least $100 billion in oil industry investment for Venezuela. |

| Executive Concerns | Oil executives describe Venezuela as currently ‘un-investable’ due to risks and past asset seizures. |

| Current Production | Venezuela’s oil output is around 1 million barrels per day, less than 1% of global supply. |

| Potential for Change | Some executives believe Trump’s promises might improve investment prospects, contingent on political stability. |

| Foreign Interest | Chevron remains the last major U.S. company in Venezuela, while other foreign firms still operate. |

| Sanctions and Control | The U.S. plans to selectively lift sanctions but maintain control over oil sales to leverage the Venezuelan government. |

| Investment Requirements | For significant investment, companies require assurances of security, legal certainty, and competitive conditions. |

| Small-Scale Investments | Smaller companies may invest around $50 million, which is far below Trump’s target. |

| Long-Term Projections | Tripling Venezuela’s production by 2040 may need annual investments of $8-9 billion. |

Summary

Venezuela oil investment is at a critical juncture, as President Trump actively seeks to attract $100 billion in oil industry investment to the country. Despite the appeal of Venezuela’s vast oil reserves, major oil companies have voiced significant concerns about the current state of the investment landscape, citing factors such as instability and unfavorable conditions. While some optimism exists for future investment and production increases, substantial commitment from international firms hinges on enhanced political stability and security assurances. Currently, the pathway to revitalizing the Venezuelan oil sector remains complex and fraught with challenges.